Table of Contents

Missouri W4 Form 2023 (MO W-4 2023) – Are you an employee living in Missouri? If so, you must complete a Missouri W4 Form, and Employee’s Withholding Certificate. This form is necessary because it helps employees accurately calculate tax deductions from their paychecks throughout the year. It also gives employers important information about the employee’s tax status and filing preferences that are needed for payroll purposes.

New Article: W4 Form 2025.

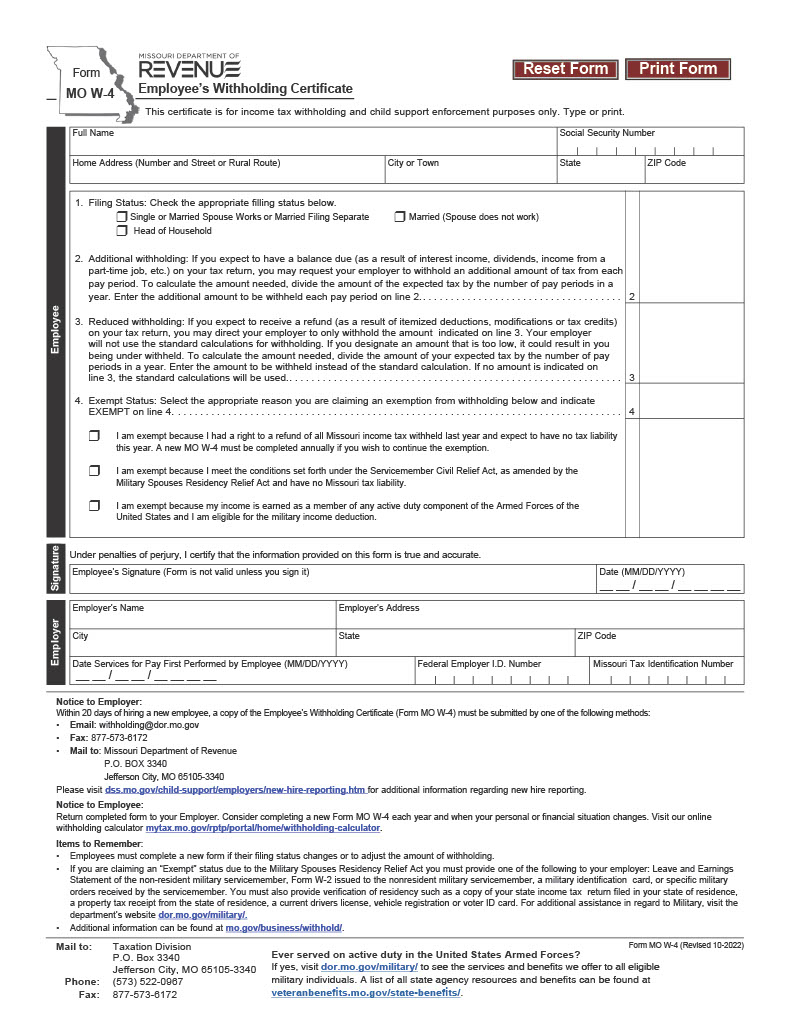

Completing a Missouri W4 Form is easy and should take only a few minutes. All you need to do is fill out the personal information section, identify any additional deductions, such as childcare costs or other adjustments, and sign off on the document at the bottom. Once this form has been completed and accepted by your employer, it will determine how much of your wages are withheld for taxes each pay period.

Missouri W4 Form, Employee’s Withholding Certificate is a critical document that helps employees declare their tax withholding preferences. It is an essential document that every employer in Missouri must provide to their employees to ensure compliance with state and federal tax regulations. If you’re a Missouri-based employer, you must ensure that your employees complete and file their W4 forms accurately and on time.

This article will guide you through the ins and outs of the Missouri W4 form, its purpose, who needs to complete it, how to complete it, and what to do if you encounter any problems. We’ll also provide a few tips to ensure that your W4 forms are correctly filled out, which can help you avoid any potential problems with the IRS.

What is a Missouri W4 Form 2023 (MO W-4 2023)?

The Missouri W4 form, Employee’s Withholding Certificate, is a form all employees in Missouri must complete and submit to their employer. The form is used to declare an employee’s tax withholding preferences, which determines the amount of tax that will be withheld from their paycheck.

The W4 form includes several sections that employees must complete, including their personal information, tax filing status, number of allowances, and any additional withholding they wish to request. Employees must complete a new W4 form whenever their tax status changes, such as getting married, having children, or changing jobs.

Who Needs to Complete a Missouri W4 Form 2023 (MO W-4 2023)?

All employees in Missouri must complete a W4 form and submit it to their employer. Employers must keep a copy of the W4 form on file for each employee. If an employee fails to complete a W4 form, the employer must withhold taxes from the employee’s paycheck at the highest tax rate, per the IRS guidelines.

How to Complete a Missouri W4 Form 2023 (MO W-4 2023)?

Completing a Missouri W4 form is a straightforward process, but it’s essential to ensure it’s filled out correctly. The following is a step-by-step guide to help you complete the form accurately:

Step 1: Provide Personal Information

The first section of the W4 form requires employees to provide their name, address, Social Security Number, and filing status. Filing status options include single, married filing jointly, married filing separately, and head of household.

Step 2: Claim Dependents

In this section, employees can claim any dependents, such as children. Claiming dependents can help reduce the tax withheld from the employee’s paycheck.

Step 3: Claim Allowances

Employees can claim allowances for themselves, their spouses, and their dependents. The more allowances claimed, the less tax will be withheld from their paycheck.

Step 4: Additional Withholding

In this section, employees can request additional withholding from their paychecks to cover any additional tax liability they may have.

Step 5: Sign and Date the Form

Once the form is complete, employees must sign and date it, certifying that the information provided is correct.

What to Do If You Encounter Any Problems?

If you encounter any problems while completing the Missouri W4 form, several resources are available to help you. The Missouri Department of Revenue has a comprehensive guide to completing the W4 form, which provides detailed instructions and examples for each section. Additionally, you can consult with a tax professional to ensure that your W4 form is completed accurately.

Tips for Completing a Missouri W4 Form

Here are a few tips to help ensure that your W4 form is completed accurately:

- Review the instructions carefully: Before filling out the form, review the instructions and examples provided to ensure that you understand each section.

- Use the IRS Withholding Calculator: The IRS provides a helpful Withholding Calculator on its website, which can assist you in determining the appropriate number of allowances to claim on your W4 form. Using the calculator, you can ensure that you’re withholding the correct taxes from your paychecks, which can help prevent over or under-withholding.

- Enter personal information accurately: Be sure to enter your personal information correctly, including your name, Social Security number, and address. Inaccurate information can delay the processing of your form and cause issues with your tax returns.

- Claim allowances accurately: Claiming allowances can help adjust your withholding, so be sure to claim the appropriate number for your situation. You can refer to the instructions or use the IRS Withholding Calculator to determine the appropriate number of allowances to claim.

- Understand additional withholding: If you want to withhold additional taxes from your paycheck, you can indicate this on the form. Follow the instructions carefully to ensure that the correct amount is withheld.

- Review and sign the form: Once you’ve completed it, review it carefully to ensure that all information is accurate and complete. Sign and date the form as required and provide it to your employer.

By following these tips, you can help ensure that your Missouri W4 form is completed accurately, which can help prevent issues with your tax returns and ensure that you’re withholding the correct amount of taxes from your paychecks.

If you need more assistance or have questions about completing your W4 form, don’t hesitate to reach out to a tax professional or the IRS for guidance.

Missouri W4 Form 2023 Table Guides

| Topic | Description |

| Purpose | To declare an employee’s tax withholding preferences to determine the amount of tax withheld from their paycheck. |

| Who needs to complete it? | All employees in Missouri must complete and submit the W4 form to their employer. |

| Sections to complete | Personal information, filing status, dependents, allowances, and additional withholding requested. |

| How to complete it? | Provide personal information, claim dependents, claim allowances, request additional withholding, and sign, and date the form. |

| Tips for accurate completion | Review instructions carefully, use the IRS Withholding Calculator, enter personal information, claim allowances accurately, understand additional withholding, and review and sign the form. |

| Resources available | A comprehensive guide by the Missouri Department of Revenue, tax professionals, and the IRS. |

Completing the Missouri W4 Form is a straightforward process, but it is critical to ensure that it is accurately completed. The form helps to determine the amount of tax withheld from an employee’s paycheck. All employees in Missouri must complete the W4 form and submit it to their employer. It is essential to provide accurate personal information, claim dependents and allowances correctly, request additional withholding if needed, and sign and date the form. Reviewing instructions and using available resources can help prevent issues with tax returns.

Missouri W4 Form 2023 Printable PDF – MO W-4 2023

Download and Print Here: Recent Missouri W4 Form 2023 Printable – MO W-4 2023 (Revised 10-2022)