Table of Contents

Good News for Arizona Taxpayers: Rates Lowered!

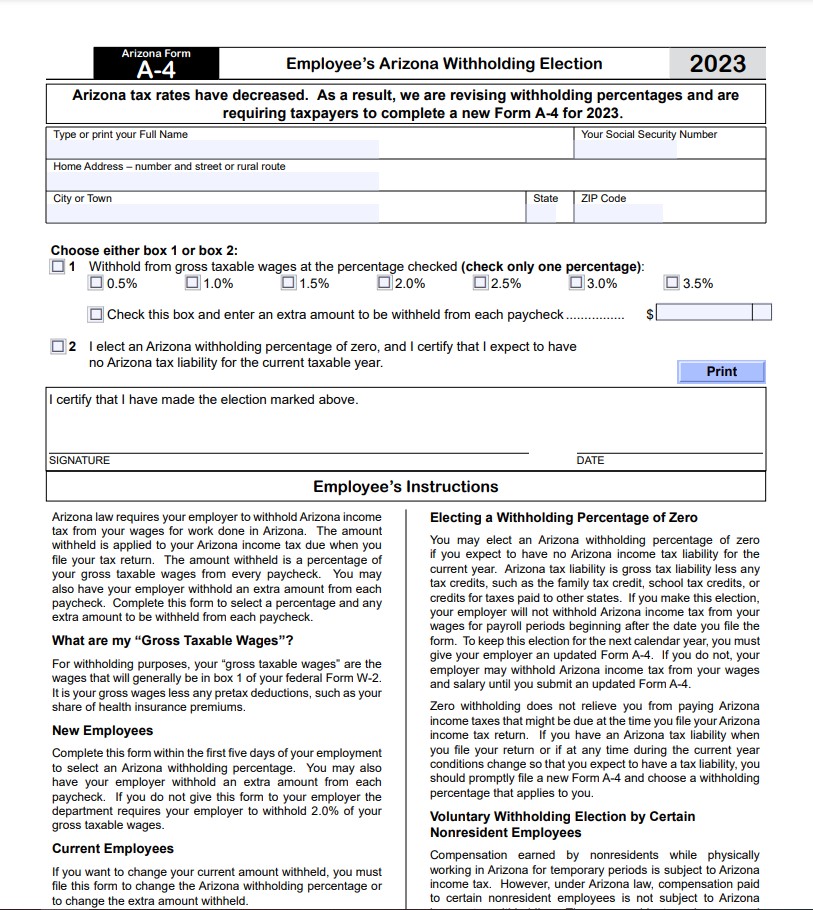

A-4 Form 2023 Printable – Employee’s Arizona Withholding Election – Filing an A-4 form is a necessary step of the employment process for any new employee in the state of Arizona. This form outlines important information regarding how much money should be withheld from their paycheck for federal and state withholding taxes. Completing the A-4 form correctly is critical to ensure that both the employer and employee are in compliance with the tax laws in Arizona.

What is A-4 Form – Employee’s Arizona Withholding Election?

The A-4 Form is an important document for Arizona employees when it comes to their state income withholding. This form allows individuals to determine how much of their income should be withheld from their paychecks in order to cover any taxes that may be owed to the state. For those who make estimated payments, this form can also help with the calculation of what should be paid each period. It’s important for employees to understand how this works, as errors or omissions on the A-4 Form can lead to a higher tax bill or even penalties later on.

The A-4 Form allows individuals to select either a flat percentage rate or dollar amount withholding option when filling out the form. The flat percentage rate option works like a traditional tax withholding system, where each paycheck is reduced by a certain percentage amount towards taxes.

Where Can I Find the A-4 Form?

The A-4 Form is commonly used by employers in Arizona to document an employee’s withholding election. This form allows employees to make informed decisions about the amount of tax they wish to have withheld from their paychecks and provides employers with the necessary information for accurate reporting. Knowing where to find this important document can be beneficial for both employers and employees looking to remain in compliance with Arizona state income tax laws.

For those in need of an A-4 Form, there are several options available. The first is visiting the official website of the Arizona Department of Revenue, which has links to download the current version free of charge. Additionally, employers may contact local agencies such as their county or city government offices or chambers of commerce for assistance in obtaining a copy.

However, there is no need to be concerned since we have provided the most recent version of the A-4 form, which is available for direct download from our website. At the very bottom of this article is a link that will take you to the download page.

Arizona Employer Requirements

Employers in Arizona are required to deduct state income tax from their employees’ pay for work done within the state. The tax is a percentage of the employee’s total taxable earnings. Total taxable earnings referred to as “gross taxable wages,” are defined as the amount defined as wages by U.S. Code § 3401, typically found in box 1 of the employee’s W-2 form. Wages considered taxable for federal taxes are also considered taxable for Arizona state taxes. Any amounts that are excluded from federal wage tax obligations are also excluded from Arizona state tax obligations.

A-4 Form 2023 Printable – Employee’s Arizona Withholding Election

The A-4 form is an important document for employees in Arizona. It allows employers to accurately calculate their state income tax withholding for each employee’s wages. Employees must complete the A-4 form at the start of each employment year and may need to make changes throughout the year if there are changes in their filing status or a number of exemptions claimed.

Employees who wish to adjust their withholding can submit a new A-4 form with revised information as needed. The form will provide accurate calculations for both Federal and Arizona state taxes, based on filing status, number of exemptions claimed, and other factors. In addition, employers must also use the A-4 Form to determine employer FICA taxes due on employee wages.