Table of Contents

W2 Form 2024, Wage and Tax Statement – As we welcome the dawn of a new tax year, the W2 Form 2024 stands as an essential document in the lives of millions of working individuals across the United States. This seemingly innocuous piece of paper holds within its meticulous columns and boxes a wealth of information about our earnings, taxes withheld, and contributions to various benefits programs. However, beyond being just another form to file away, the W2 Form 2024 is a gateway to understanding our financial health and responsibilities as citizens. Join us as we delve into the intricacies of this crucial Wage and Tax Statement, uncovering its significance in shaping both individual financial planning and national economic trends.

New Article: W-2 Form 2025.

The W2 Form 2024 not only serves as a reflection of our past year’s labor but also acts as a compass guiding us through the labyrinthine landscape of tax regulations and obligations. Its numbers tell stories—of hard work exerted, taxes paid, savings accrued—and offer insights into our own financial habits and governmental policies alike. Moreover, with the ever-evolving nature of tax laws and societal shifts impacting income dynamics, it becomes imperative to grasp how this humble sheet can impact our present-day decisions and future aspirations. So let’s embark on this journey together to unravel the hidden gems within the W2 Form 2024—a journey that promises empowerment through knowledge and understanding in navigating our fiscal world.

What is W2 Form 2024, Wage and Tax Statement?

The W2 Form 2024 is a tax document used in the United States, that employers must fill out and provide to their employees. This form reports the amount of income an employee earned during the year 2023 and the taxes withheld from their paycheck. It’s a crucial document for both employers and employees as it is used for preparing individual tax returns.

Key Features of the W2 Form 2024:

- Income Reporting: The W-2 form details an employee’s income, including wages, tips, and other forms of compensation.

- Tax Withholding: It shows the amount of federal, state, and other taxes withheld from the employee’s income throughout the year.

- Social Security and Medicare Contributions: The form also reports the contributions made to Social Security and Medicare.

- New Electronic Filing Requirements: Starting with the tax year 2023, employers who need to file 10 or more W-2 forms must do so electronically. This change, effective for forms filed in 2024, aims to streamline the filing process and improve efficiency.

- Updated Design: While there were plans for a major redesign of the W-2 form, these have been postponed, and the form will retain its current design for the 2023 tax year.

- New Box 12 Code: A new code (Code II) has been introduced in Box 12 for reporting Medicaid waiver payments that are excluded from gross income.

- Deadline for Filing: Employers are required to send out the W-2 forms to their employees by January 31, 2024, and also file them with the IRS.

Importance for Employees:

- Tax Return Preparation: Employees use the information on the W-2 form to prepare their annual tax returns.

- Verification of Withholdings: It allows employees to verify that the correct amount of taxes has been withheld over the year.

- Social Security Benefits: The reported earnings contribute to the calculation of future social security benefits.

The W-2 Form 2024 is an essential document in the U.S. tax system, serving as a record of an employee’s earnings and tax withholdings for the year 2023. Understanding this form is crucial for both employers, who need to comply with the new electronic filing requirements, and employees, who use this information for their tax filings.

Understanding the New Electronic Filing Requirements for W2 Form 2024

The Internal Revenue Service (IRS) has introduced significant changes to the filing requirements for Forms W-2, which will take effect in the 2024 tax year. These changes, as outlined on the IRS’s official website, are part of an amendment to Regulations section 301.6011-2, established by Treasury Decision 9972, published on February 23, 2023.

Key Changes in Filing Threshold

The most notable change is the reduction of the threshold for mandatory electronic filing. Previously, employers were required to file Forms W-2 electronically if they had a substantial number of forms to submit. However, starting with tax year 2023 (for filings due by January 31, 2024), the threshold has been significantly lowered.

Employers must now file their Forms W-2 electronically if they are submitting a total of 10 or more forms. This new threshold is a substantial decrease from previous years, aiming to streamline the filing process and improve efficiency.

Forms Affected by the New Rule

The new electronic filing requirement encompasses various forms, including Forms W-2, W-2AS, W-2GU, W-2VI, and Form 499R-2/W-2PR. It is important to note that Form W-2CM is not included in this list.

To determine if they meet the electronic filing requirement, employers must add together the total number of information returns they file, which includes the following forms:

- Form 1042-S

- Form 1094 series

- Form 1095-B/C

- Form 1097-BTC

- Form 1098 series

- Form 1099 series

- Form 3921

- Form 3922

- Form 5498 series

- Form 8027

- Form W-2G

If the combined total of these forms and the Forms W-2 reaches or exceeds 10, the employer is mandated to file them electronically.

Treatment of Corrected Information Returns

It’s also important to note that corrected information returns are treated separately under these new rules. They are not included in the calculation of the number of information returns to determine the electronic filing requirement. Employers seeking more details about the rules for the correction of Forms W-2c should refer to the specific guidelines provided by the IRS.

These changes mark a significant shift in the IRS’s approach to handling Forms W-2, emphasizing the importance of electronic filing for efficiency and accuracy. Employers should take note of these new requirements and prepare accordingly for the 2024 tax year filings. By understanding and adhering to these new regulations, employers can ensure compliance and avoid potential penalties associated with non-compliance.

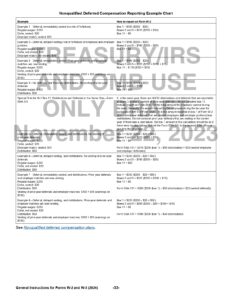

IRS Releases Draft 2024 General Instructions for Forms W-2 and W-3

In a significant move to keep taxpayers and employers informed, the Internal Revenue Service (IRS) has recently released the draft version of the 2024 General Instructions for W2 Form 2024 and W-3 Form. This preliminary release marks an important step in preparing for the upcoming tax season, offering a glimpse into the changes and updates that will impact how employers report employee wages and tax withholdings. Accompanying this article, we have included the actual draft file from the IRS, providing our readers with direct access to these critical guidelines. This document is essential for understanding the nuances of the W2 Form 2024 and ensuring compliance with the latest tax reporting requirements.

Access the Draft 2024 General Instructions for Forms W-2 and W-3 here: Download Link. This comprehensive guide provides essential information for accurate and compliant tax filing.

Key Highlights from the 2024 General Instructions for Forms W-2 and W-3

As we approach a new fiscal year, it’s crucial for both employers and employees to stay abreast of the latest tax regulations and requirements. The Internal Revenue Service (IRS) has recently issued the 2024 General Instructions for Forms W-2 and W-3, introducing several significant updates and changes. These modifications are designed to streamline the tax filing process, enhance security, and ensure accurate reporting of wages and taxes. In this section, we delve into the key highlights from these instructions, providing a concise overview of what’s new and what’s changed for the 2024 tax year. Understanding these updates is essential for effective tax planning and compliance.

Detailed Updates for 2024

- Electronic Filing Requirements: A significant update for the 2024 W-2 form is the change in electronic filing requirements. Employers who are required to file 10 or more W-2 forms must now do so electronically. This mandate is part of the IRS’s efforts to streamline the filing process, reduce paperwork, and enhance the efficiency and security of tax reporting. This change means that more employers will need to adapt to electronic filing methods, which can be more efficient but may require an initial adjustment period to familiarize themselves with the electronic systems.

- New Box 12 Code for Medicaid Waiver Payments: The IRS has introduced a new Code II in Box 12 of the W-2 form. This code is specifically designated for reporting Medicaid waiver payments that are excluded from the employee’s gross income. This is a critical update for accurately reporting these specific types of Medicaid payments, ensuring that they are not mistakenly included as taxable income. This change is particularly relevant for employees receiving these types of benefits and their employers.

- Increased Penalties for Non-Compliance: To emphasize the importance of timely and accurate filing, the IRS has increased the penalties for failing to file or furnish W-2 forms on time. This change is a result of inflation adjustments and serves as a deterrent against late or incorrect filings. Employers must be particularly vigilant to meet the filing deadlines to avoid these increased penalties.

- Enhanced Security for Online Services: For employers using the Business Services Online (BSO) platform for e-filing, the IRS has implemented enhanced security measures. These measures require employers to update their credentials for accessing BSO services. This update is part of a broader effort to secure sensitive tax information and protect against data breaches and fraud.

General Instructions and Key Points

- Filing Deadline: The deadline for filing 2024 W-2 forms with the Social Security Administration is January 31, 2025. This applies to both electronic and paper filings. Adhering to this deadline is crucial to avoid penalties.

- Health FSA Limit: For the year 2024, the limit on health flexible spending arrangements (FSA) is set at $3,200. This limit does not include any amount carried over from a previous year. Employers offering FSA benefits must ensure that their plans comply with this limit.

- Additional Medicare Tax: Employers are required to withhold an additional 0.9% Medicare tax on wages exceeding $200,000. This tax is only imposed on the employee, and there is no employer share. This withholding should begin in the pay period when the employee’s wages exceed the $200,000 threshold and continue for the rest of the year.

- SSN Truncation: To enhance privacy and security, employers are permitted to truncate the employee’s Social Security Number on employee copies of the W-2 form. This means replacing the first five digits of the SSN with asterisks or Xs. However, the full SSN must be used on Copy A of the form, which is filed with the Social Security Administration.

The W-2 Form for 2024 introduces several important updates that reflect the IRS’s commitment to modernizing the tax filing process and enhancing security measures. These changes, including the shift to mandatory electronic filing for larger batches of forms, the introduction of new reporting codes, and increased penalties for non-compliance, are crucial for employers to understand and implement. For employees, being aware of these changes is important for understanding their tax documents and ensuring their income and deductions are reported accurately. As always, both employers and employees should stay informed and possibly seek professional advice to navigate these changes effectively.

Detailed Overview of the Draft 2024 General Instructions for W2 Form 2024 and W3 Form

W2 Form 2024 Printable

In this part of our guide, we’re getting ready to give you the W2 Form 2024 Printable. Right now, we don’t have it because the IRS hasn’t put out the new W-2 Form 2024 yet. But if you need the W-2 Form from last year, you can download it from the link below. We’ll make sure to add the 2024 form here as soon as the IRS releases it. Stay Tuned!

Accessing Previous W2 Forms

- W2 Form 2023: Download Link

- W2 Form 2022: Download Link

- W2 Form 2024 (UPDATED)