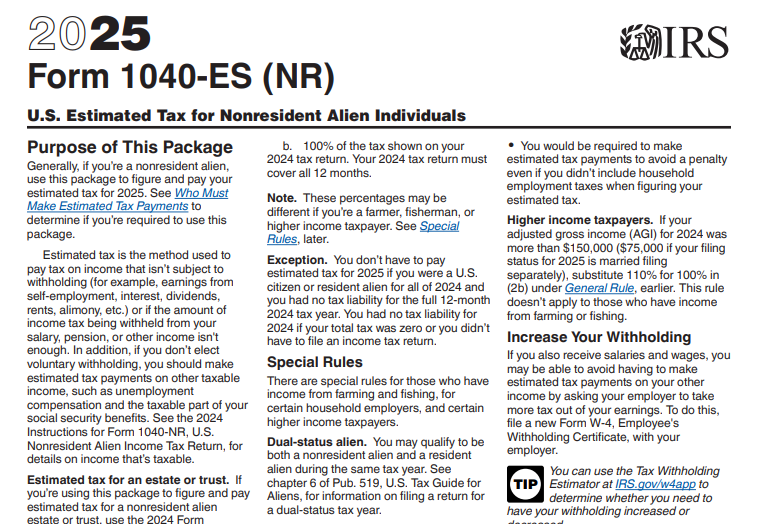

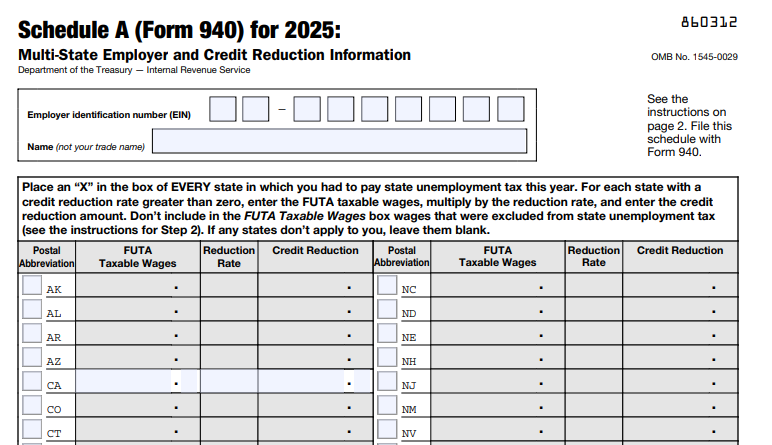

IRS Form 940 (Schedule A) – Multi-State Employer and Credit Reduction Information – As a business owner or HR professional navigating payroll taxes, understanding IRS Form 940 Schedule A is crucial for compliance, especially if your operations span multiple states or involve wages in credit reduction states. This schedule, titled “Multi-State Employer and Credit Reduction Information,” helps calculate adjustments to your Federal Unemployment Tax Act (FUTA) liability. Filed alongside Form 940 (Employer’s Annual Federal Unemployment Tax Return), it ensures accurate reporting of state-specific unemployment taxes and any FUTA credit reductions due to outstanding federal loans in certain states.

In 2025, with ongoing economic pressures, credit reduction states like California and Connecticut could increase your effective FUTA tax rate from the standard 0.6% to as high as 1.2% or more. This guide breaks down everything you need to know about Form 940 Schedule A 2025, including who must file, step-by-step instructions, and tips to minimize penalties. Stay compliant and optimize your tax strategy—read on.

What Is IRS Form 940 Schedule A?

IRS Form 940 Schedule A is a required attachment to Form 940 for employers who pay state unemployment taxes in more than one state or operate in states subject to FUTA credit reductions. It allocates taxable wages across states and computes any reductions in the standard 5.4% FUTA credit, which normally lowers the gross 6.0% FUTA rate to 0.6% on the first $7,000 of each employee’s wages.

The form was revised on November 24, 2025, and is available for download from the IRS website. Its primary purposes are:

- Multi-state allocation: Distributes aggregate FUTA wages reported on Form 940 to specific states.

- Credit reduction calculation: Applies penalties for states that haven’t repaid federal loans for unemployment benefits, increasing your federal tax burden.

Failing to file Schedule A when required can trigger audits, penalties up to 5% of unpaid tax per month, and interest charges. For tax year 2025, the IRS emphasizes electronic filing via approved e-file providers to streamline processing.

Who Needs to File Form 940 Schedule A in 2025?

Not every employer files Schedule A—it’s targeted at specific scenarios. You must complete and attach it to your Form 940 if:

- You are a multi-state employer: If you paid wages subject to unemployment insurance (UI) tax in more than one state (including D.C., Puerto Rico, or U.S. Virgin Islands) during 2025, check the box on Form 940, line 1b, and fill out Schedule A.

- You paid wages in a credit reduction state: Even single-state employers must use Schedule A if any wages were subject to UI tax in a state with an outstanding federal loan balance. For 2025, these include California (1.2% reduction), Connecticut (1.2%), New York (1.2%), and the U.S. Virgin Islands (4.5%). Check the box on Form 940, line 2.

Household employers typically file Schedule H (Form 1040) instead, but multi-state household operations may still need Schedule A. Agricultural and nonprofit employers follow similar rules but consult IRS Publication 15 for exemptions.

| Scenario | Must File Schedule A? | Form 940 Line to Check |

|---|---|---|

| Single-state employer, no credit reduction | No | N/A |

| Multi-state employer (2+ states) | Yes | Line 1b |

| Wages in credit reduction state (e.g., CA, NY) | Yes | Line 2 |

| Household employer with multi-state wages | Possibly (use Schedule H primarily) | Line 1b if applicable |

Understanding FUTA Credit Reductions in 2025

FUTA credit reductions occur when a state borrows from the federal Title XII fund to pay unemployment benefits and fails to repay by November 10 of the tax year. This reduces the 5.4% credit, raising your effective FUTA rate. The U.S. Department of Labor (DOL) determines reductions annually; for 2025, the base reduction starts at 0.3% for the first year, increasing by 0.3% per consecutive year.

Key 2025 credit reduction states and rates:

| State/Territory | 2025 Credit Reduction Rate | Effective FUTA Rate (on $7,000 wages) | Additional Notes |

|---|---|---|---|

| California | 1.2% | 1.8% ($126 per employee) | Potential BCR add-on up to 3.7%; ongoing loan ~$23.7B |

| Connecticut | 1.2% | 1.8% ($126 per employee) | Resumed borrowing; 0.8% add-on possible |

| New York | 1.2% | 1.8% ($126 per employee) | Repaid $8B in June 2025, but base reduction applies; 1.1% add-on |

| U.S. Virgin Islands | 4.5% | 5.1% ($357 per employee) | Highest rate; no BCR waiver likely |

These reductions apply only to wages subject to state UI tax. Excluded wages (e.g., certain agricultural) are exempt. DOL’s final determinations were updated November 17, 2025—monitor IRS.gov for changes.

IRS Form 940 (Schedule A) Downloadn and Printable

Download and Print: IRS Form 940 (Schedule A)

Step-by-Step Instructions: How to Complete Schedule A (Form 940) for 2025

The 2025 Schedule A (OMB No. 1545-0029) has three parts. Enter your EIN and business name at the top. Use the IRS draft PDF for practice.

Part 1: Multi-State Employer Employer Tax Information

- Step 1: Place an “X” in the box for every state where you paid state UI tax in 2025. This includes all 50 states, D.C., Puerto Rico, and U.S. Virgin Islands. Leave non-applicable boxes blank.

- Purpose: Allocates total payments from Form 940 across states. No calculations here—just identification.

Part 2: Credit Reduction Information (If Applicable)

Only complete for credit reduction states where you paid UI-taxable wages.

- FUTA Taxable Wages: Enter wages up to $7,000 per employee in that state, minus exemptions (e.g., payments over $7,000 or FUTA-exempt categories like certain family members).

- Credit Reduction Rate: Use the DOL rate (e.g., 0.012 for 1.2% in CA).

- Credit Reduction Amount: Multiply taxable wages by the rate (e.g., $21,000 wages × 0.012 = $252).

Example: You paid $20,000 to each of three employees in California (credit reduction state). Total payments: $60,000. Exempt over $7,000: 3 × $13,000 = $39,000. Taxable FUTA wages: $21,000. Credit reduction: $21,000 × 1.2% = $252. Enter on the CA line.

Part 3: Total Credit Reduction

- Add all Part 2 credit reduction amounts.

- Transfer the total to Form 940, line 11. This increases your FUTA liability.

Attach Schedule A to Form 940. E-file for faster processing and error checks.

Common Mistakes to Avoid When Filing Schedule A

- Forgetting multi-state boxes: Missing a state triggers underpayment penalties.

- Incorrect wage allocation: Double-counting wages across states can inflate taxes—use payroll software for accuracy.

- Ignoring credit reductions: Even small wages in CA or NY add up; review DOL updates quarterly.

- Late state UI payments: Delays reduce your 5.4% credit independently of Schedule A.

- Manual calculations: Opt for IRS-approved e-file tools to auto-populate rates.

Pro Tip: If wages were split between states for the same employee, allocate based on services performed (e.g., $4,000 in State B, $3,000 in State C = $3,000 taxable in C after $7,000 base).

Filing Deadlines and Tips for 2025 Form 940 with Schedule A

- Due Date: January 31, 2026, for 2025 taxes. Extend to February 10, 2026, if all FUTA deposits were timely.

- Deposits: Quarterly via EFTPS if liability exceeds $500. Include credit reductions in Q4 deposit.

- E-Filing: Mandatory for 250+ forms; recommended for all. Use providers like TaxBandits or OnPay for integration.

- Amendments: File Form 940-X if errors occur; electronic amendments available for 2023+ years.

To minimize costs: Pay state UI taxes by January 31, 2026, for full credit. Track multi-state employees via W-2 localization.

Final Thoughts: Stay Ahead of FUTA Compliance in 2025

Mastering IRS Form 940 Schedule A ensures your business avoids costly surprises from multi-state operations or credit reductions. With 2025 rates hitting 1.8% in key states like California, proactive planning—via DOL monitoring and e-filing—can save thousands. Download the latest forms from IRS.gov and consult a tax advisor for personalized advice.

For more on FUTA taxes, visit the IRS Form 940 page or DOL’s FUTA Credit Reductions site. Questions? Comment below or reach out to a payroll expert today.