Table of Contents

Everything You Need to Know About Form 940 for Federal Unemployment Tax

940 Form 2023 – Employer’s Annual Federal Unemployment Tax Return – If you’re a business owner with employees, you’re probably familiar with the concept of paying unemployment taxes.

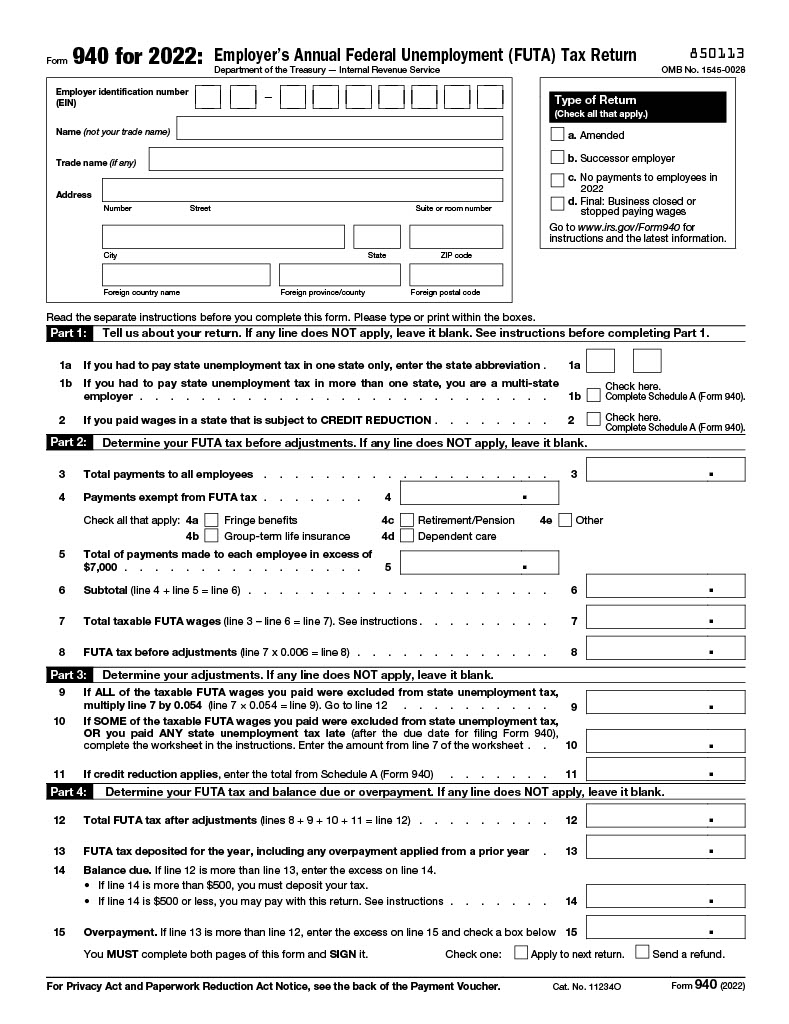

Form 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is a form that employers use to report and pay their FUTA tax.

FUTA tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. As an employer, it’s your responsibility to understand and comply with FUTA tax requirements.

Understanding Form 940, Employer’s Annual Federal Unemployment Tax Return

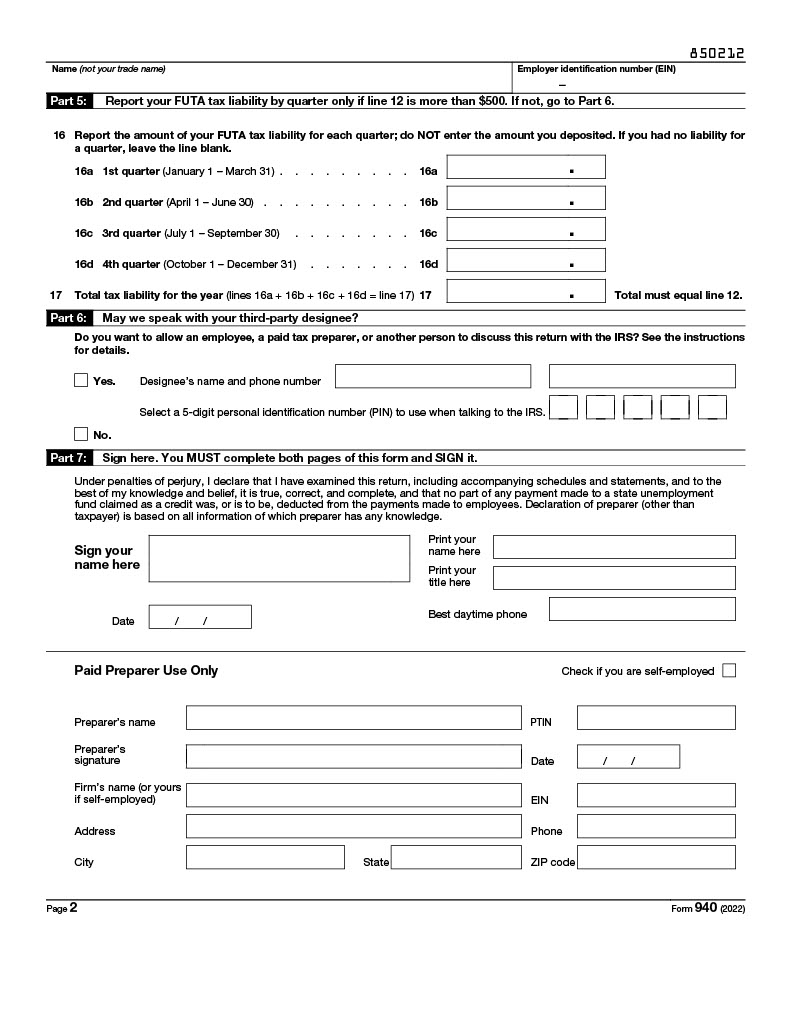

Form 940 is an annual tax return that’s due on January 31 of the year following the year in which you paid wages of $1,500 or more in any calendar quarter, or had one or more employees for at least some part of a day in any 20 or more different weeks in the current or preceding year. The form consists of two parts: Part 1 and Part 2.

- Part 1 of Form 940 asks for information about your business, such as your name and address, and your state unemployment tax rate. Part 1 also asks for the total amount of FUTA tax you owe for the year.

- Part 2 of Form 940 asks for information about your unemployment tax liability for each quarter of the year. You must report the total amount of taxable wages you paid in each quarter and the amount of FUTA tax you owe for each quarter.

What’s New For the 940 Form?

In the United States, a state that has not repaid the funds borrowed from the federal government to pay for unemployment benefits is known as a “credit reduction state.” The determination of credit reduction states is made by the U.S. Department of Labor.

If an employer pays wages that are subject to the unemployment tax laws of such a state, they must pay an additional federal unemployment tax when filing their Form 940.

This is because the credit against the federal unemployment tax that an employer is entitled to receive will be reduced based on the credit reduction rate for that specific state.

For the year 2022, there are credit reduction states in the United States.

Therefore, if an employer paid any wages that are subject to the unemployment compensation laws of a credit reduction state, their credit against the federal unemployment tax will be reduced accordingly.

To determine the exact credit reduction, employers can use Schedule A (Form 940).

It is important to note that the credit reduction rate for each state may differ, which is why it’s essential to stay up to date on any changes made by the U.S. Department of Labor.

Employers in the United States must keep in mind the credit reduction states while filing their Form 940.

Any wages paid to employees subject to unemployment compensation laws in these states will result in a reduction of their credit against federal unemployment tax.

To determine the exact credit reduction, employers can use Schedule A (Form 940), which will calculate the credit reduction rate for the specific credit reduction state.

The table below summarizes the credit reduction states and their respective credit reduction rates for the year 2022.

| State | Credit Reduction Rate | FUTA (0.6%) + Credit Reduction |

| California | 0.30% | 0.90% |

| Connecticut | 0.30% | 0.90% |

| Illinois | 0.30% | 0.90% |

| New York | 0.30% | 0.90% |

| US Virgin Islands | 3.60% | 4.20% |

Reporting and Paying FUTA Tax

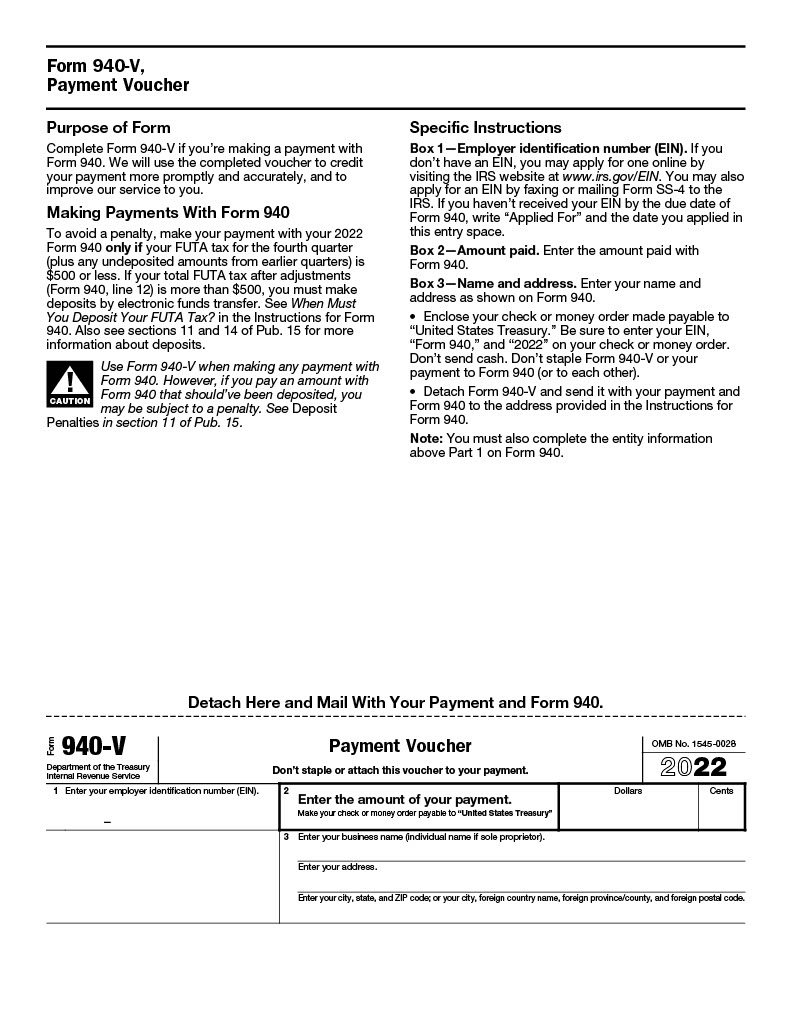

As an employer, you’re responsible for both reporting and paying FUTA tax. You must report your FUTA tax liability on Form 940 and pay the tax by the due date. If you don’t pay your FUTA tax on time, you may be subject to penalties and interest.

To report and pay FUTA tax, you’ll need to calculate your total FUTA tax liability for the year. The FUTA tax rate is 6% on the first $7,000 of each employee’s wages for the year. If you paid state unemployment tax in full and on time, you’re entitled to a credit of up to 5.4% against your FUTA tax liability. This means that the effective FUTA tax rate is 0.6%.

To calculate your FUTA tax liability, multiply your total taxable wages for the year by the FUTA tax rate of 0.6%. You can use the worksheet provided in the Form 940 instructions to help you calculate your FUTA tax liability.

What is Form 940 and Its Purpose?

This guide provides information on Form 940, including who needs to file it, how to complete it, and when and where to submit it. Use Form 940 to report your FUTA tax liability, which along with state unemployment tax systems, provides unemployment compensation to workers who have lost their jobs. Remember that the FUTA tax only applies to employers, and not to employees.

940 Form 2023 Printable

940 Form 2023 Printable PDF

Download & Print Here: Recent 940 Form [.PDF] (Current Revision: 2022)

Note: The most recent version of Form 940 is the 2022 edition. We will provide an update for the 2023 edition once it is released by the IRS.