Table of Contents

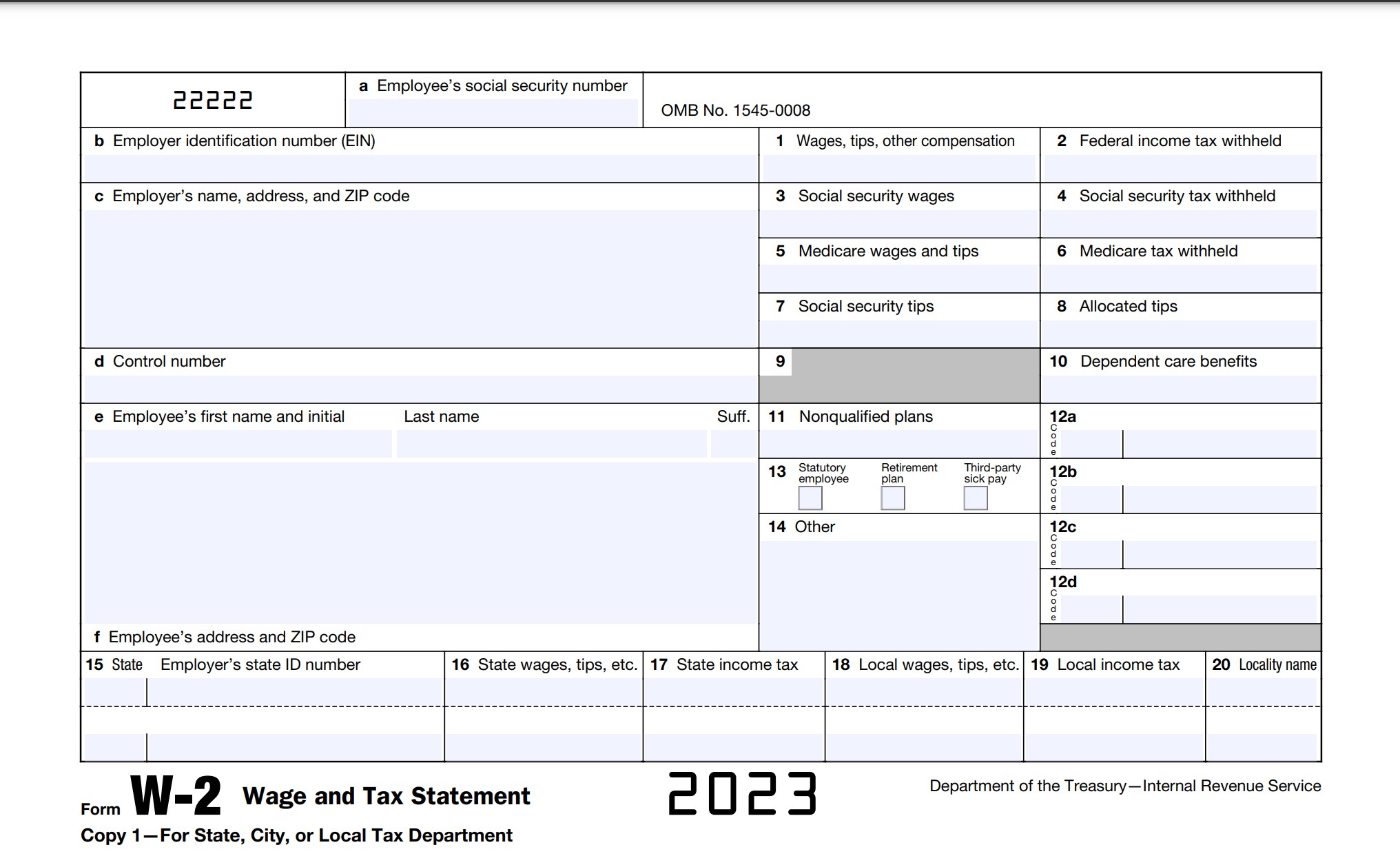

IRS W-2 Form 2023 PDF Printable – The W-2 form, also known as the Wage and Tax Statement, is a document used by the Internal Revenue Service (IRS) to report an individual’s annual wages and the amount of taxes withheld from their paycheck. This form serves as a record of employee wages and taxes withheld from their paycheck for the calendar year.

New Article: W-2 Form 2025.

It provides employees with information needed to file their income tax returns and helps them obtain the proper amount of credit for taxes paid. Employers also use this form to report employee wages to the Internal Revenue Service (IRS) and other government agencies.

It is provided by an individual’s employer and must be completed by the employer and submitted to the employee by January 31st each year.

The W-2 form is used by employees to file their tax returns and by the IRS to verify the accuracy of the information reported on an individual’s tax return.

Is There a New IRS W-2 Form for 2023?

As the tax season approaches, many people are wondering if there will be any changes to the W-2 form for 2023? With new tax laws, updates to existing forms and additional guidance from the Internal Revenue Service (IRS), taxpayers need to stay on top of any changes that might impact their filing. Starting in 2023, the IRS will streamline the Form W-2, Wage and Tax Statement, by combining it onto fewer pages.

What’s New For IRS W-2 Form 2023?

IRS W-2 Form 2023 including Forms W-2AS, W-2GU, and W-2VI) Redesigned

The W-2 forms, including the W-2AS, W-2GU, and W-2VI, have undergone a redesign and are now available for completion and printing on IRS.gov. Starting with the 2023 tax year, Copies 1, B, C, 2 (if applicable), and D (if applicable) of the W-2 forms can be printed and submitted to the appropriate recipient. It is important to note that any changes made to one copy will be reflected on all other copies. However, it is important to note that Copy A of the forms cannot be completed online and is only available on IRS.gov for informational purposes.

Please be advised that Forms W-2AS, W-2GU, and W-2VI no longer include Copy D for employers, nor do they contain the former Note for Employers that was previously supplied on the reverse of Copy D. This change has been made in order to reduce the number of pages required to complete the forms.

Electronic Filing of Returns

The Taxpayer First Act of 2019, which went into effect on July 1, 2019, has given the Department of the Treasury and the Internal Revenue Service the authority to establish regulations that lower the threshold for mandatory electronic filing. Currently, electronic filing is required if more than 250 returns of a certain type are submitted. If the final rules are released and take effect for tax returns for the 2023 tax year, which will be filed in 2024, we will promptly publish a article outlining the change on IRS.gov/FormW2. However, until the final rules are released, the threshold for electronic filing will remain at 250 returns.

Disaster Tax Relief

Individuals who have been affected by recent natural disasters may be eligible for disaster tax relief.

Penalties Increased

Due to inflationary adjustments, the penalties for failing to file and furnish, as well as for intentionally disregarding the filing and payee statement requirements, have increased. These increased penalties will apply to tax returns due to be submitted after December 31, 2023. For more information you can read here: https://www.irs.gov/instructions/iw2w3#en_US_2023_publink1000308313

Sources: irs.gov/instructions/iw2w3

IRS W-2 Form 2023 PDF Printable

Get Here IRS W-2 Form 2023 PDF Printable.

UPDATED: IRS Has Released W2 Form 2024 Printable.

You can also read our article about “W2 Form 2024, Wage and Tax Statement“