Table of Contents

IRS Form 944-X – Adjusted Employer’s Annual Federal Tax Return or Claim for Refund – As an employer filing Form 944 annually, discovering errors in your reported wages, taxes withheld, or credits can be stressful—but IRS Form 944-X provides a straightforward way to correct them. Whether you’re adjusting underreported taxes or claiming a refund for overreported amounts, understanding Form 944-X is essential for compliance and avoiding penalties. In this comprehensive 2025 guide, we’ll cover everything from eligibility to step-by-step filing instructions, drawing directly from the latest IRS resources. If you’re searching for “how to file IRS Form 944-X” or “Form 944-X deadline,” you’ve come to the right place.

What Is IRS Form 944-X?

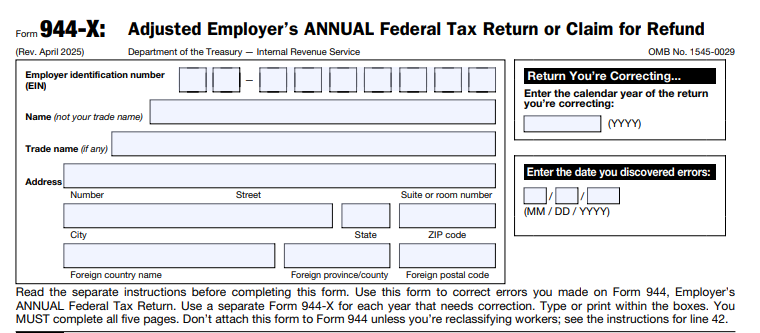

IRS Form 944-X, titled Adjusted Employer’s Annual Federal Tax Return or Claim for Refund, is the official tool for correcting errors on your previously filed Form 944 (Employer’s Annual Federal Tax Return). This form allows employers to amend reported amounts for wages, tips, federal income tax withheld, Social Security and Medicare taxes, and specific credits like the qualified small business payroll tax credit.

Key purposes include:

- Adjustments: Correct underreported (pay more) or overreported (credit to future returns) taxes without a refund.

- Claims: Seek refunds or abatements for overreported taxes only.

- Special Corrections: Handle reclassifications of workers or expired COVID-era credits (e.g., qualified sick and family leave wages from 2020-2021).

Use a separate Form 944-X for each tax year corrected—don’t mix years. The April 2025 revision reflects updates like expired limitations periods for many 2020-2021 credits, ensuring you only report eligible items.

Who Needs to File Form 944-X?

Form 944-X is designed for employers who file Form 944 annually (typically small employers with low quarterly tax liability). You must file if:

- You discover errors in wages, tips, withheld taxes, or credits on a prior Form 944.

- You’re reclassifying independent contractors as employees (or vice versa) under Section 3509 rates.

- You’re claiming overlooked credits, such as the qualified small business payroll tax credit (now up to $500,000 for tax years after December 31, 2022).

Who shouldn’t file? Use other forms like 941-X for quarterly filers or 943-X for agricultural employers. If you never filed Form 944 but should have, submit the original Form 944 first.

Related resources: Review IRS Publication 15 (Circular E, Employer’s Tax Guide) for general employment tax rules.

When Is the Deadline to File IRS Form 944-X?

Timing is critical to avoid interest, penalties, or missed refunds. Deadlines depend on the error type and discovery date:

- Underreported Taxes: File by January 31 of the year following discovery (e.g., for an error found in 2025, file by January 31, 2026). Pay any owed amount by then to stop interest accrual.

- Overreported Taxes (Adjustments): File promptly after discovery, but at least 90 days before the statute of limitations expires—generally 3 years from the original Form 944 filing date (or 2 years from payment, whichever is later). Forms filed before April 15 are treated as filed on April 15.

- Overreported Taxes (Claims for Refund): File anytime within the limitations period.

2025 Note: Many COVID-related credits (e.g., employee retention credit for 2020-2021) have expired limitations as of April 15, 2024-2025. Lines for these (e.g., 17a, 23, 24) are now reserved—leave blank unless your period is still open.

File late? It’s postmarked timely if mailed by the due date or sent via private delivery service (PDS) to the correct address.

IRS Form 944-X Download and Printable

Download and Print: IRS Form 944-X

How to File IRS Form 944-X: Step-by-Step Guide

Filing Form 944-X requires accuracy—use the April 2025 version (download from IRS.gov). Type or print; report negative amounts with a minus sign (no parentheses). Staple attachments and explain every correction in detail.

Step 1: Gather Your Documents

- Original or prior Form 944-X.

- Corrected Forms W-2/W-2c (file with SSA).

- Worksheets for credits (e.g., Worksheet 1 for 2020 sick leave credits).

- Employee consents for overreported employee-share refunds.

Step 2: Complete the Header

Enter your EIN, business name, address, the tax year corrected, and error discovery date.

Part 1: Select Your Process

- Line 1 (Adjustment): For under- or overreported taxes; credits apply to your next Form 944.

- Line 2 (Claim): For overreported taxes only—request refund or abatement.

Part 2: Certifications

- Line 3: Certify you’ll file (or have filed) accurate W-2/W-2c forms.

- Lines 4-5: For overreports, detail employee repayments, consents, or employer-only shares.

Part 3: Enter the Corrections

This is the core—report totals for all employees:

- Columns: 1 (Corrected total), 2 (Original/prior), 3 (Difference), 4 (Tax effect, e.g., multiply Line 8 difference by 0.124 for Social Security).

- Key Lines:

- 6: Wages/tips/other compensation.

- 7: Federal income tax withheld (administrative errors only).

- 8: Taxable Social Security wages.

- 12: Taxable Medicare wages/tips (multiply by 0.029).

- 15: Qualified small business payroll tax credit (attach Form 8974).

- 16/25: Sick/family leave credits (use worksheets; negate for credits).

- 27: Net tax (owed or credit).

- 41-43: Explain mixed adjustments, reclassifications, and each error (line number, discovery date, amount, cause).

For credits, refigure using provided worksheets and enter negatives in Column 4.

Part 4-5: Finalize and Sign

- Line 43: Attach extra sheets if needed.

- Sign as the authorized officer; paid preparers add PTIN.

Filing and Payment

- Mail Paper Forms: Use state-specific addresses (e.g., Cincinnati, OH 45999-0044 for CT, DE, DC, etc.; Ogden, UT 84201-0044 for most Western states). Exempt orgs/governments go to Ogden.

- Electronic Filing: Not directly supported for 944-X; use EFTPS for payments.

- Payment: For owed taxes, pay via EFTPS, card, or check (payable to “United States Treasury”). Include credits on future Form 944.

If under $1 owed, no payment needed.

Common Mistakes to Avoid When Filing Form 944-X

Steer clear of these pitfalls to ensure smooth processing:

- Vague explanations on Line 43 (e.g., “payroll error”—specify amounts and causes).

- Entering amounts on reserved lines (e.g., expired COVID credits).

- Mixing under- and overreports without netting/explaining on Line 41.

- Forgetting W-2 certifications or employee consents for refunds.

- Incorrect signs in Column 4 (credits are negative).

- Filing for the wrong form type (e.g., use 941-X for quarterly returns).

Amending late? Attach Form 945-A to avoid deposit penalties.

Frequently Asked Questions (FAQs) About IRS Form 944-X

Can I e-file Form 944-X?

No, it’s paper-only; mail to the IRS address based on your location.

What if I overreported employee taxes—do I need to repay them?

Yes, for claims (Line 2), reimburse employees or get written consents before filing.

Is there a penalty for late Form 944-X?

Yes, for underreported taxes—interest and failure-to-pay penalties apply if not paid timely.

How do I correct Form 944-X errors?

File another 944-X for the same year; explain the second correction on Line 43.

For more, consult the full Instructions for Form 944-X (Rev. April 2025).

Conclusion: Stay Compliant with Timely Form 944-X Filings

IRS Form 944-X empowers employers to fix Form 944 errors efficiently, whether adjusting taxes or claiming refunds—potentially saving thousands in overpayments. With 2025 updates simplifying expired credits, now’s the time to review your records. Download the form and instructions from IRS.gov, and consult a tax professional for complex cases. Proper filing not only ensures accuracy but also maintains your business’s good standing.

Last updated: December 2025. Always verify with official IRS sources for changes.