Table of Contents

W4 Form 2024, Employee’s Withholding Certificate – Are you ready to embark on a fiscal journey into the future? The year 2024 is just around the corner, and with it comes an updated version of the W4 form, also known as the Employee’s Withholding Certificate. As we hurtle toward this futuristic date, it’s essential for both employers and employees to understand the changes that will come with this new iteration of the form. Whether you’re a seasoned tax professional or just someone looking to stay ahead of the game when it comes to your finances, delving into the intricacies of the W4 form 2024 promises to be a fascinating and enlightening experience.

New Article: W4 Form 2025.

In a world where financial regulations are constantly evolving, staying informed about changes like those in the W-4 form can be empowering. This pivotal document determines how much income tax employers withhold from employees’ paychecks based on their individual circumstances. The 2024 version is poised to introduce updates that could impact millions of workers across various industries, making it crucial for everyone in the workforce to grasp its nuances. So fasten your seatbelts and get ready for an exploration of what lies ahead as we uncover what’s in store with the W-4 form 2024!

LATEST UPDATE: IRS Just Released the Latest 2024 W-4 Form

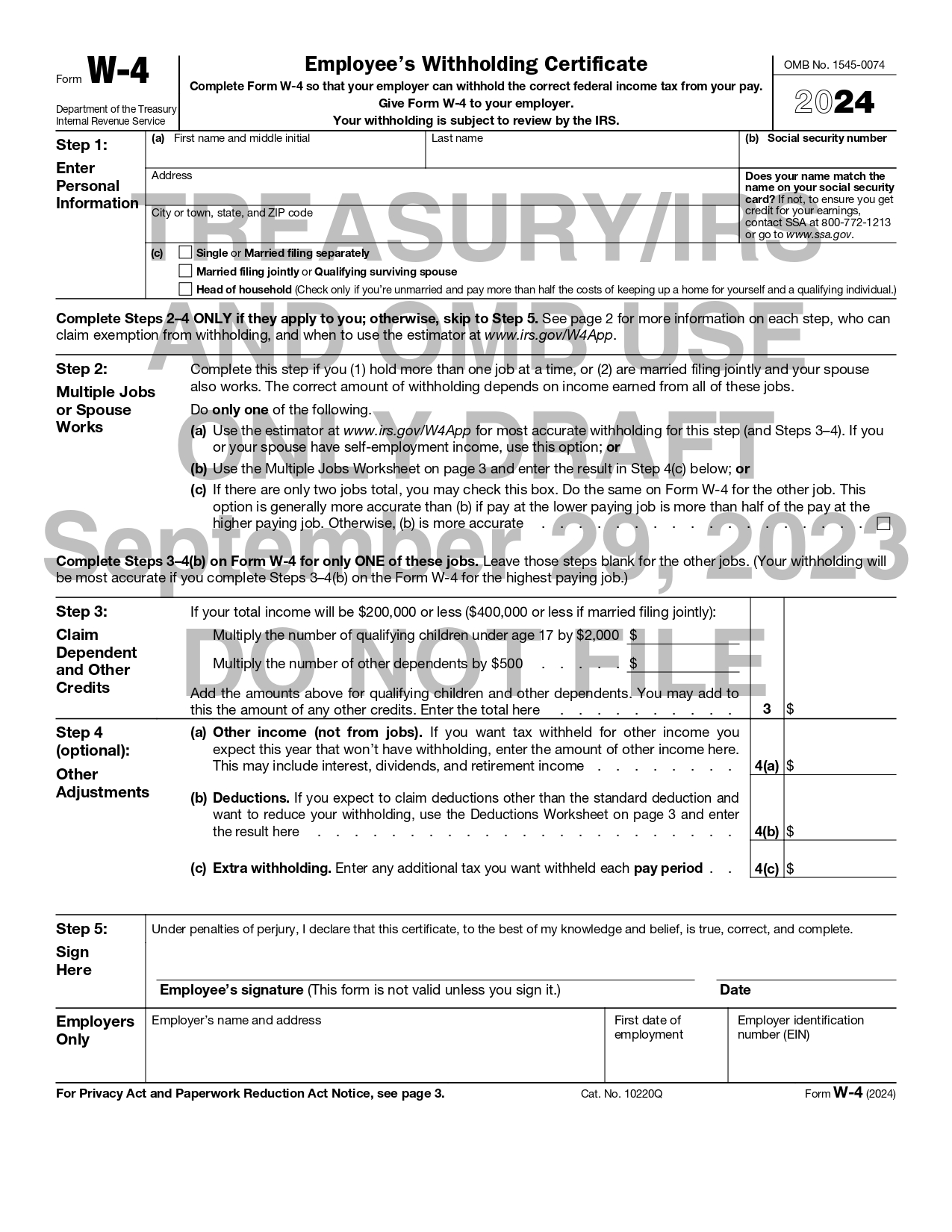

The Internal Revenue Service (IRS) has just released the latest version of the 2024 W-4 Form. This update brings essential changes that are crucial for accurately determining your tax withholdings for the year. To ensure you’re up-to-date with these changes, we’ve made the new form readily available for download and printing. Get your hands on the updated 2024 W-4 Form by clicking on this link: Download and Print the 2024 W-4 Form. Stay informed and compliant by accessing the most current version of this important tax document.

What is W4 Form 2024, Employee’s Withholding Certificate?

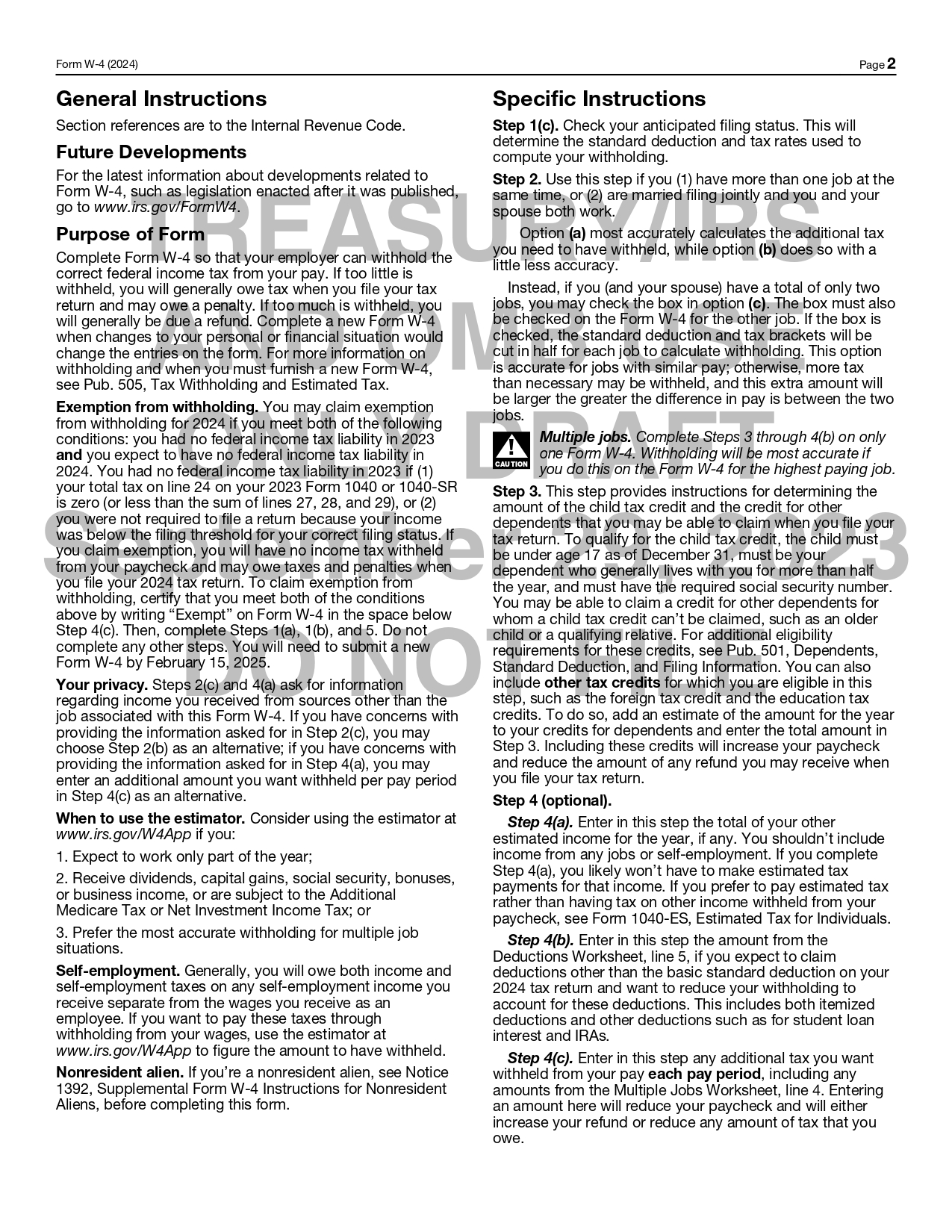

The W-4 form, officially known as the Employee’s Withholding Certificate, is a crucial document for U.S. employees, particularly in the context of the 2024 version. This form plays a pivotal role in determining the amount of federal income tax that is withheld from an employee’s paycheck. Its design and structure are aligned with the federal tax code and are subject to change as tax laws evolve.

The primary purpose of the W-4 form is to enable employees to accurately convey their personal financial situation to their employers. This includes marital status, number of dependents, additional income sources, and any other factors that might influence their tax liabilities. By providing this information, employees can ensure that the correct amount of tax is withheld from their earnings, avoiding underpayment or overpayment.

For the 2024 version of the W-4 form, it’s essential to understand any new regulations or adjustments that may have been introduced since the previous year. These changes often reflect broader shifts in tax legislation or policy adjustments made by the Internal Revenue Service (IRS). Staying informed about these updates is crucial for both employees and employers to ensure compliance and accurate tax withholding.

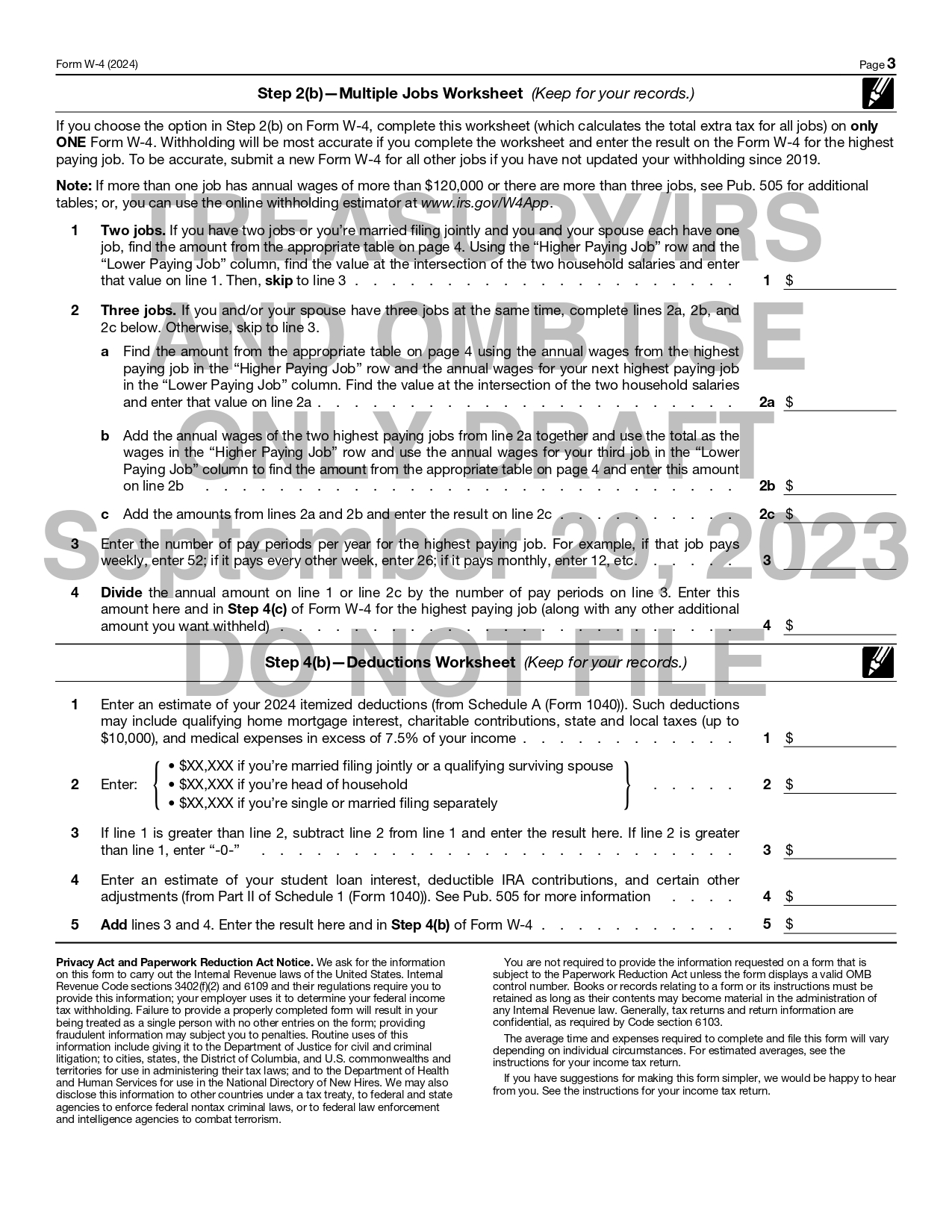

The form itself is divided into several sections, each designed to capture specific information relevant to tax withholding. This includes personal information, multiple job adjustments, claims for dependents, and other adjustments. The accuracy of the information provided on the W-4 directly impacts the calculation of withholding taxes, making it important for employees to fill out the form carefully and truthfully.

W-4 form for 2024 is a key document that impacts how much tax is withheld from an employee’s paycheck. Its relevance extends beyond individual financial management to encompass broader aspects of tax compliance and fiscal responsibility. As tax laws and regulations evolve, staying updated with the latest version of the W-4 form is essential for both employers and employees.

General Information about W4 Form

When you hire an employee, it’s mandatory for them to complete a Form W-4, Employee’s Withholding Certificate. This form is essential as it provides detailed information including the employee’s filing status, adjustments for multiple jobs, credits, other income, deductions, and any additional amount to be withheld from their paycheck. This information is critical for accurately computing the federal income tax to be withheld from the employee’s pay.

Key Points

- Employee’s Responsibility: To provide a properly completed Form W-4.

- Employer’s Action on Incomplete Forms: Withhold taxes as if the employee is single or married filing separately with no adjustments if a properly completed Form W-4 is not provided.

Updating W4 Form

Employees should update their Form W-4 whenever there are changes in their personal or financial situation. As an employer, you’re required to implement any changes from a revised Form W-4 no later than the start of the first payroll period ending on or after the 30th day from the date you received the revised form, except in certain situations outlined in the sections on Invalid Form W-4 and Lock-in Letters.

When to Update W4 Form?

- Change in Marital Status, Dependents, or Income

- Revised Form W-4 Received: Implement changes within 30 days.

Accessibility of Form W-4

You can download, print, or order multiple copies of Form W-4 from the IRS. Substitute Form W-4s developed by you (not by employees) are permissible if they contain identical language to the official form and comply with IRS rules. The IRS also provides Form W-4 in multiple languages.

Exemption From Withholding

Employees who had no tax liability in the previous year and expect none in the current year can claim exemption from withholding. This exemption, claimed through Form W-4, is valid only for the calendar year and must be renewed annually by February 15.

Invalid Form W-4

A Form W-4 is invalid if there are unauthorized changes, defacements, or false indications. Employers should not use an invalid form for withholding and must ask for a valid replacement. If not provided, withhold taxes as if the employee is single or married filing separately with no adjustments.

Is There a New W4 Form for 2024?

The IRS has released drafts of the 2024 Form W-4 and its variants, including those for pensions and annuities. These drafts were made public in September, signaling upcoming changes in the way withholding is calculated and reported.

Why Redesign Form W-4?

The redesign of Form W-4 was implemented to reduce complexity and increase both transparency and accuracy in the withholding system. This new design maintains the use of the same underlying information as the old version but replaces the more complex worksheets with simpler, more straightforward questions. This approach makes it easier for employees to ensure accurate withholding. The goal was to simplify the process of determining how much federal income tax should be withheld from an employee’s paycheck, making it more intuitive for employees to provide accurate information.

Key Changes in the W4 Form2024 Draft

While the full details of the changes in the W4 Form 2024 are still being analyzed, it’s essential to understand the implications these revisions may have for both employees and employers. The new form is expected to incorporate adjustments that align with recent tax law changes and provide clearer guidance for accurate withholding.

Importance of the Form W-4

The Form W-4, officially titled the Employee’s Withholding Certificate, plays a pivotal role in tax compliance. It determines the amount of federal income tax withheld from an employee’s paycheck. Accurate completion of this form ensures that employees are neither overpaying nor underpaying their taxes throughout the year.

Additional Resources and Drafts

For those interested in reviewing the draft forms, the IRS has made them available online. The draft of the 2024 Form W-4 can be downloaded here. This early release provides a glimpse into the proposed changes and allows for public feedback and preparation ahead of the official release.

W4 Form 2024 Draft Images

What Happened to Withholding Allowances?

Withholding allowances, a staple of the previous versions of Form W-4, have been eliminated in the redesigned form. This significant change aims to enhance the form’s transparency, simplicity, and accuracy. Previously, the value of a withholding allowance was closely linked to the amount of the personal exemption. However, due to changes in tax law, personal and dependency exemptions are no longer claimable. This shift reflects the evolving tax legislation and is intended to streamline the withholding process, reducing confusion for employees when completing the form.

Notes: Currently, the IRS has released just the draft version of the 2024 W4 Form. We promise to deliver the official 2024 W4 Form itself as soon as it’s available from the IRS. Keep an eye out for our latest updates to get your hands on it first!

Previous W4 Forms

Understanding the evolution of the W4 form is crucial for grasping the nuances of tax withholding in the United States. The Form W-4, officially known as the Employee’s Withholding Certificate, has undergone several changes over the years, each reflecting shifts in tax laws and the economic landscape.

Historical Context

The W4 form has been a staple in the U.S. tax system for decades, serving as a tool for employees to indicate their tax situation to employers. The form’s design and complexity have varied, adapting to tax reforms and societal changes.

Significant Changes Over the Years

- Pre-2018 Era: Before the Tax Cuts and Jobs Act (TCJA) of 2017, the W4 form was relatively stable. It focused on allowances based on personal exemptions, including dependents and marital status.

- Post-TCJA Adjustments: The TCJA brought significant changes, eliminating personal exemptions. This led to a major overhaul of the W4 form in 2020, shifting the focus from allowances to a more detailed income and deduction-based approach.

- The 2020 Redesign: The 2020 version of Form W-4 was a departure from previous formats. It eliminated the concept of withholding allowances and introduced a five-step process for declaring additional income, deductions, and extra withholding. This change aimed to improve accuracy in tax withholding.

Impact of Changes

Each iteration of the W4 form has aimed to balance simplicity with accuracy. The pre-2018 forms were simpler but often less precise, potentially leading to under or over-withholding of taxes. The post-2018 forms, while more complex, offer a more tailored approach to withholding, reducing the likelihood of unexpected tax bills or large refunds.

As tax laws and economic conditions change, so too do the forms and processes associated with them. The evolution of the W4 form underscores the importance of staying informed and adapting to new tax regulations. For employees, understanding these changes is key to ensuring the right amount of tax is withheld, avoiding surprises during tax season.

Accessing Previous W4 Forms

If you’re in need of previous versions of the W4 form for reference or record-keeping, you’re in luck. Below are the links to download past W4 forms for the years 2023 and 2022. These forms can be useful for a variety of purposes, including comparing changes over the years or understanding your past tax withholdings.

- W4 Form 2023: Download Link

- W4 Form 2022: Download Link

Simply click on the links to access and download the forms for the respective years. It’s always a good practice to keep a record of your tax documents, and these forms are an essential part of that archive.