Table of Contents

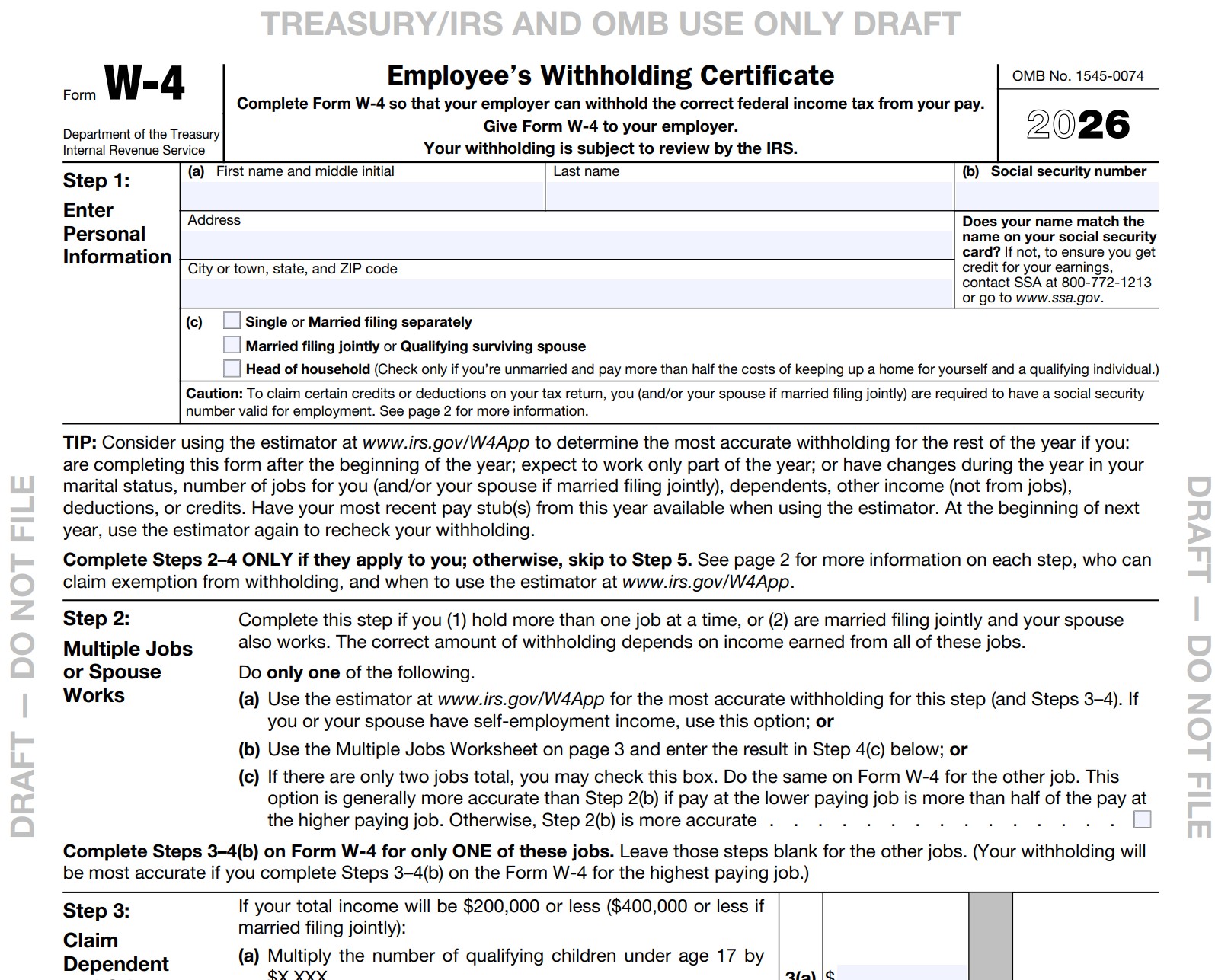

W-4 Form 2026 Draft – As tax season approaches, the Internal Revenue Service (IRS) has released a draft of the 2026 Form W-4, Employee’s Withholding Certificate, signaling significant updates driven by the One Big Beautiful Bill Act (OBBBA). If you’re wondering how these changes to Form W-4 2026 will impact your paycheck or tax refund, you’re not alone. With the draft expanding to five pages and introducing new deductions for tips, overtime, and more, staying ahead is crucial to avoid surprises come filing time in 2027.

In this comprehensive guide, we’ll break down the key Form W-4 changes for 2026, explain why they matter, and provide actionable steps to update your withholding effectively. Whether you’re a new hire, a parent claiming credits, or someone with side income, understanding the draft 2026 W-4 can help you optimize your finances for the year ahead.

What Is Form W-4 and Why Does It Matter for 2026?

Form W-4 is the IRS document employees use to tell their employers how much federal income tax to withhold from each paycheck. Getting it right ensures you neither overpay (tying up your money interest-free with the IRS) nor underpay (risking penalties). Since the 2020 redesign, the form has simplified withholding calculations by focusing on filing status, dependents, and adjustments rather than outdated allowances.

The 2026 draft reflects legislative shifts from the OBBBA, passed in 2025, which made permanent many Tax Cuts and Jobs Act (TCJA) provisions while adding worker-friendly deductions like no tax on qualified tips and overtime. These updates aim to align withholding more closely with actual tax liabilities, especially for service workers, hourly employees, and seniors. The draft, released on August 21, 2025, is for informational purposes only—expect the final version in late 2025 or early 2026.

Key Changes in the Draft 2026 Form W-4

The draft introduces several structural and substantive tweaks to accommodate OBBBA’s tax relief measures. Here’s a rundown of the most notable updates:

1. Expanded Form Length and Layout

- The current four-page form balloons to five pages, primarily due to a beefed-up deductions section. This allows for more detailed input without overwhelming the main form.

2. Step 3: Split Lines for Dependent Credits

- Previously a single section for credits, Step 3 now divides into Line 3a (qualifying children under 17) and Line 3b (other dependents).

- The child tax credit amount is a placeholder (blanked out), reflecting an OBBBA increase from $2,000 to $2,200 per child—finalized closer to tax season. Other dependents remain at $500.

3. Step 4: Streamlined Adjustments Without “Optional” Label

- The “Optional” tag is gone, signaling these fields are now core for accurate withholding.

- Step 4(b) Deductions Worksheet: This is the star of the show. Expanded to 15 lines on its own page, it starts with OBBBA-specific items before traditional deductions. New additions include:

- Qualified tips (up to $25,000 deduction, non-itemizers eligible).

- Qualified overtime pay (exempt from income tax).

- New passenger vehicle loan interest (for 2025+ purchases).

- Enhanced senior deduction ($6,000 per qualifying taxpayer age 65+, phasing out above $75,000 single/$150,000 joint).

- If skipped, withholding defaults to the standard deduction ($16,100 single/$32,200 joint for 2026, inflation-adjusted).

4. Exemption from Withholding: Checkbox Upgrade

- No more handwriting “Exempt”—now a formal checkbox with certification language. You must affirm:

- No 2025 tax liability.

- Expected none in 2026.

- Includes a reminder to file a new W-4 for 2027, reducing errors.

5. Tie-Ins to Broader 2026 Tax Updates

- Aligns with inflation-adjusted brackets (e.g., 37% top rate starts at $640,600 single) and permanent TCJA rates (10%-37%).

- Supports new W-2 reporting for tips and overtime, ensuring consistency.

| Change | Current (2025) Form | Draft 2026 Form | Impact |

|---|---|---|---|

| Form Length | 4 pages | 5 pages | More space for detailed deductions; easier navigation. |

| Step 3 Credits | Single section | Split: 3a (kids) & 3b (others) | Better precision for child tax credit ($2,200 placeholder). |

| Step 4(b) Worksheet | Short, itemized focus | 15 lines, OBBBA-first | Accounts for tips/overtime; reduces over-withholding for service workers. |

| Exemption | Handwrite “Exempt” | Checkbox + certification | Simpler, with annual renewal reminder. |

| Standard Deduction Default | Assumed if skipped | Explicit note | Clarifies fallback for non-itemizers. |

Who Will Be Most Affected by These Form W-4 2026 Changes?

These revisions target everyday workers benefiting from OBBBA:

- Tipped Employees (e.g., servers, bartenders): Deduct qualified tips directly, potentially boosting take-home pay.

- Hourly/Shift Workers: Overtime exclusion means less withheld on extra hours.

- New Car Buyers: Interest on 2025+ loans deductible, ideal for recent purchasers.

- Seniors 65+: Extra $6,000 deduction phases in relief.

- Families: Higher child credit flows through to withholding.

If your situation is stable, the impact may be minimal—but life’s changes (job switch, marriage, new dependent) warrant a review.

What Should You Do? Step-by-Step Guide to Updating Your Withholding

Don’t wait for January—proactive steps now can fine-tune your 2026 finances. Here’s how:

1. Review the Draft and Assess Your Situation

- Download the draft from IRS.gov (search “draft fw4–dft”).

- List your expected 2026 income, dependents, and deductions (tips, overtime, etc.). Use the IRS Tax Withholding Estimator (IRS.gov/W4app) for a preview—update it post-draft finalization.

2. Gather Documentation

- Pay stubs for tip/overtime tracking.

- Loan statements for new vehicle interest.

- Prior-year return for credit baselines.

3. Complete and Submit a New Form W-4

- New Hires: Fill out upon starting in 2026.

- Existing Employees: Submit anytime—effective next pay period. Aim for Q4 2025 if changes apply retroactively via estimator.

- Steps: Enter personal info (Step 1), multiple jobs (Step 2), credits (Step 3), adjustments (Step 4), sign (Step 5).

- For exemptions: Check the box only if criteria met; refile annually.

4. Monitor and Adjust Mid-Year

- Recheck after life events (e.g., birth, divorce).

- Employers: Update payroll systems for new fields; provide employee education.

5. Seek Professional Help if Needed

- Complex scenarios (self-employment, investments)? Consult a tax pro. Tools like TurboTax or H&R Block simulators can help simulate impacts.

Pro Tip: Over-withholding? You’ll get a refund, but it means lending to Uncle Sam. Under-withholding? Safe harbor rules require 90% of 2026 tax or 100% of 2025 tax paid via withholding/estimates to avoid penalties.

W-4 Form 2026 Draft

W4 Form 2026 Printable

Download & Print: W4 Form 2026

Final Thoughts: Prepare Now for a Smoother 2026 Tax Year

The draft 2026 Form W-4 is a forward-looking tool, blending OBBBA’s tax breaks with IRS efficiency. By embracing these changes—expanded deductions, clearer credits, and user-friendly exemptions—you can minimize tax surprises and maximize your paycheck. Remember, the final form may tweak placeholders, so bookmark IRS.gov for updates.

Ready to act? Run the withholding estimator today and draft your updates. For personalized advice, reach out to a certified tax advisor. Your future self (and wallet) will thank you.

This article is for informational purposes only and not tax advice. Consult a professional for your specific situation.