Table of Contents

4506-T Form 2023 – The IRS Form 4506-T, also known as the Request for Transcript of Tax Return, is critical tool lenders and third parties use to verify an individual’s income. This form is required for all applicants seeking a loan or financial assistance from a lender. Lenders can view an applicant’s tax return information quickly and efficiently.

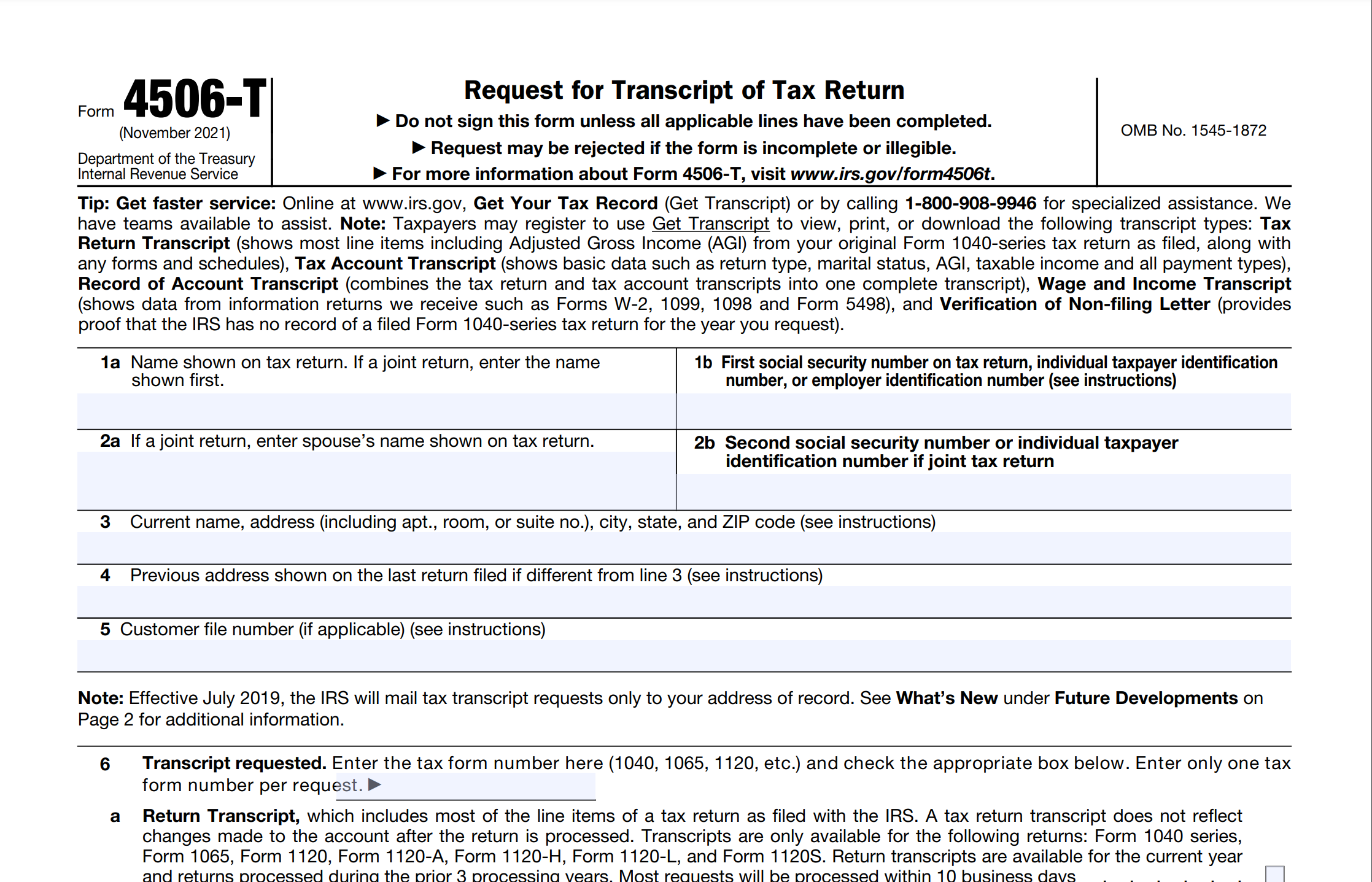

The 4506-T Form is a request form used by individuals and businesses to request a transcript or copy of their tax return from the Internal Revenue Service (IRS). The form is used to request tax return information for the current tax year and previous tax years. The information provided on the form includes the taxpayer’s name, social security number, and current mailing address. The form also asks for the tax year or period for which the transcript is requested.

Once the form is completed and submitted, the IRS will process the request and provide the requested transcript to the taxpayer. The transcript summarizes the taxpayer’s tax return, including income, adjustments, deductions, and tax liability. It is often used for verification purposes, such as when applying for a mortgage or loan.

What is a 4506-T Form Used For?

Individuals and businesses use the 4506-T Form to request a transcript or copy of their tax return from the Internal Revenue Service (IRS). The form is used to request tax return information for the current tax year and previous tax years.

The transcript summarizes the taxpayer’s tax return, including income, adjustments, deductions, and tax liability. It is often used for verification purposes, such as when applying for a mortgage or loan.

What is the Purpose of the 4506-T Form?

Form 4506-T requests a tax return transcript from the Internal Revenue Service (IRS). This form is typically used by individuals and businesses with a fiscal tax year, meaning their tax year begins in one calendar year and ends in the following year. It is important to note that if you are unsure which type of transcript you need, requesting the Record of Account is recommended, as it provides the most detailed information.

The requested transcript will summarize the taxpayer’s tax return, including income, adjustments, deductions, and tax liability. It is often used for verification purposes, such as when applying for a mortgage or loan.

4506-T Form 2023 Download

For the 2023 tax year, you can use Form 4506-T (Rev. 11-2021) to request a tax return transcript from the Internal Revenue Service (IRS). This is the latest revision of the form, which can be downloaded from HERE. Using the most current version is important to ensure your request is processed accurately and promptly.

The form can be used to request tax return information for the current tax year as well as for previous tax years. The requested transcript will summarize the taxpayer’s tax return, including income, adjustments, deductions, and tax liability. It is often used for verification purposes, such as when applying for a mortgage or loan.

Where to File 4506-T Form?

To request a transcript using Form 4506-T, the form must be mailed or faxed to the appropriate IRS address for the state where the taxpayer lived or where the taxpayer’s business was located when the return was filed. The IRS provides two address charts for this purpose: one for individual transcripts (Form 1040 series and Form W-2) and one for all other transcripts.

If a taxpayer is requesting more than one transcript or other product and the address chart shows two different addresses, the request should be sent to the address based on the taxpayer’s most recent return address.

It is recommended to use the IRS’ online services to request a transcript, as it is the fastest and most secure method. However, if a taxpayer cannot use the online services, mailing or faxing Form 4506-T to the appropriate address is the next best option. It is essential to follow the instructions on the form carefully and provide all the required information to ensure that the request is processed promptly and accurately.

Suppose you need to request a transcript of your tax return using Form 4506-T and you lived in, or your business was located in, one of the following states or territories. In that case, you can mail or fax your request to the Internal Revenue Service RAIVS Team at the following address:

Internal Revenue Service RAIVS Team

P.O. Box 9941

Mail Stop 6734

Ogden, UT 84409

Fax: 855-298-1145

The states and territories that are included in this mailing address are:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Iowa

- Kansas

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Washington

- Wyoming

- A Foreign Country

- American Samoa

- Puerto Rico

- Guam

- The Commonwealth of the Northern Mariana Islands

- The U.S. Virgin Islands

- A.P.O. or F.P.O. Address.

If you lived in or your business was located in one of the following states, you can mail or fax your request to the Internal Revenue Service RAIVS Team at the following address:

Internal Revenue Service

RAIVS Team

Stop 6705 S-2

Kansas City, MO 64999

Fax: 855-821-0094

The states that are included in this mailing address are:

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Vermont

- Virginia

- West Virginia

- Wisconsin

It is important to note that this is only one of several mailing addresses that may be applicable depending on the state or territory where the taxpayer lived or where the business was located. For complete instructions and to determine the correct mailing address for your request, it is recommended to consult the instructions for Form 4506-T or contact the IRS directly.