Table of Contents

W-2 Form 2025 Printable – The W-2 form, Wage and Tax Statement, is a key document for both employees and employers in the U.S. tax system. For employees, it provides a summary of income earned, taxes withheld, and contributions to social security and Medicare. This makes it essential for filing accurate tax returns, tracking income for loans or mortgages, and managing retirement benefits. The W-2 helps employees ensure they have paid the correct amount of taxes throughout the year, and it serves as proof of income when applying for financial assistance.

For employers, the W-2 form is a legal requirement to report employee wages and taxes to the IRS and state tax agencies. It plays a vital role in ensuring compliance with tax laws, helps employers track payroll expenses, and provides necessary data for their own tax filing. The W-2 also outlines contributions to social security and Medicare, ensuring both employer and employee fulfill their responsibilities to these programs. Accurate W-2 reporting helps employers avoid penalties and ensures the integrity of tax reporting.

The W-2 form includes several important sections, such as employer and employee information, wage details, tax withholdings, and retirement plan contributions. It also records any deductions, including health insurance premiums and retirement contributions. Each section of the W-2 is coded to make the information clear and accessible for both employees and the IRS. The form can be delivered either electronically or in paper format, with employers required to send it by January 31st each year.

In case an employee does not receive their W-2 on time, there are steps they can take, including contacting their employer, waiting for a short extension, or filing an IRS Form 4852 to request a substitute. The W-2 form is a critical tool in maintaining accurate tax records, ensuring proper tax payment, and helping both employees and employers stay compliant with tax regulations.

What is the W-2 Form: Wage and Tax Statement?

The W-2 Form, formally titled “Wage and Tax Statement,” is a crucial document for both employees and the IRS. It summarizes your income and taxes withheld from your paycheck during a calendar year.

For Employees

- Tax Filing: The W-2 provides the information you need to file your federal and state income tax returns accurately. It includes your gross earnings, federal and state income tax withheld, Social Security and Medicare taxes withheld, and any other deductions like health insurance premiums or retirement contributions.

- Verification of Income: You can use your W-2 to verify your income for various purposes, like applying for loans or mortgages.

- Retirement Benefits: Your W-2 also includes information about your Social Security earnings, which is crucial for determining your future retirement benefits.

For the IRS

- Tax Collection: The W-2 helps the IRS track your income and ensure you pay the correct amount of taxes.

- Tax Audit: The IRS can use the W-2 to verify the accuracy of your tax return during an audit.

Why is the W-2 form important for employees and employers?

The W-2 form is a crucial document for both employees and employers. The W-2 Form is important for employees and employers. Here are the breakdowns:

For Employees

- Tracks Income: It summarizes your wages and salaries earned during the year, including bonuses, commissions, and other compensation. This information is crucial for accurate tax filing.

- Determines Tax Obligations: The W-2 form provides the information needed to calculate your federal, state, and local income tax liability.

- Helps with Tax Filing: It provides all the necessary information for you to fill out your tax return correctly, including withholdings for taxes and Social Security.

- Documents Retirement Contributions: It includes details about contributions made to your 401(k) and other retirement plans, which helps you track your savings and plan for retirement.

- Proof of Income: The W-2 form serves as proof of your income for other financial purposes, such as applying for loans or mortgages.

For Employers

- Complies with Tax Laws: The W-2 form is legally mandated by the IRS and state tax agencies, and employers are required to file them accurately for each employee.

- Tracks Payroll Expenses: The W-2 form helps employers keep track of their payroll expenses, including taxes withheld from employee wages.

- Provides Information for Tax Filing: It provides all the information employers need to file their own tax returns, including the amount of taxes withheld from employees’ wages.

- Contributes to Social Security: The W-2 form details Social Security and Medicare taxes withheld from employees’ wages, which contribute to these vital programs.

- Ensures Accurate Reporting: Accurate W-2 forms help employers avoid penalties and fines associated with incorrect reporting of employee wages and taxes.

The W-2 form is a critical piece of the tax system, facilitating the accurate reporting and payment of taxes, ensuring the fairness and integrity of the tax system for both employees and employers.

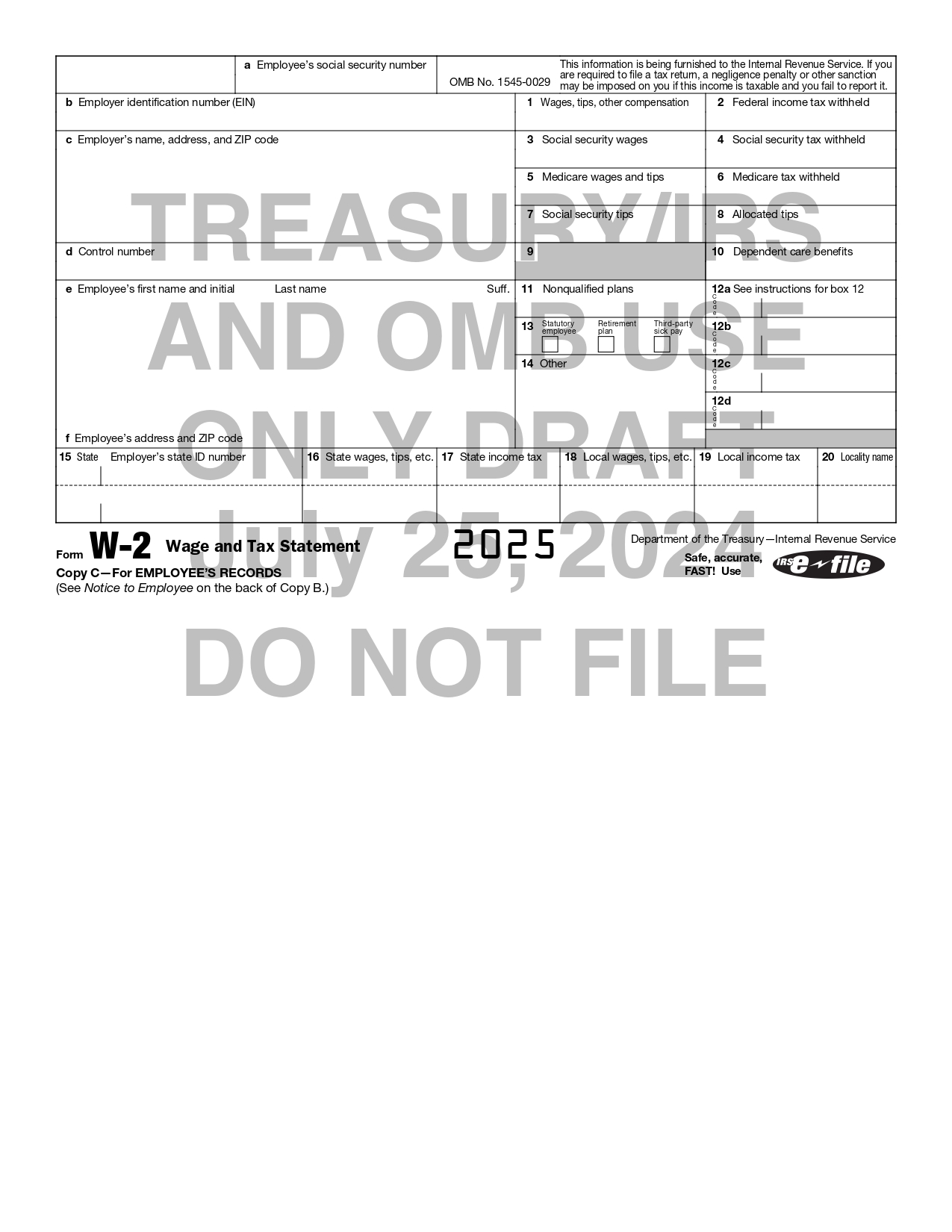

What are the key components of a W-2 form?

The key components of the W-2 form are:

1. Employer Information

- Employer’s name, address, and phone number: This section identifies your employer.

- Employer Identification Number (EIN): This is a unique nine-digit number assigned by the IRS to every business entity.

2. Employee Information

- Employee’s Social Security Number (SSN): This is your unique identifier used for tax purposes.

- Employee’s name and address: This identifies you as the recipient of the W-2.

3. Wage and Tax Information

- Box 1: Wages, tips, other compensation: This is your total gross income from your employment. It includes salaries, bonuses, commissions, and tips.

- Box 2: Federal income tax withheld: This is the amount of federal income tax withheld from your paychecks throughout the year.

- Box 3: Social Security wages: This amount is used to calculate your Social Security benefits.

- Box 4: Social Security tax withheld: This is the amount of Social Security tax withheld from your paychecks.

- Box 5: Medicare wages and tips: This amount is used to calculate your Medicare benefits.

- Box 6: Medicare tax withheld: This is the amount of Medicare tax withheld from your paychecks.

- Box 7: Social Security tips: This is the amount of tips reported to the Social Security Administration.

- Box 8: Allocated tips: This amount is used for employers who have a tip allocation plan.

- Box 9: Dependent care benefits: This amount reflects any dependent care benefits provided by your employer.

- Box 10: Nontaxable sick pay: This is the amount of nontaxable sick pay received from your employer.

- Box 11: State and local income tax withheld: This section lists any state and local income taxes withheld from your paycheck.

4. Other Important Information

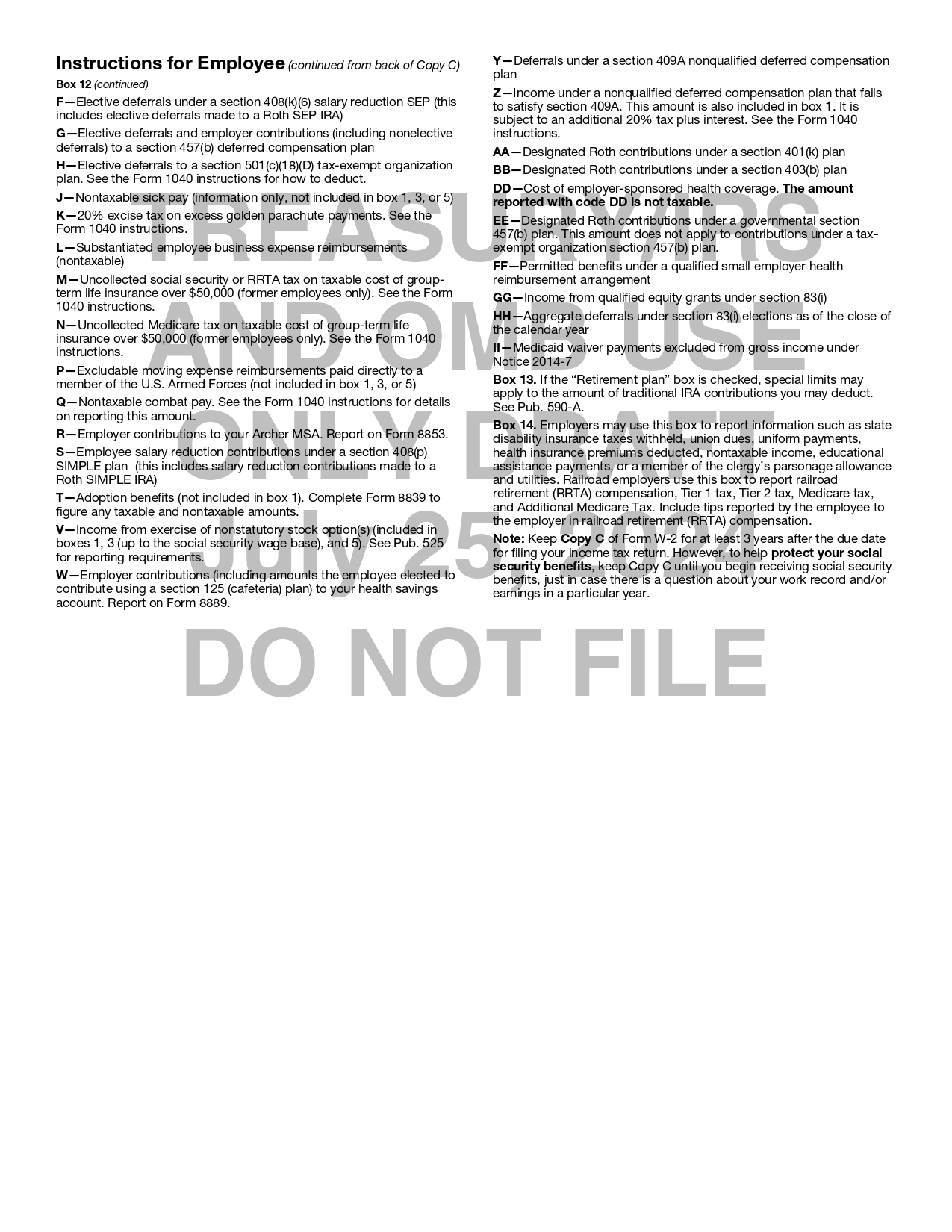

- Box 12: Other deductions: This section lists other deductions, such as health insurance premiums, retirement contributions, and child tax credits. Each deduction is coded with a letter to identify the specific deduction.

- Box 13: Retirement plan: This box indicates if you participated in a retirement plan.

- Box 14: Employer-provided health insurance: This box identifies whether you were covered under an employer-provided health plan.

- Box 16: State/Local wages: This box lists your state and local wages for reporting purposes.

5. Employer’s Certification

- Employer’s signature and date: This section confirms the accuracy and completeness of the information reported on the W-2 form.

Note: The W-2 form may include additional boxes for specific information depending on your employment situation and state regulations.

What is the Purpose of a W-2 Form?

The W-2 form is a cornerstone of the U.S. tax system, serving critical purposes for both employees and employers. For employees, it provides a summary of total wages and salaries earned throughout the year, including bonuses and commissions. This accurate reporting ensures compliance with IRS requirements and allows individuals to calculate their federal, state, and local income tax liabilities. Additionally, the form includes the amount of taxes already withheld from paychecks, helping employees determine whether they owe taxes or qualify for a refund.

Beyond tax filing, the W-2 form tracks contributions to retirement plans, such as 401(k)s, and other benefits like health insurance, offering employees a clear record of their savings and coverage. It also serves as proof of income for financial transactions, such as applying for loans, mortgages, or credit cards. By providing this comprehensive overview, the W-2 helps employees manage their financial obligations and plan for the future.

For employers, the W-2 form ensures compliance with tax laws by accurately reporting employee wages and withholdings to the IRS and state tax agencies. It plays a vital role in payroll management, helping employers track expenses and meet their tax filing obligations. Furthermore, the W-2 details contributions to Social Security and Medicare, ensuring both employer and employee responsibilities to these essential programs are fulfilled.

The W-2 form bridges the gap between employees and employers, facilitating accurate income reporting, proper tax withholding, and compliance with U.S. tax regulations. Its role in promoting transparency and accountability makes it a vital tool for ensuring fairness within the tax system.

The W-2 form serves important purposes for both employees and employers, as outlined below.

For Employees

- Accurate Income Reporting: Summarizes total wages, salaries, bonuses, commissions, and other compensation earned during the year.

- Tax Calculation and Filing: Provides necessary information to calculate federal, state, and local tax liabilities, and determine refunds or additional taxes owed.

- Retirement and Benefits Tracking: Documents contributions to retirement plans (e.g., 401(k)) and benefits like health insurance.

- Proof of Income: Serves as verification of income for financial activities such as loan, mortgage, or credit card applications.

For Employers

- Compliance with Tax Laws: Fulfills legal obligations to report employee wages and withholdings to the IRS and state tax agencies.

- Payroll Management and Reporting: Tracks payroll expenses, including taxes withheld, ensuring accurate accounting.

- Tax Filing Obligations: Provides essential data for employers to complete their own tax returns.

- Social Security and Medicare Contributions: Details contributions to these programs, ensuring obligations are met by both employer and employee.

Who Receives a W-2 form?

Anyone who receives wages, salaries, tips, or other compensation from an employer will receive a W-2 form. This includes:

- Full-time employees

- Part-time employees

- Temporary employees

- Independent contractors (if they meet certain criteria and the employer chooses to classify them as an employee)

- Household employees (e.g., nannies, housekeepers)

- Government employees

- Military personnel

If you received compensation from an employer during the tax year, you should expect to receive a W-2 form by January 31st of the following year.

Who Files Form W-2?

The employer is responsible for filing Form W-2.

When are W-2 forms sent out?

The deadline for employers to provide employees with their W-2 forms is January 31st of each year. So, if you worked for an employer during the previous year (e.g., 2024), you should receive your W-2 form by January 31st, 2025. This is the same deadline for employers to file the W-2 form with the Social Security Administration (SSA) and the Internal Revenue Service (IRS). It’s important to note that although the deadline is January 31st, some employers may send out W-2s earlier. You can check with your employer for their specific timeframe.

What to Do If You Don’t Receive a W-2?

It’s frustrating to not receive your W-2 by the January 31st deadline, but don’t worry! Here’s what you can do:

1. Contact Your Employer:

- Reach out first: The most straightforward solution is to contact your former employer directly. They may have accidentally overlooked sending it to you.

- Be polite but persistent: Explain that you haven’t received your W-2 and need it to file your taxes.

- Provide your contact information: Make sure they have your current address and email address.

2. Wait a Little Longer:

- The IRS extension: While the official deadline is January 31st, the IRS allows employers a bit of leeway. They might send it out within the following few weeks.

3. File an IRS Form 4852 (Substitute W-2):

- If you still haven’t received it: You can use Form 4852 to get a substitute W-2. You’ll need to contact the IRS directly for instructions on how to obtain and file the form. You can find more information on the IRS website.

- Important note: You’ll need to gather information from your pay stubs or other records to complete the form accurately.

4. Contact the Social Security Administration (SSA):

- If the employer is unresponsive: You can contact the SSA to inquire about your W-2. They might be able to help you track it down.

- SSA website: The SSA website also offers information on how to obtain a substitute W-2.

Remember: It’s crucial to file your taxes on time, even if you don’t have your W-2. Filing an extension may be an option, but it’s best to get in touch with the IRS or your tax professional to understand your options.

Can W-2s be Received Electronically?

Yes, W-2s can be received electronically! It’s becoming increasingly common for employers to offer electronic W-2 delivery options.

Here’s how electronic W-2s work:

- Online portals: Employers often provide secure online portals where employees can access their W-2s.

- Email delivery: Some employers choose to send W-2s as secure PDF attachments via email.

- Third-party providers: There are specialized services that employers can use to send W-2s electronically.

Benefits of Electronic W-2s:

- Convenience: You can access your W-2 anytime, anywhere, without waiting for it to arrive in the mail.

- Speed: Electronic delivery is faster than traditional mail.

- Environmental friendliness: Electronic W-2s reduce paper waste.

- Security: Electronic W-2s can be encrypted to protect your personal information.

If you haven’t received your W-2 electronically, you can check with your employer to see if they offer this option.

How to Read a W-2 Form?

Reading and understanding W-2 form is crucial for accurately filing your taxes. While it might look complex at first, breaking it down section by section makes it much easier to grasp. Here’s a the explanation of each part:

Personal and Employer Information: Boxes A-F

- Box A: Your Social Security Number (SSN). Verify that it’s correct to avoid issues.

- Box B: Your employer’s Identification Number (EIN), used by the IRS for tax purposes.

- Box C: Your employer’s name, address, and ZIP code.

- Box D: A control number used internally by your employer to identify your W-2.

- Box E: Your full name. Ensure it’s accurate and matches your Social Security card.

- Box F: Your address. Confirm it’s correct as this is where the form was sent.

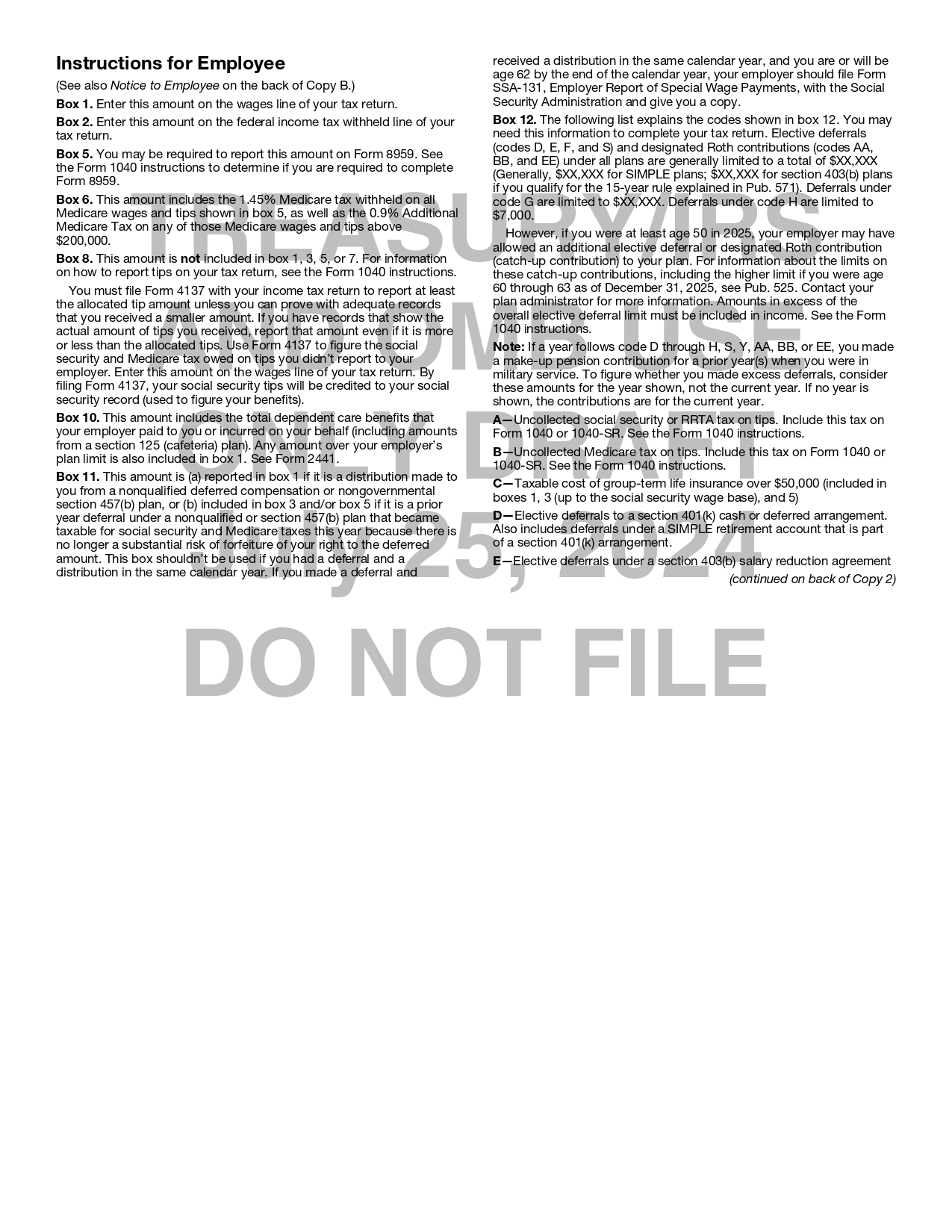

Earnings and Withholding: Boxes 1-6

- Box 1: Your total taxable wages, including salary, tips, bonuses, and other compensation.

- Box 2: Federal income tax withheld by your employer and paid to the IRS.

- Box 3: Wages subject to Social Security tax (may differ from Box 1 due to wage limits).

- Box 4: Social Security tax withheld.

- Box 5: Wages subject to Medicare tax.

- Box 6: Medicare tax withheld.

Tips and Dependent Care: Boxes 7-10

- Box 7: Tips you reported that are subject to Social Security tax.

- Box 8: Allocated tips (assigned by your employer if you didn’t report enough).

- Box 9: No longer used; it’s left blank.

- Box 10: Dependent care benefits, such as contributions to a dependent care flexible spending account.

Deferred Compensation and Additional Taxes: Boxes 11-12

- Box 11: Distributions from a nonqualified deferred compensation or non-government 457(b) plan.

- Box 12: Various compensations or benefits identified by letter codes. Common codes include:

- Code A: Uncollected Social Security tax on tips you reported.

- Code B: Uncollected Medicare tax on tips you reported.

- Code C: The taxable cost of group-term life insurance provided by your employer for coverage exceeding $50,000.

- Code D: Pre-tax contributions to a 401(k) retirement plan.

- Code E: Pre-tax contributions to a 403(b) plan, typically for non-profits and schools.

- Code F: Contributions to a Simplified Employee Pension (SEP) plan.

- Code G: Contributions to a 457(b) deferred compensation plan (common for government and non-profits).

- Code H: Contributions to a 501(c)(18)(D) plan for specific tax-exempt organizations.

- Code J: Non-taxable sick pay received.

- Code K: 20% excise tax on excessive “golden parachute payments” (high severance packages for executives).

- Code L: Non-taxable reimbursements for employee business expenses, such as mileage or travel.

- Code M: Uncollected Social Security tax on group-term life insurance over $50,000 (for former employees).

- Code N: Uncollected Medicare tax on group-term life insurance over $50,000 (for former employees).

- Code P: Non-taxable moving expense reimbursements for Armed Forces members.

- Code Q: Non-taxable combat pay received by members of the military.

- Code R: Contributions made by your employer to an Archer Medical Savings Account (MSA).

- Code S: Contributions you’ve made to a SIMPLE plan.

- Code T: Employer-provided benefits for adoption assistance.

- Code W: Employer contributions to a Health Savings Account (HSA).

- Code V: Income from exercising non-statutory stock options, included in Box 1 wages.

- Code Y: Deferrals to a non-qualified deferred compensation plan (not tax-favored).

- Code Z: Income from a non-qualified deferred compensation plan that violates Section 409A (subject to penalties).

- Code AA: After-tax Roth contributions to a 401(k).

- Code BB: After-tax Roth contributions to a 403(b).

- Code DD: The total cost of your employer-sponsored health coverage, reported for informational purposes (not taxable).

- Code EE: After-tax Roth contributions to a governmental 457(b) plan.

- Code FF: Benefits under a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA).

- Code GG: Income from qualified equity grants under certain employee stock programs.

- Code HH: Aggregate deferrals under Section 83(i), often related to stock-based compensation.

- Code II: Medicaid waiver payments excluded from Box 1 wages.

Special Categories: Box 13

- Statutory employee: You’re treated as self-employed for tax purposes.

- Retirement plan: You were part of a retirement plan during the year.

- Third-party sick pay: Payments you received from a third party for sick leave.

Miscellaneous Information: Boxes 14-20

- Box 14: Other details your employer wants to report, such as union dues or educational benefits.

- Boxes 15-20: State and local tax information, including wages, income tax withheld, and local tax authorities.

Reading the W-2 form begins with double-checking your personal information to ensure your name, address, and Social Security Number are correct. Next, carefully review the tax withholdings listed in Boxes 2, 4, and 6 to confirm the accuracy of your federal, Social Security, and Medicare tax amounts. If you identify any discrepancies, it’s important to contact your employer promptly to request a corrected W-2, referred to as Form W-2c. By thoroughly understanding each section of your W-2, you can file your taxes accurately and address any potential errors early on.

What Happens If Your W-2 is Lost or Damaged?

Losing or damaging your W-2 can be stressful, but there are steps you can take to get a replacement. Don’t panic! Here’s what you need to do:

1. Contact Your Employer

- First step: Your employer is the primary source for a replacement W-2. Contact their payroll department or HR department and explain that you’ve lost or damaged your W-2 form.

- Provide information: Be prepared to give them your name, Social Security number, and the tax year for which you need the replacement.

2. Allow Time for Processing

- Don’t rush: It can take a few weeks for your employer to process and send you a replacement W-2.

3. Consider Substitute Form 4852

- If you need it urgently: If you’re approaching the tax filing deadline and haven’t received your replacement W-2, you can file a substitute Form 4852, “Substitute Form W-2.”

- Get instructions from the IRS: You can find the necessary instructions and the form on the IRS website.

- Accurate information needed: You’ll need to have your pay stubs or other documentation to provide the accurate details on the form.

4. Contact the Social Security Administration (SSA)

- If your employer is unresponsive: If you can’t get a replacement W-2 from your employer, you can contact the SSA and ask for assistance.

- SSA website: They may be able to help you get a copy of your W-2 or provide information on alternative filing methods.

Tips for Preventing Loss or Damage

- Keep it safe: Store your W-2 in a secure place, preferably a fireproof filing cabinet.

- Make copies: Keep a copy of your W-2 for your records.

- Electronic options: Consider asking your employer about electronic delivery of W-2s to avoid potential loss.

Note: While you can file your taxes without a W-2 by using Form 4852, it’s crucial to have accurate information. If you have any questions or difficulties, don’t hesitate to contact the IRS or a tax professional for assistance.

What to do If You Find an Error on Your W-2?

Finding an error on your W-2 can be concerning, but it’s important to address it promptly. Here’s what you should do:

1. Verify the Error

- Double-check: Carefully compare the information on your W-2 to your pay stubs or other documentation to confirm the error.

- Types of errors: Common errors can include incorrect Social Security number, wrong wages, incorrect withholdings, or missing information.

2. Contact Your Employer

- Inform them: Reach out to your employer’s payroll department or HR department and inform them about the error.

- Provide details: Clearly explain the error and provide any supporting documentation, like your pay stubs, to help them verify the issue.

3. Request a Corrected W-2

- Formal request: Ask your employer to issue a corrected W-2 form (Form W-2c). This form will rectify the error and provide accurate information for your tax return.

- Processing time: It may take some time for your employer to process and send the corrected W-2.

4. Keep Records

- Copies of W-2s: Retain copies of both your original W-2 and the corrected W-2.

- Communication records: Keep a record of your communication with your employer, including the date, method of contact, and any information shared.

5. Update Your Tax Filing

- If you’ve already filed: If you’ve already filed your taxes based on the incorrect W-2, you’ll need to file an amended tax return (Form 1040-X). This will correct the error and ensure your tax liability is accurate.

- If you haven’t filed: Wait for the corrected W-2 to arrive and then file your taxes using the accurate information.

Note: It’s crucial to address errors on your W-2 promptly to avoid potential penalties or issues with your tax return.

What are the Consequences of Incorrect or Missing Information on a W-2 Form?

Incorrect or missing information on a W-2 can have significant consequences for both employees and employers. Here’s a breakdown of potential repercussions:

For Employees

- Tax Filing Errors: Incorrect W-2 information can lead to errors on your tax return, resulting in:

- Underpayment: You may owe additional taxes if your W-2 underreports your income or overstates your withholdings.

- Overpayment: You may receive a smaller refund or even owe taxes if your W-2 overreports your income or understates your withholdings.

- Audits: The IRS might audit your tax return if there are discrepancies between your W-2 and other information.

- Delayed Refunds: An incorrect W-2 can delay the processing of your tax return, making it harder to receive your refund on time.

- Incorrect Social Security and Medicare Contributions: Errors in Social Security and Medicare withholdings can affect your future benefits.

For Employers

- Penalties and Fines: The IRS imposes penalties on employers for filing incorrect or incomplete W-2s. These penalties can be substantial and include:

- Failure to file: Penalties for failing to file W-2s by the deadline.

- Accuracy: Penalties for reporting inaccurate information on the W-2.

- Legal Issues: In some cases, employers could face legal action for intentional errors or omissions on W-2 forms.

- Reputation Damage: Incorrect W-2s can damage an employer’s reputation, leading to mistrust from employees and potential negative publicity.

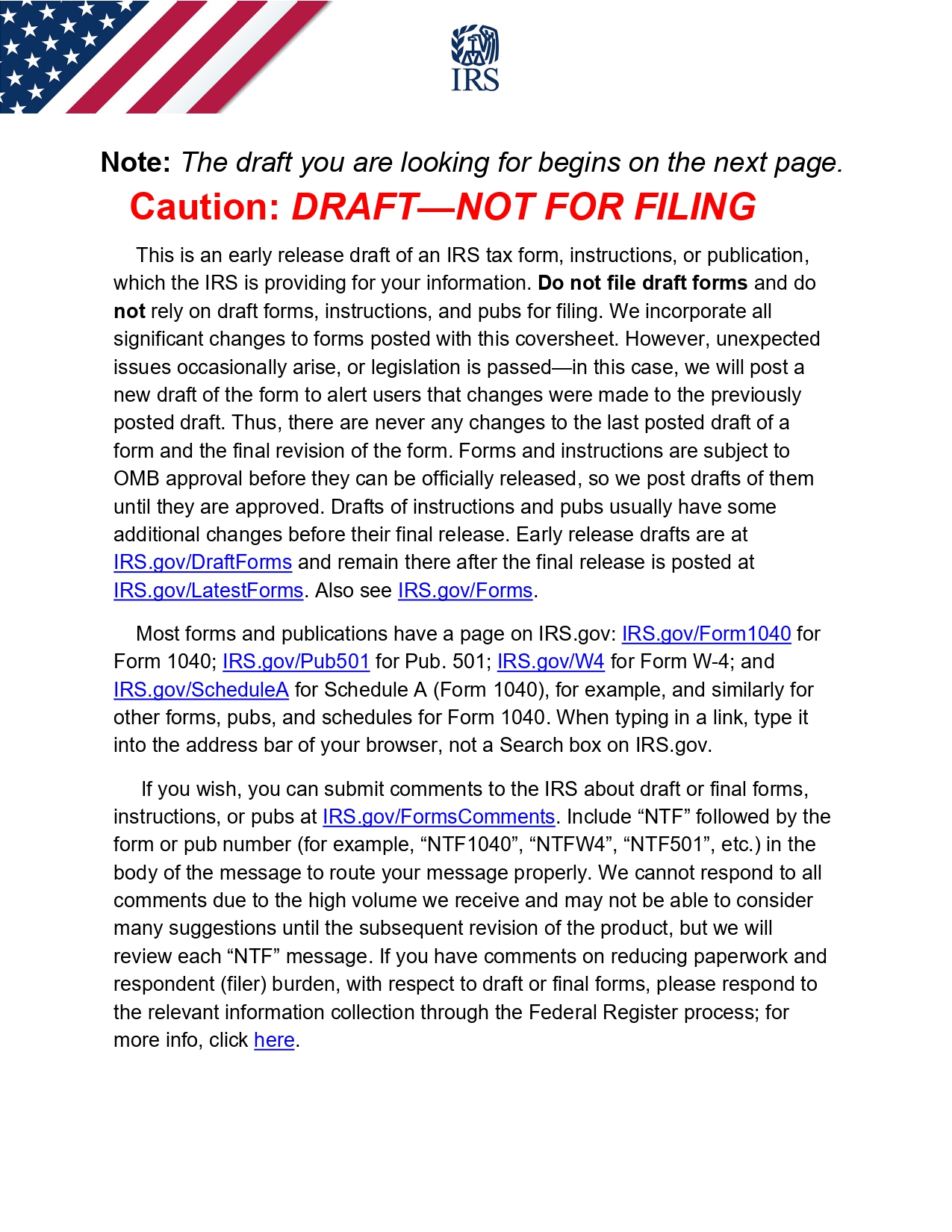

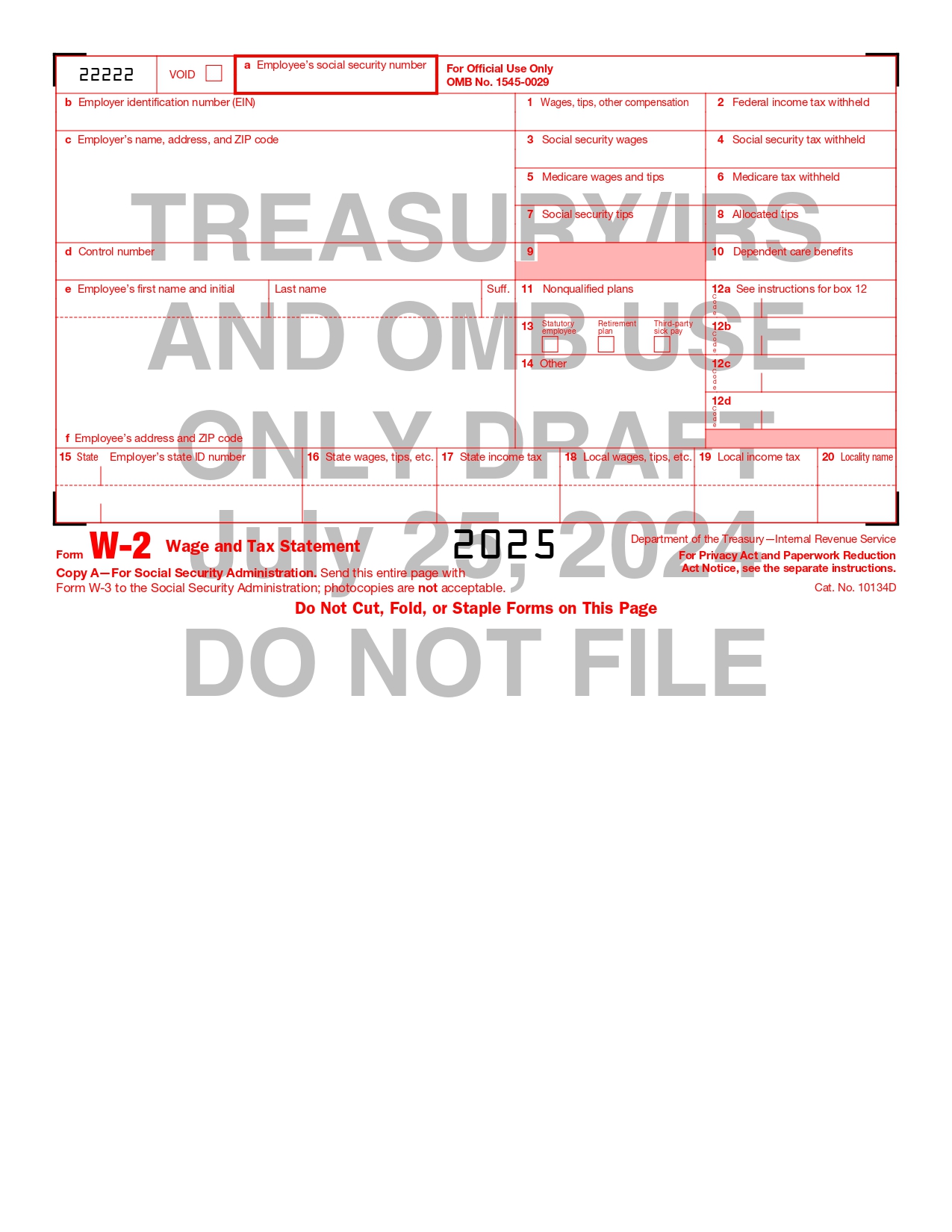

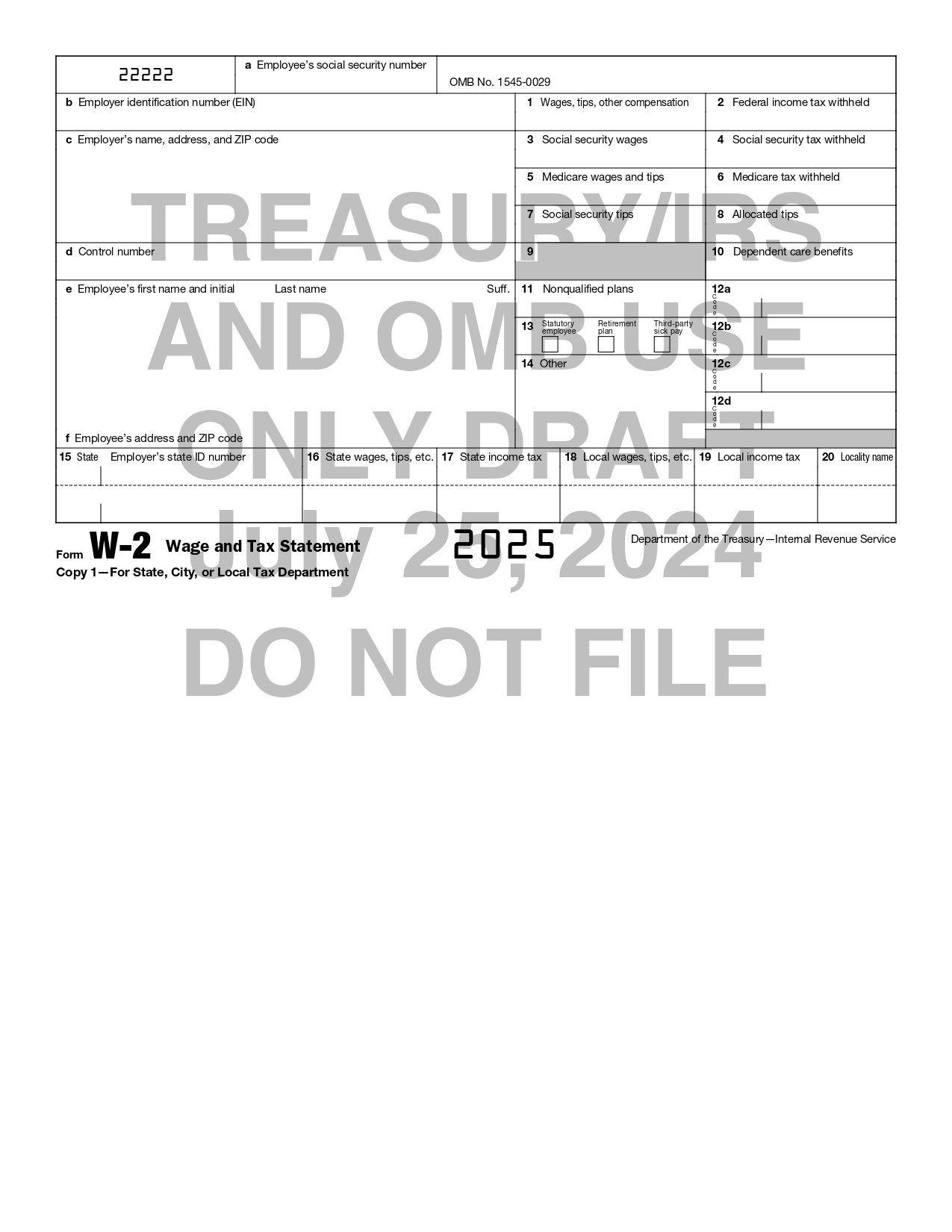

W-2 Form 2025 Printable

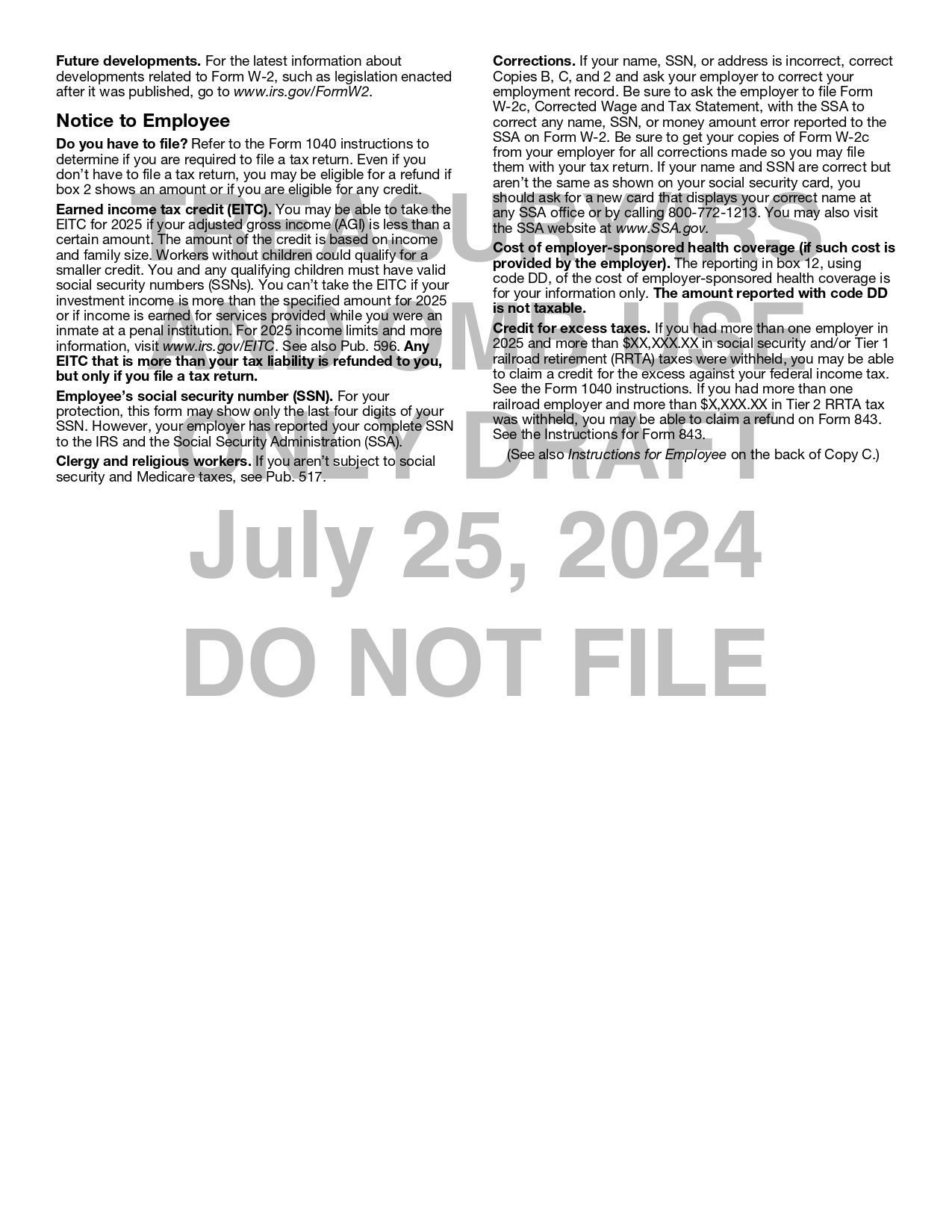

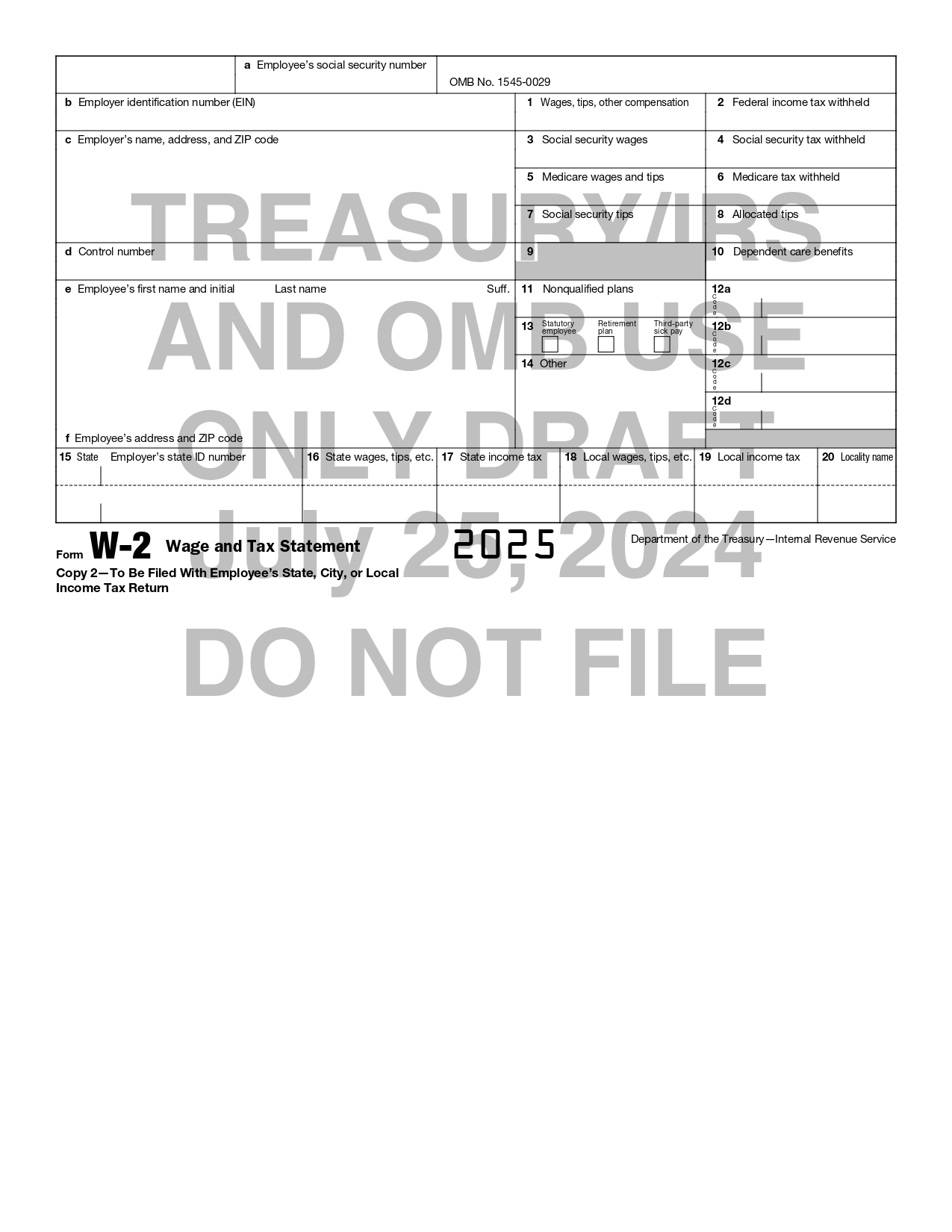

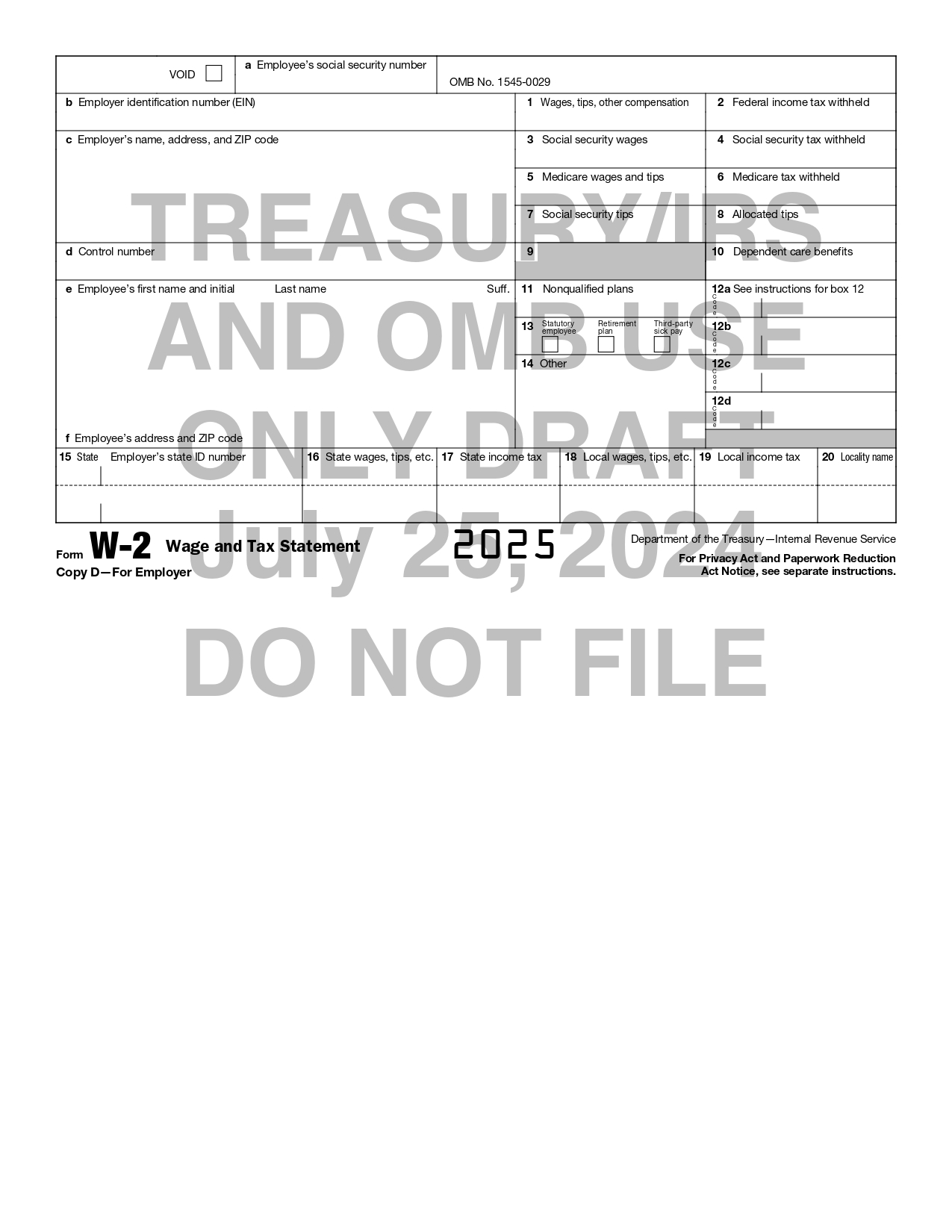

The IRS has recently released the draft version of the 2025 W-2 form. While this is not the final version, it provides an early look at the upcoming changes and structure. Once the official W-2 form for 2025 is published, we will promptly update our resources to include a printable version. For now, you can review the draft of the W-2 form for 2025 to get an idea of what to expect in the coming year.

Download W-2 Form 2025 Draft Version.