Table of Contents

Form 944 2023, Employer’s Annual Federal Tax Return – The Internal Revenue Service (IRS) says that every employer is responsible for paying taxes and making sure their business is in line with the law. One essential document employers must file every year is IRS Form 944, also known as the employer’s Annual Federal Tax Return. This form needs to be filled out every year, and it tells the IRS about an employer’s payroll taxes.

What is Form 944?

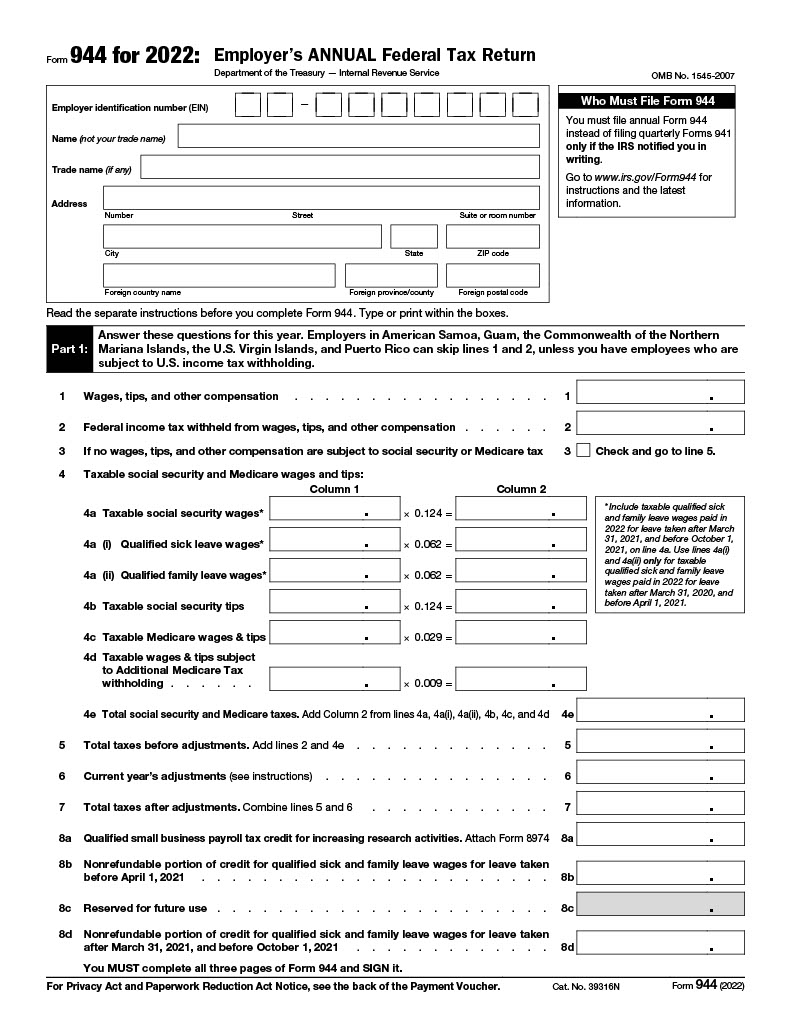

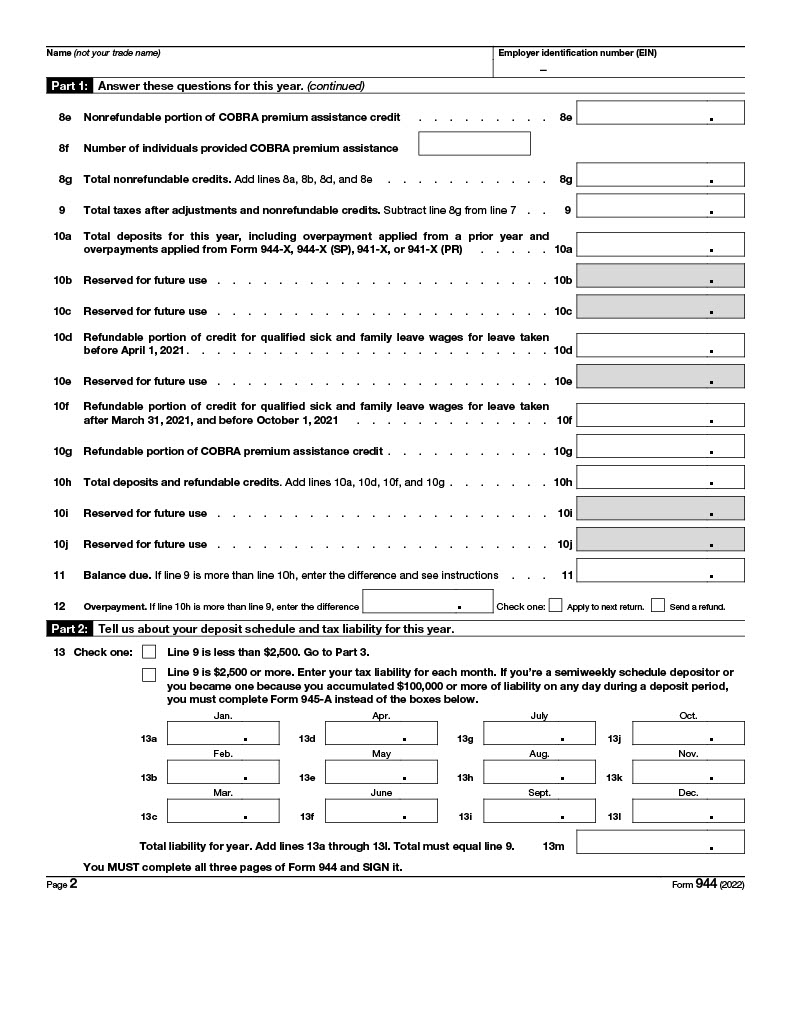

Form 944 is a federal tax return that employers use to report their Social Security and Medicare taxes annually. It’s also called the Employer’s Annual Federal Tax Return. The form allows employers to report their total liability for Social Security and Medicare taxes on employees’ wages, tips, and other compensation during the year. Employers usually have to file Form 944 instead of Form 941 every three months if they owe $2,500 or less in employment taxes each year.

In order to fulfill their tax liabilities related to employment, companies commonly utilize Form 941, while small enterprises with fewer personnel and reduced tax obligations can employ 944 Form. The Employer’s Annual Federal Tax Return, known as Form 944, is a document issued by the IRS that enables businesses to report their employees’ tax withholdings, including federal income tax, social security tax, and Medicare Tax, as well as calculate and report their own contributions to employer Social Security and Medicare tax.

Part 1 of this form is for businesses to report how much each employee was paid and how much was taken out. Part 2 asks businesses to fill in the total amount of income tax withheld for all employees. They must also list any extra credits that were taken from these totals and used to pay off past debts or refund overpayments made during the year. Part 3 also says that businesses have to say how they will pay their annual tax bill. They can either give credit card information or give permission for direct debit payments from a checking account.

What If the IRS Matches My 944 With My W-2 Form?

If the IRS finds that your Form 944 and your W-2 form do not match, they will likely take a closer look at the information you have provided. First, they may compare records from previous years to see if any discrepancies appear. If there are clear differences between what was written on different forms, it could mean that something was written wrongly or left out. The IRS can also use other methods to determine whether there are inconsistencies with the data reported on both forms, such as examining bank records or looking for patterns of income and expenses over time.

The IRS may also contact employers for more information or to find out why there are differences between Form 944 and Form W-2. This could include requesting documentation related to employee wages, hours worked, or deductions are taken. It is important to note that failure to respond promptly and accurately to these inquiries can result in additional penalties or fines from the IRS so it’s important you prepare yourself well when responding. Finally, it’s important to remember that the easiest way to avoid problems is by ensuring accurate records are kept throughout the year so discrepancies don’t arise in the first place.

How do I Write a Trade Name on Form 944?

When filling out Form 944, the business name should be written exactly as it appears on the Employer Identification Number (EIN) application. This means that if the trade name is being used, it should be entered in box 2 under “Employer’s Name and Address.” The trade name should follow the Employer Identification Number (EIN) and precede any dba or assumed business names. Additionally, businesses can enter more than one trade name in this field if necessary by separating them with a comma. It is important to note that using a trading name does not replace or change an employer’s legal business name; rather, it is an additional way of identifying a business for tax purposes. Lastly, when entering a trading name on Form 944, make sure to list all applicable state registration numbers with each listed trade name.

To complete the necessary fields, you should provide your EIN, name, and address, as well as enter your name and EIN at the top of pages 2 and 3, and it’s recommended that you refrain from using your social security number (SSN) or individual taxpayer identification number (ITIN); it’s generally best to use your business’s legal name as it was recorded during your EIN application, for instance, if you’re a sole proprietor, you would input “Tyler Smith” on the Name line and “Tyler’s Cycles” on the Trade name line, and if the Trade name is identical to the Name line, it should be left blank.

Form 944 (2022) Instructions

| Topic | Information |

| Purpose of Form 944 | Designed for the smallest employers to file/pay social security, Medicare, and federal income taxes only once a year instead of every quarter |

| Who Must File Form 944? | Employers who the IRS has notified to file Form 944 instead of Forms 941, 941-SS, or 941-PR to report wages paid, tips, federal income tax withheld, employer and employee share of social security and Medicare taxes, additional Medicare tax withheld, current year’s adjustments to social security and Medicare taxes, qualified small business payroll tax credit for increasing research activities, credit for qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before October 1, 2021, and credit for COBRA premium assistance payments |

| Exceptions | Household employers, agricultural employers, employers notified by the IRS to file quarterly Forms 941, 941-SS, or 941-PR, employers not notified to file Form 944 |

| Annual Tax Liability | Employers notified to file Form 944 must file it, regardless of tax liability, until the IRS notifies them that they must file Forms 941, 941-SS, or 941-PR quarterly |

| Requesting to File Other Forms | Employers can request to file quarterly Forms 941, 941-SS, or 941-PR instead of Form 944 by calling the IRS or sending a written request between January 1, 2023, and March 15, 2023 |

| Where to Send Written Requests? |

|

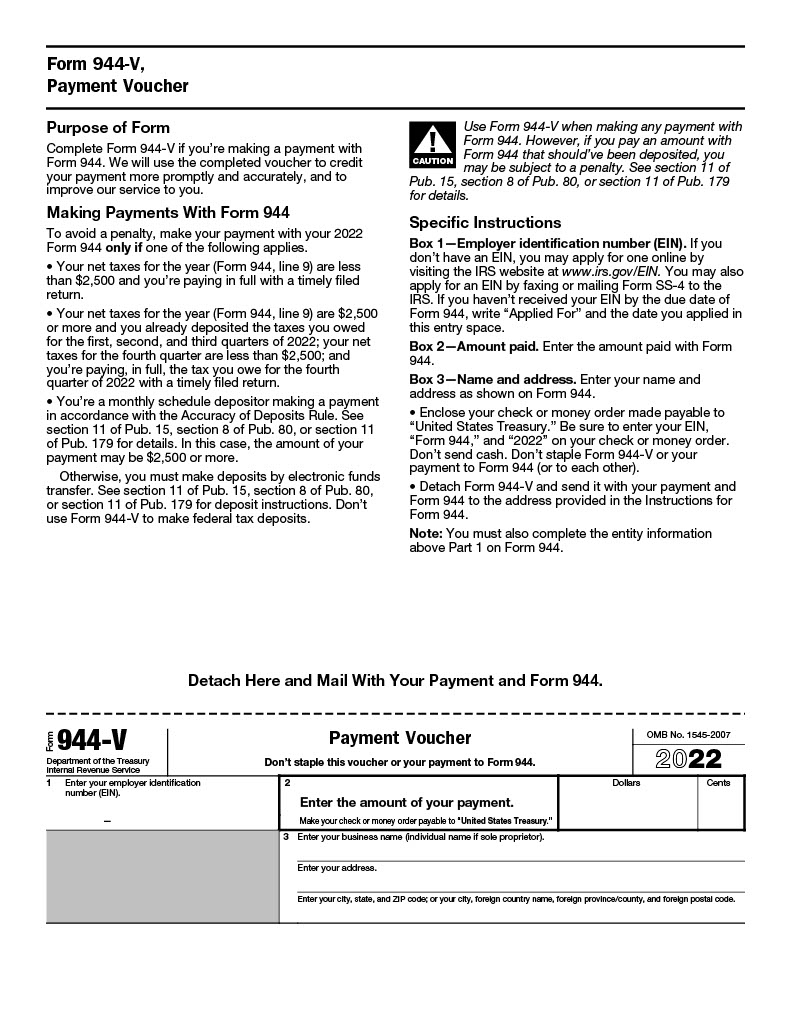

Form 944 2023 (2022) Printable

Form 944 2023 (2022) Printable PDF

Download & Print Here: Recent 944 Form [.PDF] (Current Revision: 2022)

Note: The most recent version of Form 944 is the 2022 edition. We will provide an update for the 2023 edition once it is released by the IRS.