IRS Form 706 (Schedule D) – Insurance on the Decedent’s Life – When a loved one passes away, navigating estate taxes can feel overwhelming. One critical component is accurately reporting life insurance policies on IRS Form 706 Schedule D, which ensures compliance with federal estate tax rules. Whether you’re an executor handling a complex estate or simply educating yourself on estate planning, this guide breaks down everything you need to know about Schedule D—its purpose, filing requirements, and step-by-step instructions. Updated for decedents dying in 2025, this article draws from official IRS resources to help you file confidently and avoid costly penalties.

What Is IRS Form 706 and Why Does Schedule D Matter?

IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is filed by the executor of a decedent’s estate to calculate federal estate taxes under Internal Revenue Code Chapter 11. It also computes generation-skipping transfer (GST) taxes on direct skips. For decedents dying in 2025, Form 706 is required if the gross estate, plus adjusted taxable gifts and the specific gift tax exemption, exceeds the basic exclusion amount of $13,990,000.

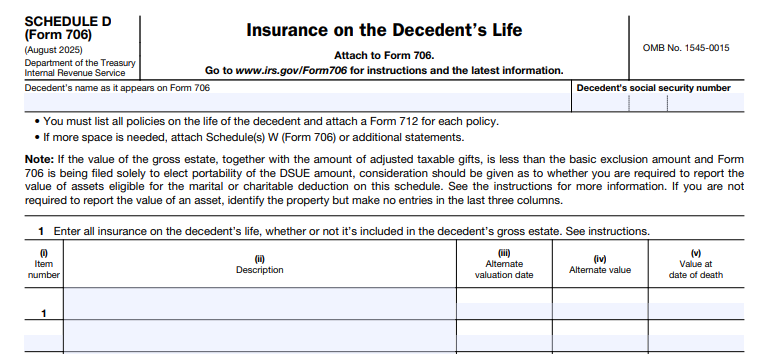

Within Form 706, Schedule D (Form 706) specifically addresses “Insurance on the Decedent’s Life.” Its primary purpose is to report every life insurance policy insuring the decedent’s life, regardless of whether the proceeds are includible in the gross estate. This includes traditional policies, death benefits from fraternal societies, or even no-fault automobile insurance if unconditionally payable upon death.

Why report non-includible policies? The IRS requires full disclosure to verify inclusion under Section 2042 of the IRC. Failing to attach Schedule D when required can delay processing or trigger penalties. In 2025, the form and its schedules have been redesigned for efficiency, with schedules now as separate PDFs and parts renumbered using Roman numerals (I-VI).

When Must You File Form 706 Schedule D?

You must complete and attach Schedule D to Form 706 if:

- Form 706 is required (e.g., gross estate over $13,990,000 for 2025 decedents).

- There was any insurance on the decedent’s life, even if proceeds go directly to beneficiaries outside the estate.

- You answer “Yes” to Part IV, lines 9a or 9b on Form 706, indicating life insurance exists (includible or not).

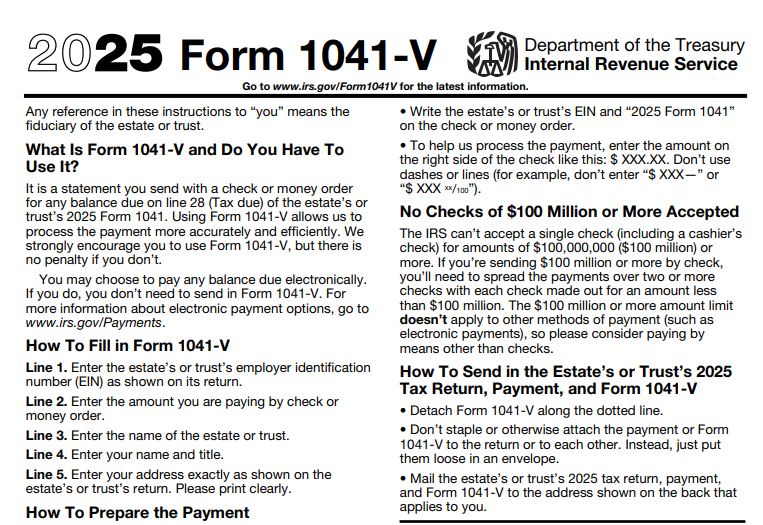

Even if filing solely for portability of the deceased spousal unused exclusion (DSUE) amount, consider reporting insurance assets eligible for marital or charitable deductions—though values may not need entry if not required. File by the due date: nine months after death, with possible extensions via Form 4768. Note: As of 2025, e-filing is not supported; mail to the IRS in Kansas City, MO.

Key Rules: What Life Insurance Proceeds Are Includible in the Gross Estate?

Under IRC Section 2042, life insurance proceeds are includible if:

- Receivable by the Estate: Full proceeds if payable to the executor or usable for estate benefits (e.g., paying taxes, debts, or charges), even if premiums were paid by others.

- Incidents of Ownership: The decedent possessed rights at death, including:

- Right to economic benefits.

- Power to change the beneficiary.

- Ability to surrender or cancel the policy.

- Power to assign or revoke assignment.

- Right to pledge as loan collateral or borrow against cash value.

- Reversionary interest exceeding 5% of the policy’s value immediately before death (e.g., if the decedent regains rights upon a contingency like the beneficiary’s predecease).

Policies owned by the decedent on their own life are typically includible, but exclusions apply if no incidents of ownership exist (e.g., employer-owned group life insurance). Non-includible proceeds under Section 2042 may still count via other sections (e.g., 2035-2038 for transfers); check Schedule G.

| Inclusion Criteria | Examples | Includible Amount |

|---|---|---|

| Receivable by/for Estate | Policy pays estate debts | 100% of proceeds |

| Incidents of Ownership | Decedent could change beneficiary | Full face value |

| Reversionary Interest >5% | Contingent regain of control | Full value if threshold met |

| Non-Includible (No Ownership) | Irrevocable trust-owned policy | $0 (explain in attachment) |

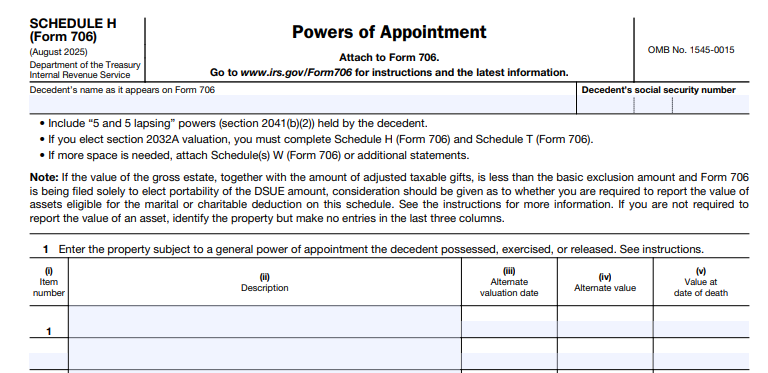

Step-by-Step Guide: How to Complete IRS Form 706 Schedule D

Schedule D is straightforward but requires precision. List policies consecutively, starting with number 1. Use the redesigned 2025 form from IRS.gov.

Required Information and Columns

- Column (i): Item number (1, 2, etc.).

- Column (ii) Description: Insurance company name and policy number. Reference attached Form 712 as an exhibit.

- Column (iii) Beneficiary: Name and relationship to decedent.

- Column (iv) Alternate Valuation: Value as of six months after death (if elected on Form 706).

- Column (v) Value at Date of Death: Primary valuation column—enter net proceeds if paid in one sum (Form 712, line 24) or interpolated terminal reserve if not (line 25).

- Total: Sum column (v) and carry to Form 706, Part V, line 9.

For non-includible policies, enter $0 in value columns but fully describe and attach an explanation (e.g., “No incidents of ownership per policy terms”).

Valuation Methods for Life Insurance Policies

Valuation ensures fair market value at death:

| Policy Type | Valuation Method | Source |

|---|---|---|

| One-Sum Proceeds | Net death benefit minus loans/fees | Form 712, line 24 |

| Installment/Non-One-Sum | Interpolated terminal reserve (actuarial value) | Form 712, line 25 |

| Single Premium/Paid-Up | Higher of surrender value or replacement cost | Rev. Rul. 78-137; Form 712, line 59 |

| Alternate Election | Six-month post-death value (if elected) | Column (iv) |

If Form 712 is unavailable, attach alternatives like policy riders, assignments, or proceeds checks.

IRS Form 706 (Schedule D) Download and Printable

Download and Print: IRS Form 706 (Schedule D)

Essential Documents: Don’t Forget Form 712

The cornerstone for Schedule D is Form 712, Life Insurance Statement, requested from each insurer. It provides policy details, proceeds, and values—attach one per policy. Other attachments:

- Explanations for exclusions.

- Death certificate and will copy (for overall Form 706).

- Prior gift tax returns (Form 709) if relevant.

Pro tip: Request Form 712 when claiming proceeds to avoid delays.

2025 Updates to Form 706 and Schedule D

The 2025 revisions streamline filing:

- Redesign: Main form now Parts I-VI (Roman numerals); schedules as separate downloads.

- Basic Exclusion: $13,990,000 (inflation-adjusted).

- Closing Letter Fee: Reduced to $56 (from $67) for requests after May 21, 2025—request via Pay.gov after 9 months.

- No major Schedule D changes, but enhanced instructions for portability elections.

Common Mistakes to Avoid When Filing Schedule D

Executors often trip up here—steer clear:

- Omitting Policies: Report all insurance, even excluded ones.

- Missing Form 712: Always attach or explain alternatives.

- Valuation Errors: Use Form 712 lines correctly; don’t guess.

- No Explanations: Attach details for $0 values to avoid audits.

- Late Filing: Penalties under Section 6651 apply without extension.

Final Thoughts: Seek Professional Help for Peace of Mind

Completing IRS Form 706 Schedule D accurately safeguards the estate from penalties and ensures smooth processing. With the 2025 basic exclusion at $13,990,000, fewer estates need to file, but life insurance reporting remains crucial for those that do. Always consult a tax professional or estate attorney for personalized advice, especially with redesigns and portability elections.

For the latest forms and instructions, visit IRS.gov/Form706. Proper planning today can honor your loved one’s legacy tomorrow.

This article is for informational purposes only and not tax advice. Verify with current IRS publications.

Related Searches: IRS Form 706 filing deadline 2025, life insurance estate tax inclusion, Form 712 life insurance statement.