IRS Form 1098-E – Student Loan Interest Statement – As a recent college graduate or current student loan borrower, you’re likely juggling payments while planning your financial future. One often-overlooked perk? The student loan interest deduction, which can shave up to $2,500 off your taxable income for 2025. At the heart of this tax break is IRS Form 1098-E, the Student Loan Interest Statement. This simple document from your lender could mean hundreds of dollars back in your pocket come tax time.

In this comprehensive guide, we’ll break down everything you need to know about Form 1098-E—from what it is and who gets one to eligibility rules, deduction limits, and step-by-step claiming instructions. Whether you’re filing your first return or optimizing for 2025, this article equips you with trusted insights to maximize your savings. Let’s dive in.

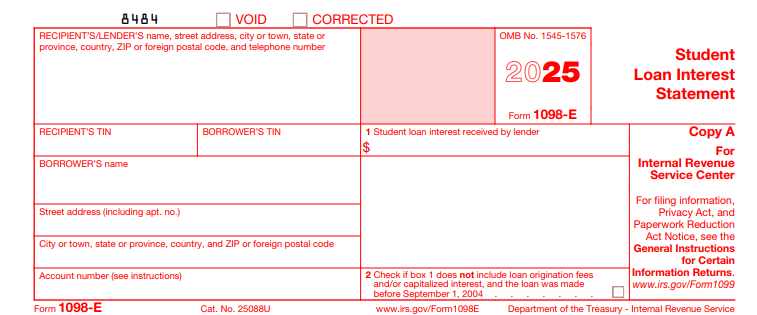

What Is IRS Form 1098-E?

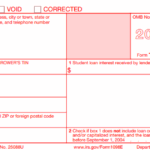

IRS Form 1098-E, officially titled the Student Loan Interest Statement, is a tax form used to report the interest you’ve paid on qualified student loans during the tax year. Issued by your loan servicer or lender, it helps the IRS track this interest and allows you to claim a valuable deduction on your federal tax return.

Key Details on Form 1098-E

- Box 1: Shows the total student loan interest you paid (typically $600 or more to trigger issuance).

- Box 2: Indicates if the interest is from a federally subsidized loan.

- Other Boxes: Include your name, address, taxpayer ID, and loan details for verification.

Lenders must issue this form if you paid at least $600 in interest in the course of their business. For 2025, a “qualified student loan” includes those subsidized, guaranteed, or financed under federal, state, local government, or postsecondary education programs—or loans certified by you solely for higher education expenses.

Unlike Form 1098-T (for tuition), the 1098-E focuses exclusively on interest, making it essential for borrowers with private or federal loans like Direct Loans or PLUS Loans.

Who Should Expect to Receive a Form 1098-E?

Not everyone gets a 1098-E—it’s reserved for those who’ve paid enough interest to qualify for reporting. Here’s who typically receives one:

- Borrowers: If you made payments totaling $600+ in student loan interest during 2025, your servicer (e.g., Nelnet, MOHELA, or Aidvantage) will send it by January 31, 2026. Multiple servicers? Expect a separate form from each.

- Lenders/Filers: Financial institutions, government units, educational organizations, or other entities receiving $600+ in interest must file with the IRS.

Didn’t receive yours? Download it from your servicer’s portal (e.g., studentaid.gov for federal loans) or contact them directly. Even if under $600, you can still deduct the interest—just track it manually via statements.

Pro Tip: Federal student aid borrowers can access 1098-E forms dating back to 2019 through their Federal Student Aid account.

The Student Loan Interest Deduction: A Quick Overview

The star of the 1098-E show is the student loan interest deduction, an above-the-line adjustment that reduces your adjusted gross income (AGI) without itemizing. For 2025, you can deduct up to $2,500—or the actual interest paid, whichever is less. This includes both required payments and voluntary prepayments.

Why claim it? At a 22% tax bracket, a $2,500 deduction could save you $550. It’s available for interest on loans used for you, your spouse, or a dependent’s higher education expenses.

Eligibility Requirements for the Student Loan Interest Deduction

To qualify for the deduction in 2025, meet these IRS criteria:

- Qualified Loan: Must be for higher education costs (tuition, fees, books, etc.) at an eligible institution. Covers federal and private loans.

- Payment Obligation: You (or your spouse, if filing jointly) must be legally responsible for the interest.

- Filing Status: Cannot be married filing separately.

- Dependency Status: Neither you nor your spouse can be claimed as a dependent on someone else’s return.

- Income Limits: Your modified AGI (MAGI) must fall below phase-out thresholds (detailed below).

No need to itemize—claim it on your Form 1040 regardless of standard vs. itemized deductions.

2025 Income Limits and Phase-Out Ranges

The deduction isn’t one-size-fits-all; it phases out based on your MAGI (AGI before the deduction, plus certain add-backs like foreign income exclusions). For tax year 2025:

| Filing Status | Full Deduction (MAGI ≤) | Partial Deduction (MAGI Between) | No Deduction (MAGI ≥) |

|---|---|---|---|

| Single/Head of Household/Qualifying Surviving Spouse | $85,000 | $85,001–$100,000 | $100,000 |

| Married Filing Jointly | $170,000 | $170,001–$200,000 | $200,000 |

These limits are inflation-adjusted annually; 2025 marks a $5,000 increase for singles from 2024’s $80,000–$95,000 range. Use the IRS worksheet in Publication 970 to calculate your exact amount.

IRS Form 1098-E Download and Printable

Download and Print: IRS Form 1098-E

How to Claim the Student Loan Interest Deduction Using Form 1098-E

Ready to file? Follow these steps for your 2025 return (due April 15, 2026):

- Gather Documents: Use Box 1 from your 1098-E(s). Add up interest from multiple loans.

- Calculate MAGI: Start with your AGI, then adjust per IRS rules.

- Apply the Worksheet: In Publication 970 or tax software, enter interest paid and MAGI to determine your deduction.

- Report on Your Return: Enter the amount on Schedule 1 (Form 1040), line 21. It flows to Form 1040, line 11.

- E-File or Mail: Most use software like TurboTax, which auto-imports 1098-E data if you grant consent.

Tax pros recommend double-checking for prepaid interest or loan origination fees, which may qualify if amortized over the loan term.

Deadlines and Filing Requirements for Form 1098-E

Timing matters:

- To Borrowers: Lenders must provide your 1098-E by January 31, 2026.

- To IRS: File by February 28, 2026 (paper) or March 31, 2026 (electronic). Use Form 1096 as transmittal.

- Electronic Option: Allowed for statements to borrowers; required for 10+ returns to IRS.

Late filing? Penalties apply, but borrowers aren’t penalized for lender delays.

Common Mistakes to Avoid with Form 1098-E and Your Deduction

Steer clear of these pitfalls to ensure smooth sailing:

- Forgetting Small Amounts: Deduct interest under $600 using bank statements—don’t rely on no form.

- Ignoring Phase-Outs: Overestimating eligibility leads to IRS adjustments and potential audits.

- Mixing Loans: Only qualified education loans count; personal loans don’t.

- Dependent Errors: If someone claims you, skip the deduction.

- Double-Dipping: Can’t claim if using employer-provided loan assistance as income exclusion.

Consult a tax advisor for complex situations, like refinanced loans or international students.

Frequently Asked Questions (FAQs) About IRS Form 1098-E

Do I need a 1098-E to claim the student loan interest deduction?

No, but it’s the easiest proof. Track payments manually if under $600.

Can parents claim the deduction if paying a child’s loan?

Only if the loan is in the parent’s name and they’re legally obligated.

Is the deduction available for private loans?

Yes, as long as they’re qualified for higher education.

What if my servicer doesn’t send a 1098-E?

Request it online or via phone; federal servicers must provide it upon request.

Has the student loan interest deduction changed for 2025?

Limits rose slightly due to inflation, but the $2,500 cap remains.

Final Thoughts: Maximize Your 2025 Tax Savings with Form 1098-E

IRS Form 1098-E isn’t just paperwork—it’s your ticket to reducing taxable income and easing the student debt burden. With up to $2,500 deductible and straightforward claiming, it’s a no-brainer for eligible borrowers. As you prep for 2025 taxes, log into your loan portal early, run the MAGI numbers, and consider free IRS tools like the Interactive Tax Assistant.

Stay proactive: Bookmark IRS.gov for updates, and if debt feels overwhelming, explore forgiveness options via studentaid.gov. Questions? A certified tax preparer can tailor advice to your situation. Here’s to smarter finances and a brighter post-grad life!

This article is for informational purposes only and not tax advice. Consult a professional for personalized guidance.