IRS Form 8275 – Disclosure Statement – IRS Form 8275, known as the Disclosure Statement, is a critical tool for taxpayers and tax professionals. It helps disclose positions on a tax return that may not be fully clear, potentially avoiding costly accuracy-related penalties.

Filing Form 8275 proactively alerts the IRS to uncertain or aggressive tax positions, demonstrating good faith and reducing penalty risks if the IRS challenges the position.

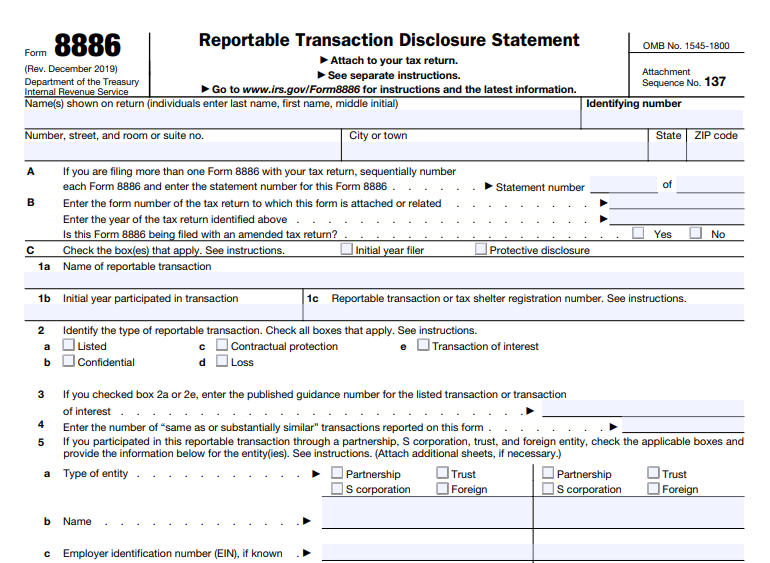

What Is IRS Form 8275?

The IRS defines Form 8275 (Revision October 2024) as a form taxpayers and preparers use to disclose items or positions not otherwise adequately disclosed on a tax return. This disclosure avoids portions of the accuracy-related penalty under IRC Section 6662, including:

- Substantial understatement of income tax

- Disregard of rules

It applies only to non-tax-shelter items with a reasonable basis (a higher standard than “not frivolous” but lower than “substantial authority”).

Form 8275 does not apply to positions contrary to Treasury regulations—use Form 8275-R (Regulation Disclosure Statement, Revision November 2024) instead.

When Should You File Form 8275?

File Form 8275 when your tax return includes a position that:

- Lacks full support on the return itself

- Could lead to an understatement of tax

- Has a reasonable basis but might invite IRS scrutiny

Common scenarios include:

- Uncertain deductions

- Credits

- Income exclusions

- Valuation issues

Disclosure protects against the 20% accuracy-related penalty on underpayments from substantial understatements or negligence. It also helps avoid preparer penalties under Section 6694.

Disclosure does not protect against penalties for:

- Tax shelter items

- Fraud

- Positions lacking reasonable basis

For recurring items (e.g., annual depreciation), file Form 8275 each year. Carryover or carryback items from disclosed years may not require repeat filing.

Annual IRS revenue procedures (e.g., for 2024-2025) list items with automatic adequate disclosure—no Form 8275 needed if met.

Key Differences: Form 8275 vs. Form 8275-R

| Aspect | Form 8275 | Form 8275-R |

|---|---|---|

| Purpose | Disclose positions not contrary to regulations | Disclose positions contrary to Treasury regulations |

| When to Use | Gray-area positions with reasonable basis | Challenging validity of a regulation |

| Penalty Protection | Substantial understatement, disregard of rules (non-tax shelter) | Similar, but specific to regulation conflicts |

| Latest Revision | October 2024 | November 2024 |

Use the wrong form, and disclosure may be invalid.

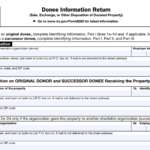

IRS Form 8275 Download and Printable

Download and Print: IRS Form 8275

How to File IRS Form 8275

- Attach to Your Return — File with your original tax return (or qualified amended return). Keep a copy.

- Complete the Form:

- Part I: List disclosed items (form/schedule, line, amount).

- Part II: Provide detailed facts and explanation of your position.

- Part III: For pass-through entities (e.g., partnerships).

- Use continuation sheets if needed.

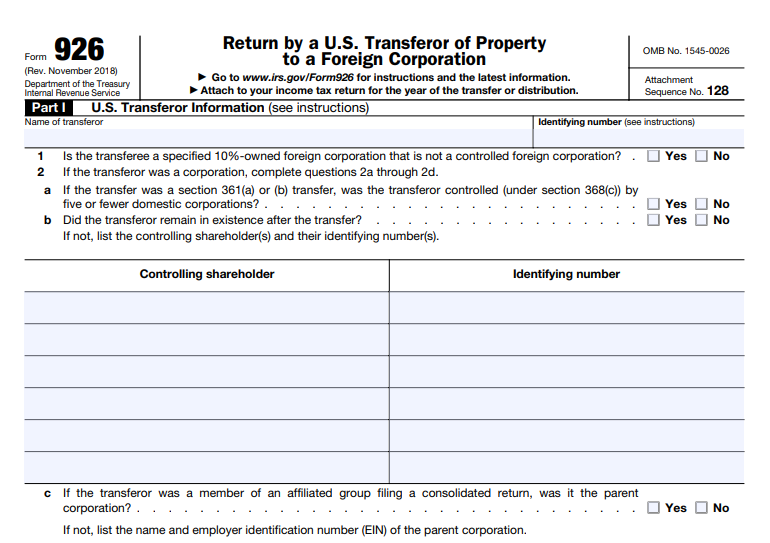

- Pass-Through Items — Disclose on the entity’s return if possible; otherwise, on your own.

- Foreign Entities — Match reference ID from forms like Form 5471.

For corporations filing Schedule UTP (Uncertain Tax Positions), separate Form 8275 may not be needed for certain disclosures.

Benefits of Filing Form 8275

- Reduces or eliminates accuracy-related penalties if the position has reasonable basis.

- Shows good faith, potentially aiding reasonable cause defenses.

- Does not guarantee IRS acceptance but flags the issue upfront.

Risks of Not Disclosing

Without adequate disclosure, the IRS may impose a 20% penalty on underpayments from disallowed positions. Preparers face penalties for unreasonable positions.

As of December 2025, use the latest versions from IRS.gov (Form 8275 Rev. October 2024; instructions at irs.gov/form8275). Always check for updates.

Consult a tax professional for your situation—proper disclosure can save thousands in penalties.

For official guidance, visit IRS.gov/Form8275 and download the form and instructions.