Table of Contents

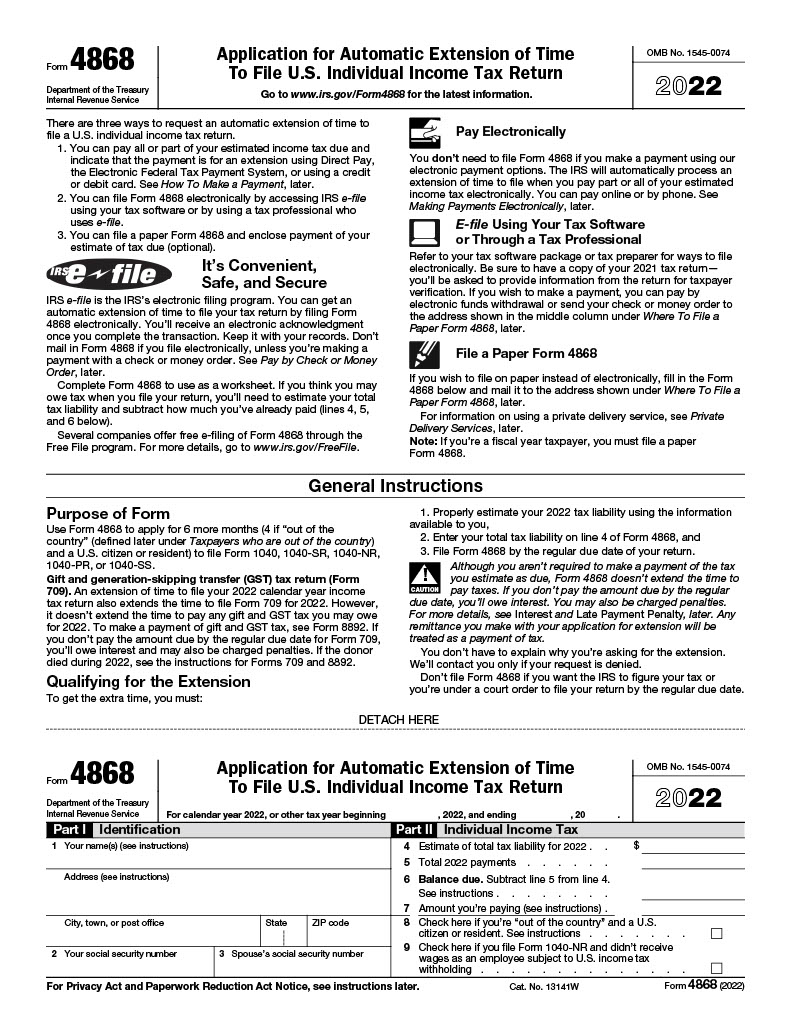

IRS Form 4868 Extension Printable – 4868 Form 2023 – 4868 Form, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is an IRS form that allows taxpayers to request a six-month extension on the deadline for filing their federal income tax return. This extension doesn’t give more time to pay the tax due, but it helps taxpayers avoid late-filing penalties.

Who is Eligible for a Tax Extension?

Any individual taxpayer who is unable to file their federal income tax return by the original due date can apply for an extension using Form 4868. However, it’s important to remember that the extension only applies to the filing deadline and not the payment deadline.

Key Deadlines For Filing Form 4868

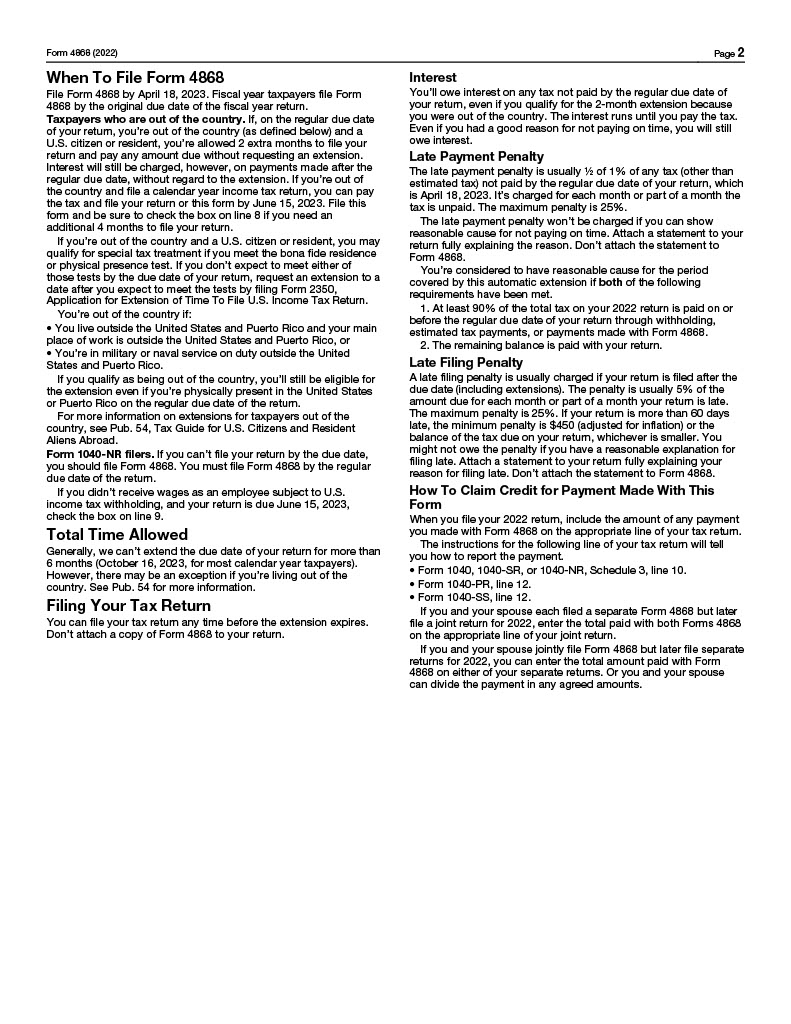

To be eligible for an extension, taxpayers must file Form 4868 by the original due date of their tax return, typically April 15th. The extended deadline is usually October 15th, giving taxpayers six additional months to file their return.

How to file Form 4868?

Filing taxes can be a daunting and time-consuming task, especially if you’re facing unexpected hurdles or waiting on essential documents. However, the Internal Revenue Service (IRS) provides a solution in the form of Form 4868, which grants an automatic six-month extension to submit your individual income tax return. In this guide, we’ll walk you through the process of filing Form 4868, ensuring you have the necessary information and tools to complete it accurately and on time, all while avoiding penalties and interest. Let’s dive into the steps to secure your extension and put your tax worries to rest.

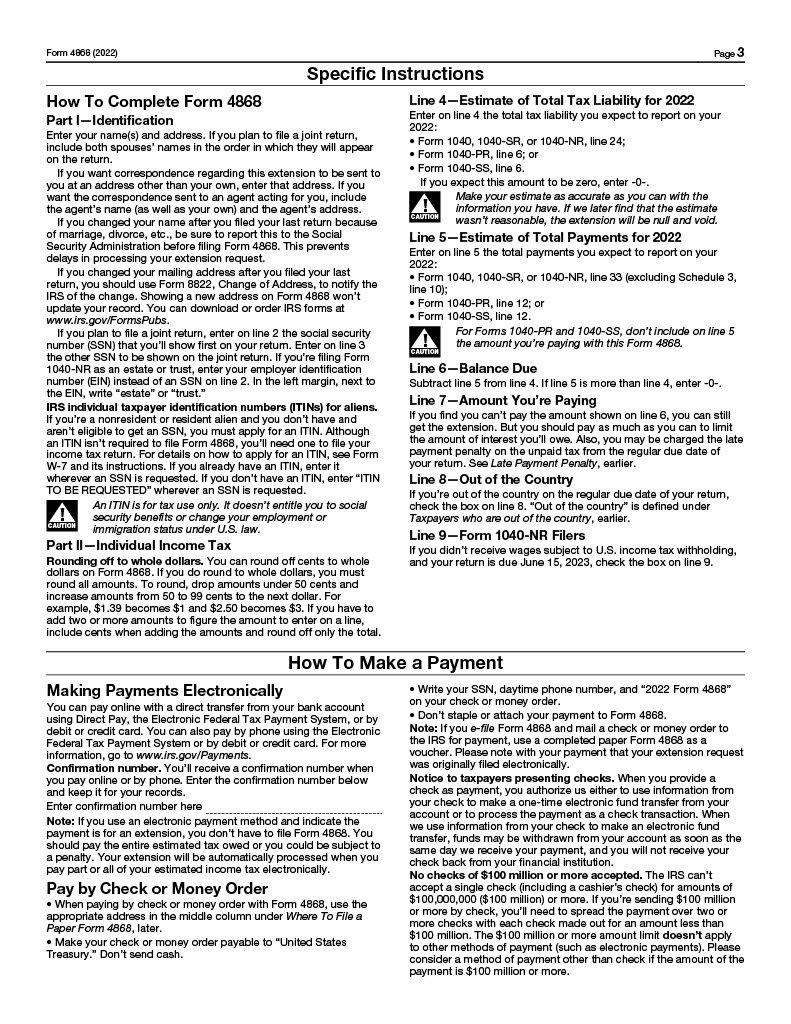

There are two ways to file Form 4868: electronically or by mail.

Electronically

Taxpayers can file Form 4868 electronically using tax software or through a tax professional. The IRS offers a Free File program for eligible taxpayers, providing free access to tax software and electronic filing.

By mail

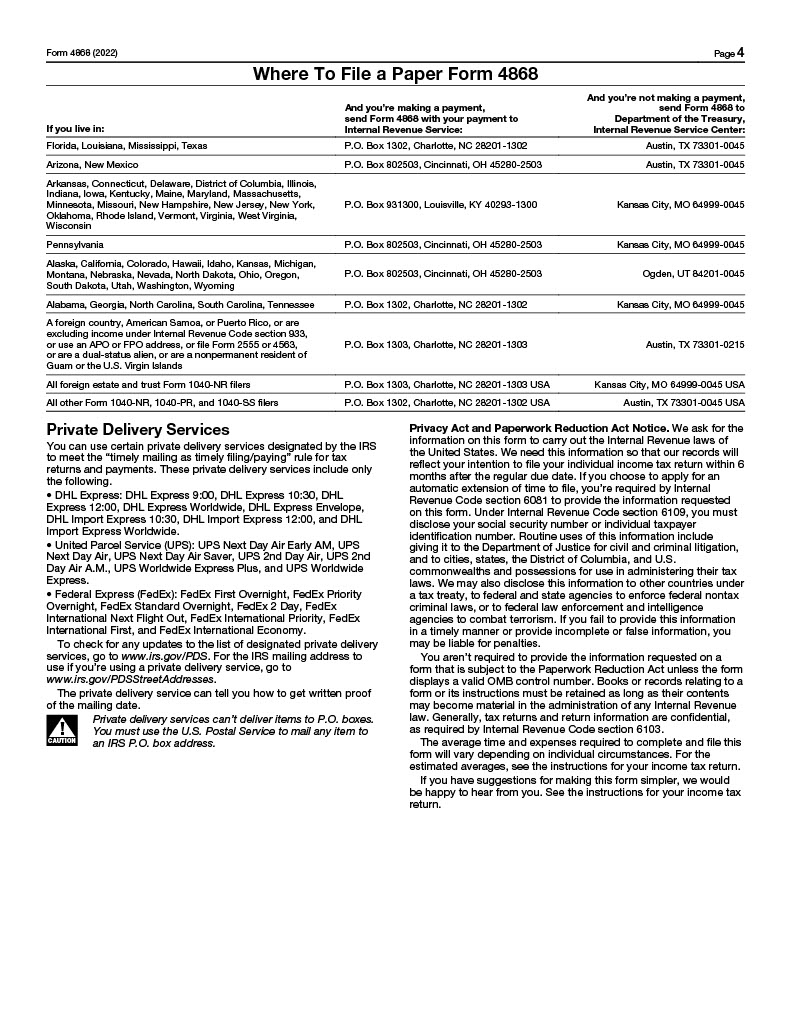

To file Form 4868 by mail, taxpayers should complete the paper form and mail it to the appropriate IRS address, depending on their state of residence. It’s crucial to postmark the form by the original tax return due date.

Paying the tax due

While Form 4868 extends the filing deadline, it doesn’t extend the time to pay taxes. Taxpayers should estimate and pay their tax liability by the original due date to avoid penalties and interest.

IRS Form 4868 Extension Printable

Navigating the complexities of tax season can often lead to last-minute scrambles and mounting stress. Thankfully, the Internal Revenue Service (IRS) offers a convenient solution through IRS Form 4868, which provides taxpayers with an automatic six-month extension to file their individual income tax return. Here we will provide you to the printable version of Form 4868. With the right resources at your fingertips, obtaining the additional time you need to file your taxes has never been easier.

Download, Print & Fill – IRS Form 4868 Extension Printable [.PDF]

Attention: For the accurate completion of the IRS Form 4868 for the year 2023, please ensure you are utilizing the most recent version of the form, which is the 2022 version. This will ensure compliance with the latest requirements and prevent any processing delays or complications.