Table of Contents

Federal Income Tax Withholding Tables 2023 – As we approach 2023, staying current on the latest changes to the federal withholding tables is important. Understanding these tables is essential for employers and employees to ensure accurate and timely tax payments. This article will provide an in-depth look at the federal withholding tables for 2023, including what they are, how they work, and what changes have been made.

What Are Federal Withholding Tables?

The federal withholding tables are tables employers use to determine how much federal income tax should be withheld from an employee’s paycheck. These tables are based on the employee’s income, filing status, and the number of withholding allowances they claim. The tables are updated each year to reflect changes to the tax code, and employers must use the most current version of the tables to calculate withholding taxes.

How Do Federal Withholding Tables Work?

The federal withholding tables provide employers with a chart that lists the amount of tax to withhold based on an employee’s income and withholding allowances. To use the tables, an employer must determine an employee’s taxable income by subtracting their withholding allowances from their gross pay. The employer then uses the federal withholding tables to find the appropriate tax withholding amount based on the employee’s taxable income and filing status.

What Changes Have Been Made to the 2023 Federal Withholding Tables?

For 2023, employers and employees should be aware of several changes to the federal withholding tables. One of the most significant changes is the increase in the standard deduction for all filing statuses. The standard deduction is a set amount that taxpayers can subtract from their income to reduce their taxable income. The increase in the standard deduction will result in lower tax liability for many taxpayers.

Another change to the 2023 federal withholding tables is the increase in the income brackets for each filing status. Taxpayers can earn more income before being bumped into a higher tax bracket. Additionally, the tax rates have been adjusted to reflect inflation, resulting in a slightly higher tax liability for many taxpayers.

How to Use the Federal Withholding Tables for 2023

To use the federal withholding tables for 2023, employers must first determine an employee’s taxable income by subtracting their withholding allowances from their gross pay. Once the taxable income has been determined, the employer can use the appropriate federal withholding table to calculate the amount of tax to withhold. It’s important to note that employers must use the most current version of the tables to ensure accurate tax withholding.

The federal withholding tables for 2023 are essential for employers and employees. Understanding how these tables work and the changes made can help ensure accurate and timely tax payments. By staying up-to-date on the latest changes to the federal withholding tables, employers can avoid costly penalties, and employees can avoid unexpected tax bills. If you have any questions or concerns about the federal withholding tables for 2023, be sure to consult a tax professional.

Federal Income Tax Withholding Tables 2023 – IRS Publications 15-T

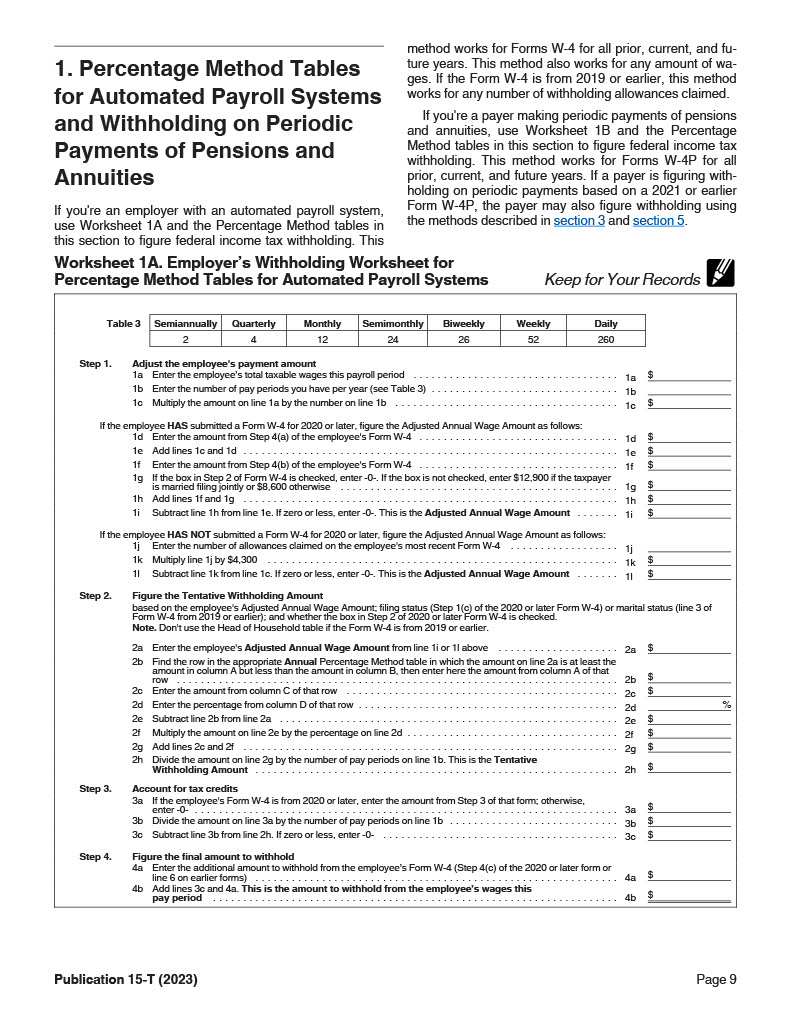

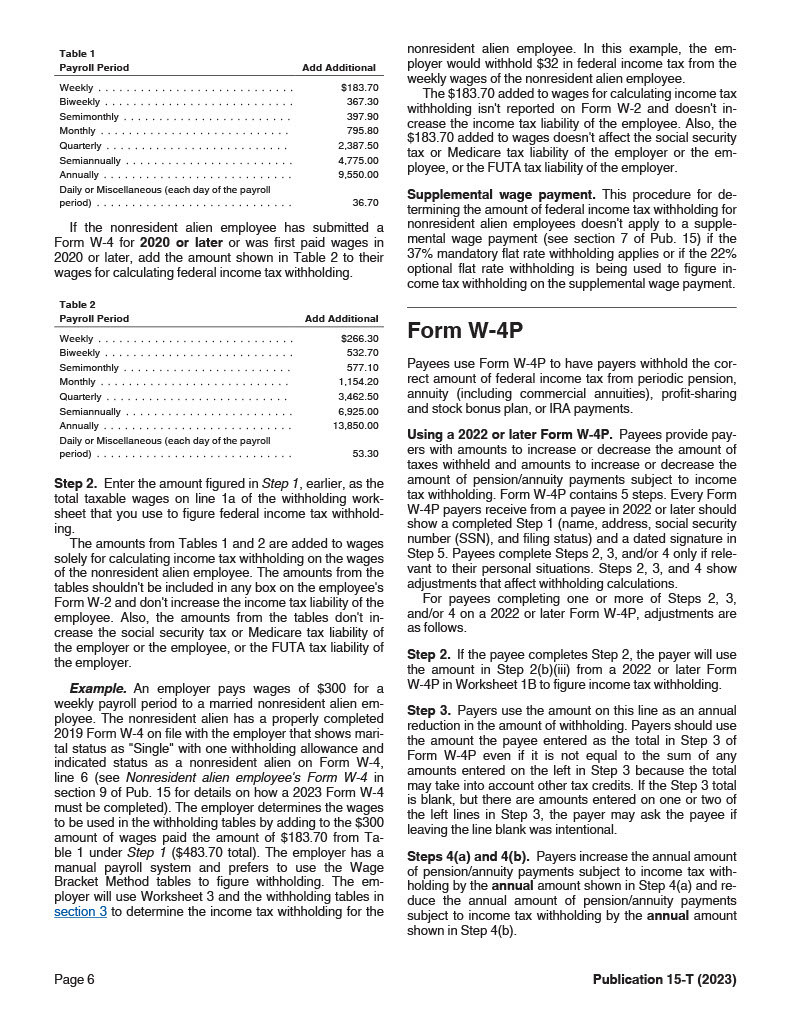

Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities

Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities

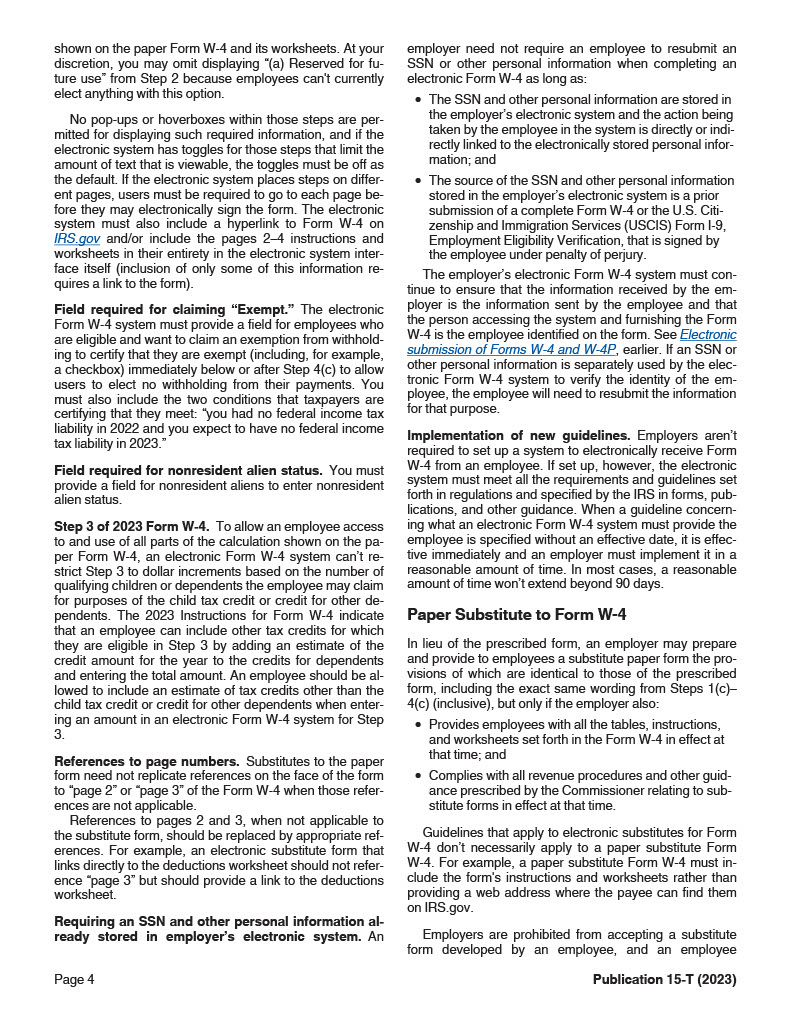

Worksheet 1A. Employer’s Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems

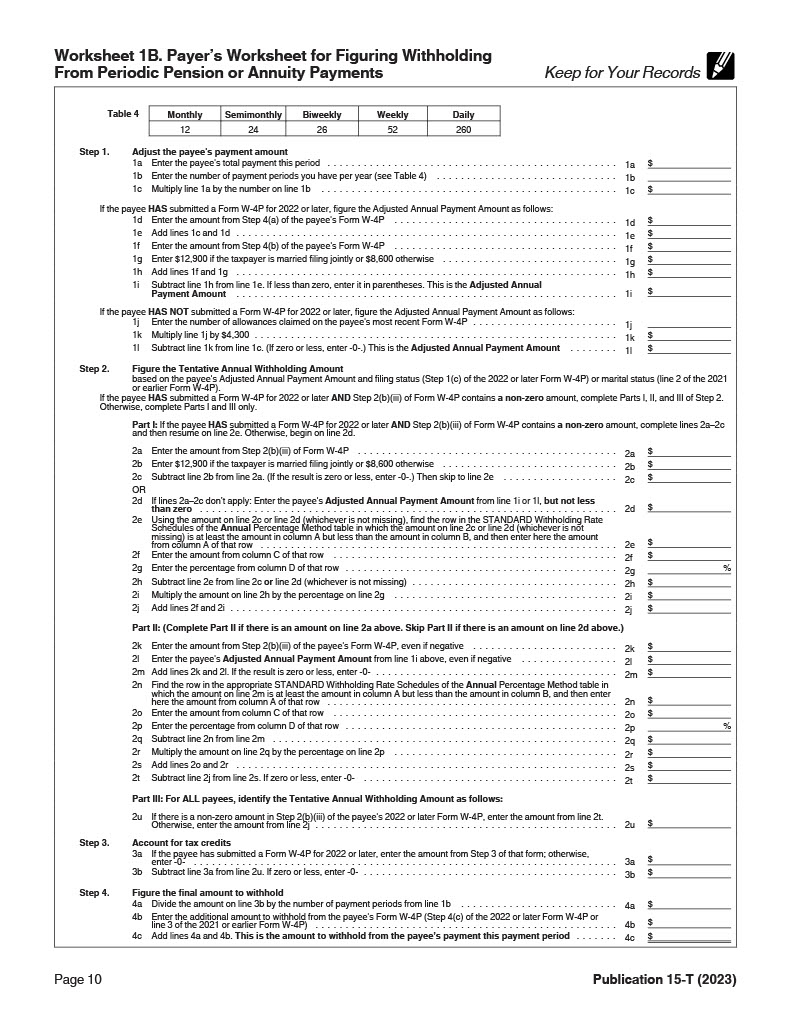

Worksheet 1B. Payer’s Worksheet for Figuring Withholding From Periodic Pension or Annuity Payments

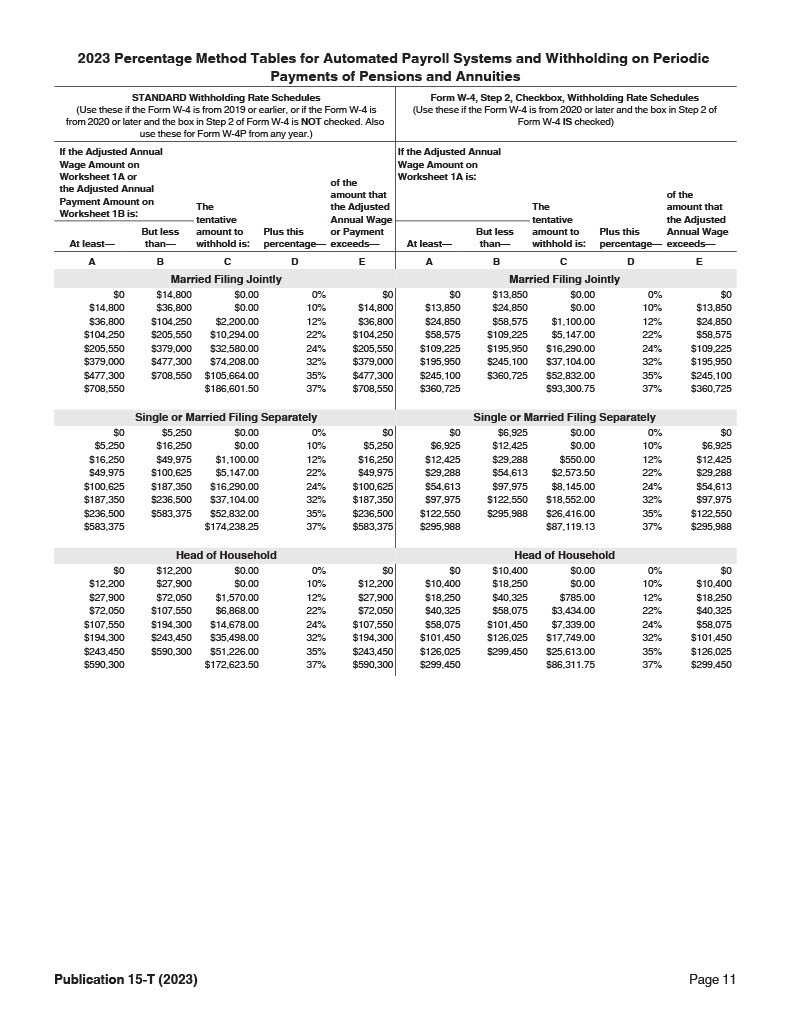

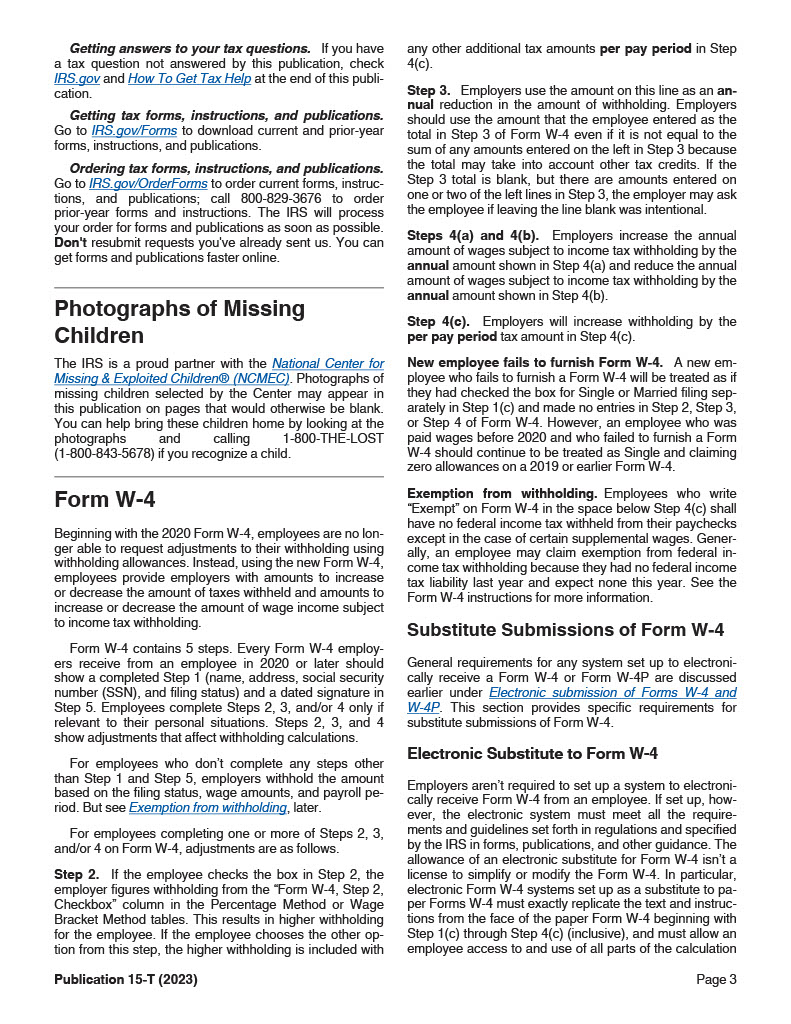

2023 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities

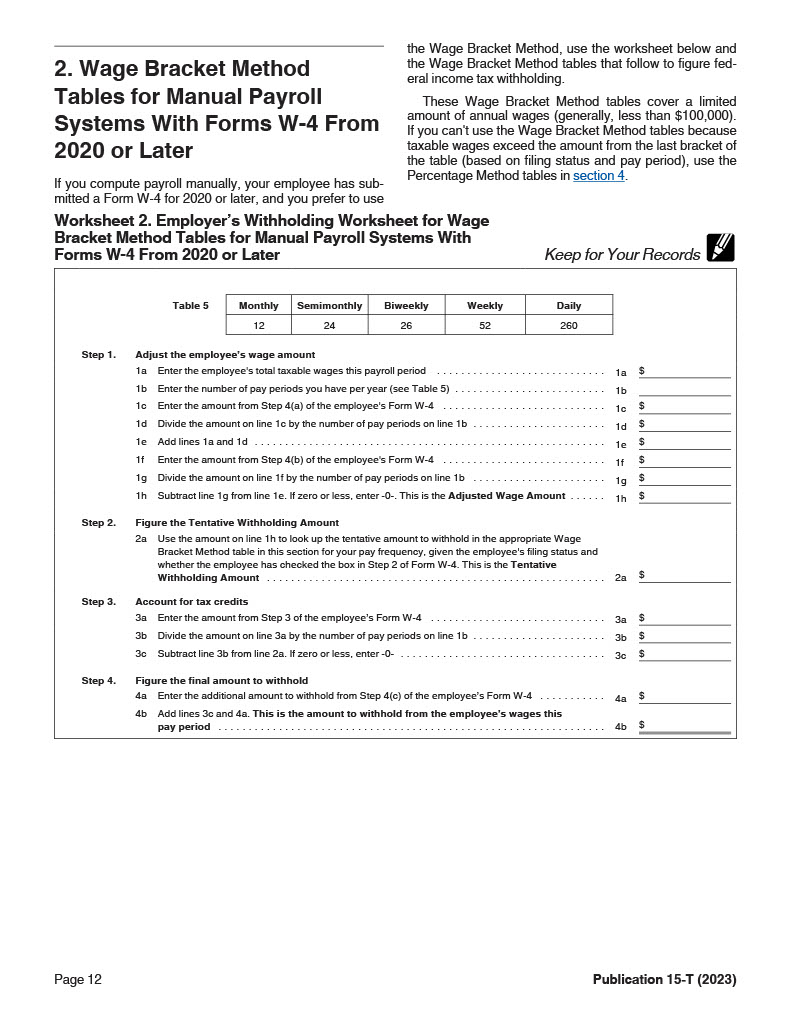

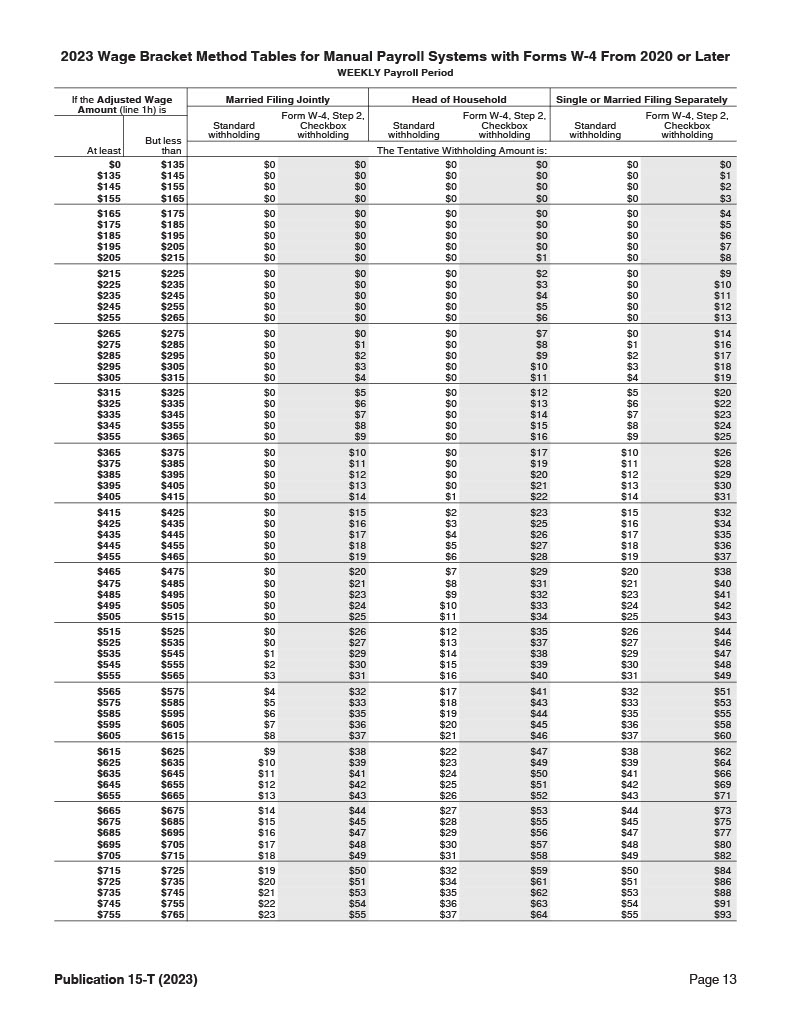

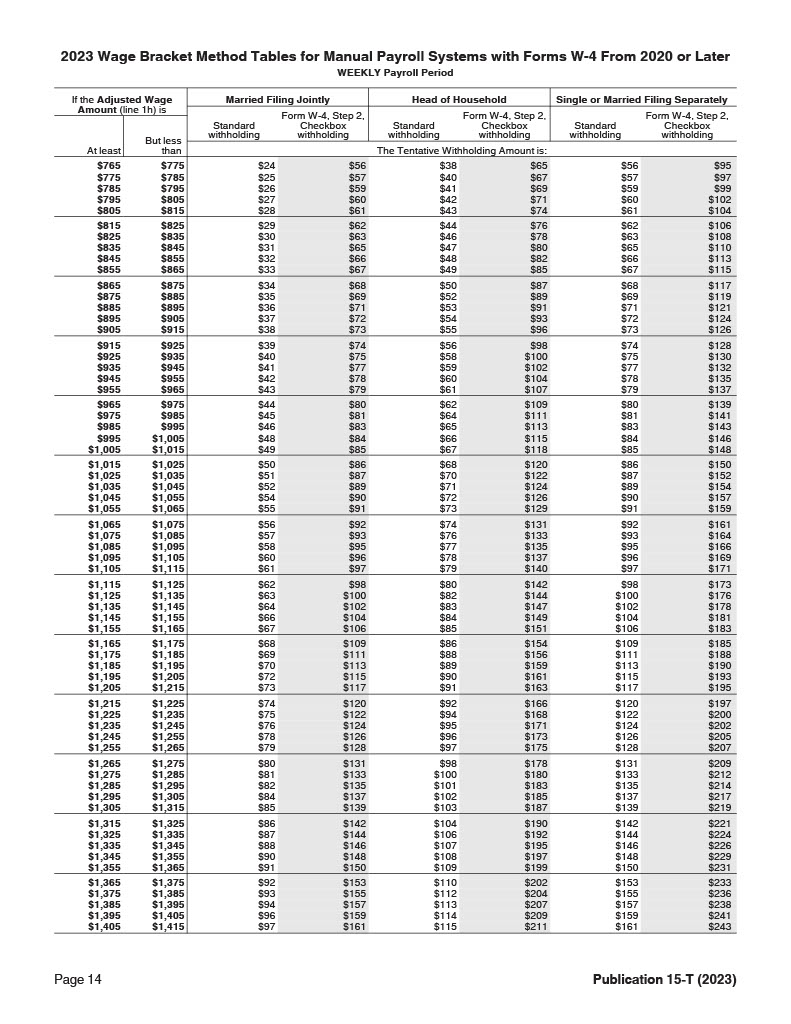

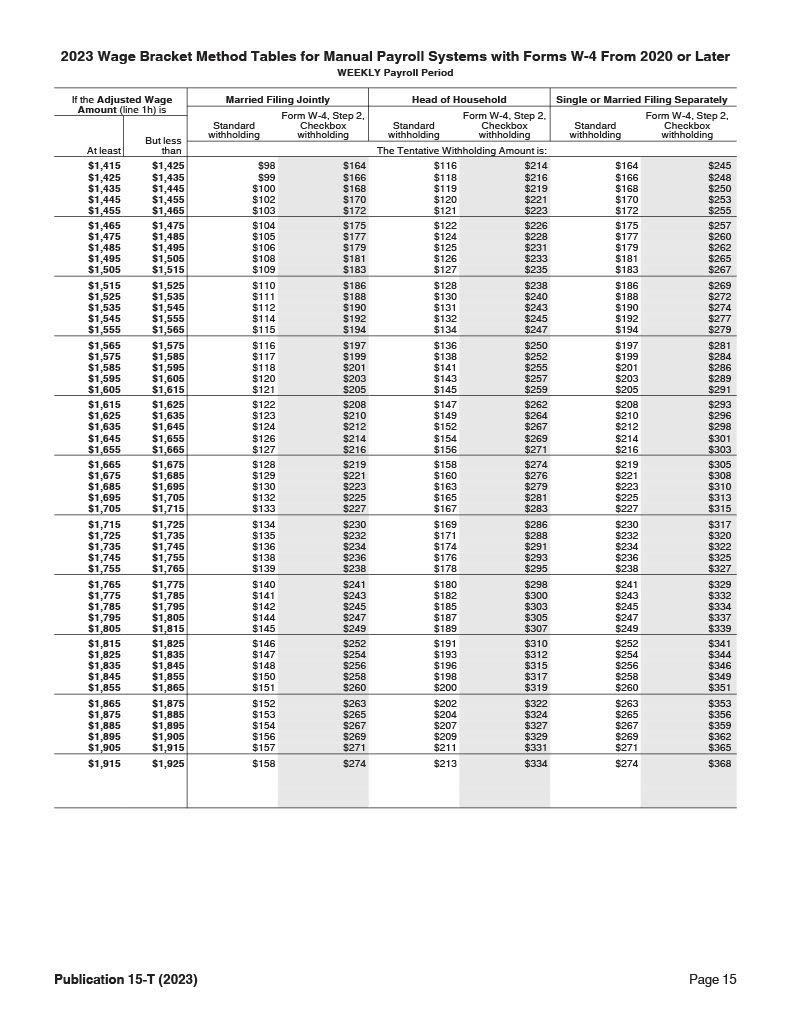

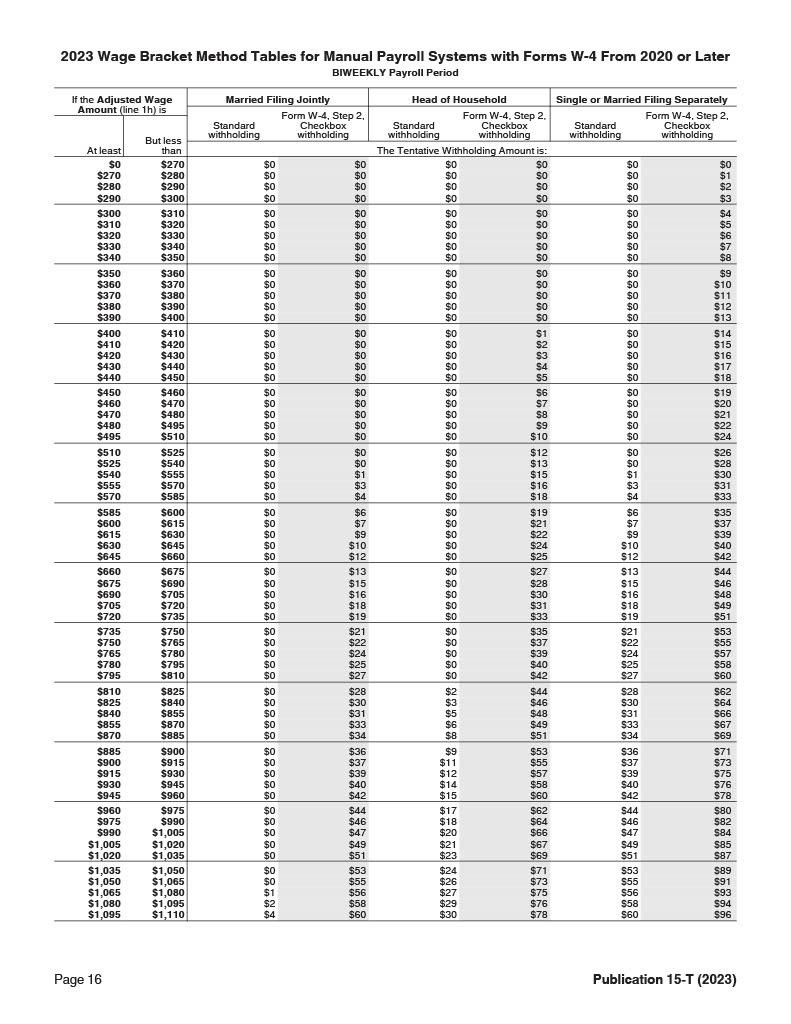

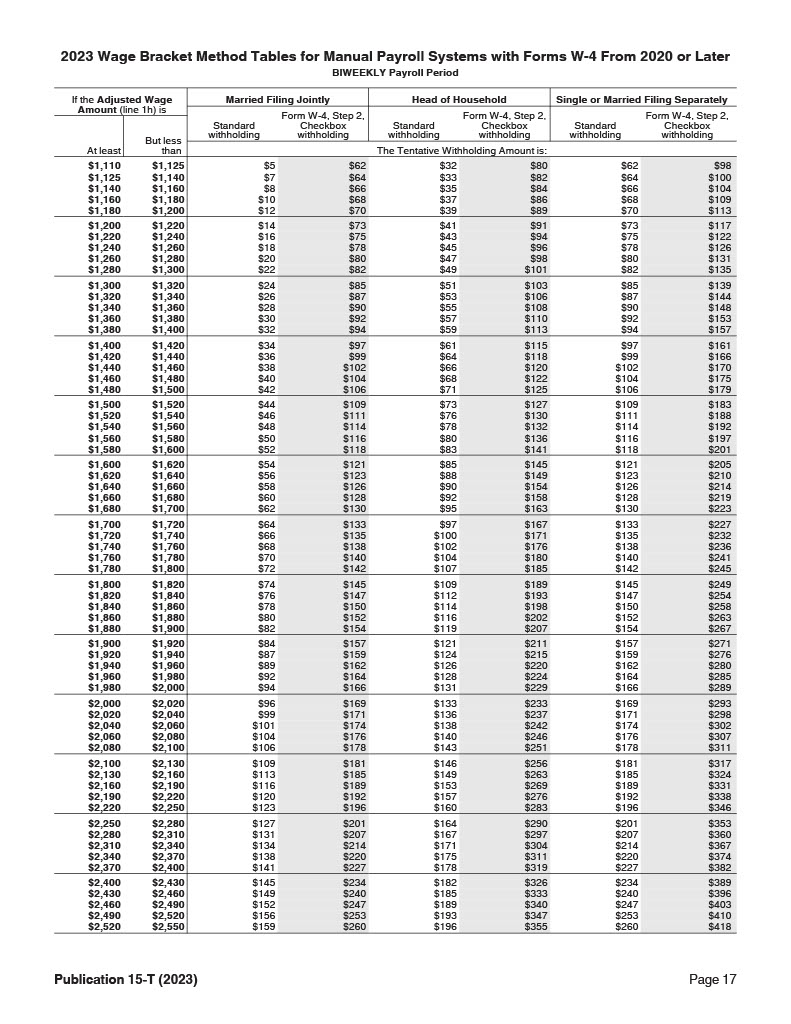

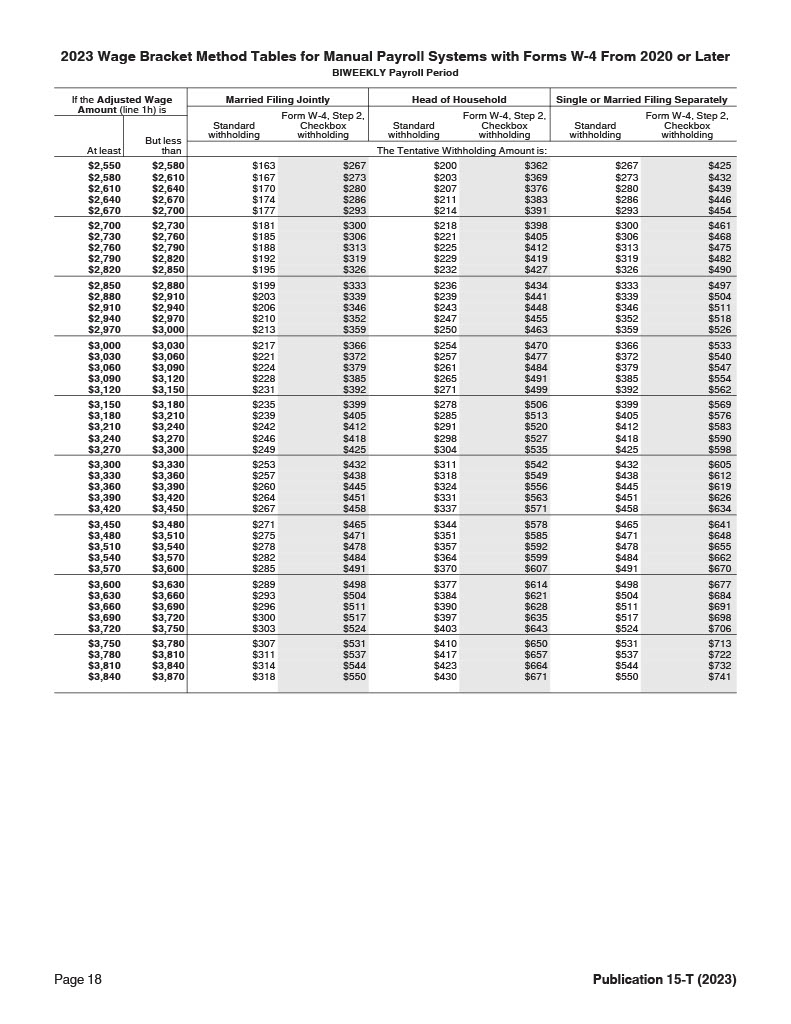

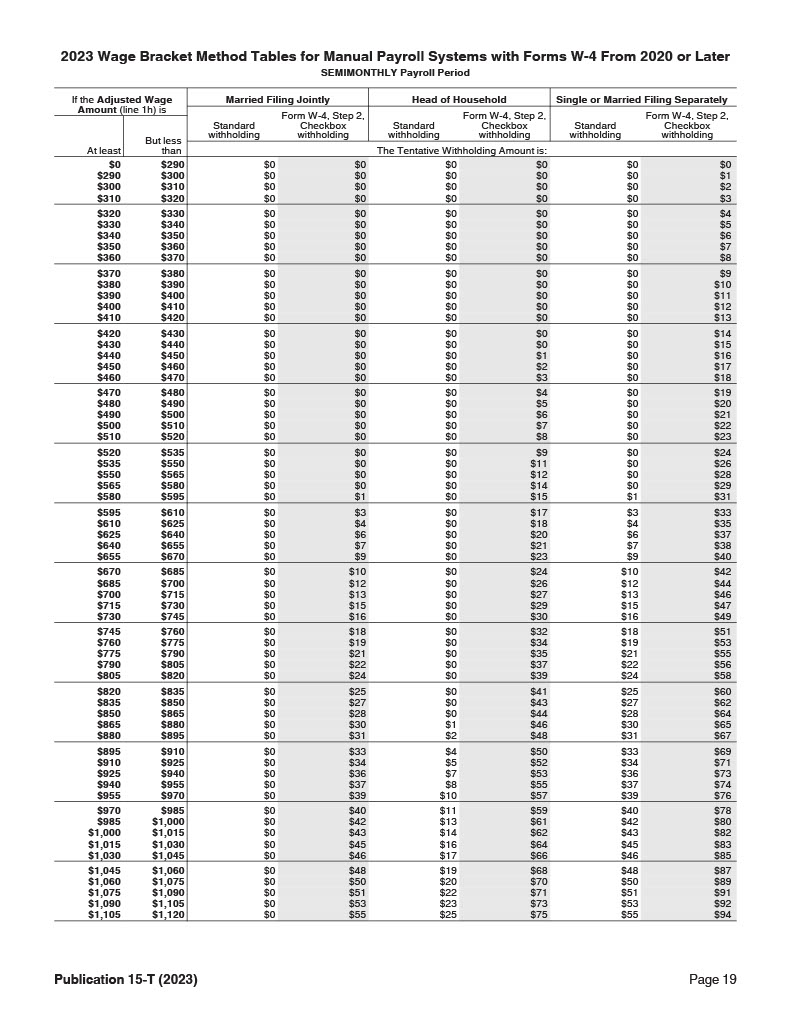

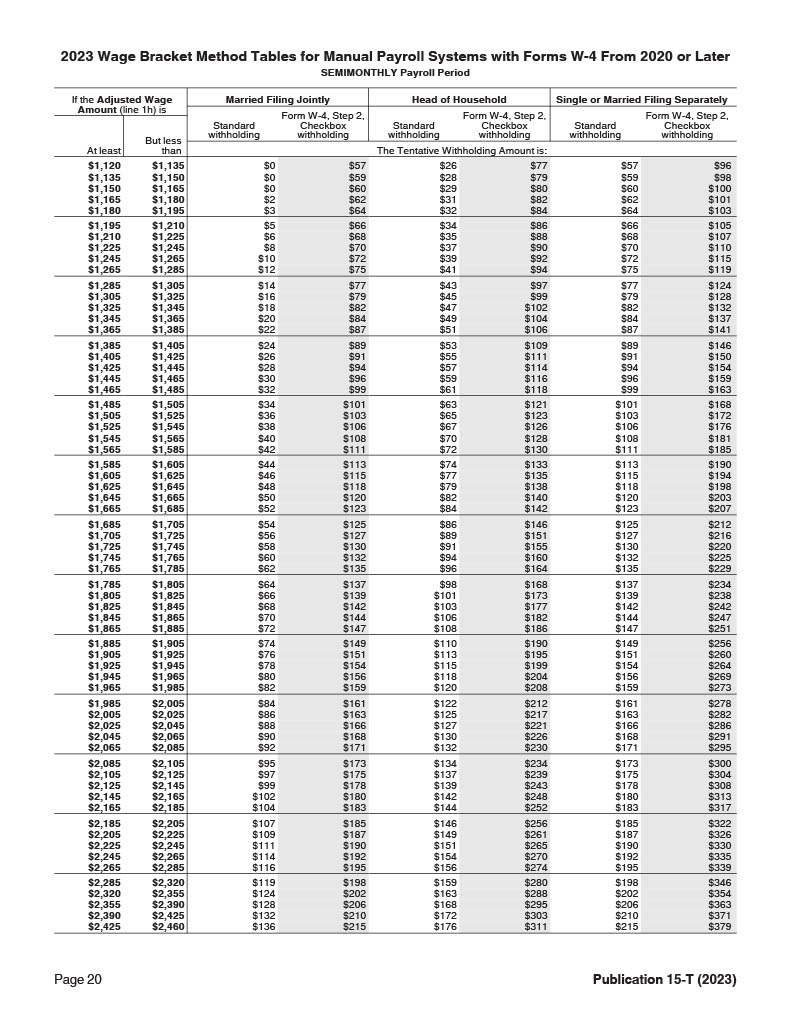

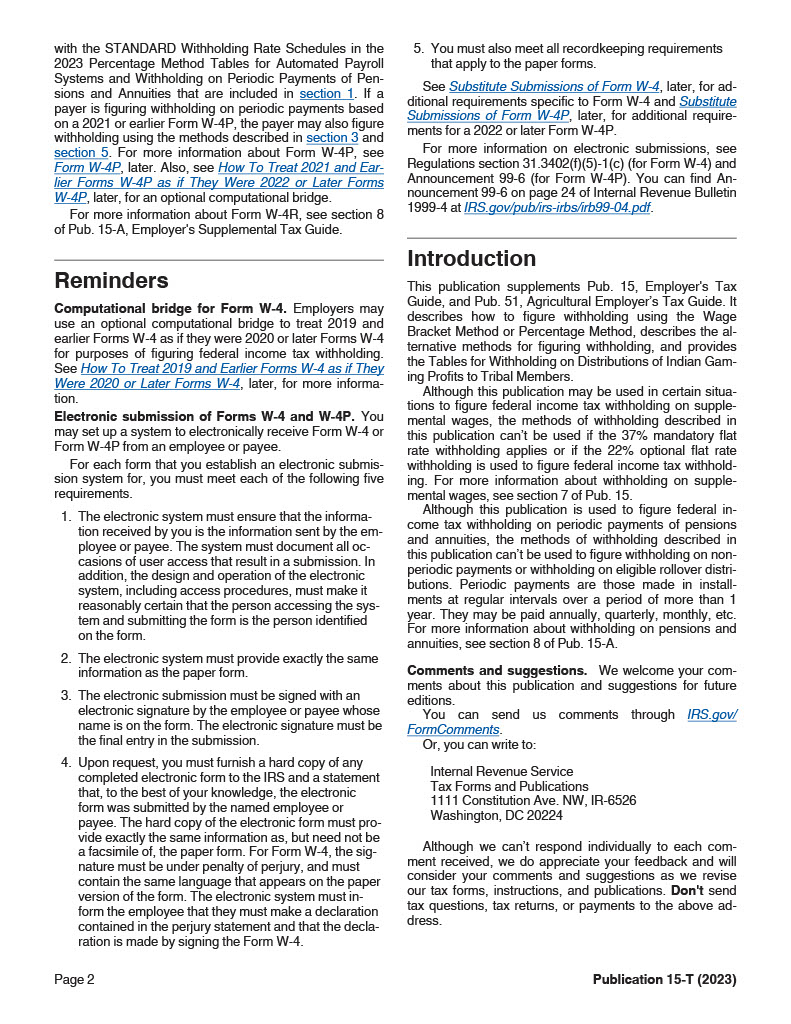

Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

2023 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later (WEEKLY Payroll Period)

2023 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later (BIWEEKLY Payroll Period)

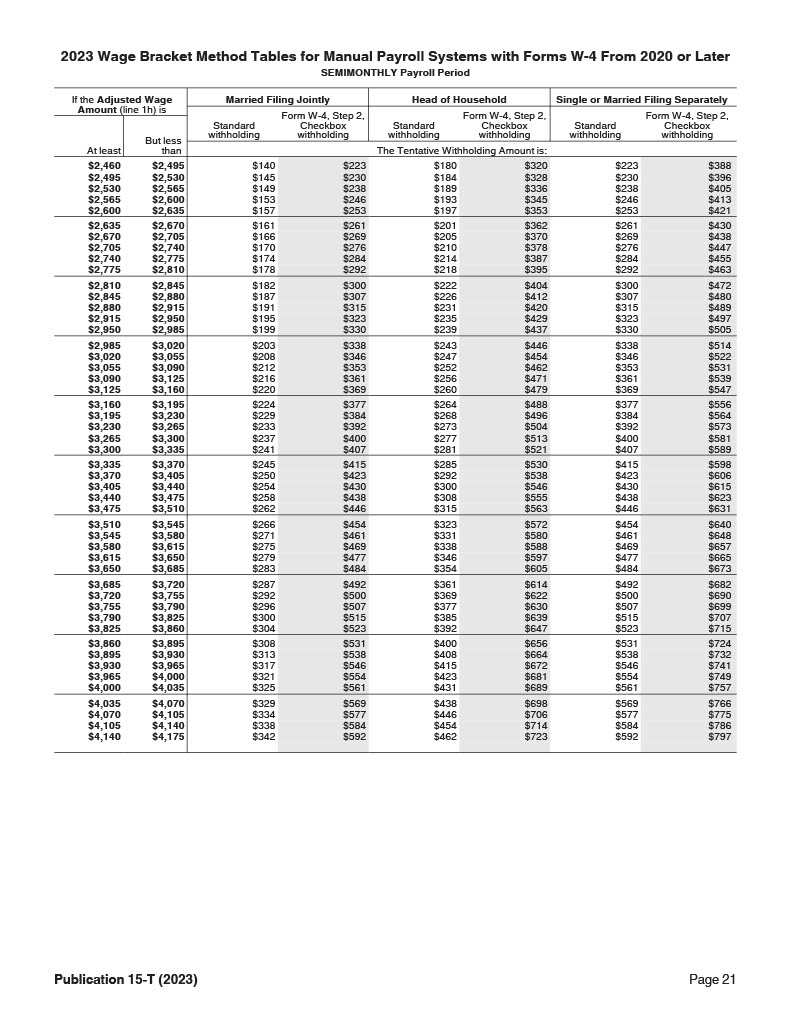

2023 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later (SEMIMONTHLY Payroll Period)

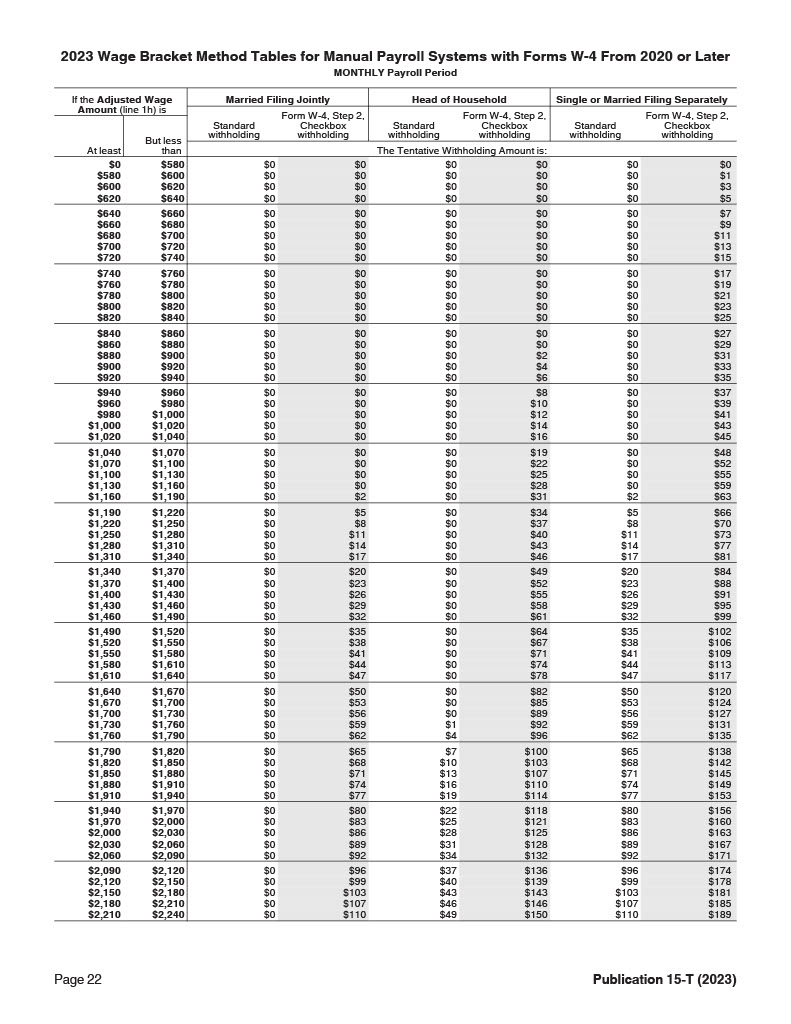

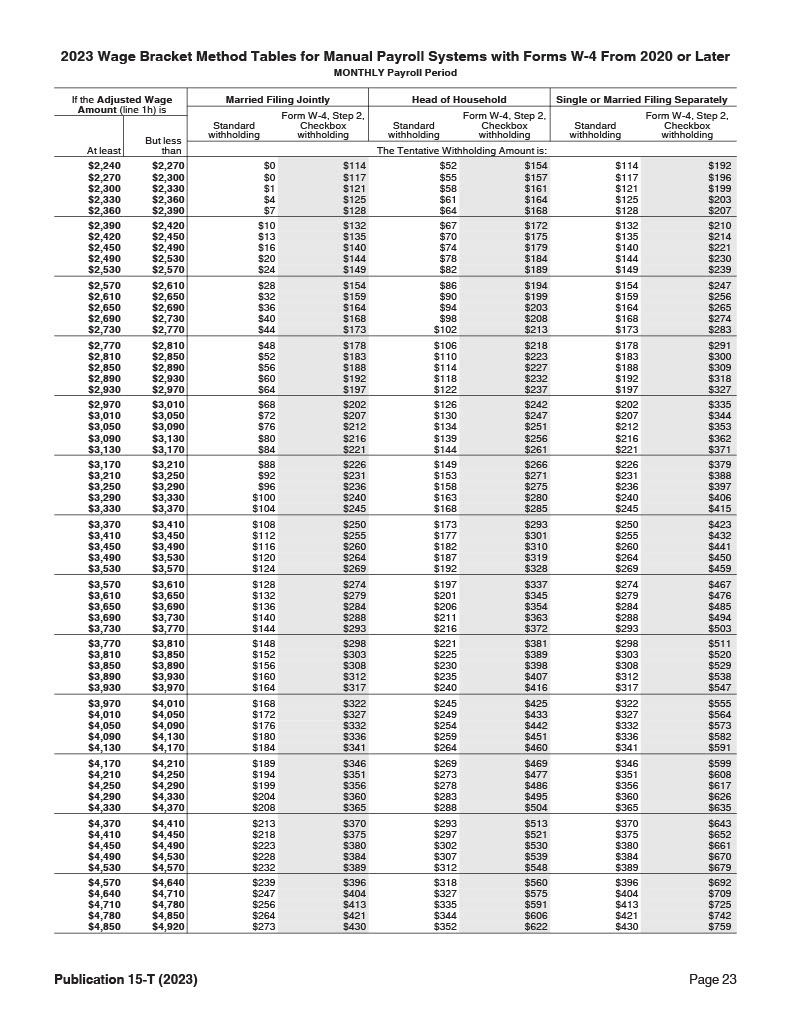

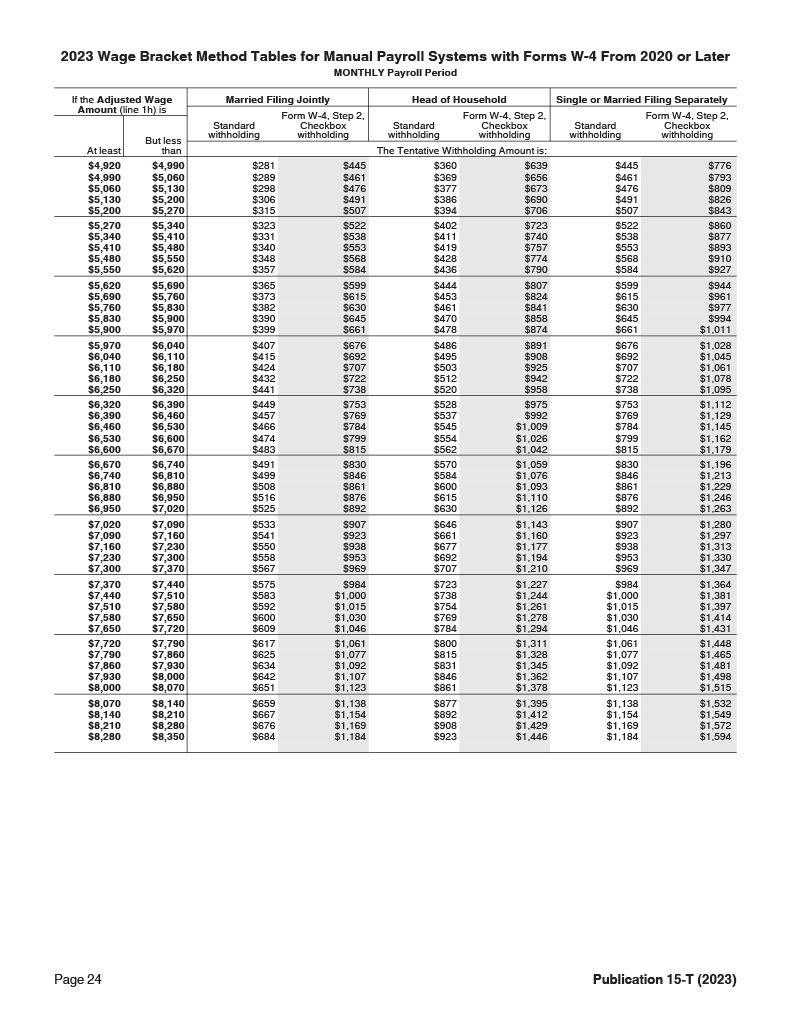

2023 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later (MONTHLY Payroll Period)

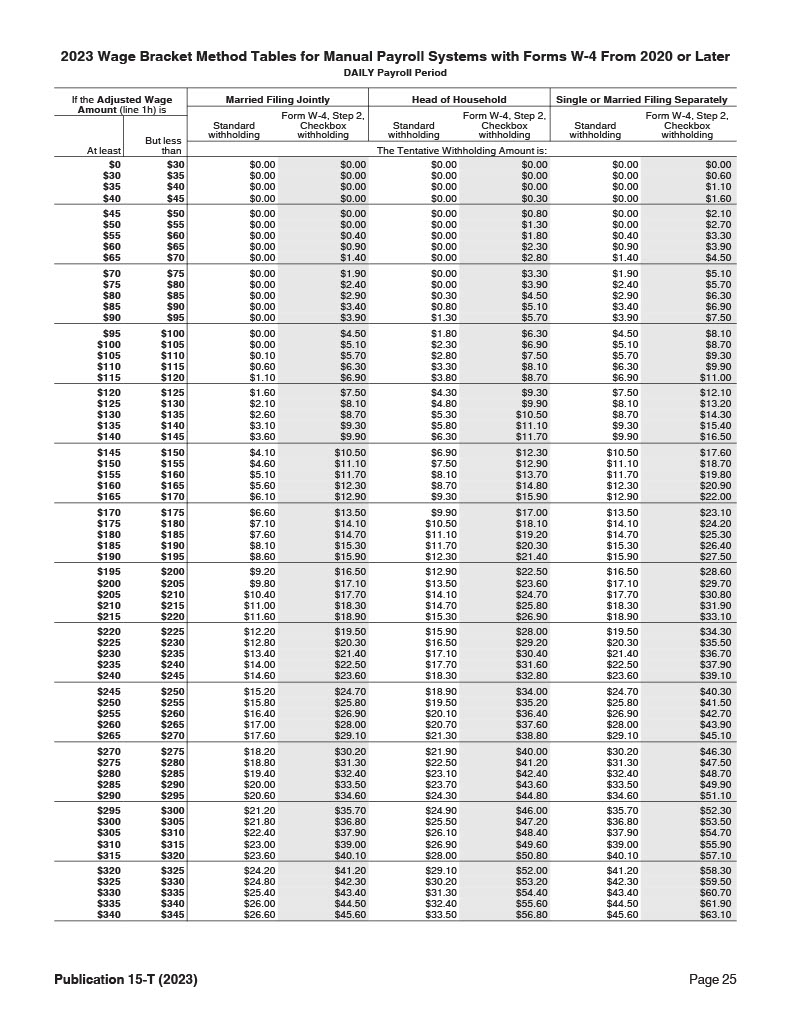

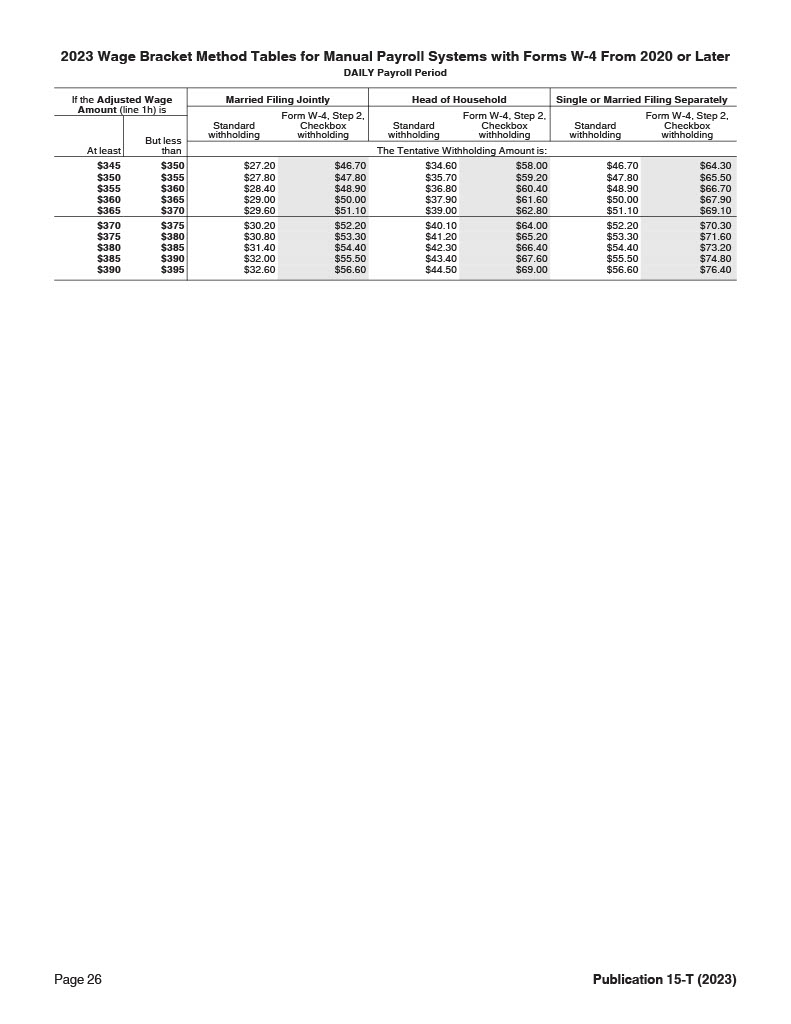

2023 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later (DAILY Payroll Period)

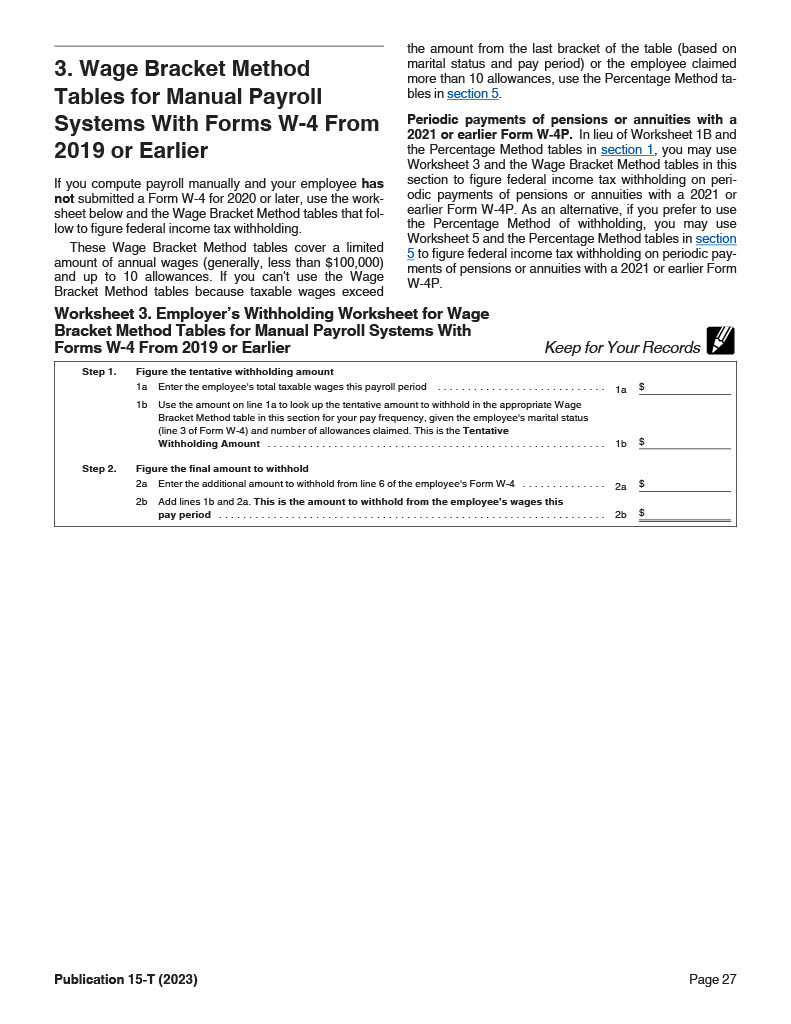

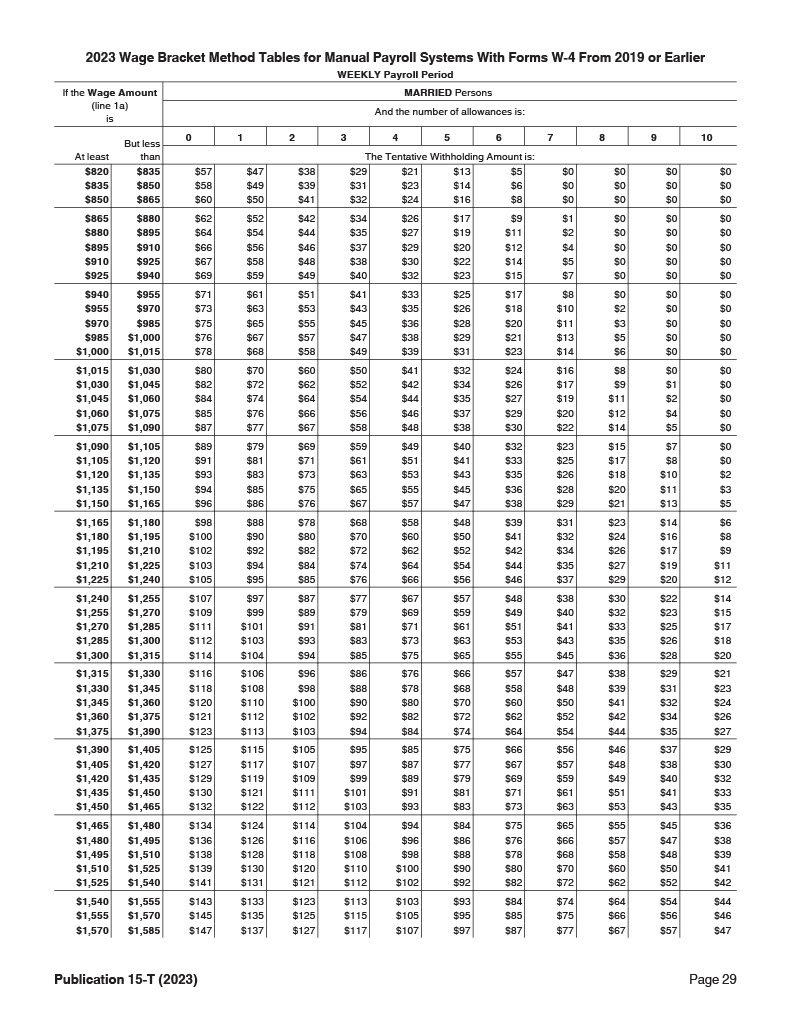

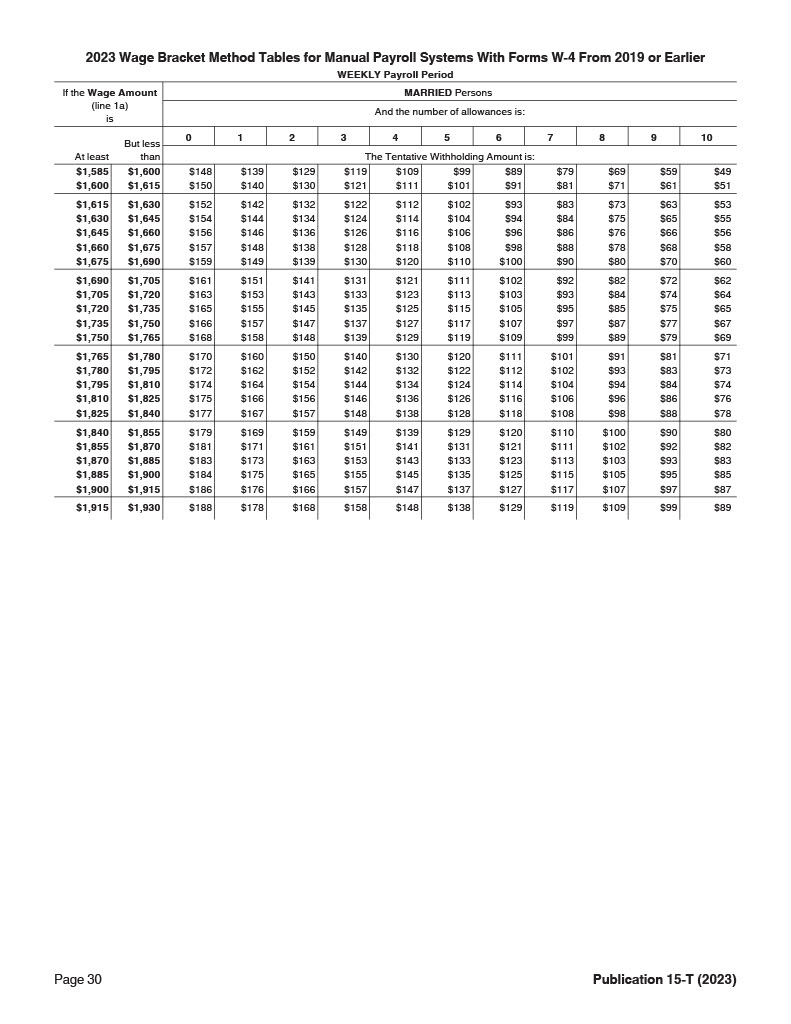

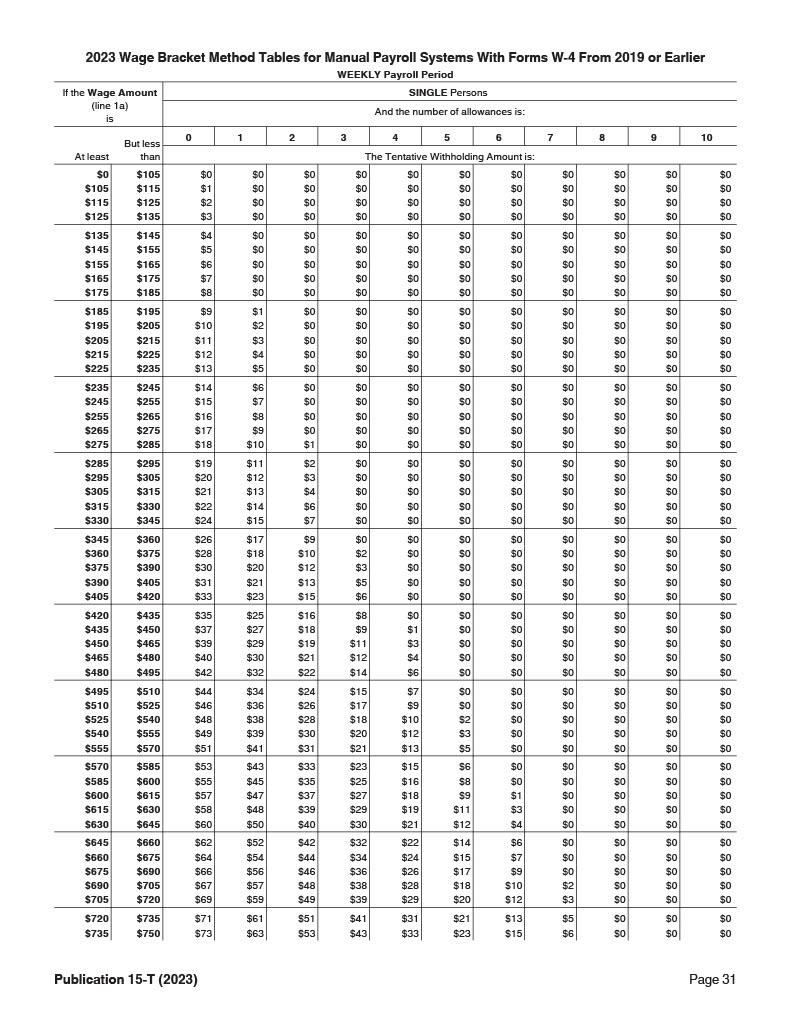

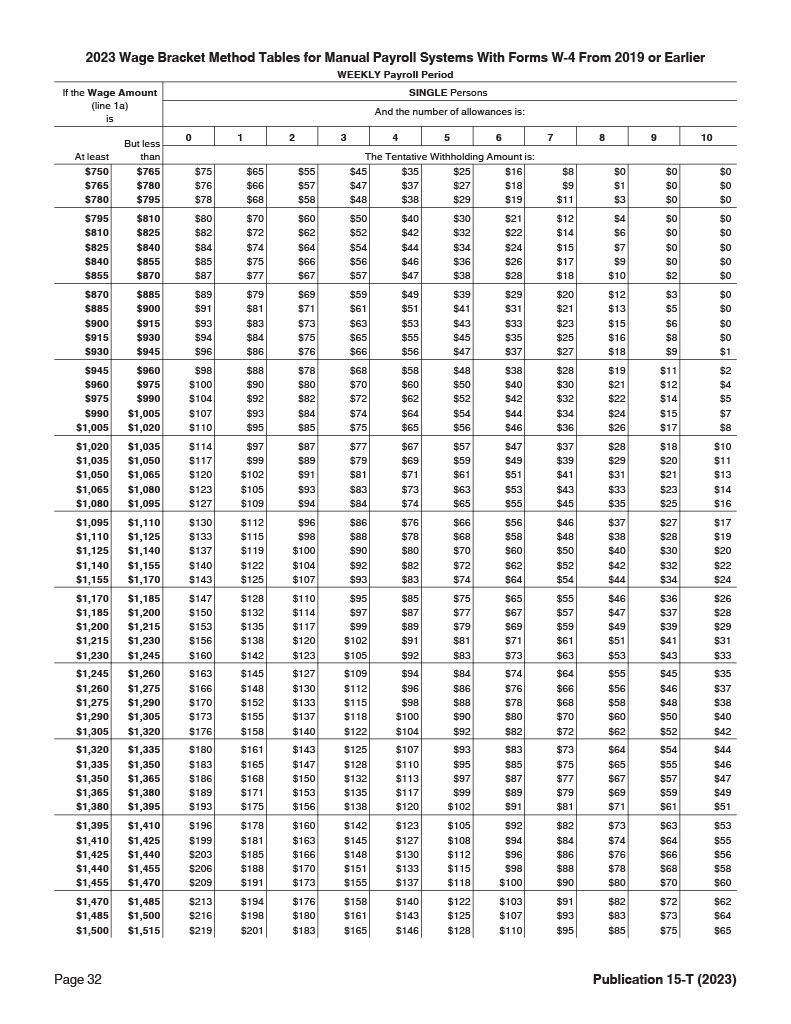

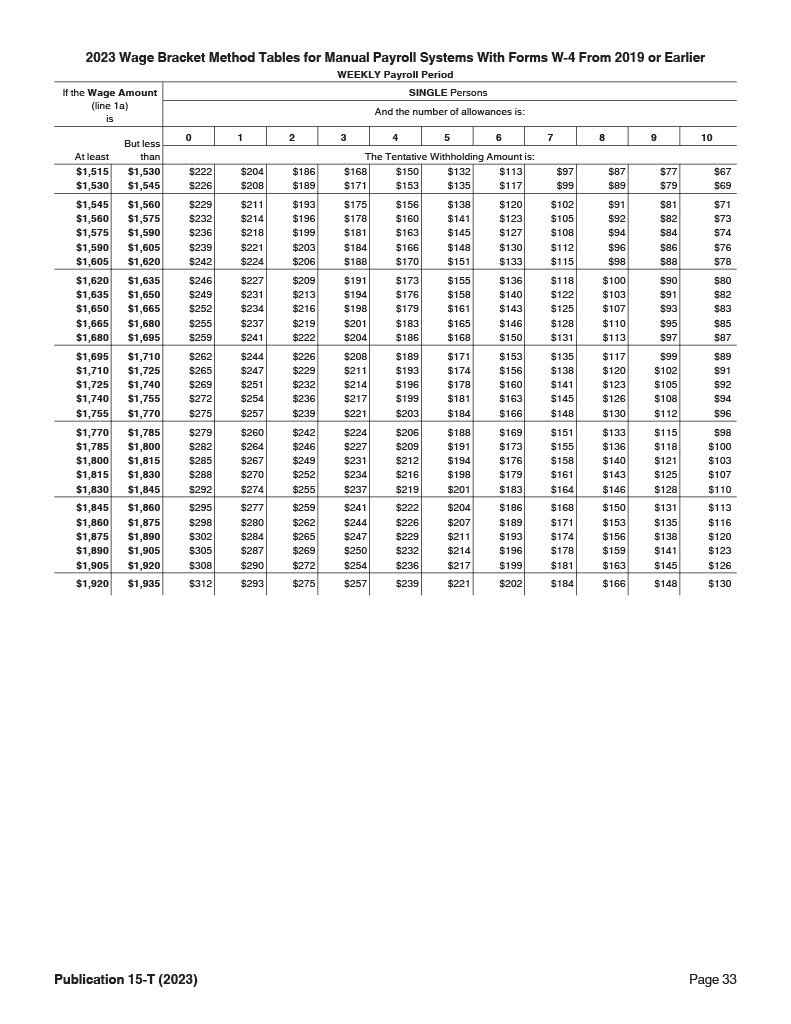

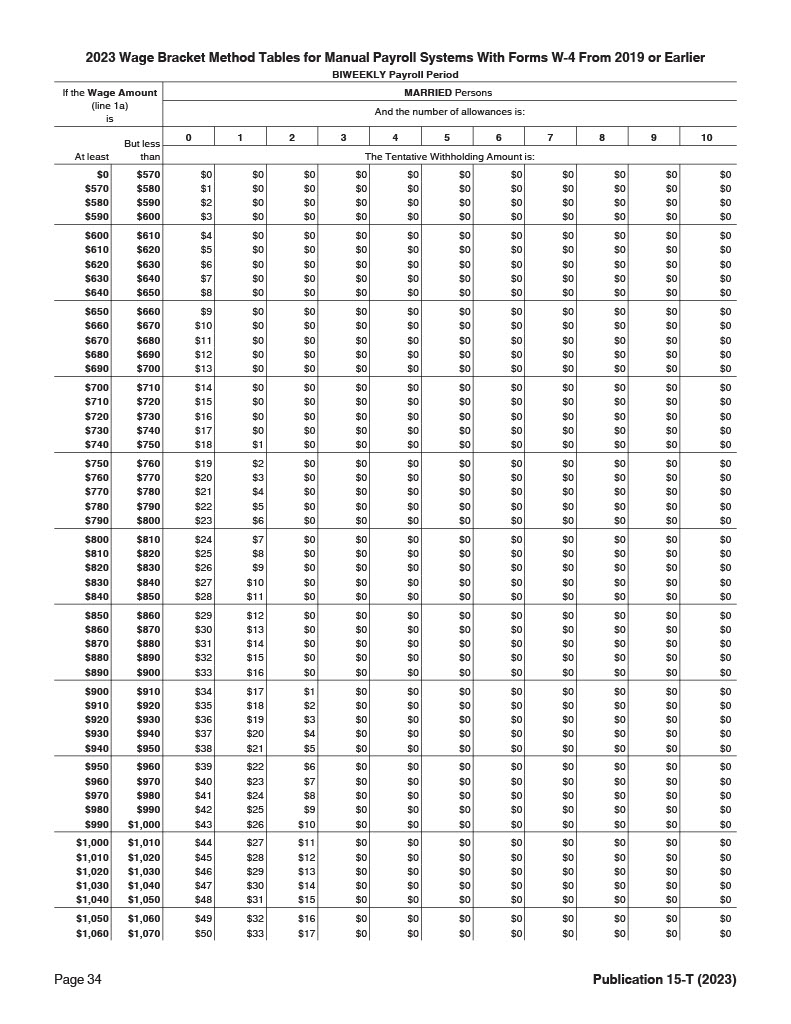

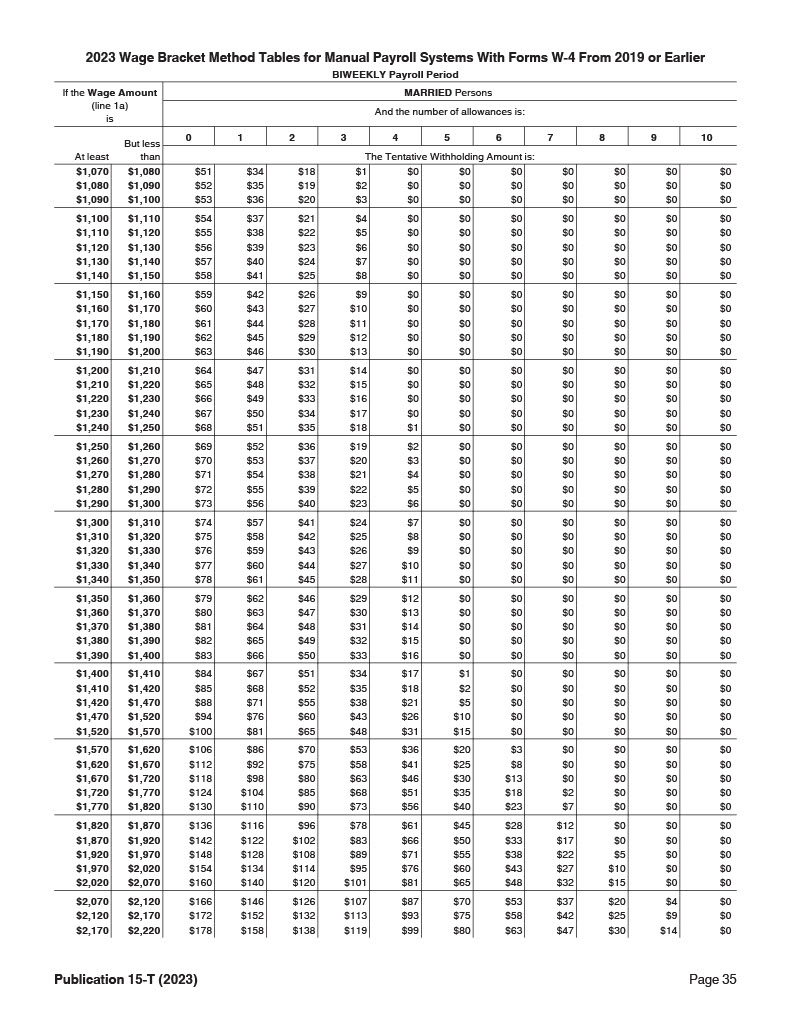

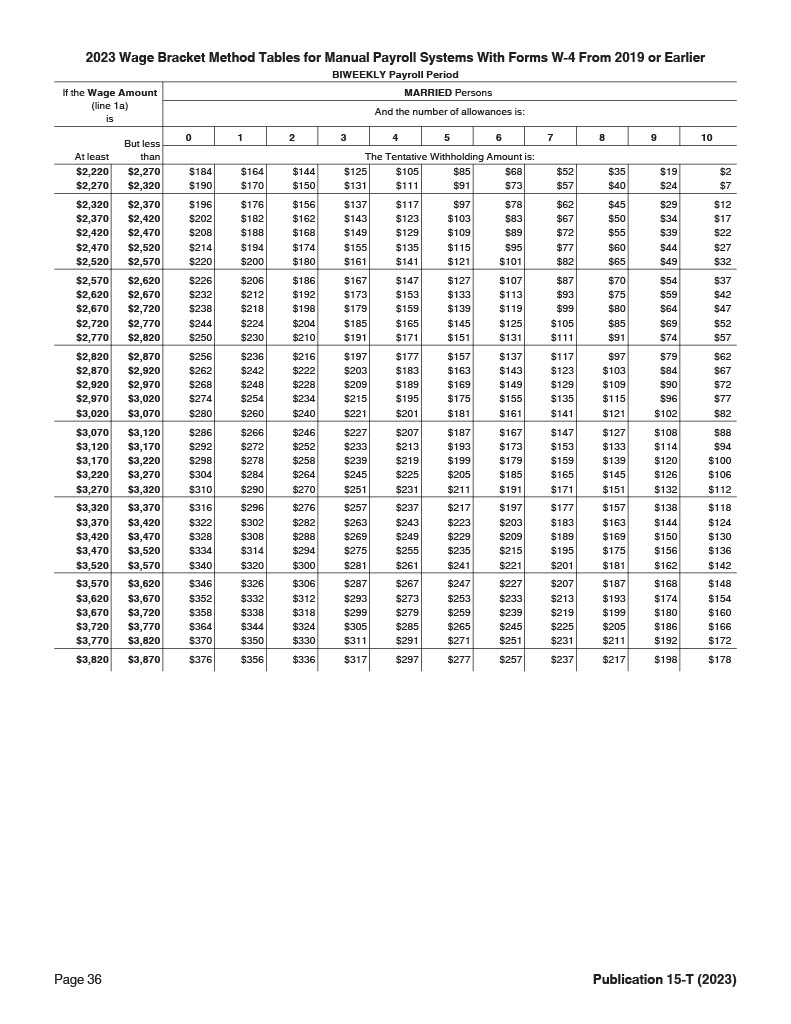

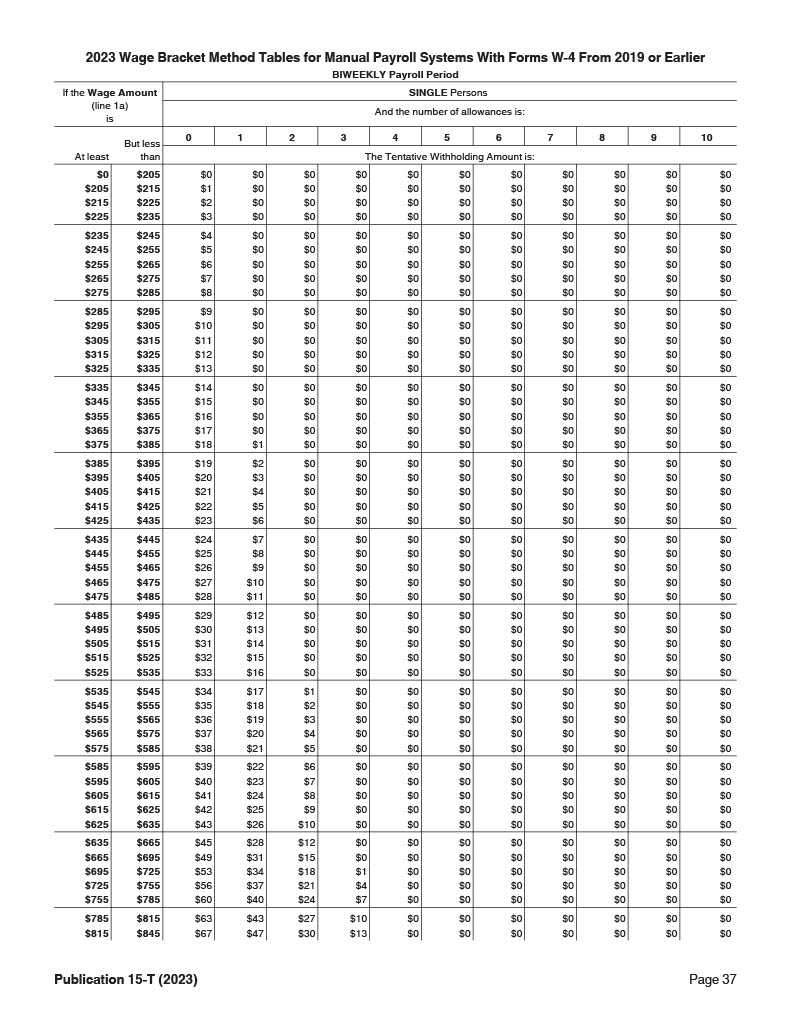

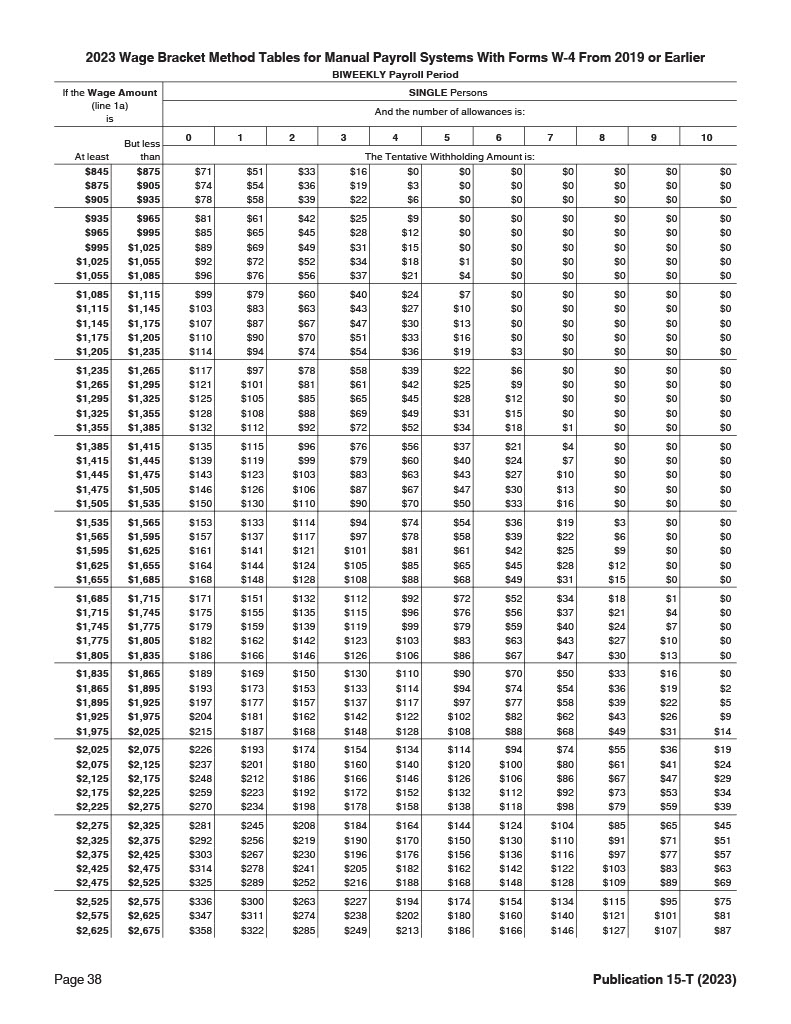

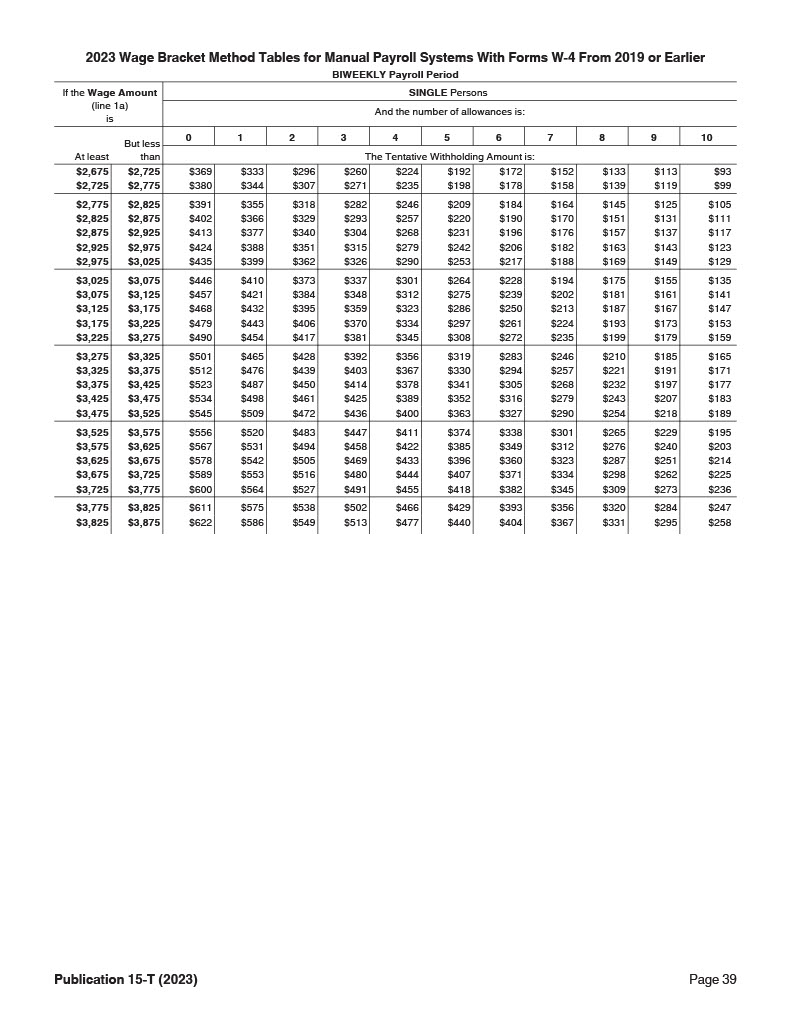

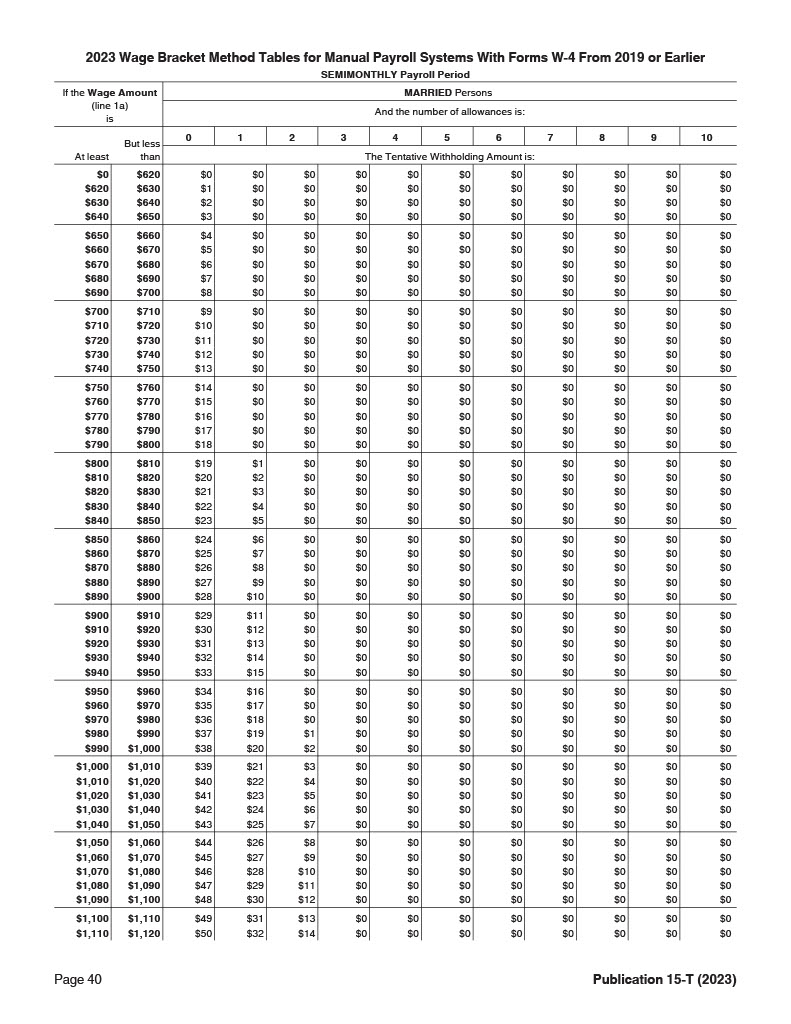

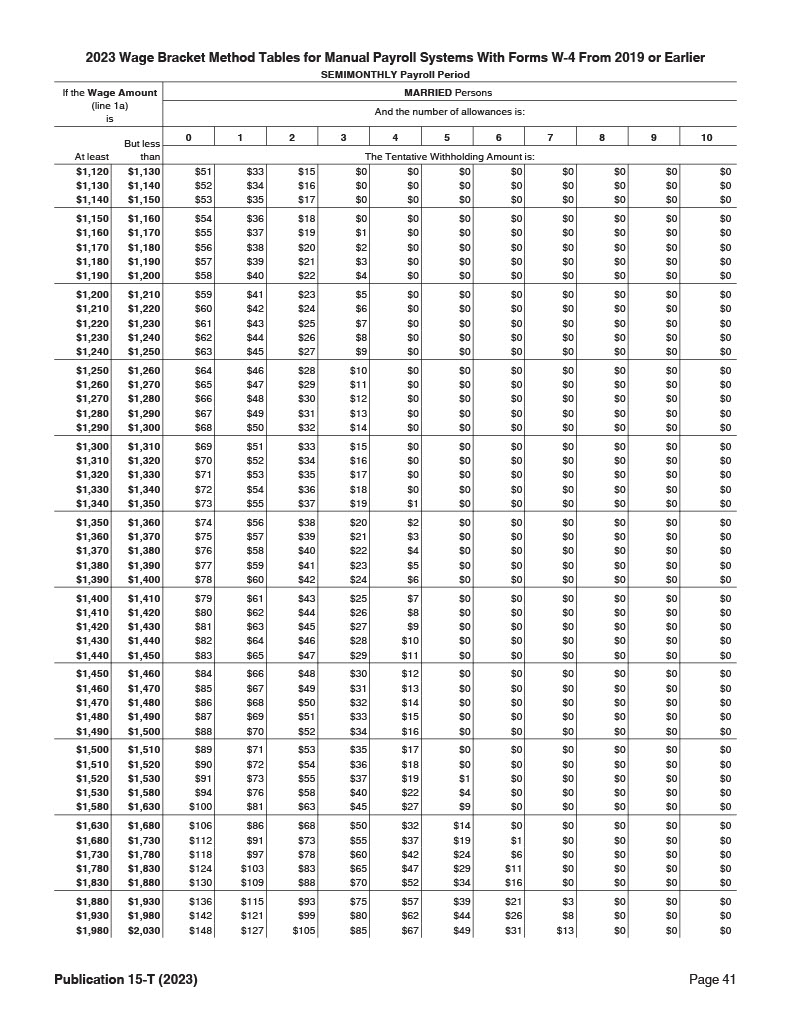

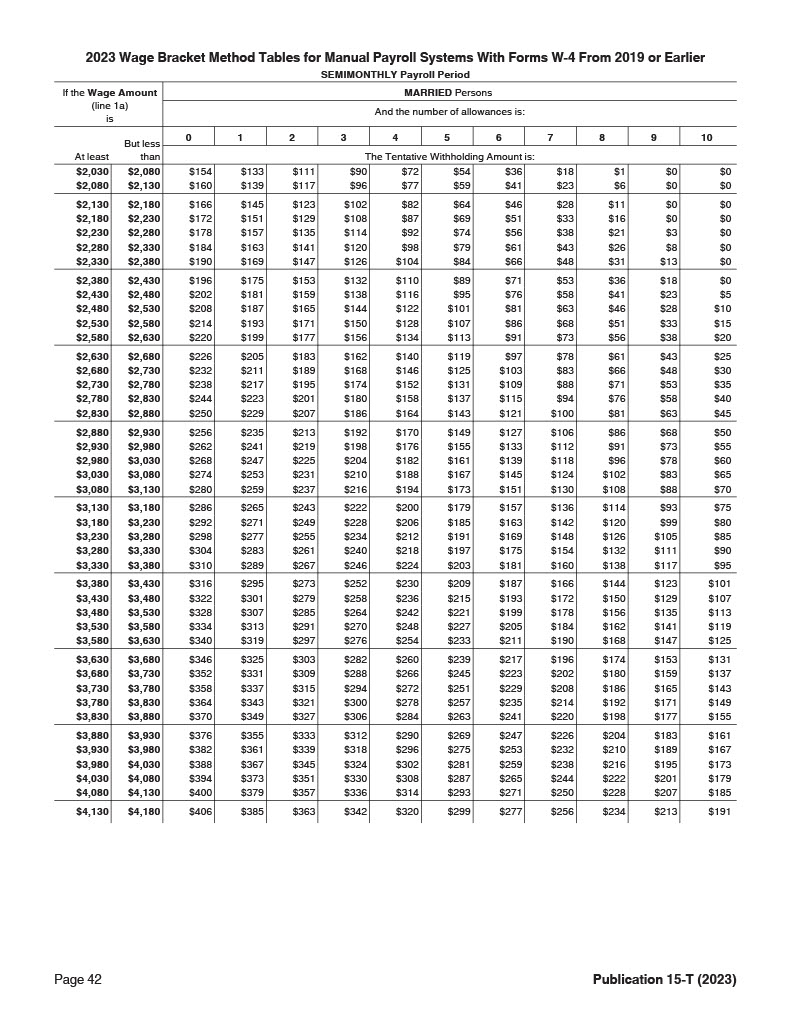

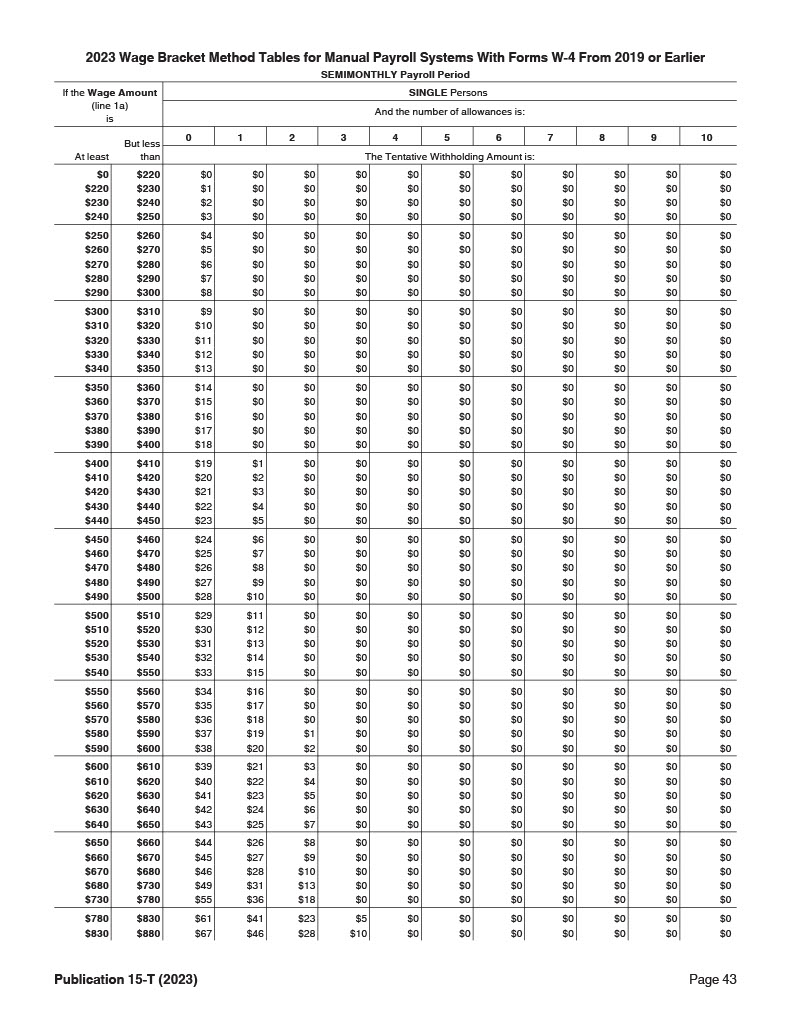

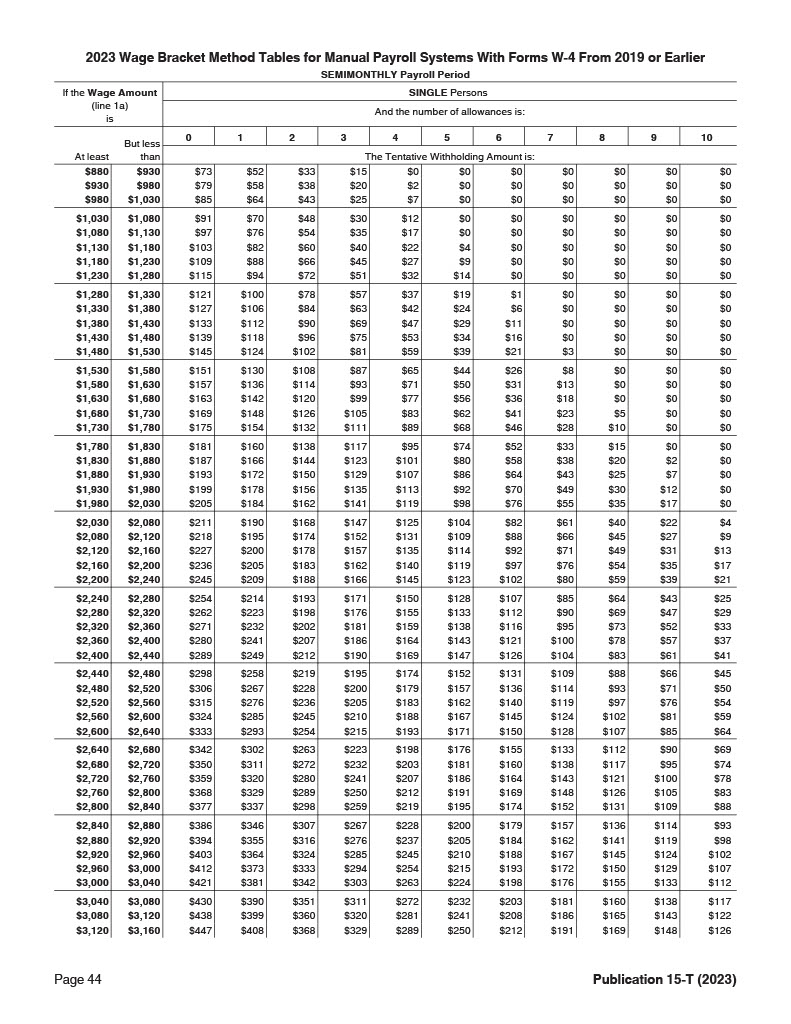

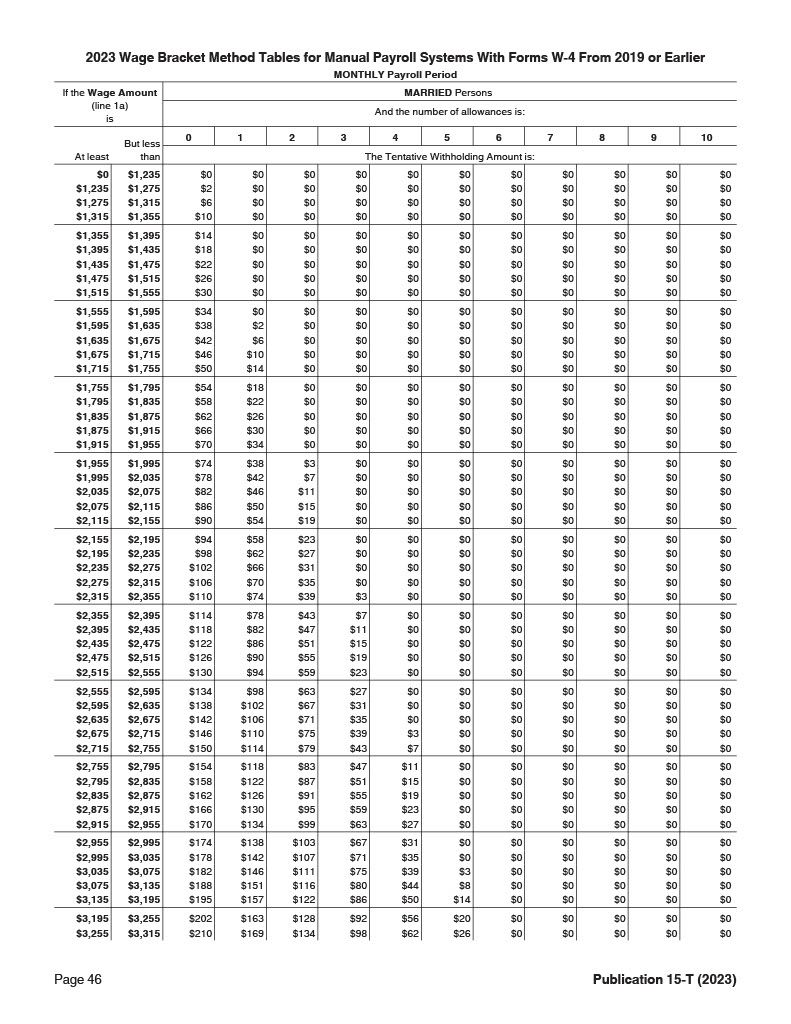

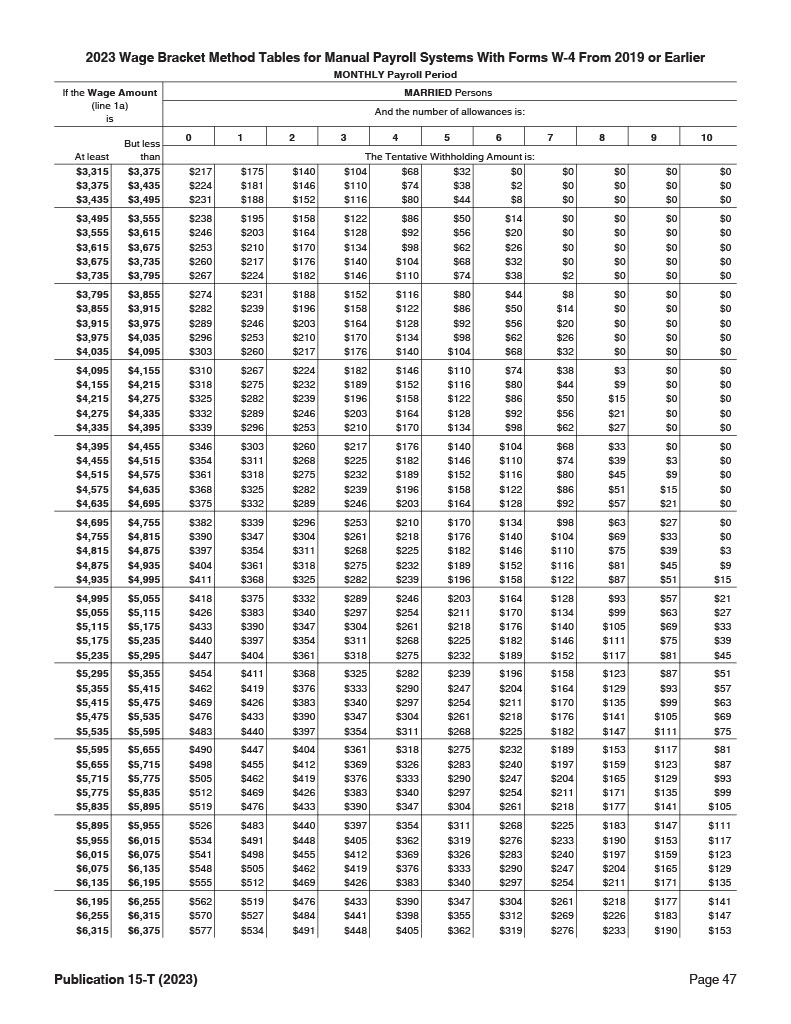

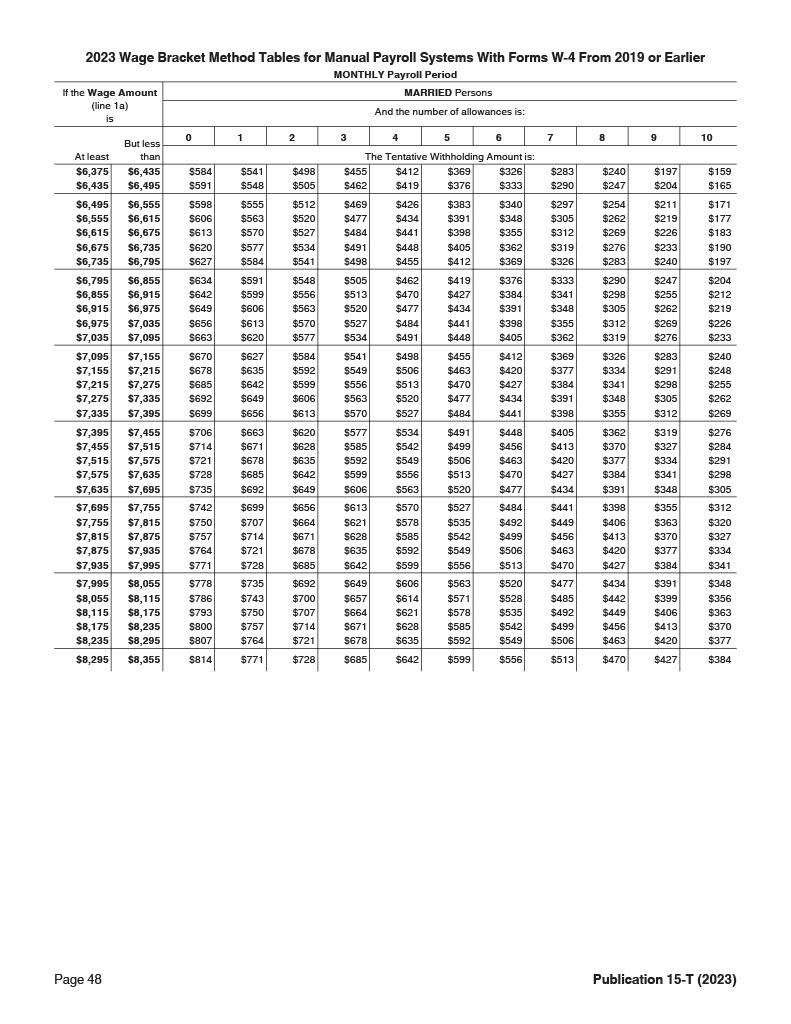

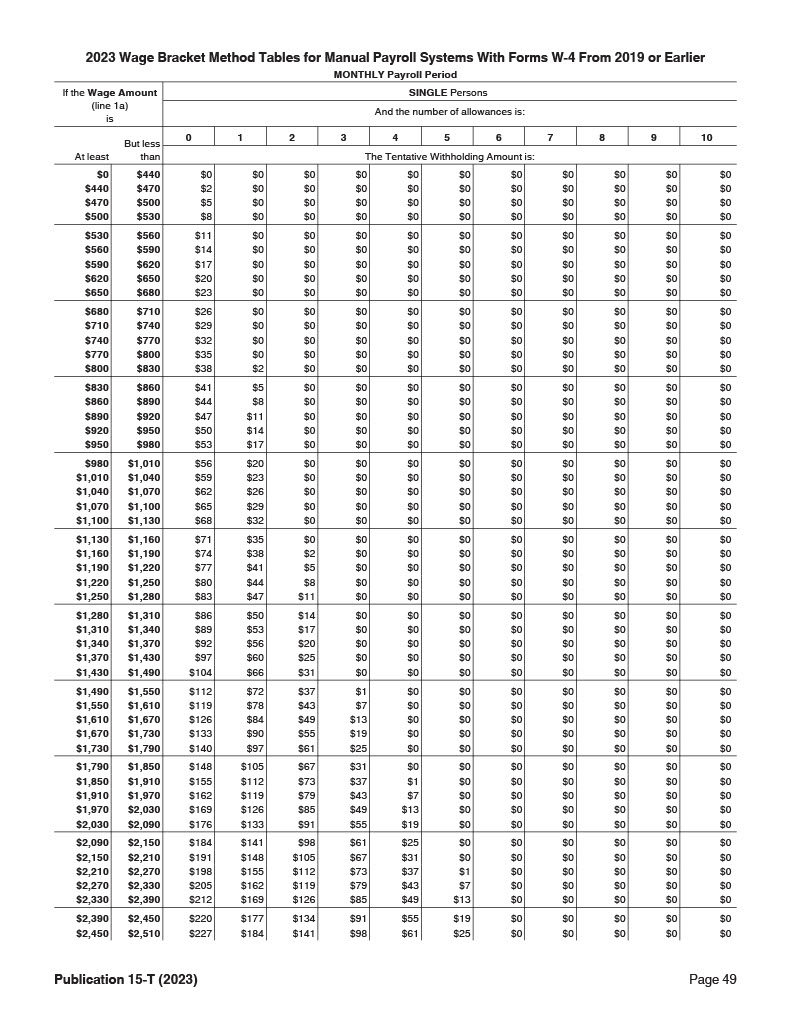

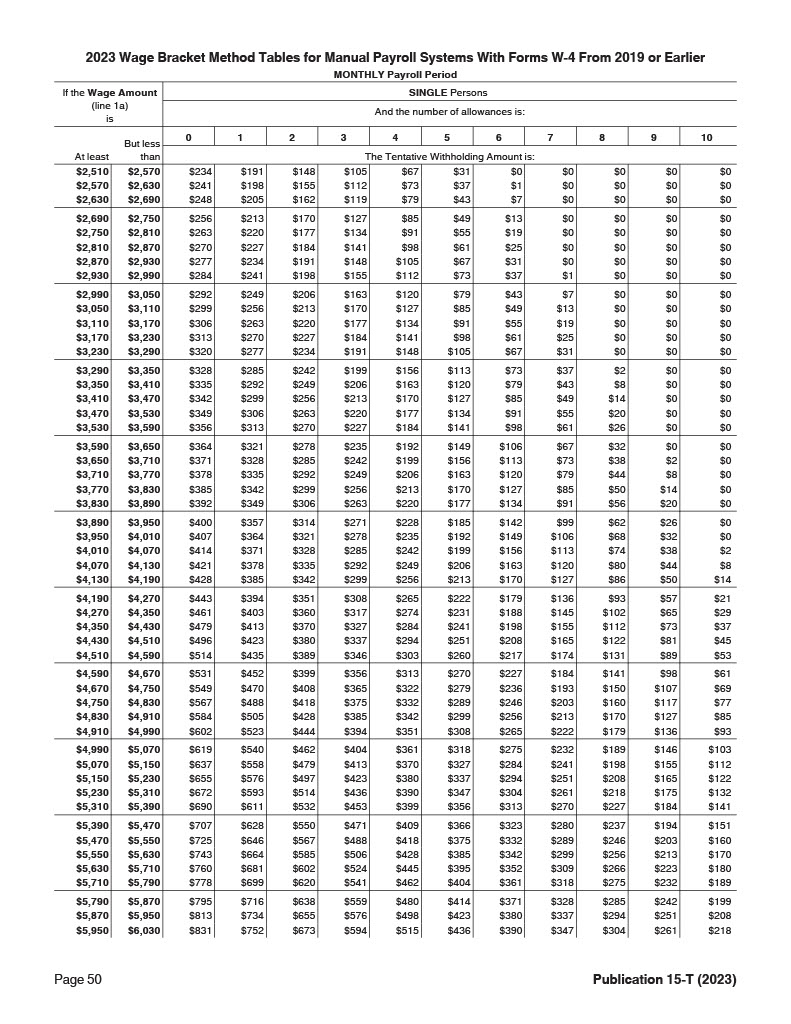

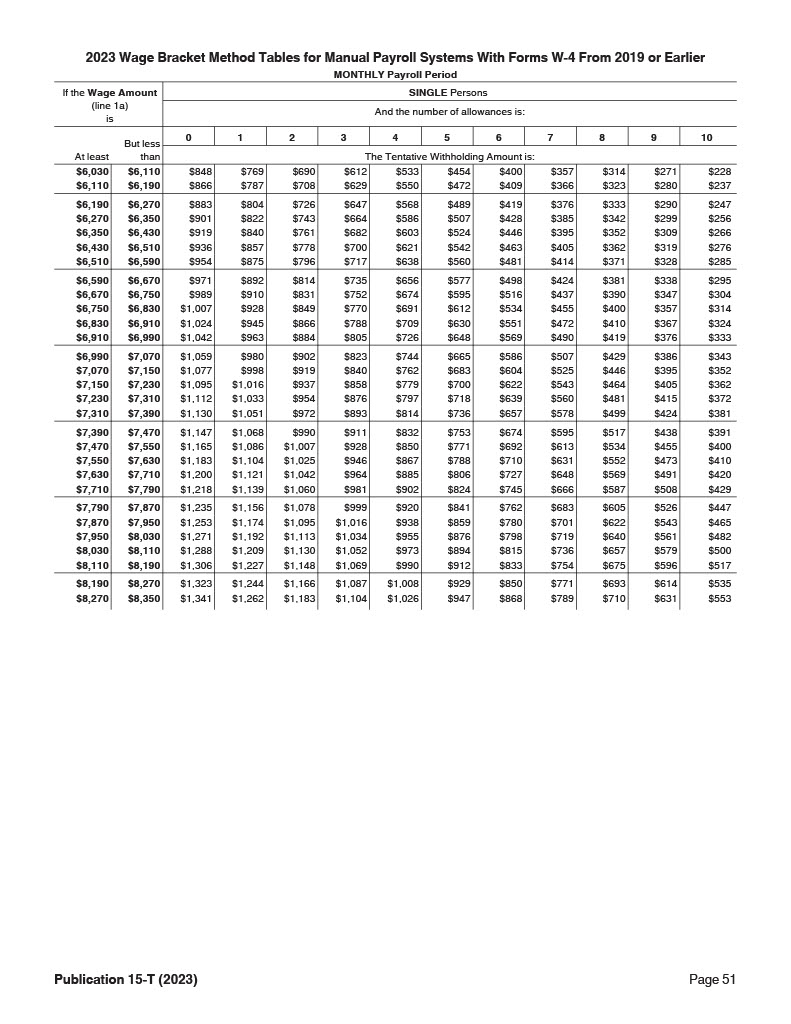

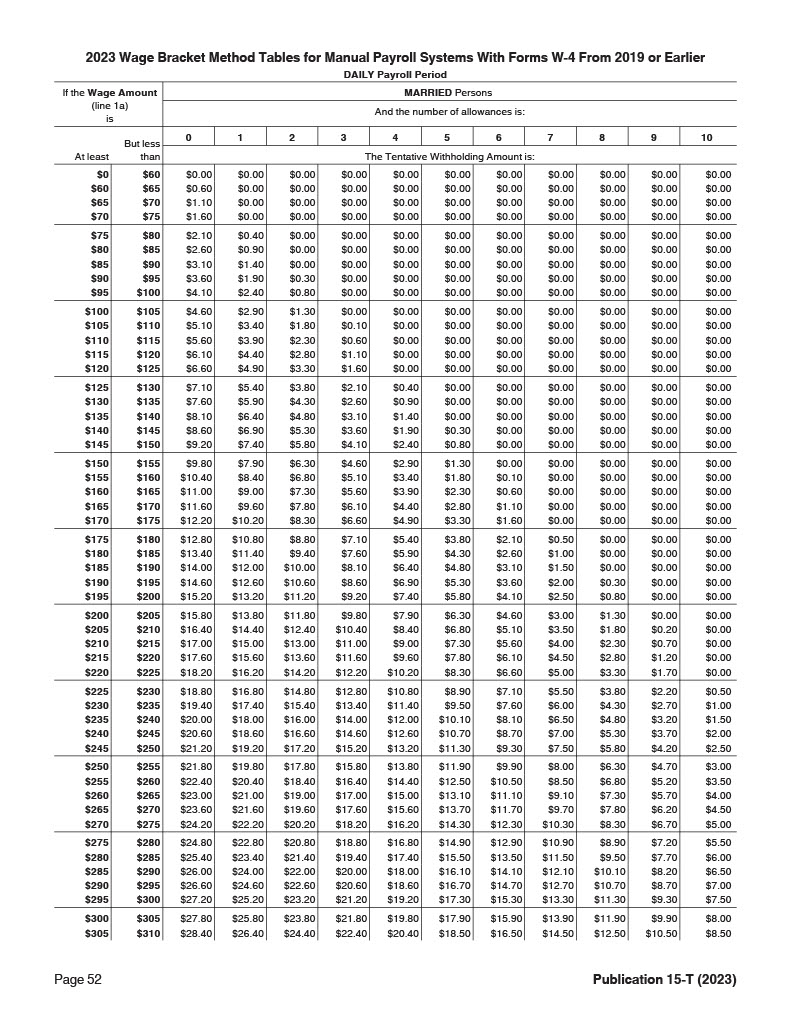

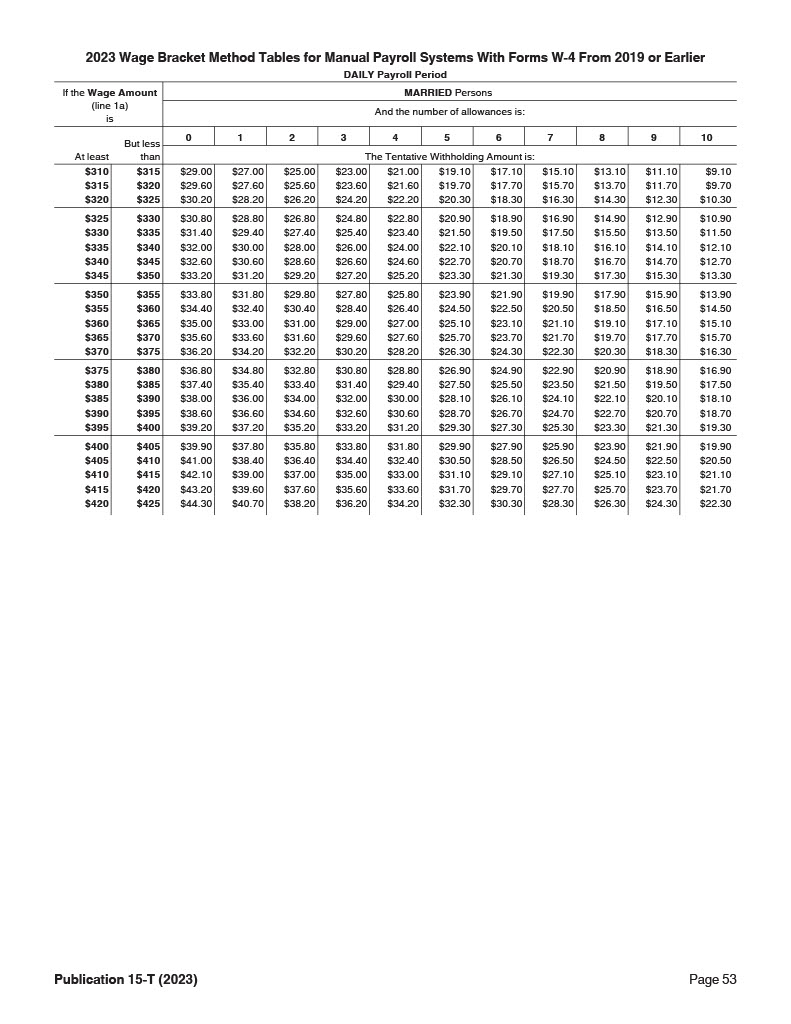

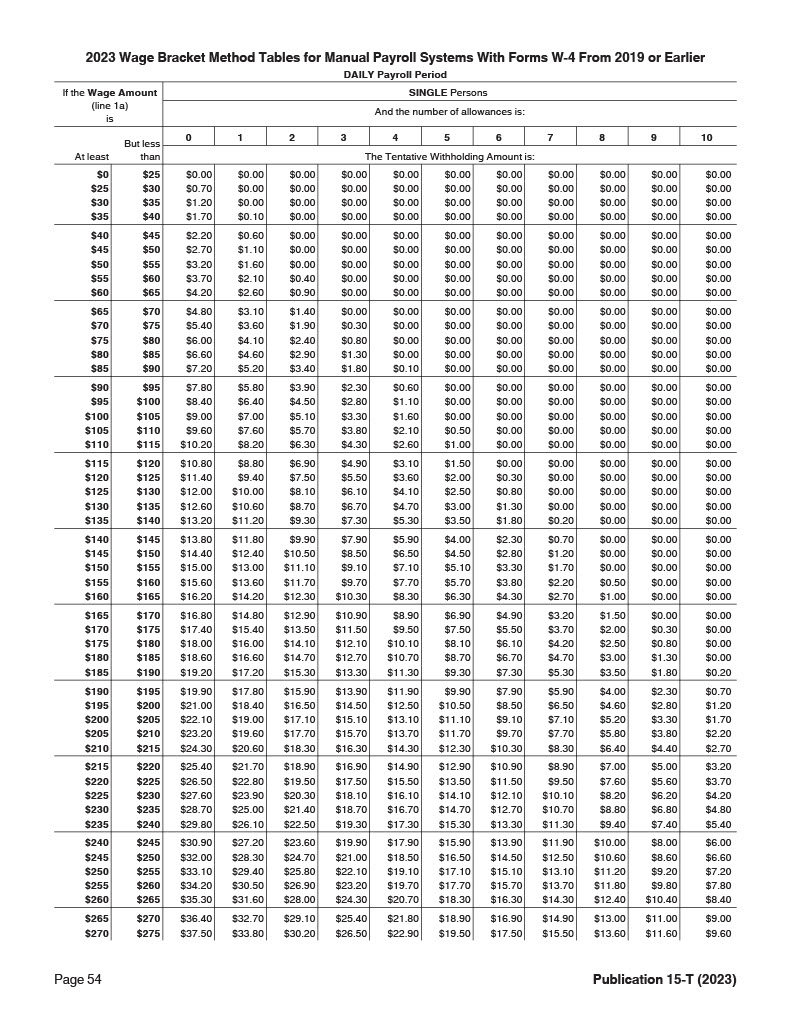

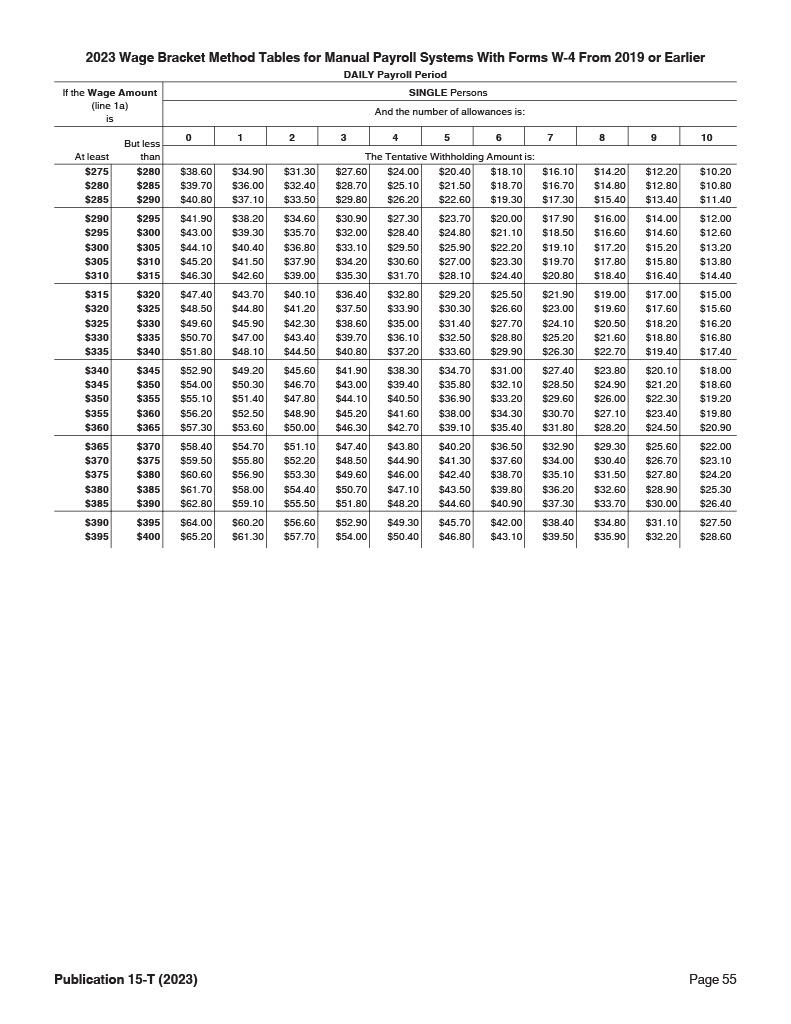

Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier

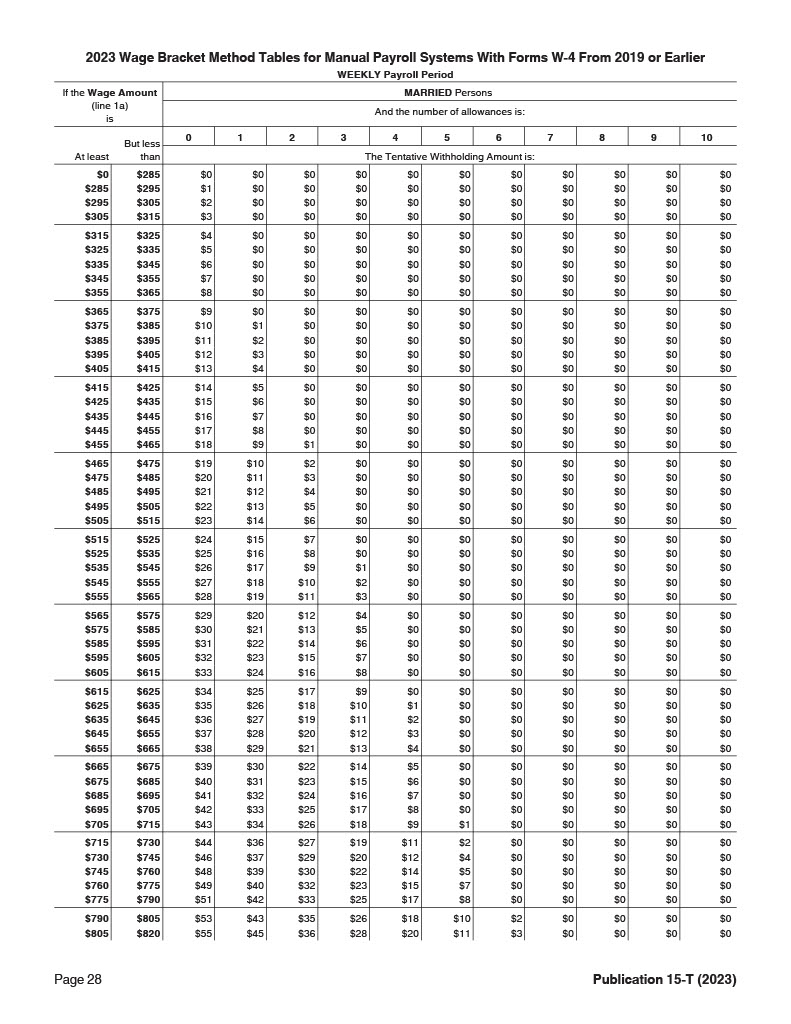

2023 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier (WEEKLY Payroll Period)

2023 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier (BIWEEKLY Payroll Period)

2023 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier (SEMIMONTHLY Payroll Period)

2023 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier (MONTHLY Payroll Period)

2023 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier (DAILY Payroll Period)

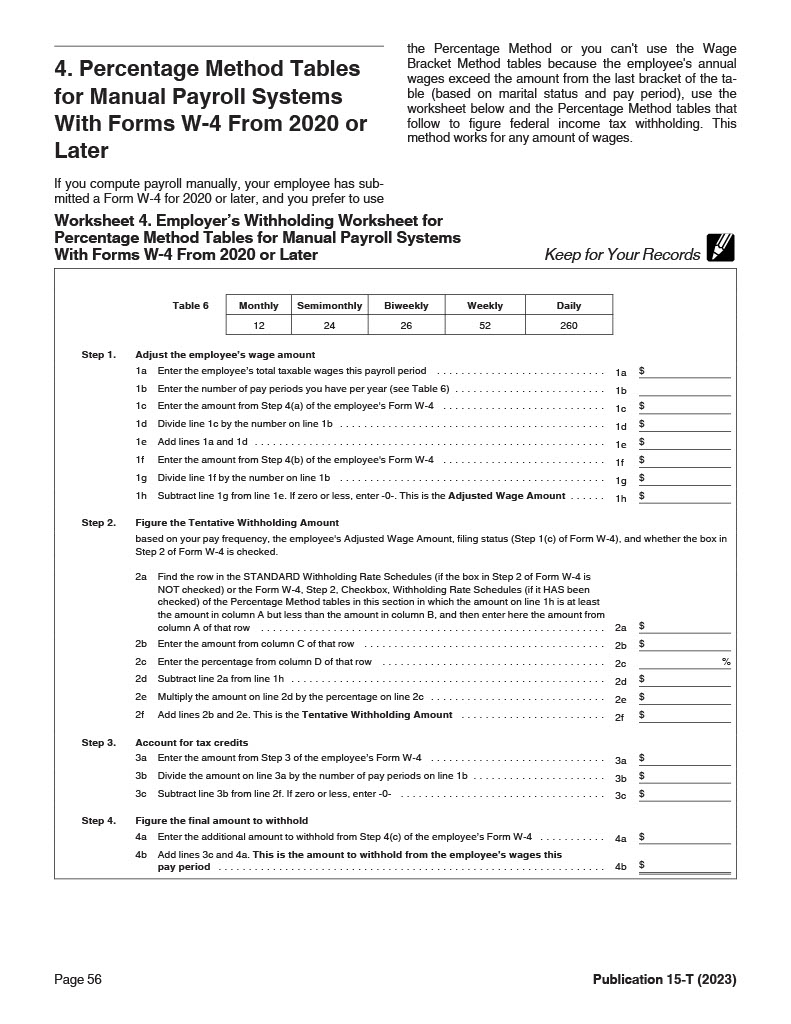

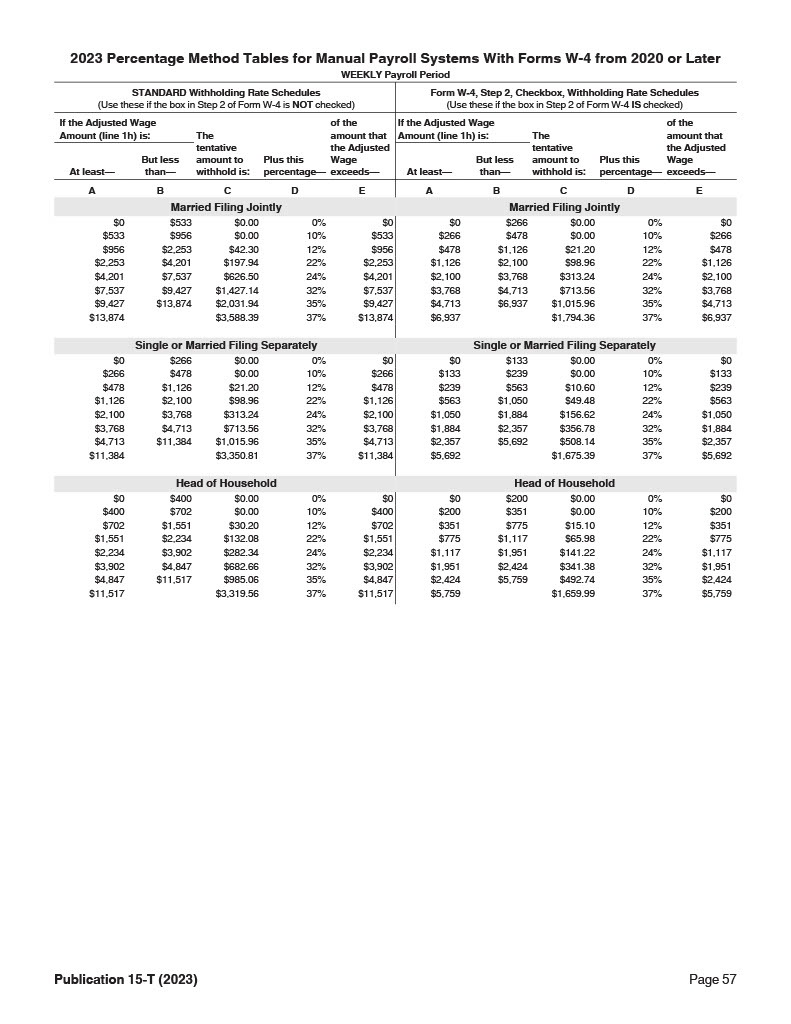

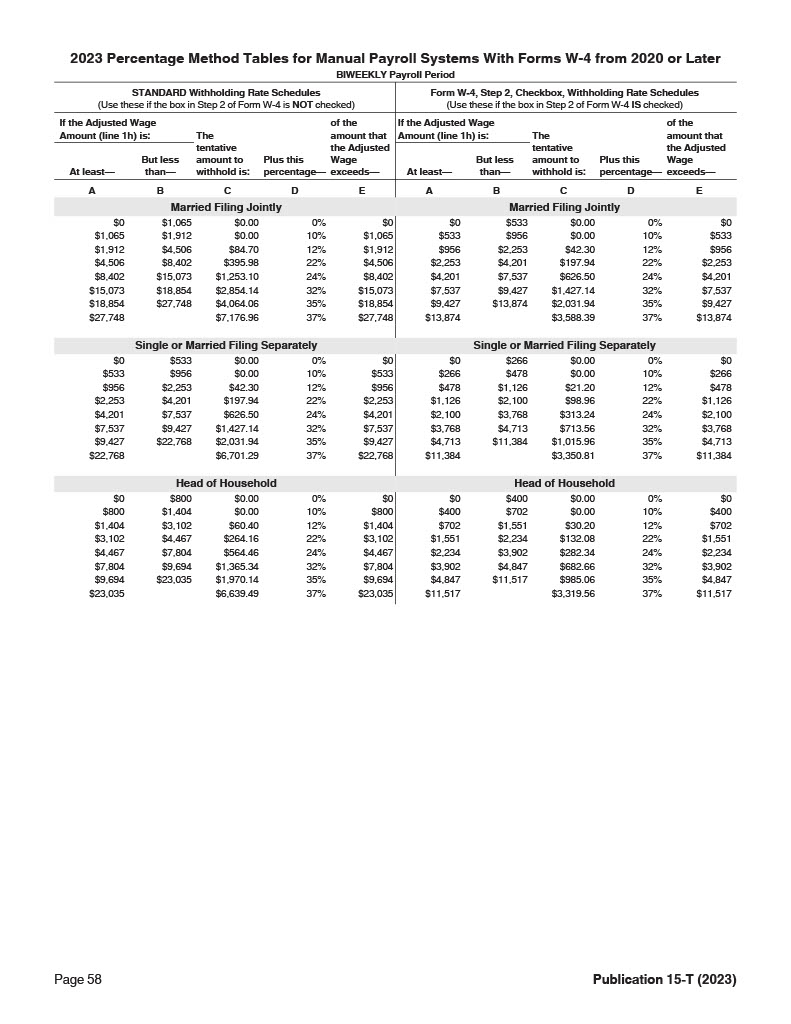

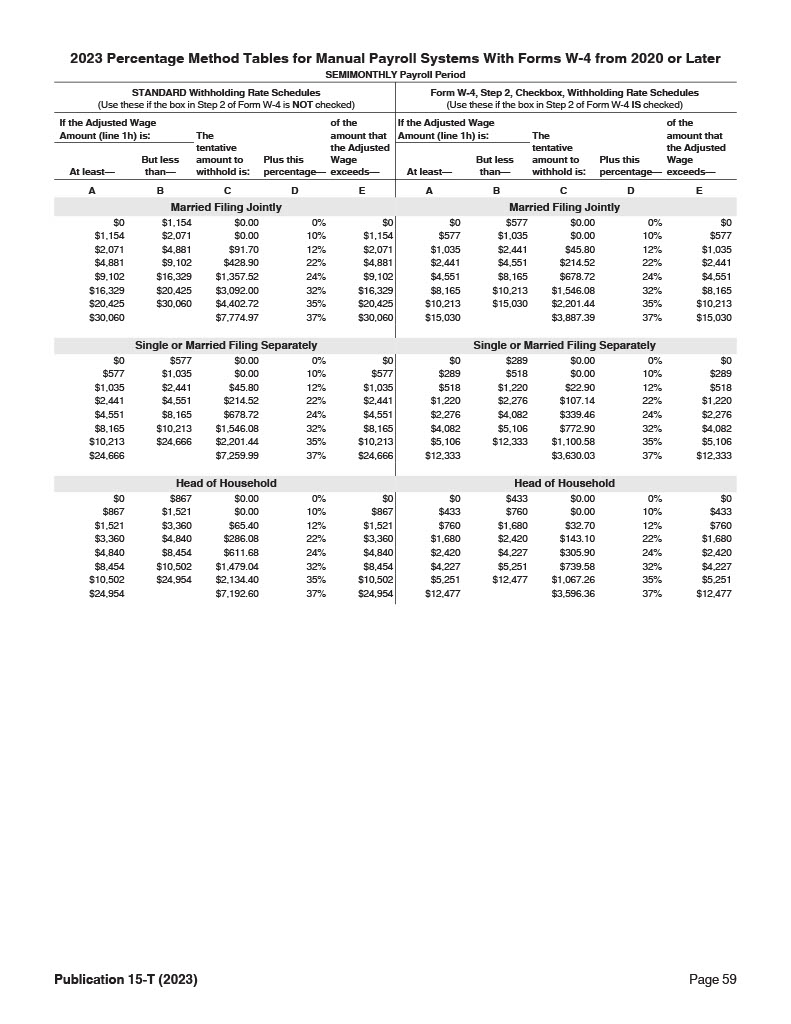

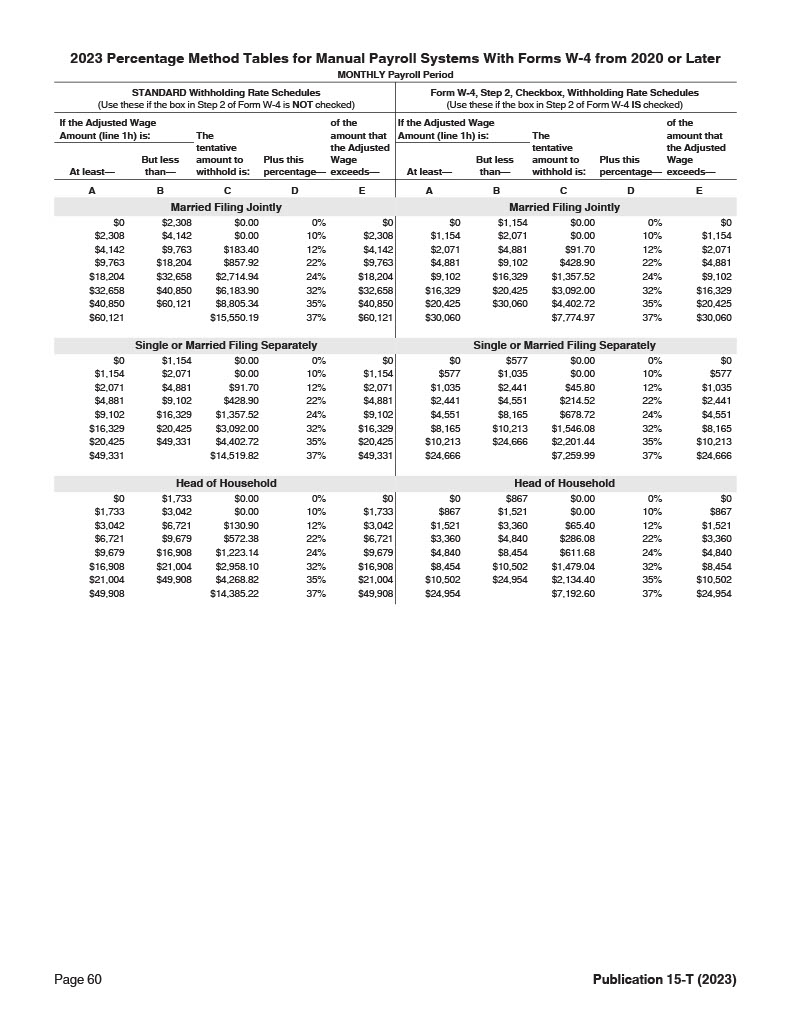

Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later (WEEKLY Payroll Period)

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later (BIWEEKLY Payroll Period)

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later (SEMIMONTHLY Payroll Period)

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later (SEMIMONTHLY Payroll Period)

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later (DAILY Payroll Period)

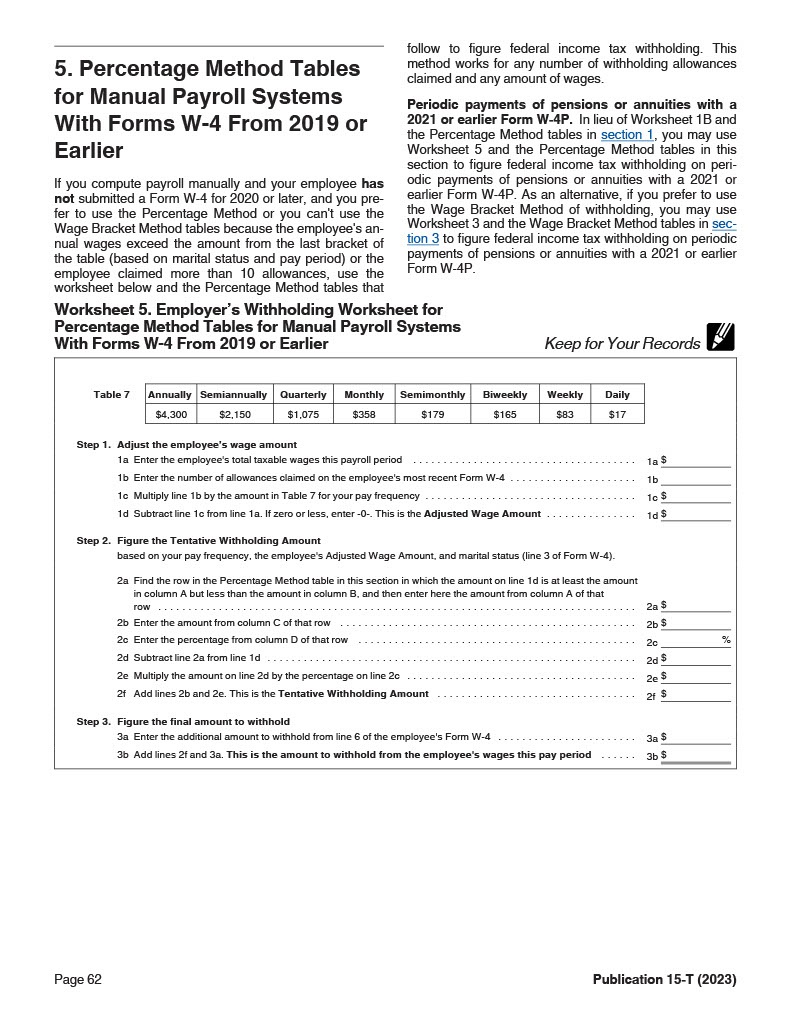

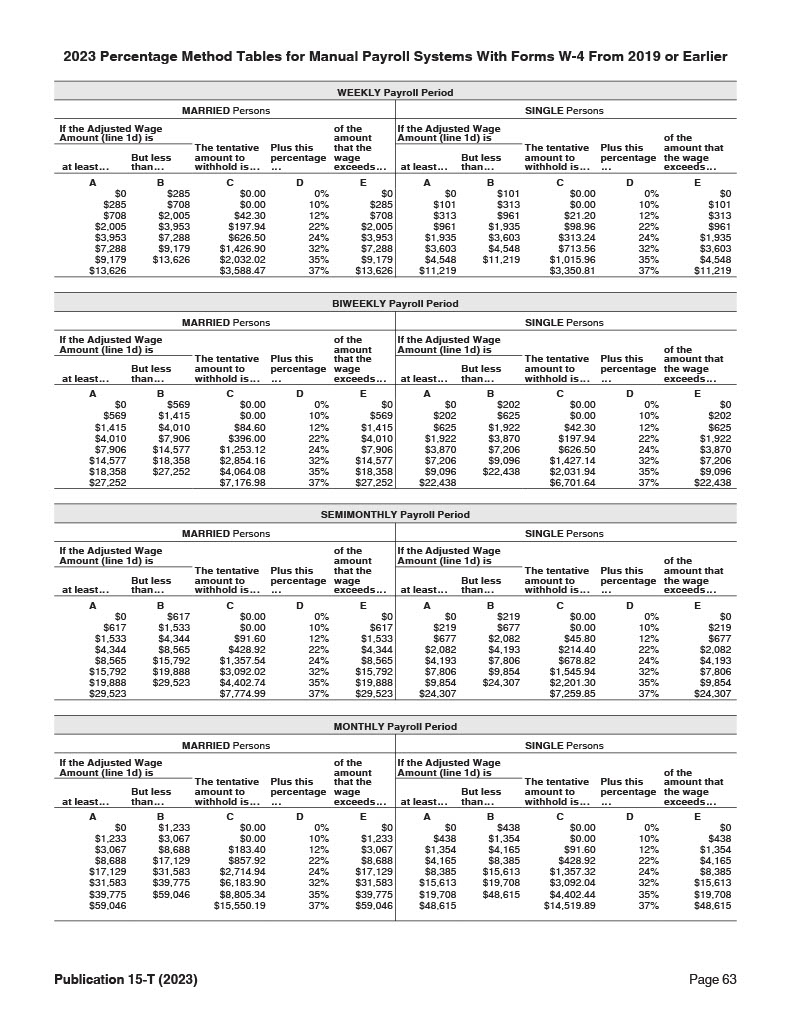

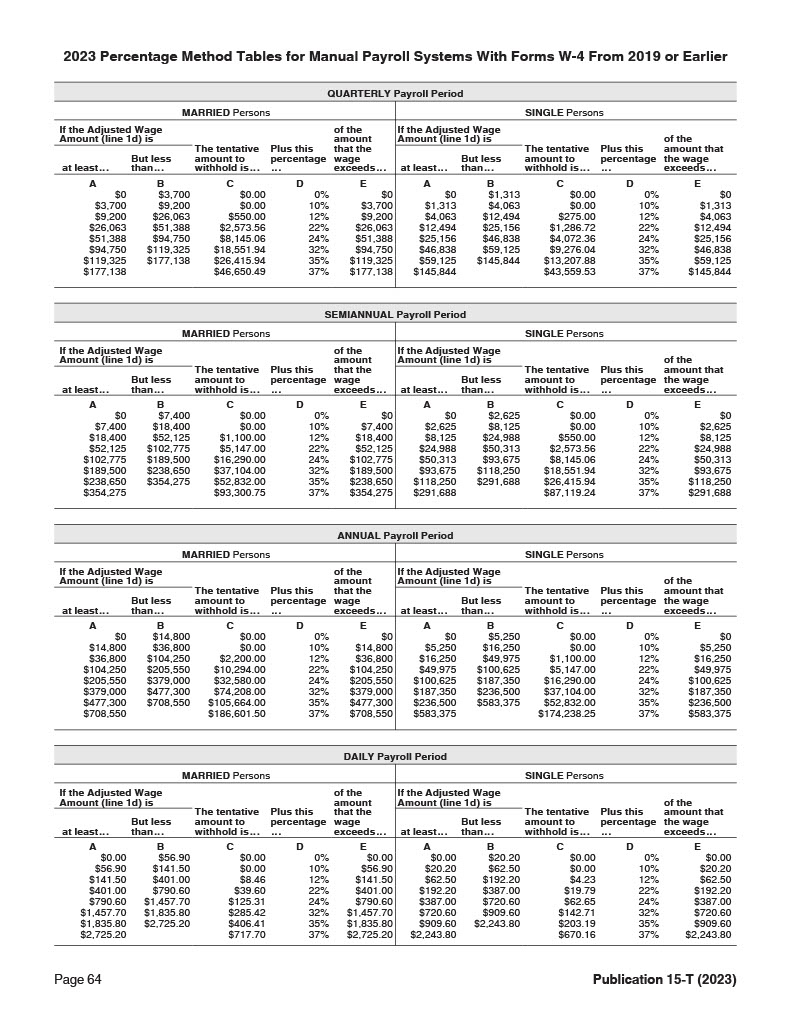

Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier

2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier

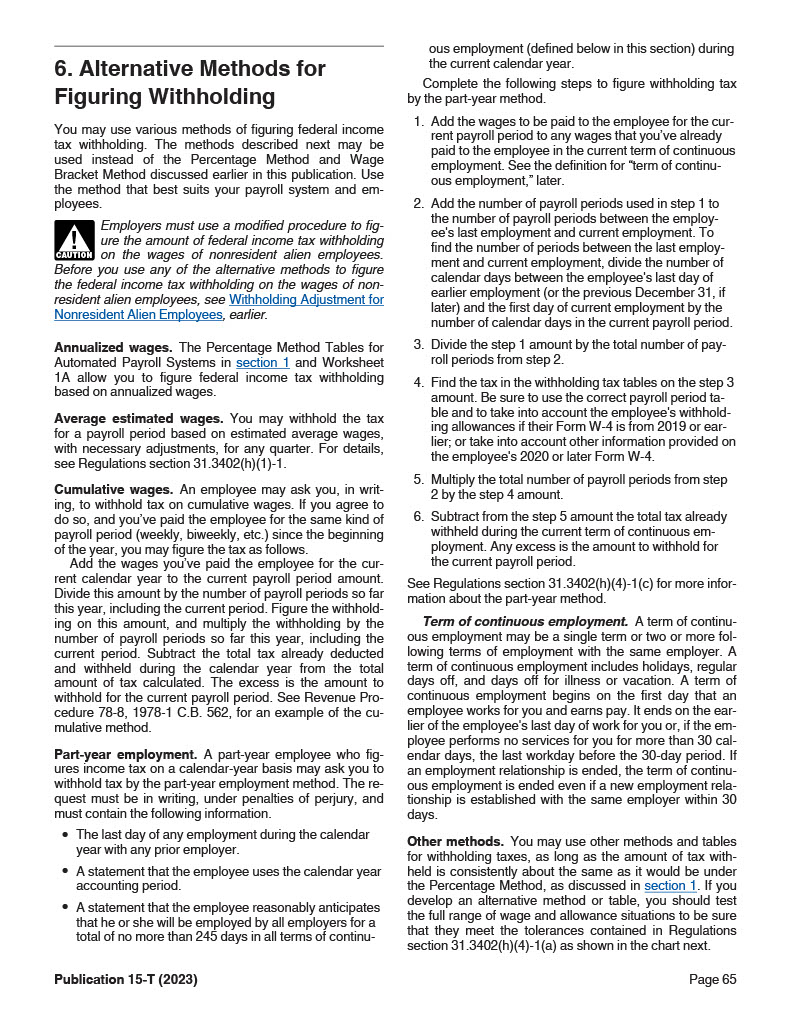

Alternative Methods for Figuring Withholding

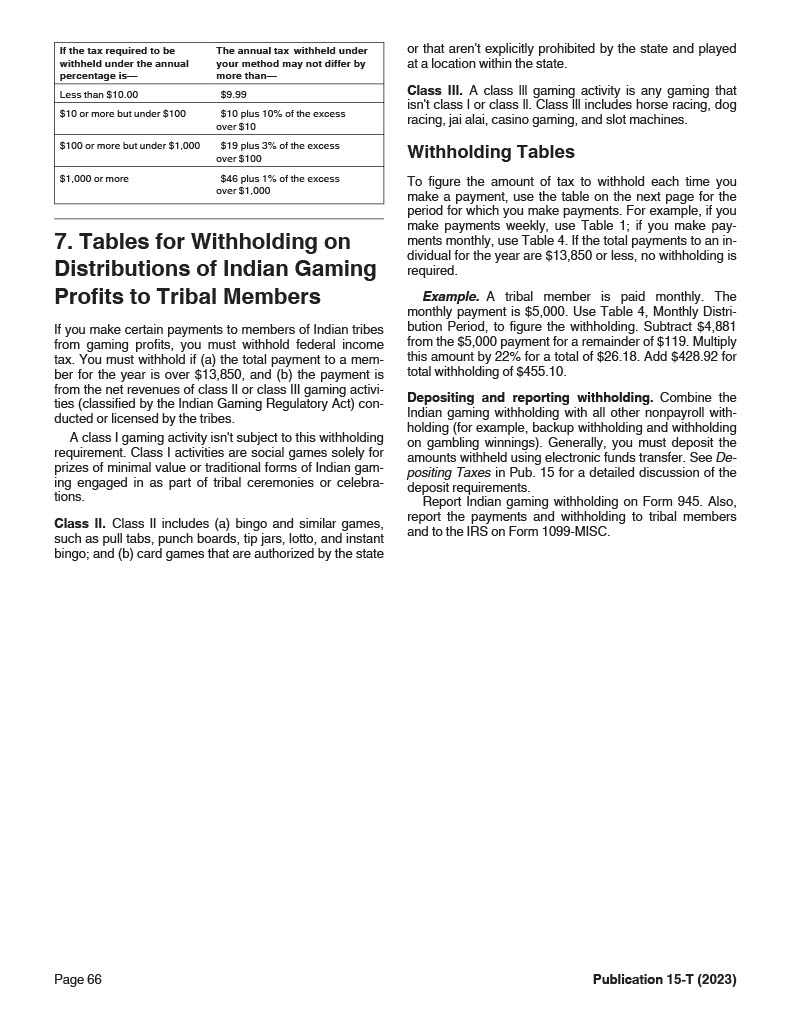

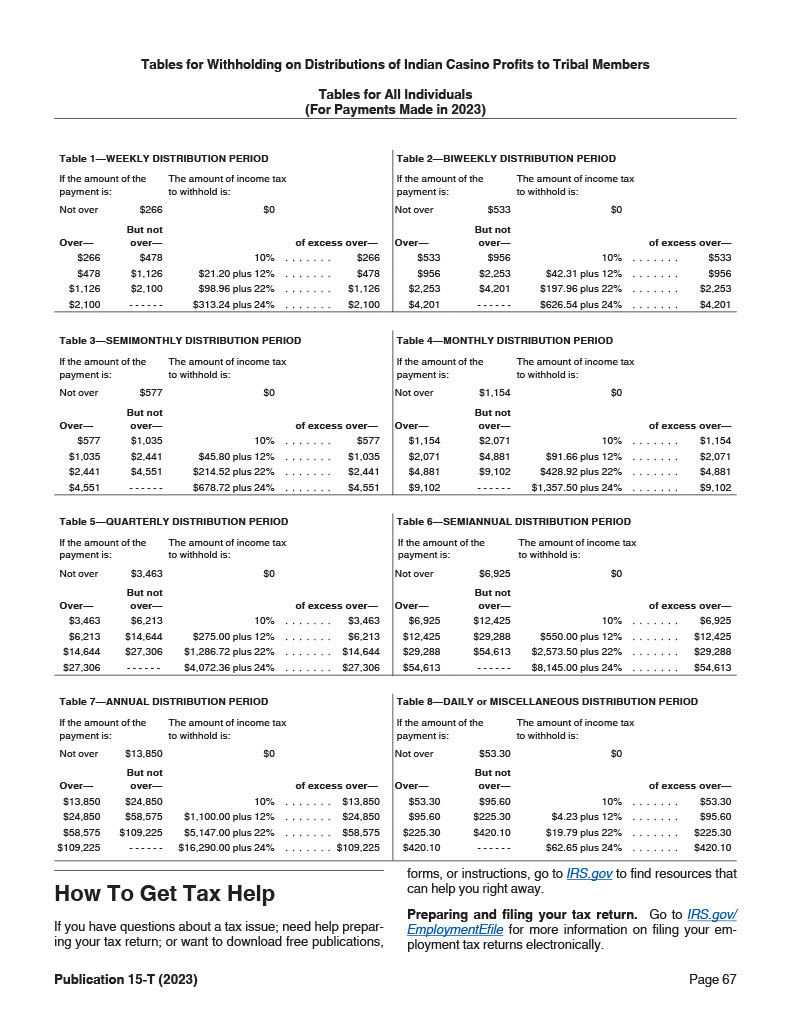

Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members