Table of Contents

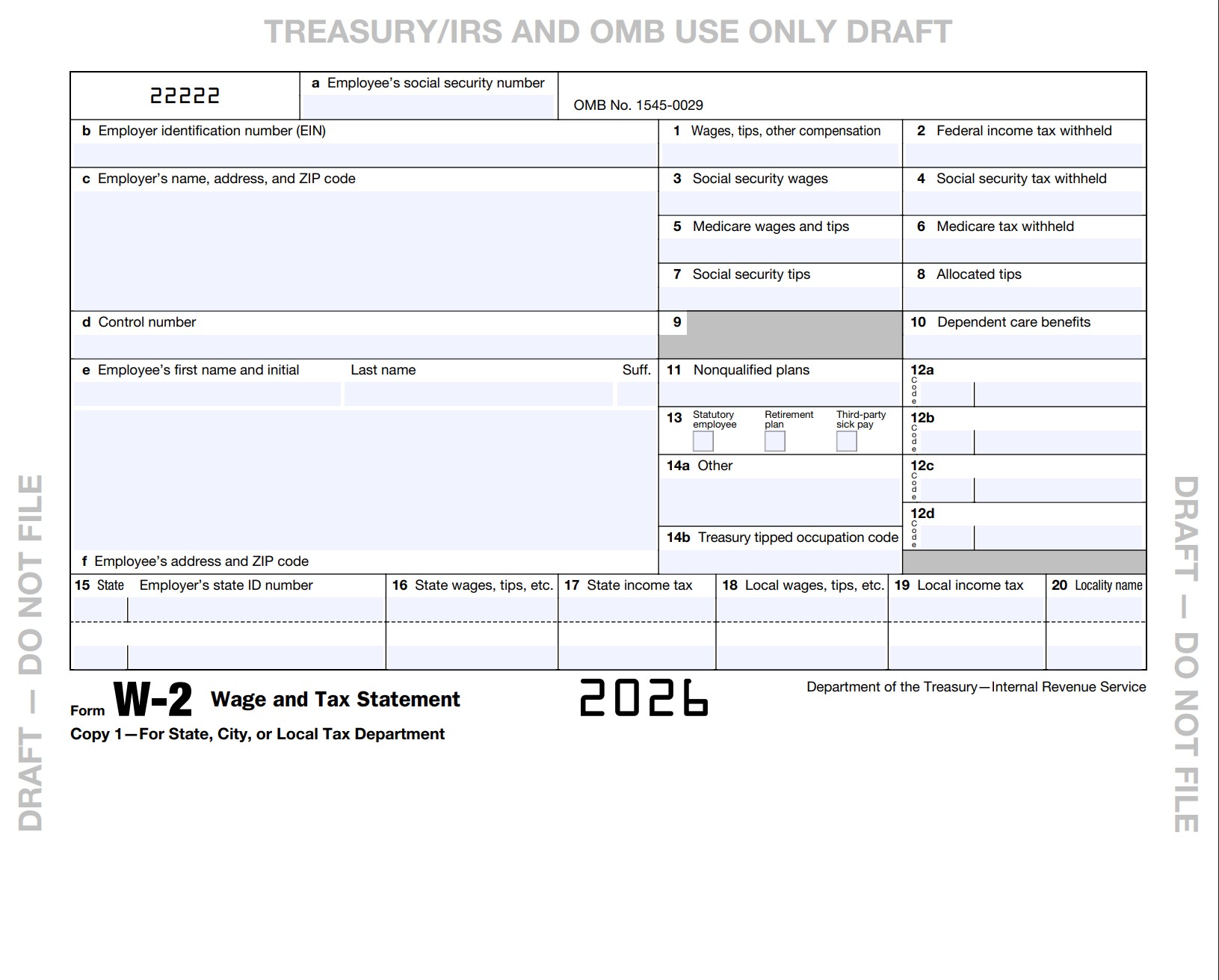

W-2 Form 2026 Draft – As we approach the 2026 tax filing season, the Internal Revenue Service (IRS) has unveiled a draft of the 2026 Form W-2, Wage and Tax Statement, incorporating key provisions from the One Big Beautiful Bill Act (OBBBA). Signed into law on July 4, 2025, the OBBBA extends many Tax Cuts and Jobs Act (TCJA) benefits permanently while introducing worker-focused deductions, such as no federal income tax on qualified tips and overtime pay. These changes mean your 2026 W-2 could look noticeably different, with new codes and fields designed to simplify claiming these deductions.

If you’re an employer preparing payroll systems or an employee eager to maximize your refund, understanding the draft 2026 W-2 updates is essential. This guide dives into the Form W-2 changes for 2026, their implications, and practical steps to prepare. With the draft released on August 15, 2025 (and a revised version on September 15), the final form is expected in late 2025—plenty of time to adapt.

What Is Form W-2 and Why the 2026 Updates Matter

Form W-2 reports your annual wages, tips, and other compensation to both you and the IRS, including taxes withheld. Employers must furnish it by January 31, 2027, for the 2026 tax year. The 2026 draft isn’t a complete overhaul but adds targeted fields to support OBBBA’s tax relief, effective for income earned in 2026 (and retroactively for 2025 claims via other means).

These updates align withholding and reporting with new above-the-line deductions, reducing taxable income for tipped workers (up to $25,000), overtime earners (up to $12,500 single/$25,000 joint), and others. Without accurate reporting, you risk missing deductions or facing audits. For employers, non-compliance could trigger penalties up to $310 per form. The draft emphasizes: “Early release drafts are for information only—do not file.”

Key Changes in the Draft 2026 Form W-2

The IRS focused on Boxes 12 and 14 for OBBBA integration, adding codes to track deductible income without altering core wage boxes. Here’s what’s new:

1. New Codes in Box 12: Reporting Deductible Compensation

- Box 12, the go-to for deferred compensation and benefits, gains three new codes to flag OBBBA-eligible items:

- TA: Employer contributions to your Trump account – Tracks contributions to the new retirement savings vehicle under OBBBA, exempt from current-year taxes.

- TP: Total amount of qualified tips (updated from “cash tips” in the September revision) – Reports tips eligible for the full deduction (phases out above $150,000 single/$300,000 joint AGI). Use this on new Schedule 1-A (Form 1040) for your deduction.

- TT: Total amount of qualified overtime compensation – Captures FLSA overtime premiums deductible through 2028 (up to $12,500 single/$25,000 joint, phasing out similarly).

- If more than four Box 12 items apply, employers issue a supplemental W-2. These codes ensure seamless integration with tax software.

2. Expanded Box 14: Tipped Occupation Identification

- Box 14a remains “Other” for miscellaneous items like union dues.

- New Box 14b: Treasury Tipped Occupation Code – A unique code (to be published by October 2, 2025) identifying “traditionally tipped” roles (e.g., servers, bartenders, hairdressers). This verifies eligibility for the tips deduction on Schedule 1-A. Only occupations customary for tips as of December 31, 2024, qualify.

3. Tie-Ins to Schedule 1-A and Broader OBBBA Provisions

- The draft references the forthcoming Schedule 1-A for claiming tips, overtime, new passenger vehicle loan interest, and senior deductions ($6,000 extra for age 65+).

- No changes to Boxes 1-11 (wages, withholdings) or social security/Medicare reporting, but inflation adjustments apply (e.g., standard deduction: $16,100 single/$32,200 joint).

- For 2025 income, no W-2 updates—use “reasonable methods” for approximations, with penalty relief via Notice 2025-62 (November 5, 2025).

| Feature | Current (2025) W-2 | Draft 2026 W-2 | Why It Matters |

|---|---|---|---|

| Box 12 Codes | Standard (e.g., D for 401(k), DD for health coverage) | Adds TA (Trump account), TP (tips), TT (overtime) | Enables direct deduction claims; reduces manual calculations. |

| Box 14 Layout | Single “Other” box | 14a (Other), 14b (Tipped Code) | Confirms tip eligibility; prevents erroneous claims. |

| Form Length/Design | 6-copy format | Unchanged, but instructions expanded | Easier payroll integration; no redesign costs. |

| Schedule Reference | N/A for OBBBA | Links to Schedule 1-A | Streamlines 1040 filing for new deductions. |

| 2025 Transition | No OBBBA fields | Penalty relief for approximations | Avoids mid-year disruptions. |

Who Will See the Biggest Impact from 2026 W-2 Changes?

These tweaks primarily benefit OBBBA’s target groups:

- Service Industry Workers: Servers, bartenders, and delivery drivers with tips—expect higher take-home via deductions.

- Hourly/Shift Employees: Those earning overtime (1.5x rate for hours over 40) can exclude premiums from taxable income.

- Retirement Savers: New TA code supports “Trump accounts,” a OBBBA innovation for tax-free growth.

- Employers in Tipped Sectors: Hospitality and retail must update systems to track and code occupations accurately.

High earners in phaseout zones or multi-job holders may need extra vigilance. Families and seniors benefit indirectly through aligned credits (e.g., child tax credit to $2,200, inflation-indexed from 2026).

What Employers and Employees Should Do Next

Preparation starts now—2026 filings are due February 2, 2027 (or January 31 if electronic). Here’s your roadmap:

For Employers:

- Audit Payroll Systems: Ensure software (e.g., ADP, Paychex) tracks qualified tips/overtime separately. Test for new codes by Q1 2026.

- Review OBBBA Guidance: Download the draft from IRS.gov (search “draft fw2–dft”). Await final occupation codes and “reasonable methods” for 2025 approximations.

- Train Staff and Communicate: Educate HR/payroll on Box 14b; notify tipped employees of changes via pay stubs.

- Plan for W-2c: The corrected form mirrors updates—use for errors post-filing.

- File Timely: E-file with SSA by January 31, 2027; furnish employee copies by February 1. Penalties start at $60/form.

For Employees:

- Verify Your W-2: Check Box 12/14 for accuracy when received. Use IRS Free File or software to import data.

- Claim Deductions: On your 2026 return (filed 2027), transfer TP/TT amounts to Schedule 1-A. For 2025, self-report approximations.

- Track Personally: Log tips/overtime via apps; retain records for audits.

- Seek Help: Use IRS Tax Withholding Estimator or consult a CPA for complex scenarios (e.g., gig work).

Pro Tip: OBBBA’s transition relief means no 2025 penalties for incomplete reporting, but full compliance kicks in 2026—update now to avoid rushes.

W-2 Form 2026 Draft

Wrapping Up: Get Ready for a Tax-Savvy 2026

The draft 2026 Form W-2 bridges OBBBA’s promises with practical reporting, empowering workers with deductions while keeping forms familiar. From new Box 12 codes to the tipped occupation field, these changes promise fairer taxes for millions—but only if you’re prepared. Monitor IRS.gov for finals and guidance; early action means bigger refunds and fewer headaches.

Bookmark this for tax season, and consider professional advice tailored to your situation. Here’s to a prosperous, deduction-filled 2026!

This article provides general information only and is not tax advice. Consult a qualified tax professional for personalized guidance.