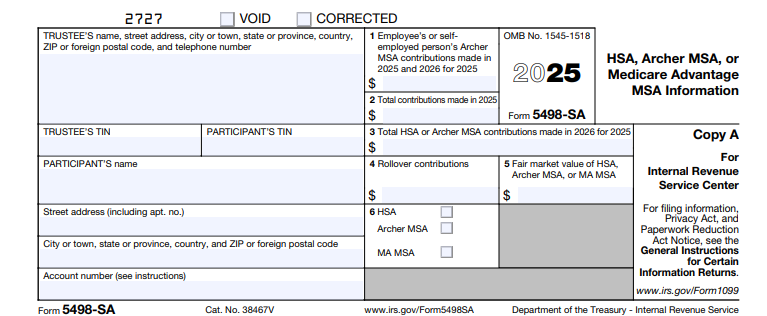

IRS Form 5498-SA – HSA, Archer MSA, or Medicare Advantage MSA Information – If you’re managing a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage Medical Savings Account (MA MSA), understanding IRS Form 5498-SA is crucial for accurate tax reporting and maximizing your tax-advantaged savings. This informational form tracks contributions to these accounts, helping the IRS ensure compliance while providing you with key details for your tax return. As of the 2025 tax year, Form 5498-SA remains a vital tool for account holders and trustees alike, with minimal updates focused on clarity and electronic filing enhancements.

In this comprehensive guide, we’ll break down what Form 5498-SA is, who needs it, how to read and file it, and the latest 2025 deadlines. Whether you’re an individual saver or a financial professional, this article will help you navigate the form with confidence. Let’s dive in.

What Is IRS Form 5498-SA?

IRS Form 5498-SA, titled “HSA, Archer MSA, or Medicare Advantage MSA Information,” is an annual information return used to report contributions to tax-favored medical savings accounts. Filed by the trustee or custodian of the account (such as a bank or investment firm), it provides the IRS and account holder with a record of all contributions made during the tax year, including those eligible for deductions.

Unlike Form 1099-SA, which reports distributions (withdrawals) from these accounts, Form 5498-SA focuses solely on inflows—helping you verify deductible amounts when filing your taxes. It’s not attached to your personal income tax return (Form 1040), but you’ll use its data to complete Form 8889 for HSAs or Form 8853 for MSAs.

Why Does Form 5498-SA Matter for Taxpayers?

- Tax Deductions: Contributions to HSAs and Archer MSAs are often tax-deductible, reducing your adjusted gross income (AGI). Form 5498-SA confirms these amounts, preventing under- or over-claiming.

- Compliance and Audits: Accurate reporting helps avoid IRS penalties, such as the 6% excise tax on excess contributions.

- Planning Tool: It shows your account’s fair market value (FMV), aiding in retirement health planning.

For 2025, the form emphasizes electronic filing for efficiency, with a lowered e-file threshold of just 10 returns.

Who Files Form 5498-SA? (And Who Receives It?)

Filers (Trustees/Custodians): If you’re the financial institution or entity maintaining an HSA, Archer MSA, or MA MSA, you must file Form 5498-SA for every account holder, even if no contributions were made—as long as the account was active in 2025. A separate form is required for each account type (e.g., one for HSA, another for Archer MSA).

Recipients (Account Holders): You’ll receive Copy B by June 1, 2026, for reference. Employer contributions may also appear on your W-2 (Box 12, Code W).

Special cases:

- Death of Account Holder: File for the decedent; spouses inherit HSAs/Archer MSAs, but MA MSAs follow Archer MSA distribution rules.

- Account Closure: If no contributions occur but the account closes with a distribution, filing may still be required.

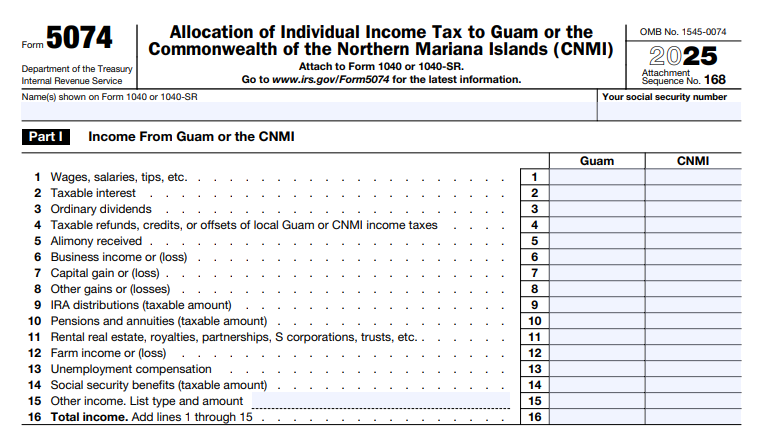

Breaking Down the Boxes: How to Read Form 5498-SA

Form 5498-SA is straightforward, with six main boxes detailing contributions and account info. Here’s a box-by-box guide based on the 2025 instructions. Use this to verify your records against the form you receive.

| Box | Description | What It Means for You |

|---|---|---|

| Account Number | Unique identifier for your account (optional but recommended). | Helps match to your statements; useful if you have multiple accounts. |

| Box 1: Employee or Self-Employed Archer MSA Contributions | Your personal contributions to an Archer MSA made in 2025 through April 15, 2026. | Eligible for deduction on Form 1040; excludes employer/third-party amounts. |

| Box 2: Total Contributions in 2025 | All contributions (yours, employer, others) to your HSA or Archer MSA in 2025. | For IRS use; includes qualified IRA transfers but not rollovers. Use for Form 8889/8853. |

| Box 3: Total Contributions in 2026 for 2025 | Contributions made January 1–April 15, 2026, designated for 2025. | Extends your deduction window; reported post-tax deadline for accuracy. |

| Box 4: Rollover Contributions | Trustee-to-trustee rollovers from another HSA/Archer MSA or one-time IRA-to-HSA transfers (under IRC §408(d)(9)). | Not deductible as new contributions; tax-free if qualified. Excludes most transfers. |

| Box 5: Fair Market Value | Account value as of December 31, 2025. | Optional statement by February 2, 2026; tracks growth for planning. Report if no contributions. |

| Box 6: Account Type | Checkbox for HSA, Archer MSA, or MA MSA. | Confirms the plan type; ensures correct tax treatment. |

Pro Tip: Boxes 2 and 3 are for IRS matching only—don’t use them directly for deductions. Cross-reference with your records or W-2, as the form arrives after the April 15, 2026, filing deadline.

IRS Form 5498-SA Download and Printable

Download and print: IRS Form 5498-SA

2025 Deadlines and Filing Requirements

For the 2025 tax year:

- File with IRS: By June 1, 2026 (or next business day if it falls on a weekend/holiday).

- Furnish to Participant: Copy B by June 1, 2026. FMV statement (Box 5) optional by February 2, 2026.

- Electronic Filing: Required if filing 10+ returns; use IRS-approved software like TaxBandits for bulk submissions.

- Extension: Request via Form 8809 for 30 days.

If no contributions (including rollovers) and FMV was already reported, skip the participant copy—but still file with the IRS.

Recent Changes for 2025

The 2025 Form 5498-SA saw minimal updates: tax year changes throughout, editorial tweaks to Copy A (e.g., added URL to General Instructions), and reinforcement of the e-file threshold drop to 10 returns (from T.D. 9972, effective 2024). No major legislative shifts, per IRS updates as of January 2025. Always check IRS.gov for post-publication developments.

Common Mistakes to Avoid with Form 5498-SA

Steer clear of these pitfalls to ensure smooth compliance:

- Filing with Your Tax Return: This is an info return—don’t attach it to Form 1040.

- Missing Zero-Contribution Filings: Required if the account existed in 2025.

- Confusing Rollovers and Contributions: Box 4 rollovers aren’t deductible; trustee-to-trustee transfers (except IRA-to-HSA) aren’t reported.

- Late or Inaccurate Employer Reporting: Ensure W-2 alignment; excess contributions trigger excise taxes.

- Ignoring Death/Closure Rules: Special handling applies—consult IRS Pub. 969.

Penalties for late filing start at $50 per return, with no cap—request reasonable cause relief if needed.

How Form 5498-SA Ties Into Your Taxes

Use Box 2 (and your records for Box 3) to report HSA/Archer MSA contributions on:

- Form 8889 (HSAs): Attached to Form 1040 for deductions.

- Form 8853 (MSAs): For Archer/MA MSA details.

Distributions? That’s Form 1099-SA territory—pair it with 5498-SA for full visibility. Track everything via account statements, as the form arrives post-April 15.

Final Thoughts: Stay Ahead with Form 5498-SA in 2025

IRS Form 5498-SA simplifies tracking your medical savings contributions, ensuring you claim every tax break while staying IRS-compliant. For 2025, focus on timely electronic filing and accurate box reporting to avoid headaches. Trustees: Leverage tools like e-filing portals for efficiency. Account holders: Review your copy against personal records and consult a tax pro for complex scenarios.

For the latest, visit IRS.gov/Form5498SA or download the 2025 instructions. Ready to optimize your HSA strategy? Start by reviewing your 2025 contributions today—your future self (and wallet) will thank you.

This article is for informational purposes only and not tax advice. Consult a qualified professional for personalized guidance.