Table of Contents

IRS Form 15112 – Earned Income Credit Worksheet (CP 27) – Raising a family on a modest income can stretch budgets thin, but the Earned Income Tax Credit (EITC)—one of the IRS’s most impactful refunds—can deliver up to $8,046 for families with three or more qualifying children in 2025, lifting millions out of poverty annually. If you’ve received IRS Notice CP 27, it might mean you missed claiming this credit on a prior return, and the IRS is offering a second chance. Enter IRS Form 15112—the Earned Income Credit Worksheet (CP 27)—a simple tool to verify eligibility and unlock your refund. For tax year 2025, with EITC maximums adjusted for inflation and the credit’s earned income threshold at $18,591 for singles with no children, Form 15112 (Rev. March 2025) ensures accurate claims without amending your original return. This SEO-optimized guide, based on the latest IRS resources, covers everything from notice details to step-by-step completion, helping eligible families secure thousands in unclaimed credits before the April 15, 2028, deadline for 2021 refunds.

What Is IRS Form 15112?

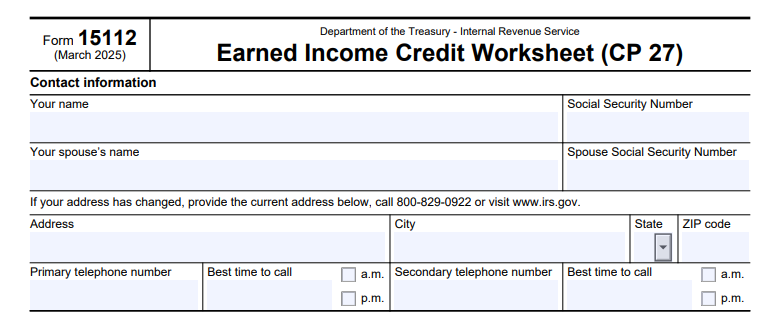

IRS Form 15112 is a one-page worksheet accompanying Notice CP 27, designed to help taxpayers confirm eligibility for the EITC on a previously filed return where the credit wasn’t claimed. Issued by the IRS to those identified via data matching (e.g., SSA records showing unreported dependents), it guides you through basic qualifiers like child age, residency, and earned income, then ties into Schedule 8812 for the final calculation. Unlike the full EITC worksheet in Pub. 596, Form 15112 is notice-specific, focusing on verification rather than initial filing.

Key features:

- Eligibility Screening: Checks for qualifying children (under 17, SSN-required) and income limits (e.g., $63,398 max for three+ kids).

- Refund Trigger: If eligible, the IRS issues your EITC—up to $8,046 for 2025—without refiling.

- No Cost/Amendment: Free; no need for Form 1040-X if responding to CP 27.

The March 2025 revision (OMB No. 1545-0074) updates income thresholds and adds guidance for electronic responses via the IRS Document Upload Tool. Download the PDF from IRS.gov/pub/irs-pdf/f15112.pdf.

Understanding IRS Notice CP 27 and When You Need Form 15112

Notice CP 27 arrives in the mail when the IRS spots potential EITC eligibility you overlooked—often due to unreported children from birth records or prior-year mismatches. It’s good news: The IRS is proactively offering a refund, but you must verify via Form 15112 within 30 days (or by the tax return deadline, whichever is later, e.g., April 18, 2025, for 2021 claims).

| Scenario | Do You Need Form 15112? | Action |

|---|---|---|

| Received CP 27 | Yes | Complete and return to confirm eligibility; expect 6-8 weeks for refund. |

| Missed EITC on Original Return | No—use Schedule 8812 | Amend via 1040-X within 3 years (e.g., by April 15, 2028, for 2024). |

| No Notice, Suspect Eligibility | No | Use EITC Assistant on IRS.gov; file Schedule 8812 with next return. |

| Non-Qualifying (e.g., No Kids, High Income) | Optional | Respond anyway—IRS explains denial. |

CP 27 targets low/moderate-income filers; respond even if you think ineligible to close the inquiry.

Step-by-Step Guide to Completing IRS Form 15112

Form 15112 is user-friendly—gather SSNs, birth certificates, and your prior return. Complete Schedule 8812 separately for the math.

- Contact Information (Top Section): Enter name, SSN, spouse details, and current address if changed (call 800-829-0922 or update at IRS.gov).

- Filing Status (Line 1): Check single, married filing jointly, etc., matching your original return.

- Qualifying Children (Lines 2-4): For each child, list name, SSN, birth/death dates, relationship, and months lived with you (>half year?).

- Eligibility Questions (Line 5): Answer yes/no: U.S. citizen? Lived with you >half year? You provided >half support? Under 17? Valid SSN by filing due date?

- Qualifying Children Total (Line 6): Count “yes” to all for Line 5—e.g., 2 children qualify.

- Attach Schedule 8812: Complete the full EITC worksheet (Pub. 596) and include; calculate earned income (wages minus exclusions like 401(k)).

- Sign and Date: Under penalty of perjury; valid for 30 days from CP 27 date.

- Submit: Mail in provided envelope or upload via IRS Document Upload Tool (irs.gov); include docs like birth certs for 2025 births/deaths.

For 2021 claims (via 2025 response), file by April 18, 2025. Processing: 6-8 weeks; call 800-829-0922 after 8 weeks.

2025 EITC Eligibility and Maximum Credits with Form 15112

The EITC rewards low/moderate earned income; Form 15112 verifies basics before Schedule 8812 computes the amount. Max refundable: $8,046 (3+ kids), phaseout at $63,398 (3+ kids, single).

| Family Size | Max Credit | Income Limit (Single) | Income Limit (Married Joint) |

|---|---|---|---|

| No Children | $632 | $18,591 | $25,511 |

| 1 Child | $4,213 | $49,084 | $56,004 |

| 2 Children | $6,960 | $55,768 | $62,688 |

| 3+ Children | $8,046 | $63,398 | $70,318 |

Qualifiers: Earned income ≥$1 (wages/self-employment); AGI ≤ limits; no foreign income disqualification. Form 15112 ensures children meet tests—respond to claim retroactively (e.g., 2021 by April 18, 2025).

Submitting Form 15112: Methods and Processing in 2025

Respond within 30 days of CP 27 (or by return deadline for older years). No fee; electronic preferred.

- Mail: Use pre-addressed envelope—expect 6-8 weeks.

- Upload Tool: IRS.gov Document Upload Tool—scan PDF, faster (4-6 weeks).

- Phone Help: 800-829-0922 for questions; status after 8 weeks.

If denied, appeal via letter; EITC Assistant on IRS.gov pre-screens.

Common Mistakes When Completing Form 15112 and How to Avoid Them

CP 27 responses yield 80%+ approvals if accurate—avoid these:

- Incomplete Child Info: Missing SSNs/months lived—attach certs.

- Wrong Status: Mismatching original return—pull copy.

- No Schedule 8812: Essential for calc—use Pub. 596 worksheet.

- Late Response: Beyond 30 days—mail immediately.

- Assuming Eligibility: Answering “no” disqualifies—review tests carefully.

Use free VITA/TCE help; EITC Assistant validates.

No Penalties for IRS Form 15112—But Missed EITC Costs Dearly

Form 15112 itself has no penalties—it’s voluntary verification. However, ignoring CP 27 forfeits your refund (e.g., $8,046 lost), and false info risks perjury (§7206). Respond promptly for 6-8 week processing; denials explain next steps.

Frequently Asked Questions About IRS Form 15112

What triggers Notice CP 27 in 2025?

IRS data matching (e.g., SSA births) flags unclaimed EITC—respond with Form 15112.

Can I claim EITC for 2021 via 2025 response?

Yes—by April 18, 2025; up to 3 years back.

What’s the max EITC for 3+ kids in 2025?

$8,046 refundable; phaseout at $63,398 single.

How to submit Form 15112 electronically?

Via IRS Document Upload Tool—scan and upload PDF.

Does Form 15112 require Schedule 8812?

Yes—attach for full calc.

Visit IRS.gov/CP27 for more.

Final Thoughts: Unlock Your EITC Refund with IRS Form 15112 in 2025

IRS Form 15112 turns a CP 27 notice into a windfall, verifying eligibility for up to $8,046 per family in missed EITC—crucial for low-income households amid 2025’s $63,398 phaseout. The March 2025 revision’s simplicity and upload tool make responding effortless; complete within 30 days, attach Schedule 8812, and await your 6-8 week refund. Download from IRS.gov today—don’t let unclaimed credits slip away; use the EITC Assistant to confirm and VITA for free help.

This article is informational only—not tax advice. Consult IRS.gov or a professional.

IRS Form 15112 Download and Printable

Download and Print: IRS Form 15112