Table of Contents

W4 Form 2025 PDF – The W-4 form is an essential document that helps individuals manage their federal income tax throughout the year. It serves as a guide for employers, instructing them on how much federal income tax to hold back from each paycheck. Getting this form filled out accurately is crucial, as it helps prevent unexpected tax bills or excessively large refunds when tax returns are filed. The federal income tax system operates on a “pay-as-you-go” basis, meaning individuals are expected to pay taxes as they earn or receive income during the year. The W-4 form is the primary tool for employees to meet this ongoing tax obligation, directly influencing their financial flow and compliance with tax laws.

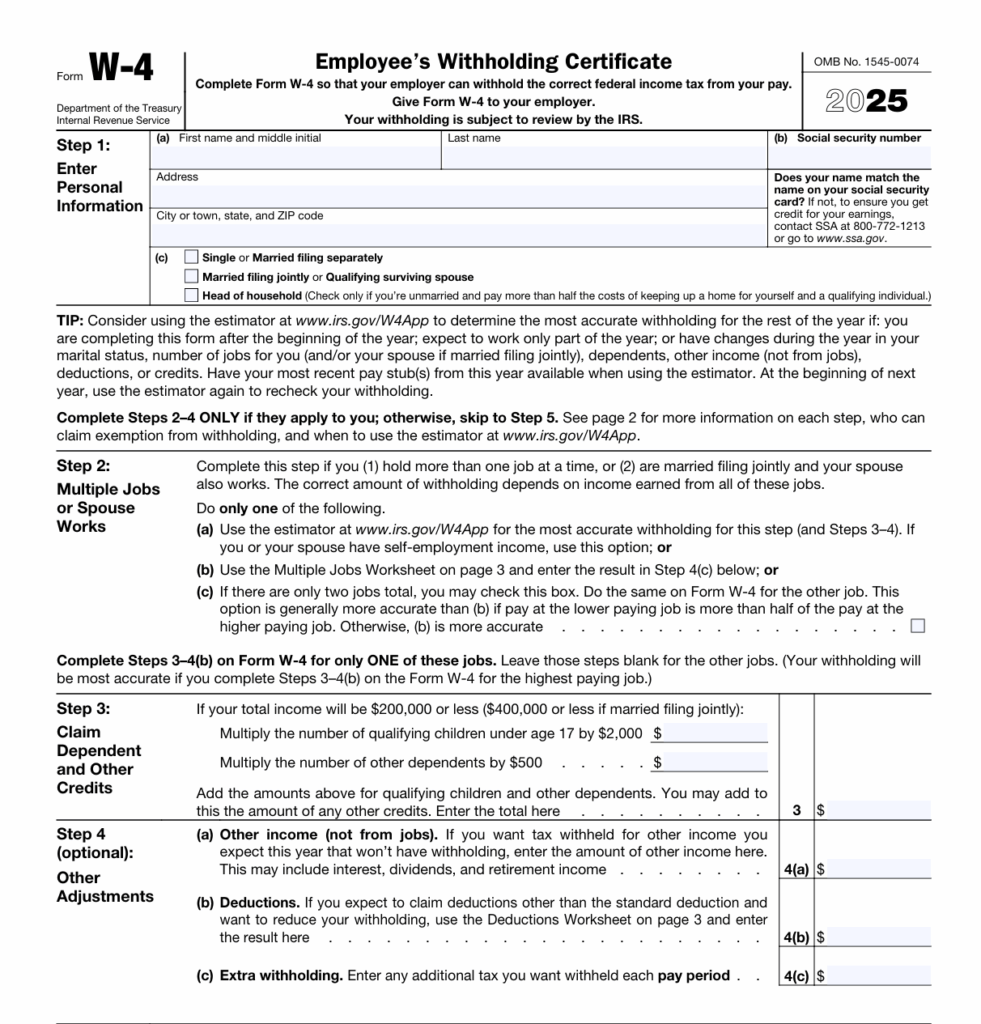

W4 Form 2025

What is the W4 Form 2025 and Why It Matters for Your Paycheck?

The Form W-4, officially known as the “Employee’s Withholding Certificate,” is the document an individual provides to their employer. Its main purpose is to ensure that the correct amount of federal income tax is deducted from each paycheck. The choices made on this form directly affect the amount of take-home pay an individual receives and their tax situation at the end of the year.

If too little tax is withheld from paychecks throughout the year, an individual may owe additional tax when they file their annual tax return. In some cases, this could also lead to penalties for underpayment if the amount owed is significant. Conversely, if too much tax is withheld, the individual will likely receive a tax refund. While a refund might seem desirable, it means the government held onto the individual’s money without paying interest throughout the year, essentially reducing their available cash flow. The aim is to have withholding amounts as close as possible to the actual tax liability, avoiding both large tax bills and substantial refunds. This balance allows individuals to manage their personal finances more effectively, ensuring they have sufficient funds throughout the year while meeting their tax obligations.

What’s New (and What’s Stayed the Same) for the W4 Form 2025?

For many, the good news is that the 2025 W-4 form is not drastically different from the versions used since 2020. The most significant changes to the W-4 form occurred a few years ago, starting in 2020. The redesign aimed to simplify the form and improve the accuracy of tax withholding, particularly after major tax law changes. A key part of this redesign was the removal of the old “allowances” system, which is still not used on the 2025 form. Instead of claiming allowances, individuals now adjust their withholding by accounting for dependents and specific deductions.

The updates for the 2025 W-4 form are minor. These include:

- More detailed information about using the IRS tax withholding estimator, which is particularly helpful for individuals who have self-employment income or whose spouse has such income.

- The amounts listed on the Deductions Worksheet, found on page 3 of the form, have been updated for 2025.

The stability in the form’s overall design since 2020 suggests that the IRS’s efforts to create a more user-friendly and accurate withholding tool are largely in place. This consistency helps individuals become more familiar with the form’s structure and how to adjust their withholding effectively. The 2025 W-4 form was released by the IRS on December 16, 2024, and is available in multiple languages, including English and Spanish.

Filling Out Your W4 Form 2025: A Step-by-Step Guide

The 2025 W-4 form is organized into five steps. It is important to note that only Steps 1 and 5 are required for all employees. Steps 2, 3, and 4 are optional and should be completed only if they apply to an individual’s specific tax situation. These optional steps allow for fine-tuning of withholding to ensure accuracy.

Step 1: Your Basic Information and Filing Status

This initial step requires an individual to provide their personal details. This includes their full name, current mailing address, and Social Security number. It is important that the name provided matches the name on the individual’s Social Security card to ensure proper credit for earnings.

The most critical part of Step 1 is selecting the correct tax filing status. This choice significantly impacts how much tax is withheld from paychecks and determines the standard deduction and tax rates used in calculating withholding. An incorrect filing status here can lead to inaccurate withholding regardless of how carefully other parts of the form are completed. The available options are:

- Single or Married filing separately: This status applies to individuals who are single or married but choose to file their tax return separately from their spouse.

- Married filing jointly or Qualifying surviving spouse: This status is for individuals who are married and plan to file a joint tax return with their spouse. It also applies to a qualifying surviving spouse.

- Head of household: This status is generally for unmarried individuals who pay more than half the cost of keeping up a home for themselves and a qualifying person, such as a child or other dependent.

Step 2: What to Do If You Have Multiple Jobs or a Working Spouse

This step is essential for individuals who hold more than one job at the same time, or for married individuals who file jointly and both spouses work. The purpose of this step is to ensure that enough tax is withheld from all combined income sources to cover the total tax liability. If this step is not completed correctly in situations with multiple incomes, it can lead to significant under-withholding, resulting in a large tax bill at year-end. This occurs because the tax system might assume each job is the only source of income, applying deductions and credits multiple times.

Individuals should choose only one of the following three options to accurately calculate their withholding:

- Option 2(a): Use the IRS Tax Withholding Estimator (www.irs.gov/W4App). This online tool is generally the most accurate method for determining the correct withholding, especially for individuals or their spouses who have self-employment income. After using the estimator, it will provide a specific amount to enter on line 4(c) or other instructions for adjustments.

- Option 2(b): Complete the Multiple Jobs Worksheet on page 3 of the W-4. This worksheet involves some calculations but helps determine an additional amount to withhold from each paycheck.

- Option 2(c): Check this box. This option is suitable only if there are a total of two jobs (either held by one individual or by a married couple filing jointly), and the pay from both jobs is roughly the same. If this box is checked, it must be checked on the W-4 form for both jobs.

A critical instruction for individuals completing Step 2 is to fill out Steps 3 through 4(b) on the W-4 for only one of their jobs, preferably the highest-paying one. These steps should be left blank on the W-4s for all other jobs. This practice prevents the tax system from applying deductions or credits multiple times, which would lead to less tax being withheld than necessary and a potential tax bill at the end of the year.

For individuals who prefer not to disclose details about a second job or other non-job income sources to their employer, the W-4 form offers flexibility. They can choose to simply instruct their employer to withhold an extra amount of tax on line 4(c), or they can make estimated tax payments directly to the IRS themselves. This allows for accurate withholding while respecting privacy concerns.

Step 3: Claiming Your Dependents and Other Tax Credits

This step allows individuals to reduce the amount of tax withheld from their paychecks if they have qualifying children or other dependents, or if they are eligible for other tax credits. It is important to note that this step should only be completed if the individual’s total income is $200,000 or less ($400,000 or less if married filing jointly).

Tax credits are particularly impactful because, unlike deductions that reduce taxable income, credits directly reduce the actual amount of tax owed. By claiming these credits on the W-4, an individual is instructing their employer to withhold less tax, anticipating that these credits will offset their final tax bill. This can directly increase the amount of money received in each paycheck throughout the year.

To calculate the amount to enter in Step 3:

- Multiply the number of qualifying children under age 17 by $2,000.

- Multiply the number of other dependents by $500.

- Add these amounts together. Individuals can also include the amount of any other tax credits they expect to claim, such as education tax credits or the foreign tax credit, on this line.

| Type of Dependent/Credit | Amount to Claim |

| Qualifying Child (under 17) | $2,000 per child |

| Other Dependents | $500 per dependent |

Individuals have the option not to claim dependents in this step, even if they qualify. This choice would result in more tax being taken out of each paycheck, which can be a strategy to reduce a potential tax bill at the end of the year.

Step 4: Making Other Adjustments (Optional)

Step 4 provides individuals with the ability to fine-tune their withholding further, accounting for various income sources, deductions, or simply requesting additional tax to be withheld. This step is designed for individuals with more complex financial situations, such as those with investment income or specific deductions, allowing them to align their withholding more precisely with their actual tax liability.

- Line 4(a) – Other Income (not from jobs): If an individual expects to receive income that will not have tax withheld (such as interest from savings accounts, dividends from investments, or certain retirement income), they can enter that amount here. Including this income helps ensure that enough tax is withheld from regular paychecks to cover the tax on this other income, potentially preventing a large tax bill at year-end.

- Line 4(b) – Deductions: This line is for individuals who plan to claim deductions other than the standard deduction, meaning they will “itemize” their deductions on their tax return, or have other specific deductions like student loan interest or IRA contributions. To determine the amount to enter, individuals can use the Deductions Worksheet provided on page 3 of the W-4 form. Entering an amount here will reduce the tax withheld from their pay. To decide if itemizing deductions might be beneficial, it is helpful to compare expected itemized deductions to the standard deduction amounts for 2025:

| Filing Status | 2025 Standard Deduction |

| Single or Married Filing Separately | $15,000 |

| Married Filing Jointly or Qualifying Surviving Spouse | $30,000 |

| Head of Household | $22,500 |

- Line 4(c) – Extra Withholding: This line allows an individual to request any additional amount of tax to be withheld from each paycheck. This can be a useful option for those who want to be certain they will not owe tax at the end of the year, or for individuals with complex tax situations that are not fully addressed by the other steps.

Step 5: Sign and Submit Your Form

The final and most crucial step is to sign and date the W-4 form. The form is legally invalid without the individual’s signature. By signing, the individual declares, “Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete”. This elevates the act of signing from a mere formality to a legal affirmation of the information provided. Once signed, the completed form should be given to the employer’s human resources or payroll department.

When Should You Update Your W4 Form 2025?

It is not generally required to fill out a new W-4 form every single year if an individual already has one on file with their employer; the current W-4 remains in effect until a change is made. However, it is highly advisable to review tax withholding at least once a year, and especially whenever significant life changes occur. This approach ensures that the W-4 remains a dynamic document that accurately reflects an individual’s evolving tax situation. Proactive W-4 management is a key component of effective personal financial planning, helping individuals adapt their tax payments to their circumstances and avoid unexpected financial burdens.

Here are common reasons to update a W-4:

| Life Event | Why It Matters for Your W-4 |

| Marriage or Divorce | Changes your filing status and potentially your combined income and deductions. |

| New Baby or Dependent | You may qualify for new tax credits, which can reduce your withholding. |

| New Job or Side Gig | Your total income increases, often requiring more withholding to avoid owing tax. |

| Significant Pay Raise/Cut | Your income level changes, directly affecting the amount of tax you owe. |

| Big Tax Bill or Refund | Indicates your previous withholding was inaccurate; an adjustment is needed for the upcoming year. |

To adjust withholding:

- To have more taxes taken out: An individual can reduce the number of dependents claimed in Step 3, or add an extra amount to withhold on line 4(c).

- To have less taxes taken out: An individual can increase the number of dependents claimed in Step 3, reduce the amount on line 4(a) (other income) or 4(c) (extra withholding), or increase the amount on line 4(b) (deductions).

An individual can submit a new W-4 to their employer at any time they need to make a change.

Important Tips and Where to Find More Help

For the most accurate withholding, especially in complex situations, individuals are strongly encouraged to use the IRS Tax Withholding Estimator. This free online tool, available at www.irs.gov/W4App, is the preferred method recommended by the IRS for figuring out withholding. It helps prevent unexpected tax bills or substantial refunds by allowing individuals to input their specific financial details, including multiple jobs, self-employment income, and other income sources. To use the estimator effectively, individuals will need their most recent pay stubs and last year’s tax return. The emphasis on this online tool indicates a shift towards a more self-service, digital approach to tax management.

It is important to remember that the W-4 form is specifically for federal income tax withholding. Most states have their own separate tax withholding forms that individuals must complete, unless they reside in one of the few states that do not have state income tax. Understanding this distinction is essential for comprehensive financial planning and avoiding unexpected state tax bills.

In certain circumstances, an individual may be able to claim exemption from withholding. This means no federal income tax will be withheld from their paychecks. To qualify for 2025, an individual must certify that they had no federal income tax liability in 2024 and expect to have no federal income tax liability in 2025. To claim this exemption, individuals must write “Exempt” in the space below Step 4(c) and complete only Steps 1(a), 1(b), and 5. This “Exempt” status is not permanent and must be renewed each year by February 17 of the following year (e.g., by February 17, 2026, for 2025 exemption). Failing to meet the criteria or forgetting to re-certify can lead to owing taxes and potential penalties because no tax was withheld throughout the year.

For more detailed guidance and official forms, individuals should always refer to official IRS resources. The IRS website (www.irs.gov) provides the latest W-4 form, its instructions, and publications such as Publication 505, “Tax Withholding and Estimated Tax,” which offers comprehensive information for various tax situations.

Conclusion

The W-4 form serves as a fundamental tool for managing federal income tax obligations under the “pay-as-you-go” system. While the 2025 form maintains the structure introduced in 2020, with only minor updates, its accurate completion remains vital for personal financial well-being. Individuals must understand how each step, from selecting the correct filing status to making optional adjustments for other income or deductions, directly influences the amount of tax withheld from their paychecks.

The ability to dynamically adjust the W-4 in response to life changes—such as marriage, new dependents, or job changes—is crucial for maintaining accurate withholding and avoiding year-end tax surprises. Utilizing resources like the IRS Tax Withholding Estimator is highly recommended, as it provides the most precise guidance for complex financial situations. By taking a proactive approach to W-4 management and understanding its intricacies, individuals can ensure they are meeting their tax responsibilities efficiently, thereby optimizing their take-home pay and preventing unexpected financial burdens.