Table of Contents

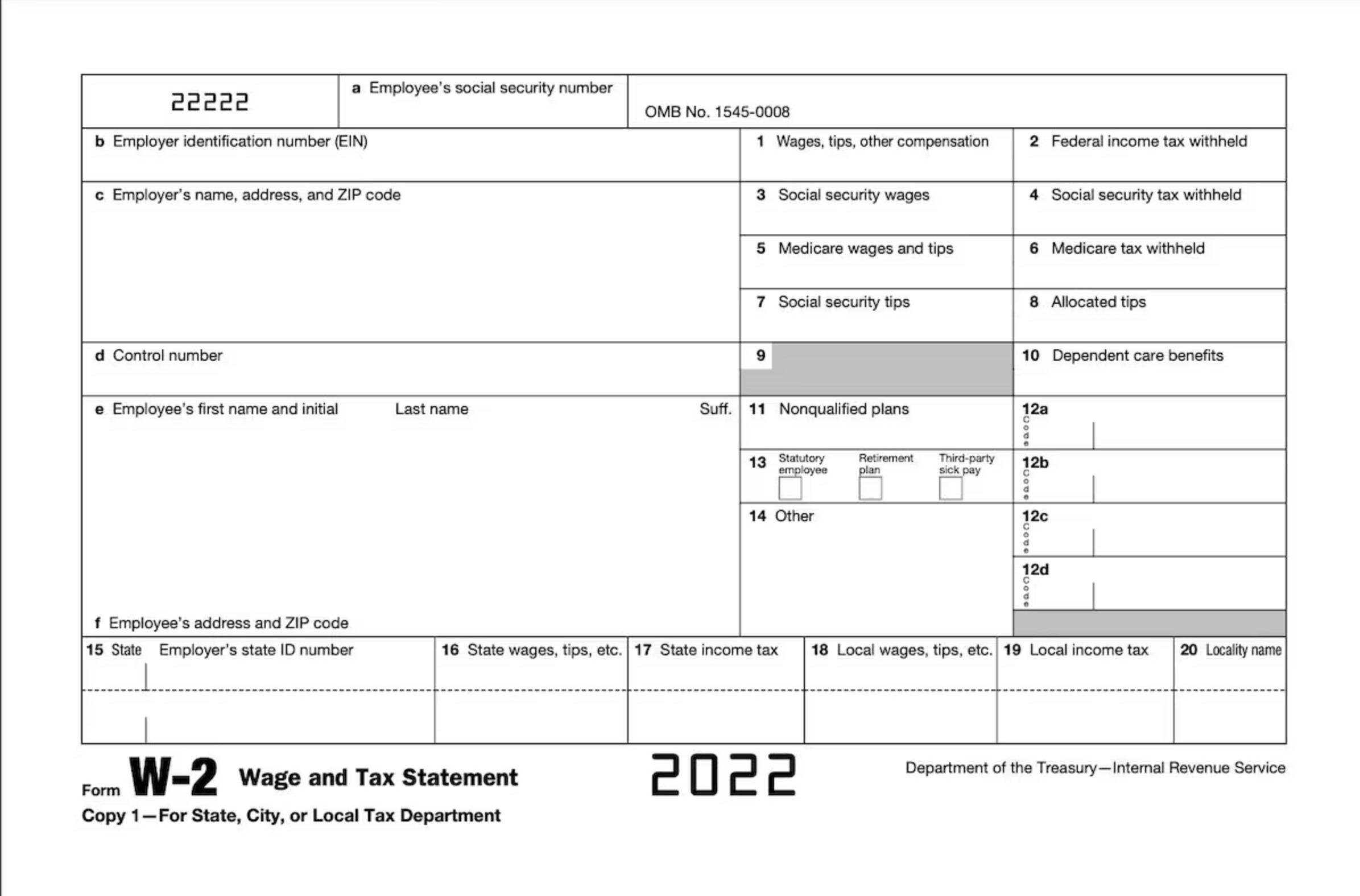

W2 Form 2022 Printable Online PDF – If you’re an employee, you’ve likely received a W2 Form from your employer at the beginning of each year. But do you know what this form is for and how to properly fill it out? A W2 Form is a tax form used by employers to report their employees’ annual wages, tips, and other compensation, as well as the amount of taxes withheld from their paychecks throughout the year. It is important for both employees and employers to understand how to properly complete and file this form to ensure accurate tax reporting and avoid potential penalties.

New Article: W-2 Form 2025.

In this guide, we’ll walk you through everything you need to know about filling out and filing your W2 Form.

W2 Form 2022 Printable Online PDF

UPDATED: IRS Has Released W2 Form 2024 Printable.

You can also read our article about “W2 Form 2024, Wage and Tax Statement“

What is a W2 Form?

A W2 Form is a tax form used by employers to report their employees’ annual wages, tips, and other compensation, as well as the amount of taxes withheld from their paychecks throughout the year. This form is necessary for employees to complete their individual tax returns, and it is also used by the Social Security Administration to track an individual’s Social Security earnings record.

Who Needs to File a W2 Form?

All employers who paid wages, salaries, or tips to their employees during the previous year must file a W2 Form for each employee. Additionally, employees must receive a copy of their W2 Form by January 31st of the following year.

When is the W2 Form Due?

The deadline for employers to provide W2 Forms to their employees is January 31st of each year. Employers must also file copies of the W2 Forms with the Social Security Administration (SSA) by February 28th, or March 31st if filing electronically.

How to Fill Out a W2 Form?

To fill out a W2 Form, you will need to gather the necessary information, including the employee’s name, Social Security number, and total wages earned for the year, among other details. Here’s a step-by-step guide:

- Enter the employer’s name, address, and employer identification number (EIN) in Box a, b, and c respectively.

- Enter the employee’s name, address, and Social Security number in Box d, e, and f respectively.

- Enter the total amount of wages, tips, and other compensation earned by the employee in Box 1.

- Enter the total amount of federal income tax withheld from the employee’s paychecks in Box 2.

- Enter the total amount of Social Security wages earned by the employee in Box 3, up to the Social Security wage base limit for the year.

- Enter the total amount of Social Security tax withheld from the employee’s paychecks in Box 4.

- Enter the total amount of Medicare wages and tips earned by the employee in Box 5.

- Enter the total amount of Medicare tax withheld from the employee’s paychecks in Box 6.

- Enter any additional taxes withheld from the employee’s paychecks in Box 2.

- Enter any dependent care benefits provided by the employer in Box 10.

- Enter the total amount of any non-taxable sick pay in Box 12.

- Complete Boxes 13 through 20 to report various types of compensation, benefits, and deductions.

- Double-check all information entered on the form for accuracy and completeness.

What are the Common Mistakes to Avoid When Filling Out a W2 Form?

There are several common mistakes that employers make when filling out W2 Forms, including:

- Entering incorrect employee information, such as a misspelled name or incorrect Social Security number.

- Reporting incorrect wage and tax amounts, which can result in incorrect tax withholding and potential penalties.

- Failing to include all necessary compensation, benefits, and deductions in the appropriate boxes.

- Using the wrong tax year on the form can result in delayed or incorrect tax returns.

To avoid these mistakes, employers should carefully review and double-check all information entered on the W2 Form before submitting it to the SSA and providing copies to employees.

What Happens If You Don’t File a W2 Form?

Failing to file a W2 Form or filing an incorrect one can result in penalties and fines from the IRS. The penalties can vary depending on how late the form is filed and how many employees are affected. Additionally, failing to file a W2 Form or filing an incorrect one can delay the employee’s tax return and potentially result in an audit from the IRS.