Table of Contents

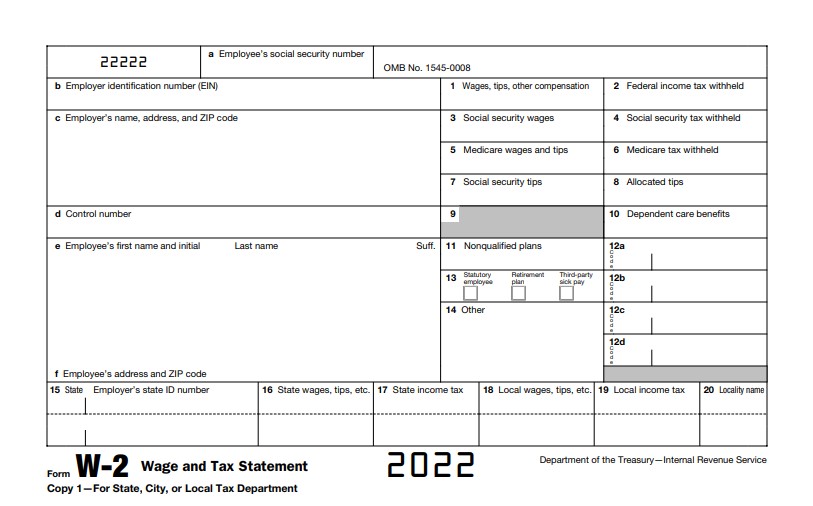

The W2 Form 2022 is a tax document that reports an individual’s annual income. The Internal Revenue Service (IRS) uses the form to calculate an individual’s tax liability. The W2 Form 2022 is available in English and Spanish.

New Article: W-2 Form 2025.

What is a W2 Form?

A W2 form is a tax document that reports an individual’s wages and taxes. The form is issued by an employer and sent to the employee. It is also sent to the Social Security Administration (SSA) and the Internal Revenue Service (IRS). The SSA and the IRS use the W2 form to determine an individual’s tax liability.

The W2 form must be filled out and filed by January 31, following the calendar year it was issued.

About Form W-2, Wage and Tax Statement

Form W-2, Wage and Tax Statement is a U.S. Internal Revenue Service (IRS) form that employers provide to their employees yearly. The form shows the employee’s wages earned in the previous tax year, as well as other information such as taxes withheld from paychecks or Social Security payments. Employees use Form W-2 to file their annual federal income tax return; it provides important data for filing taxes accurately and on time.

Form W-2 contains critical information about an employee’s wages, salary, and compensation for tax purposes including taxable tips, 401(k) deductions, and health insurance premiums taken out of an employee’s paycheck during the year.

Who Needs to File a W2 Form?

A W2 form is a document that an employer must provide to each employee. The W2 form reports an employee’s annual wages and the amount of taxes withheld from their paychecks. Employees use the information on the W2 form to file their yearly tax returns.

Self-employed individuals do not receive a W2 form because no one employs them. They must instead file a different tax form, called 1099, which reports their self-employment income.

When is the Deadline to File a W2 form?

The W2 Form 2022 is available for download on the IRS website. The deadline to file this form is January 31, 2023.

The W2 form reports an individual’s annual wages and withholding taxes. This form must be filed with the IRS by January 31.

If you are an employer, you must provide your employees with their W2 forms no later than January 31st. Employees will use this form to file their taxes.

It is important to note that the W2 form differs from the W4 form. The W4 form is used to calculate an individual’s withholding taxes. Withholding taxes are the taxes taken from an individual’s paycheck before receiving their net pay.

How To Fill Out A W2 Tax Form In 2022

W2 Form 2022 (FREE Printable & Fillable Online)

Print & Fill Online: W-2 Form 2022

UPDATED: IRS Has Released W2 Form 2024 Printable.

You can also read our article about “W2 Form 2024, Wage and Tax Statement“