Table of Contents

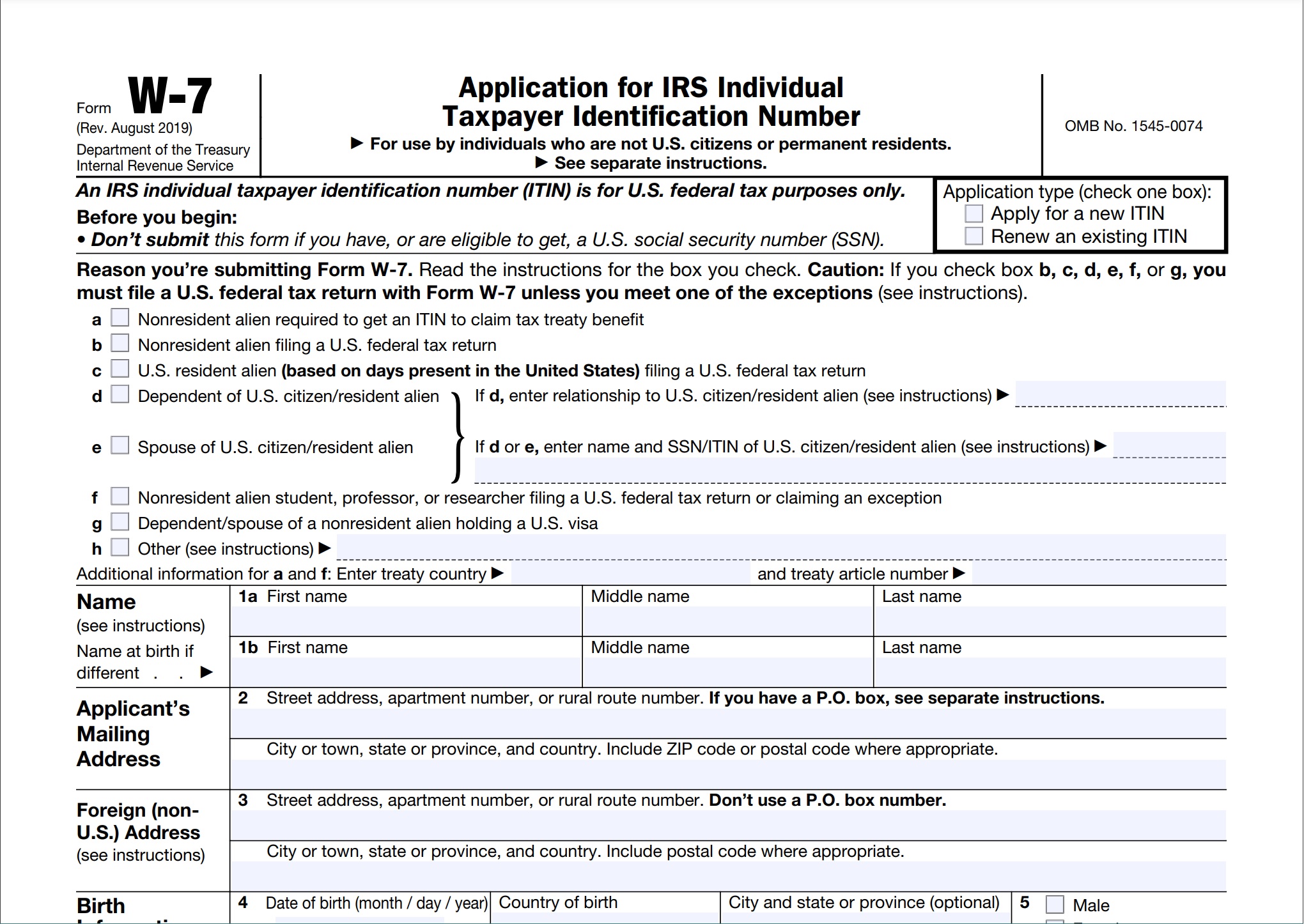

W7 Form 2023, Application for IRS ITIN – The Internal Revenue Service (IRS) offers a form called the W7 Form, or Application for IRS Individual Taxpayer Identification Number. This form is used to obtain an IRS Taxpayer Identification Number (ITIN), which is required for those who are not eligible for a Social Security Number and must file federal tax returns. The ITIN number serves as the taxpayer’s identification for the purposes of filing taxes and claiming credits or refunds in the United States.

It also helps individuals to open bank accounts, receive mortgage loans, and secure other financial services that require an identification number from applicants. The W7 Form is available online through the IRS website or through various tax preparation companies. All applicants must provide acceptable documentation with their application to prove their identity and foreign status in order to apply for an ITIN number.

What is Individual Taxpayer Identification Number (ITIN)?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) for federal tax filing purposes. An ITIN is issued to individuals who do not qualify to obtain a Social Security Number (SSN). The IRS created the ITIN program in 1996 in an effort to streamline and improve the taxation process for individuals who are not eligible for SSNs.

In order to apply for an ITIN, taxpayers must submit a completed IRS Form W-7 along with their required documents such as passports or other government-issued identification documents. Once approved, the taxpayer will receive their ITIN which they can use on their individual Federal income tax returns. The ITIN also allows foreign citizens and nonresident aliens to be accountable for taxes imposed by the U.S.

What is The Purpose of the W7 Form?

The W7 Form, also known as the Application for IRS Individual Taxpayer Identification Number (ITIN), can be a complex form to fill out. It is used by those who are not eligible for a Social Security number in order to pay taxes and file tax returns in the United States. The purpose of this form is to serve as an identification number assigned by the Internal Revenue Service (IRS) that allows individuals with an ITIN to pay taxes on income they make while living or working in the U.S.

The primary purpose of having a taxpayer identification number is so that taxpayers can provide it when filing their federal tax return forms, such as Form 1040, 1040-NR, or 1040-SR. This helps verify the identity of taxpayers and prevents any kind of fraud or misrepresentation of income and deductions.

Use W7 Form to apply for an IRS individual taxpayer identification number (ITIN). You can also use this form to renew an existing ITIN that has expired or that has already expired. A U.S. Internal Revenue Service (IRS) individual taxpayer identification number (ITIN) is a 9-digit number needed to complete tax forms when an individual is not a citizen of the United States.

Where Can I Find W7 Form?

Are you looking for the W7 form? The W7, Application for IRS Individual Taxpayer Identification Number (ITIN), is an important document that individuals need to file in order to pay taxes, claim tax credits and deductions, or receive other benefits from the Internal Revenue Service. It’s important to know where to find the form if you’re planning on filing taxes this year.

The easiest way to get your hands on a W7 form is by downloading it directly from the official IRS website. You can also get a copy of the form from an IRS office or authorized acceptance agent as well as many post offices, tax preparation services and financial institutions. Additionally, some software programs used for filing taxes allow users to fill out and print copies of the W7 Form.

W7 Form 2023 Printable PDF