Table of Contents

IRS W-2 Form 2022 Printable – As an employee in the United States, it is important to have a copy of your W-2 form from the Internal Revenue Service (IRS). This form serves as a record of your taxable income for the previous year, and it is crucial for accurately reporting this information to the IRS. In this article, we aim to provide you with a comprehensive understanding of the IRS W-2 form and its significance.

New Article: W-2 Form 2025.

We will begin by exploring what the W-2 form signifies and why it is so important to obtain one. Next, we will cover the process of filling out the W-2 form, including helpful hints and tips to make the experience as stress-free as possible. Additionally, we will discuss the importance of accurately reporting your taxable income and what you can do if you find yourself in a situation where you need to make a correction.

The IRS W-2 form is a document that provides a summary of your taxable income for the previous year, including wages, tips, bonuses, and other taxable benefits. Employers are required to provide this form to their employees by January 31st of each year. The W-2 form is a crucial document in the tax-filing process as it provides the IRS with the information needed to verify the accuracy of your tax return.

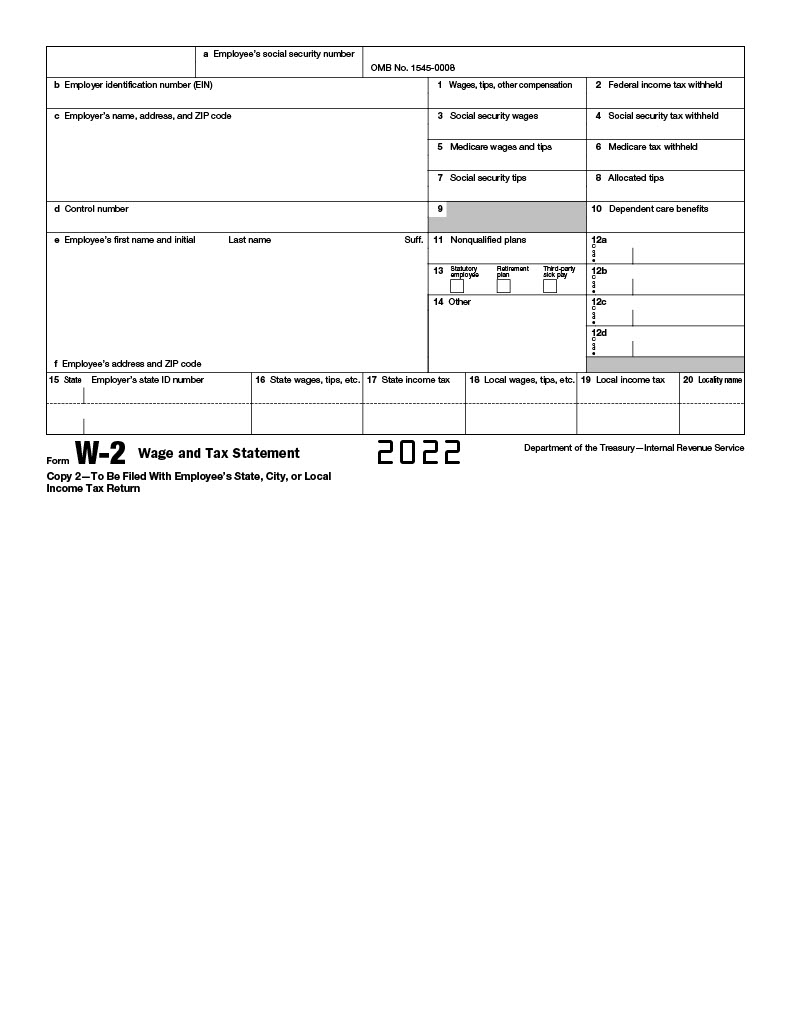

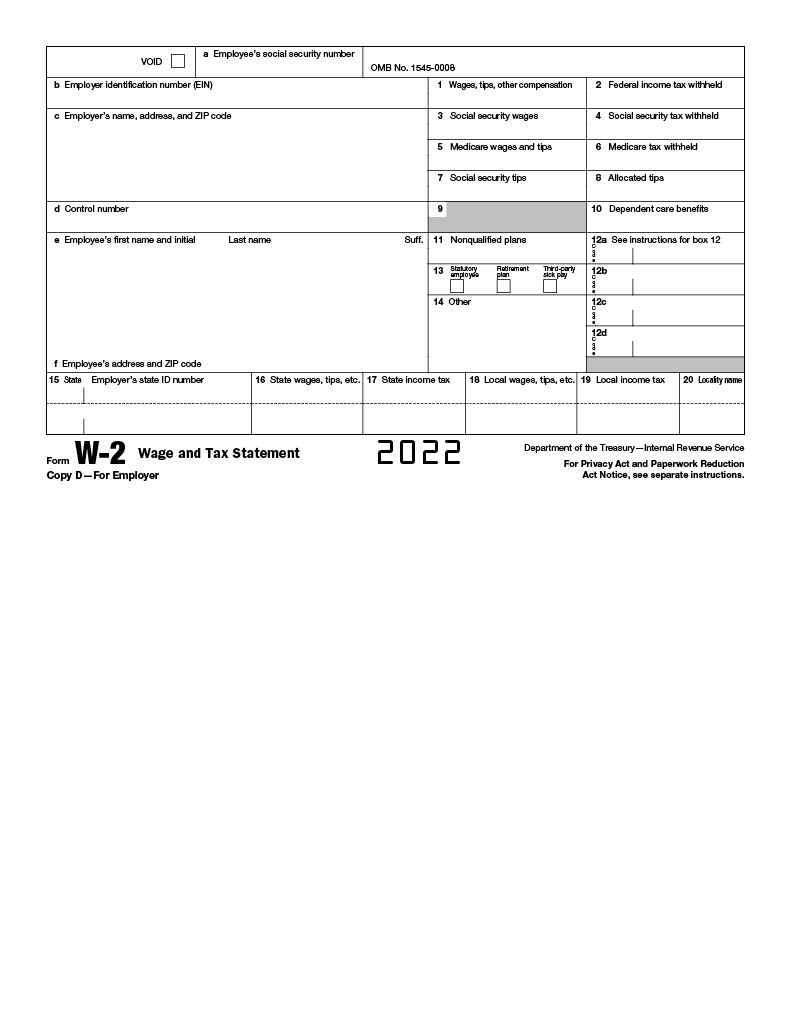

What is an IRS W-2 Form 2022?

The Wage and Tax Statement commonly referred to as IRS Form W-2 is a crucial document that outlines the taxable income of an individual employee and the taxes that have been deducted from their salary during the course of the year. The Internal Revenue Service, responsible for maintaining records of an employee’s taxable income, utilizes this document for the purpose of ensuring that the employee is making the correct amount of tax payments.

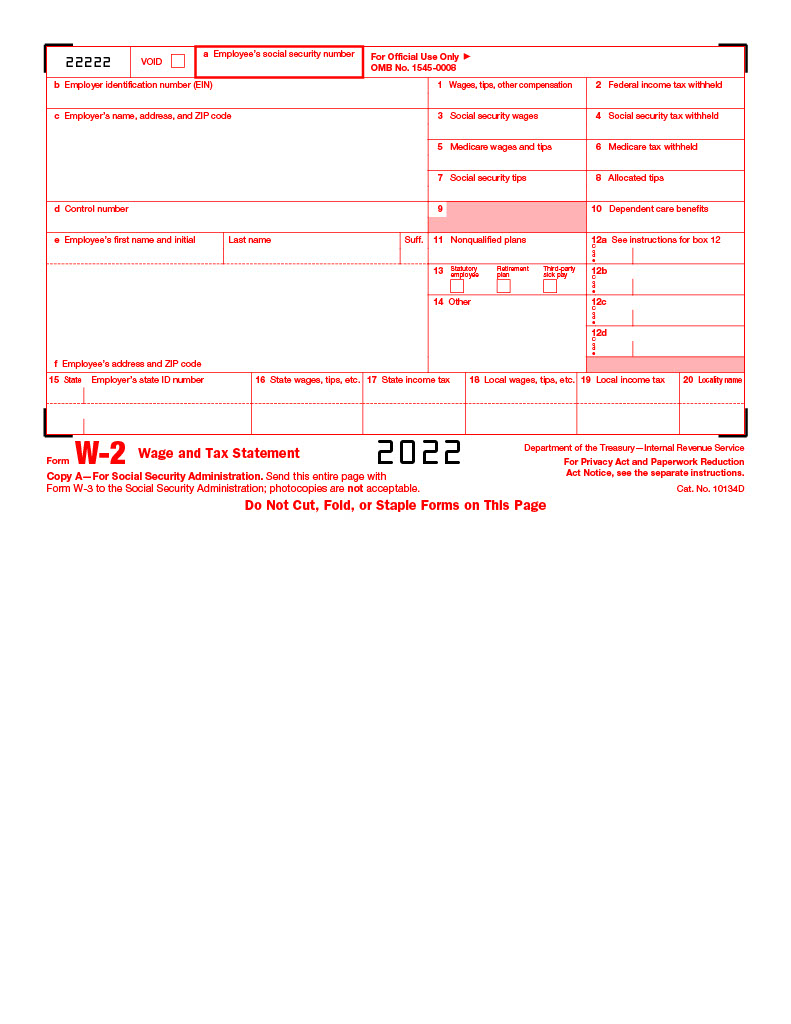

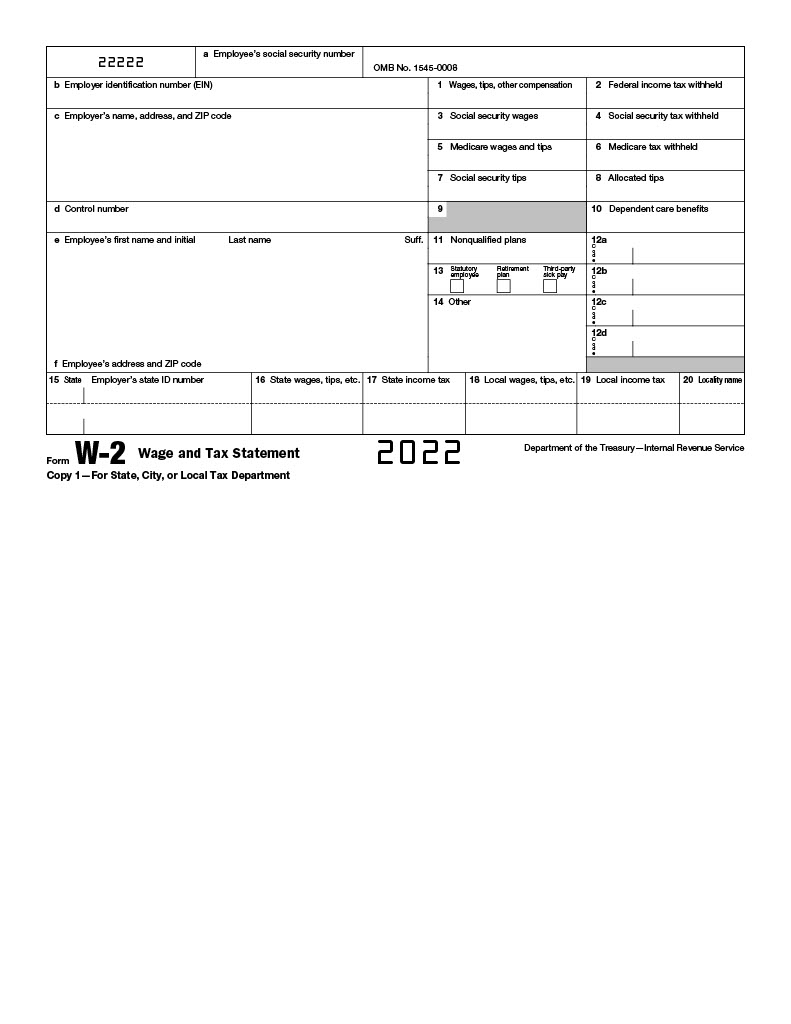

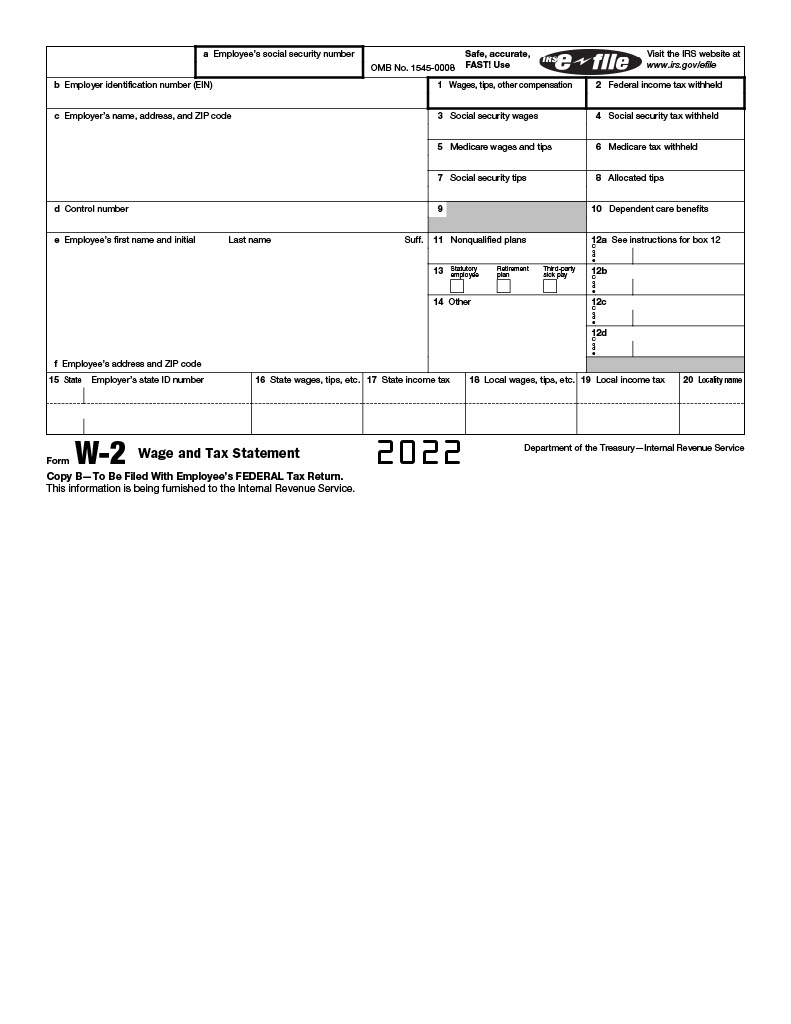

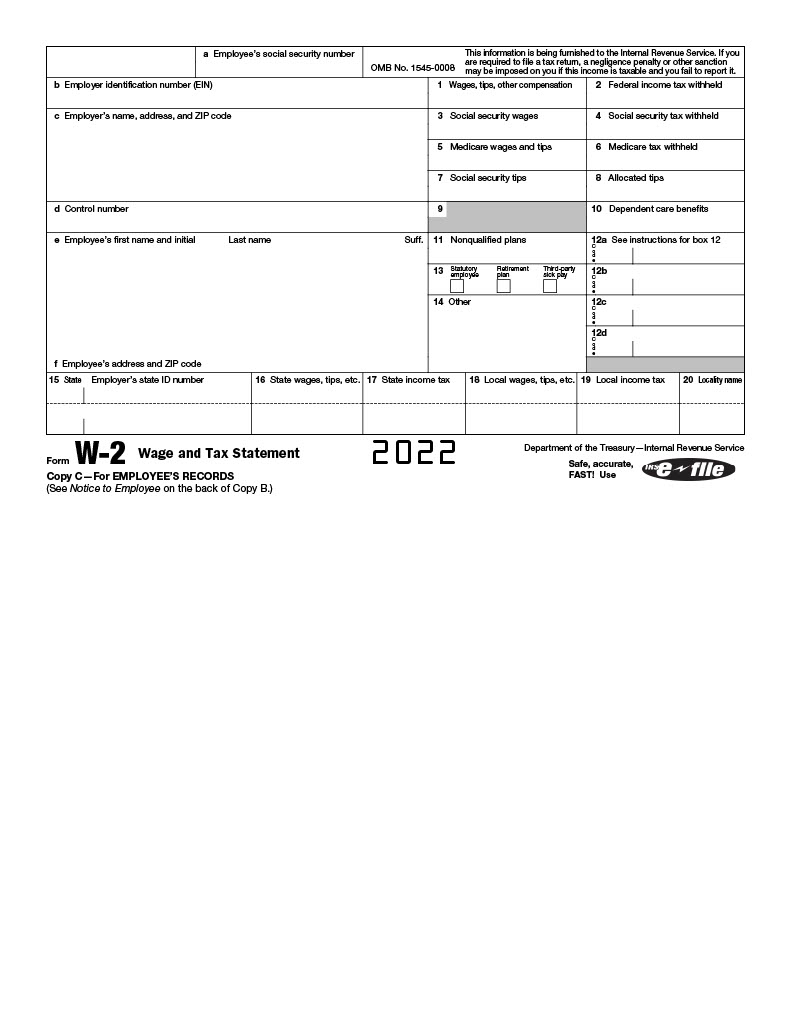

IRS W-2 Form 2022 Printable

Who Needs to File an IRS W-2 Form 2022?

Every employee who has received taxable income over the course of the year is obligated to fill out and submit an IRS Form W-2. This includes those who work full-time, part-time, and those who are self-employed. The onus is on the employer to furnish their employees with the W-2 form, which must be transmitted to the Internal Revenue Service by the 31st of January in each calendar year.

What Information is Included on the IRS W-2 Form 2022?

The employee’s taxable income, the amount of taxes withdrawn at the federal, state, and local levels, as well as the amount of taxes withheld at the Social Security and Medicare levels, are some of the essential pieces of information that are included on the W-2 form issued by the IRS. In addition to that, it contains the employee’s name, address, and Social Security number, as well as the name, address, and Employer Identification Number of the employee’s place of employment (EIN).

How to Complete the W-2 Form by the IRS?

Completing the IRS Form W-2 may appear to be a daunting task, however, it is quite straightforward. The form is divided into several sections, each designed to capture specific information regarding the employee’s taxable income and the taxes withheld from that income. Here is a step-by-step guide to filling out the W-2 form required by the IRS:

- Input the personal information of the employee, such as their name, address, and Social Security number.

- Record the information regarding the employer, including their name, address, and EIN number.

- Enter the employee’s taxable income, which should encompass their entire salary, tips, and any other forms of compensation received.

- Specify the total amount of federal, state, and local taxes that have been deducted.

- Indicate the amount of Social Security and Medicare taxes that have been deducted.

Why is the W-2 Form From the IRS so Important?

The IRS Form W-2 is a critical document for several reasons.

- The Internal Revenue Service utilizes it to monitor an individual’s taxable income and verify that the appropriate amount of taxes is being paid.

- It serves as a record of the employee’s taxable income, which can be useful in various contexts, such as when applying for a loan or mortgage.

- The W-2 form provided by the Internal Revenue Service plays a crucial role in the process of filing a tax return. This is because it contains the necessary information to calculate taxable income and determine tax liability.

IRS W-2 Form 2022 Printable PDF

Here is IRS W-2 Form 2022 Printable.

UPDATED: IRS Has Released W2 Form 2024 Printable.

You can also read our article about “W2 Form 2024, Wage and Tax Statement“