Table of Contents

A W-2 form is a wage and tax statement issued by an employer to the employee every year. It is used for various tax purposes. What is the W-2 form used for? Is there a new W-2 form in 2022? Let us find out! Hopefully, you’ll find this article useful! Until then, stay updated on all things W-2 form! It’s important to keep up with the latest changes to the tax code!

What is a W-2 Form: Wage and Tax Statement?

The W-2 form is a document used by the Internal Revenue Service to report the wages paid to employees and the taxes withheld from them. All employers are required to complete Form W-2 for every employee. Here’s a basic explanation of this document. Also, read this article for a better understanding of its purpose. This tax form is crucial to ensure that you’re paying the right amount of taxes.

The W-2 is the annual tax form filed by employees. It lists their wages and taxes paid for the previous year. Employees must file their personal income tax returns each year. The amount of tax they owe depends on their tax bracket, taxable income, and adjusted gross income. Under progressive tax systems, like the U.S., more highly compensated individuals fall into higher tax brackets and are subject to higher tax rates.

What is the W-2 Form Used For?

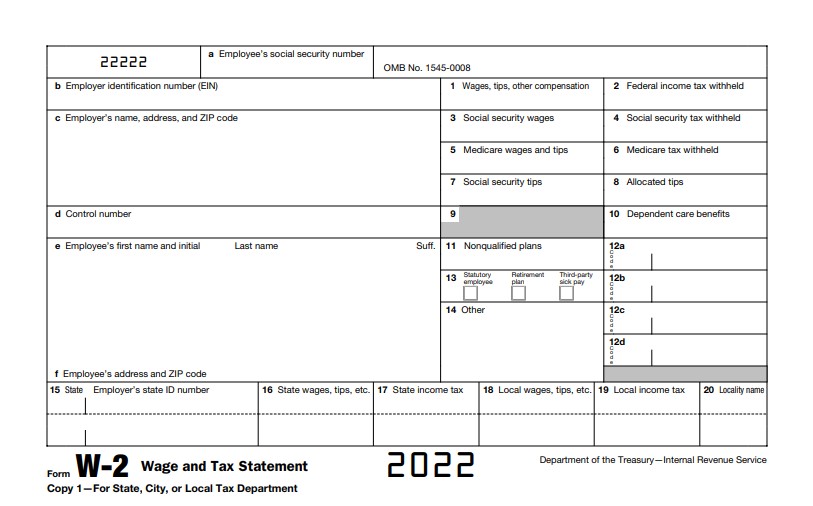

A W-2 form is a statement that a business has given to its employees reporting the wages and taxes withheld for the calendar year. The IRS uses this form to track employment income and helps prepare tax returns. The form has several sections, including an employee’s name, address, SSN, and amount of pay. Here are some of the most common types of forms. You can find examples of these forms on the IRS’s website, or you can go to the State of Kansas website and see an example of a W-2 form.

A W-2 form is used by employees to complete their personal income tax filing. The information on this form includes gross pay from an employee’s wages, payroll taxes, and contributions to a company’s retirement plan. These are both one-time documents that are filed by employees, but the difference is small. The form is typically filled out by new employees when they start a new job. It also provides employers with information regarding the wages and taxes of their employees.

W-2 Form 2022 – Is There a New W-2 Form for 2022?

The W-2 form is a government-required document that reports an employee’s wages, tax withheld, and fringe benefits. It is important to know how to fill out a W-2 when filing taxes. Businesses are required to send this form to all employees, including those earning over $600 a year. The deadline to file the form with the Social Security Administration is January 31, 2022. If you are not sure whether or not your company will be required to send you a new form in 2022, learn more about the new regulations.

If you’re an independent contractor, you should receive an earnings statement on Form 1099-NEC in addition to the W-2 form. The W-2 contains identifying information for both the employer and employee. The social security number, employer name and EIN, and control number are all listed on the form. The American Rescue Plan, which is a part of the third stimulus package, will make these new forms mandatory for all employers.

On December 20th, the Internal Revenue Service (IRS) sent the final version of Form W-2, often known as the Wage and Tax Statement.

The final version of Form W-2 for 2022 did not differ much from the draft that was distributed on December 17. In addition, forms W-3 and W-3SS, both titled “Transmittal of Wage and Tax Statements,” have been made available for the year 2022.

W-2 Form 2022 Printable Download

Download & Print W-2 Form 2022