Table of Contents

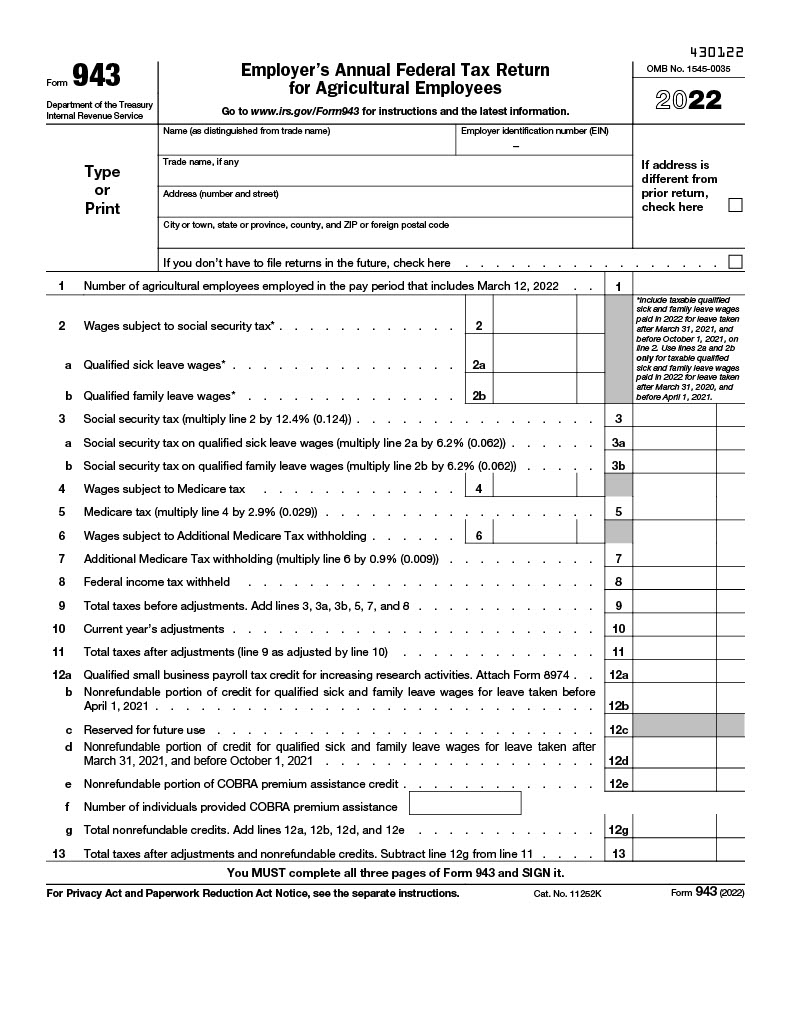

943 Form 2023, Employer’s Annual Federal Tax Return for Agricultural Employees – Employers in the agricultural industry need to fill out Form 943, Employer’s Annual Tax Return for Agricultural Employees, which is an important task. This form is used to tell the Internal Revenue Service (IRS) how much tax was taken out of agricultural workers’ paychecks throughout the year. It must be filled out and sent to the IRS every year. To stay in line with federal tax rules, it’s important for employers to know about this form and know when and how it needs to be filled out.

What is Form 943 For Agricultural Employees?

Form 943 is an IRS form that employers use to report federal taxes for agricultural employees. This form is used by business owners and self-employed individuals who hire workers in the agriculture industry, such as farmers, ranchers, dairy operators, and fruit and vegetable growers. The form must be filed annually on or before January 31 of the following year.

On Form 943, employees report their wages and the taxes that have been taken out of their paychecks over the course of the year. When filling out Form 943, employers must include all relevant information about these money payments and withholdings. As with any other employee’s income tax form, it’s important to make sure all reported wages and withholding amounts are accurate; incorrect information can result in penalties or fines for employers. Also, at the end of the calendar year, employers must give each worker a W-2 statement that sums up their total earnings and taxes paid during the year.

Do I Have to a Form 943?

Form 943 is a tax form used by employers to report income taxes and Social Security and Medicare taxes for their agricultural employees. If you are an employer with agricultural employees, you must file Form 943 each year. This includes any business or individual that paid wages of $2,500 or more during the year in cash wages to farmworkers subject to federal income tax withholding. When filing this form, employers must also provide the name and address of each employee and the total amount of wages paid throughout the year.

For employers to fill out this form correctly, they may need copies of their employees’ Forms W-2, copies of their independent contractors’ Forms 1099-MISC, records of how much they paid in wages over the course of the year, and records of how much federal income tax was taken out of their paychecks during the year. Employers should keep these forms on file in case they are ever audited by the Internal Revenue Service (IRS).

Employers must file Form 943 annually by January 31st unless they receive an extension from the IRS granting them additional time.

What is a “Refundable Credit” on Form 943?

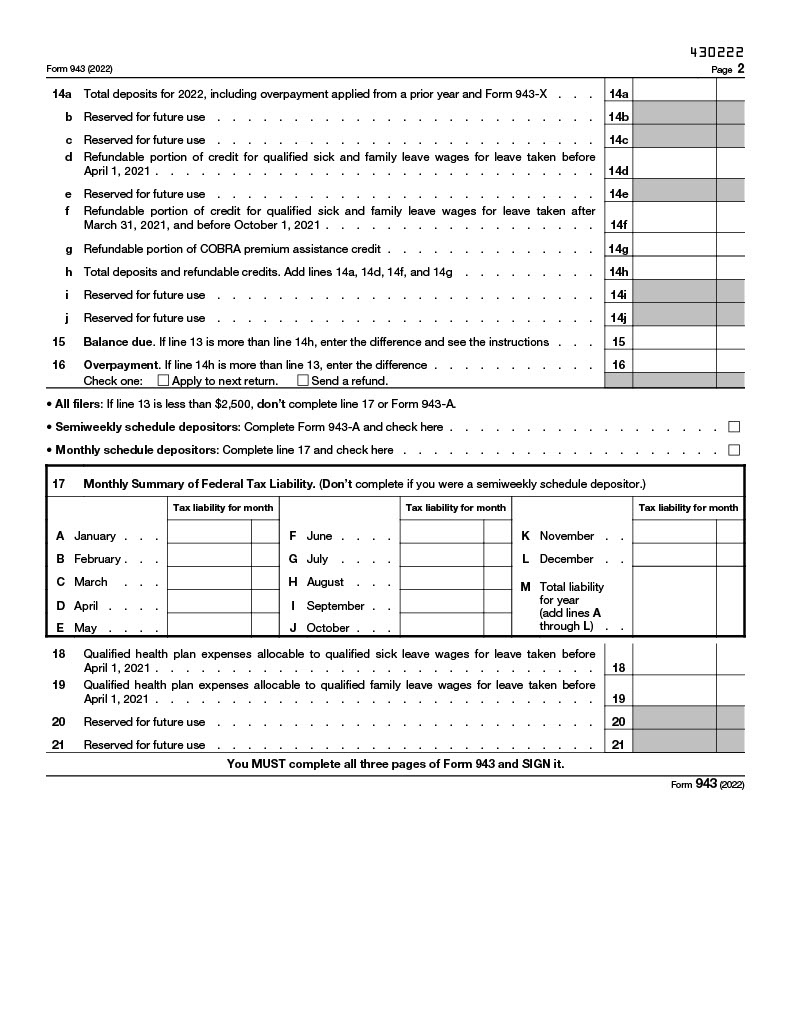

A refundable credit on Form 943 is a type of tax credit that can be used to reduce the employer’s total tax liability. The amount of the credit is based on the wages and tips that are paid to agricultural employees throughout the year. If the credit amount is more than the amount of taxes owed, it will be returned to the employer along with any other refunds they may be eligible for. Most of the time, this kind of credit is available to employers who hire seasonal or migrant workers in an agricultural setting.

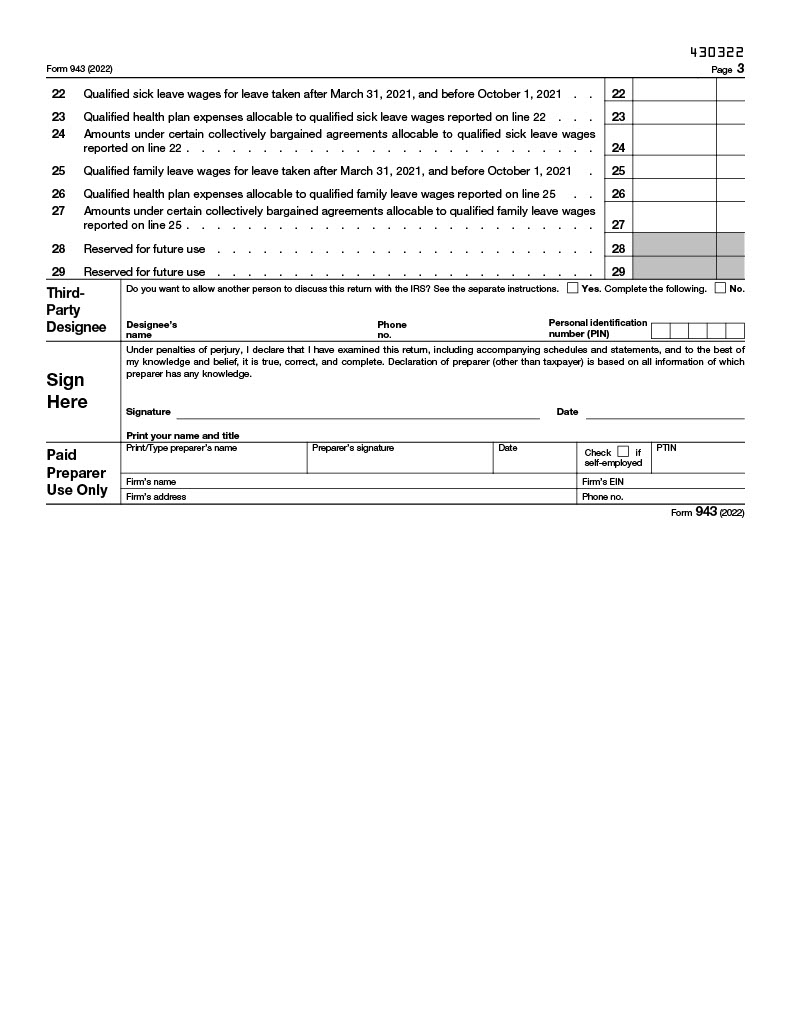

The specific requirements for claiming a refundable credit on Form 943 vary according to state guidelines and federal regulations. Generally, employers must provide certain information about their employees such as Social Security numbers, dates of birth, residency status, wage payments, and payroll deductions when filing their annual returns. This information helps determine if an employee qualifies for relief from taxation through this special kind of tax break. Once all relevant documents have been submitted and reviewed by tax authorities, a determination will be made regarding eligibility for this form of relief.

Summary of Requirements and Deadlines for Filing and Depositing Agricultural Employment Taxes

| Topic | Conclusion |

| Form to file for agricultural employees’ wages subject to income tax, social security, or Medicare withholding | Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees |

| Withholding requirements |

|

| Exceptions for hand-harvest workers | Hand-harvest workers paid less than $150 during the year (See “Exceptions” under “The $150 Test or the $2,500 Test” in Publication 51, (Circular A), Agricultural Employer’s Tax Guide) |

| Filing deadline for Form 943 |

|

| Filing deadline for Forms W-2 |

|

| Electronic deposits are required if employment taxes exceed | $2,500 in the year |

| Schedule for electronic deposits | Monthly or semiweekly |

| Lookback period to determine the deposit schedule | Second calendar year preceding the current calendar year |

| Liability threshold for monthly or semiweekly deposit schedule | Reported $50,000 or less of tax on Form 943 for monthly deposit schedule; over $50,000 in Form 943 liabilities for semiweekly deposit schedule |

| Deposit deadline for accumulating $100,000 of liability in any deposit period | 8 p.m. EST the next day which is not a Saturday, Sunday, or legal holiday |

| Change in deposit schedule due to accumulating $100,000 tax liability | A monthly schedule depositor accumulating $100,000 tax liability becomes a semiweekly schedule depositor on the next day and remains so for at least the rest of the calendar year and the following calendar year |

| Resource for more information | Section seven of Publication 51, (Circular A), Agricultural Employer’s Tax Guide |

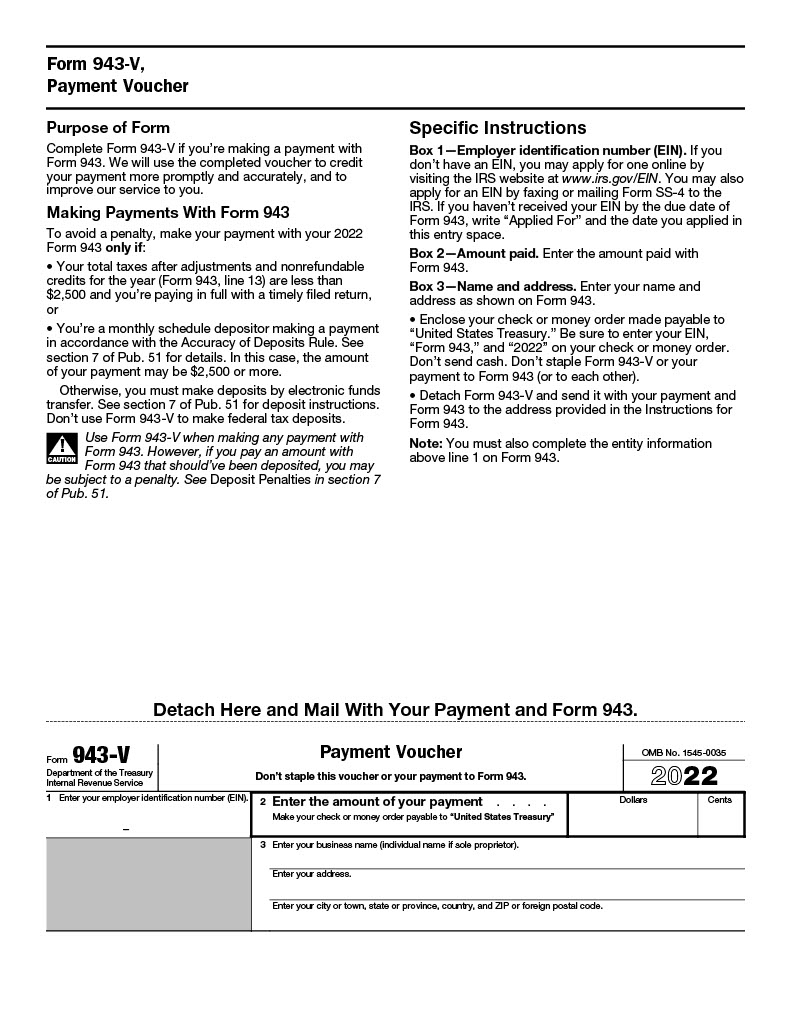

943 Form 2023 Printable (Current Revision: 2022)

943 Form 2023 Printable PDF

Download & Print Here: Recent 943 Form [.PDF] (Current Revision: 2022)

Note: The most recent version of Form 943 is the 2022 edition. We will provide an update for the 2023 edition once it is released by the IRS.