Table of Contents

Calling All Employers: Pre-Screening Notice Now Required

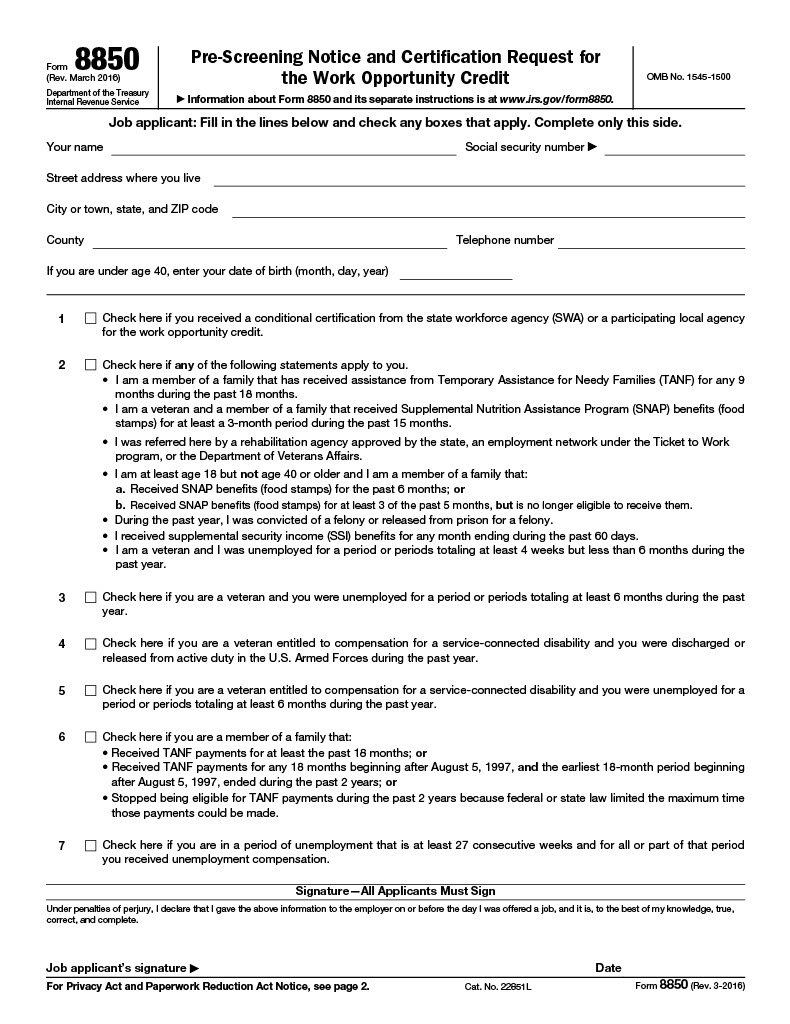

8850 Form 2023, Pre-Screening Notice and Certification Request for the Work Opportunity Credit – The Work Opportunity Credit (WOTC) provides a great opportunity for employers to reduce their federal tax liability while helping job seekers who have difficulty finding employment. The WOTC program is administered by the IRS and employers must complete Form 8850 and submit it to their state workforce agency no later than 28 days after the employee begins work. This article will provide an overview of Form 8850, also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit.

The Work Opportunity Tax Credit (WOTC) is a federal tax benefit available to employers who hire individuals from certain disadvantaged groups who have faced significant barriers to employment. The purpose of the program is to provide these individuals with the opportunity to gain valuable work experience and secure a stable income.

To be eligible for the credit, employers must complete and submit Form 8850, the Pre-Screening Notice and Certification Request, to the United States Department of Labor. This form is the first step in the process of obtaining the Work Opportunity Tax Credit.

What is The Purpose of the 8850 Form?

Form 8850 is used by employers to pre-screen potential employees and request certification from the state workforce agency (SWA) that the individual belongs to a targeted group eligible for the Work Opportunity Tax Credit (WOTC). This form must be submitted to the SWA in the state where the business is located and the employee will be working.

The process of qualifying for the WOTC involves multiple steps, with the submission of Form 8850 being one of them. It is the responsibility of the SWA’s WOTC coordinator to verify the candidate’s eligibility to one of the specified target groups. To receive the WOTC, the employee must start work and meet the minimum hour requirement. Employers must then submit Form 5884, Work Opportunity Credit, to claim the credit. Tax-exempt organizations employing a qualifying veteran must file Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans, to claim the credit for that veteran.

8850 Form 2023 Printable

Understanding the Work Opportunity Tax Credit

Employers who hire individuals from specific targeted groups are eligible for tax benefits through the Work Opportunity Tax Credit (WOTC), also known as WOTC. These targeted groups include veterans, individuals receiving food stamps, individuals with prior incarceration, and those receiving Temporary Assistance for Needy Families (TANF).

Under the WOTC program, employers may receive tax credits for a portion of the salaries paid to qualify employees during their first year of employment. The value of the credit can range from a few thousand dollars to several thousand dollars per qualifying employee and is determined by the number of hours worked and the number of wages paid.

Eligibility for the Work Opportunity Tax Credit

In order to qualify for the Work Opportunity Tax Credit (WOTC), an individual must belong to a targeted group and be hired by an employer participating in the WOTC program. The individual must also meet certain eligibility criteria, including being at least 18 years old, being a U.S. citizen or legal resident, and meeting specific income requirements.

This means the employer must fulfill certain requirements to be eligible for the credit, including having a valid Employer Identification Number (EIN), operating as a for-profit corporation, and not being subject to any federal tax liens.

Who Should Complete and Sign the Form

Information about the job candidate’s eligibility for the Work Opportunity Tax Credit (WOTC) must be provided by the candidate to the employer prior to the offer of employment being made. This information should be submitted through Form 8850. If the employer believes the applicant belongs to a targeted group, as outlined in a subsequent section, the employer must complete the remainder of the form no later than the day the job offer is given. Form 8850 must be signed by both the prospective employee and employer before being submitted to the state workforce agency (SWA).

8850 Form 2023 Printable PDF