Table of Contents

1099-K Form 2023 – The 1099-K form is an important document used by the Internal Revenue Service (IRS) to report income from payment card transactions and third-party network transactions. This form was created in response to the growth of electronic payments, allowing the IRS to monitor business activities more closely.

When filing your taxes using a 1099-K, it’s important to understand that it only reports gross income and doesn’t account for deductions like overhead costs or returns.

What is Form 1099-K?

Form 1099-K, Payment Card and Third-Party Network Transactions is a statement businesses use to report income from payment card and third-party network transactions. This form is submitted to the IRS each year, and it helps them track income received by businesses through these payment sources. It reports total gross sales, including all payments made with credit cards, debit cards, gift cards, Apple Pay, Google Pay, PayPal, and other forms of digital payments. The 1099-K form was introduced in 2011 as part of the Dodd–Frank Wall Street Reform and Consumer Protection Act to help fight tax evasion by those using cash transactions or nonstandard reporting methods. Businesses must report their total sales volume to the IRS on Form 1099-K if they have had more than 200 payments over $20,000 during a calendar year.

If you are a business owner or independent contractor, the end of January marks an important date in your financial calendar. You should receive Form 1099-K by January 31 if, in the prior calendar year, you received payments from all payment card transactions (e.g., debit, credit, and prepaid cards).

For tax returns relating to calendar years that occurred before 2022:

- Payments made in gross that amount to more than $20,000 AND

- More than two hundred of these kinds of transactions

For tax returns for years beginning after 2021, the following applies:

- Payments in gross excess of $600 made for the purchase of goods or services AND

- Any amount of deals that were made.

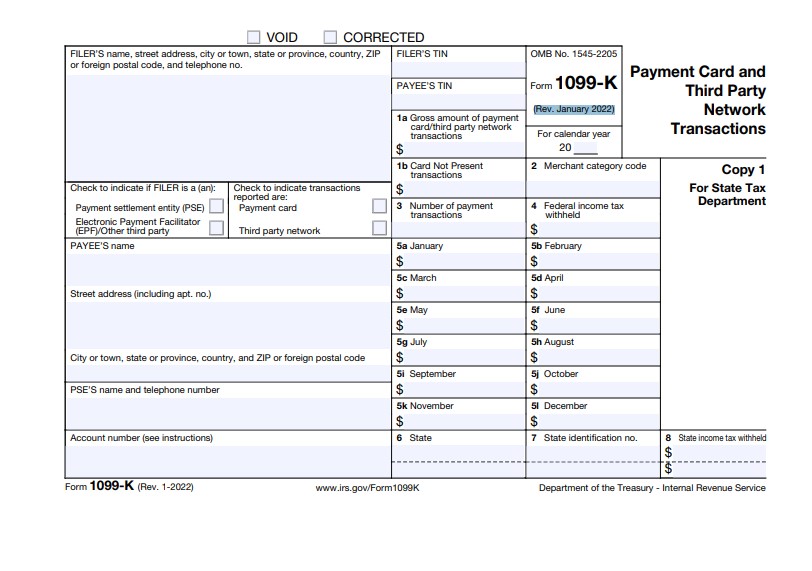

What is Included on the 1099-K Form?

The 1099-K form is an important document for business owners and independent contractors. It provides details of income earned from payment card transactions, such as debit or credit cards and third-party networks. This includes payments made through PayPal or other online payment services. Knowing the information on the 1099-K form can help you accurately report your taxable income.

The form reports gross receipts from transactions processed by third-party networks such as banks, merchant acquirers, or payment settlement entities. It also includes the total number of payments received during the year and the date when each transaction was processed. The name and address of the payor are also reported, along with their tax identification number, if available. In addition to this information, any fees charged to merchants by these networks will also be listed on the form.

1099-K Form: Everything You Must Know

Form 1099-K has been around for a while, but it has received more attention recently due to a recent rule change. This form is used by payment settlement entities such as credit card companies and third-party payment processors to report the gross payments made to merchants. With the change, it was expected that some of these entities would be required to file this form with the Internal Revenue Service (IRS).

The Internal Revenue Service (IRS) announced a surprising twist on Dec. 23, 2020- the new 1099-K form rule will be delayed. This means businesses and sole proprietors have more time to prepare for the changes in their tax filing requirements.

Taxpayers with income from payment card transactions, such as credit cards, debit cards, and prepaid cards, must report this income on form 1099-K when the total amount exceeds $20,000 or 200 transactions. The IRS had previously indicated that it would require taxpayers to file Form 1099-K for 2022 taxes filed in 2023.

According to the notice made by the IRS, the guidelines for submitting Form 1099-K during the tax year 2022 will, for the most part, be the same as during the tax year 2021.

According to the former standards, there will still be some individuals who get Form 1099-K for the tax year 2022 early in the year 2023. Because the regulation will be delayed, there won’t be as many individuals impacted as originally anticipated this year.

What are Revised Regulations for 1099-K Forms?

The 1099-K form is one of the most important documents for independent contractors and small business owners. It reports all gross payment transactions made through third-party payment networks, such as credit cards and PayPal. This year, there are a few big changes to be aware of when filing this form with the IRS. We’ve noted the biggest changes in the following paragraphs to keep it simple.

- First, 2021 saw the adoption of the $600 rule. At the beginning of 2021, a law was enacted that reduced the 1099-K reporting threshold for 2022 from $20,000 (or 200 transactions on any platform) to $600 for the total amount reported by any platform. This regulation is intended to apply to payments for products and services. Still, it may have been interpreted to encompass personal payments made via applications like Venmo, Paypal, Etsy, and Ticketmaster, to mention just a few.

- Second, The $600 rule will be postponed until December 2022. The Internal Revenue Service (IRS) announced on December 23 that the new $600 rule would be postponed and that the former standards would apply beginning with the 2022 tax returns. If you have more than $20,000 in payments or more than 200 transactions connected to products or services from a single platform, you should anticipate receiving a 1099-K form from that platform.

1099-K Form 2023

The 1099-K form is important to know if you’re a self-employed individual or small business owner. It’s the form used by payment processors such as PayPal, Stripe, and Square to report certain types of payments to the IRS. Knowing how to file your 1099-K form properly can help avoid costly penalties and potential audits.

Fortunately, various online resources make it easy to find and download a printable version of the 1099-K form. Once you’ve downloaded the form, fill out the required information and submit it with your income tax return. Double-check all of your entries before submitting them for accuracy; incorrect information could lead to delays in processing or even additional penalties from the IRS.

Until this article is published, the latest version of the 1099-K Form (Rev. January 2022) that the IRS distributes can be downloaded here.