Table of Contents

IRS Form 4562 – Depreciation and Amortization (Including Information on Listed Property) – As a business owner or investor, maximizing deductions for assets like equipment, vehicles, and software is essential for reducing your 2025 tax bill. IRS Form 4562, “Depreciation and Amortization (Including Information on Listed Property),” is your key tool for claiming these deductions through methods like MACRS, Section 179 expensing, and bonus depreciation. With recent legislative changes from the One Big Beautiful Bill Act (OBBBA) restoring 100% bonus depreciation, 2025 offers significant opportunities for immediate write-offs on qualified property.

This SEO-optimized guide covers everything from eligibility to step-by-step filing, helping you navigate Form 4562 efficiently. Whether you’re depreciating office furniture or amortizing startup costs, proper use can lower taxable income and improve cash flow. Download the latest 2025 form and instructions from IRS.gov to stay compliant.

What Is IRS Form 4562?

IRS Form 4562 allows taxpayers to report depreciation and amortization deductions for business or investment property, elect Section 179 expensing for certain assets, and detail the business use of listed property like vehicles and computers. Depreciation spreads the cost of tangible assets (e.g., machinery, buildings) over their useful life, while amortization handles intangibles (e.g., patents, goodwill).

Key components include:

- Section 179 Election: Immediate expensing of up to $1,250,000 in qualifying property costs (phase-out starts at $3,130,000 total purchases).

- Bonus Depreciation: Now permanently at 100% for qualified property placed in service after January 19, 2025, thanks to OBBBA—up from the prior 40% phase-down.

- MACRS Depreciation: The standard system for most post-1986 assets, using declining balance methods.

- Listed Property Rules: Strict substantiation for assets prone to personal use, with luxury auto limits.

For 2025, file Form 4562 with your return (e.g., Form 1040 Schedule C, Form 1065) if claiming these deductions. No form is needed for prior-year depreciation unless listed property or amortization applies.

Who Needs to File IRS Form 4562 in 2025?

You must file Form 4562 if you:

- Place depreciable property in service during 2025.

- Claim Section 179 or bonus depreciation.

- Depreciate listed property (e.g., cars, laptops) or vehicles via actual expenses.

- Amortize costs like research and experimental expenses (now over 5 years under Section 174).

- Report depreciation on corporate returns (except S corps, which use it for new assets).

Sole proprietors, partnerships, and corporations file separately for each business. Farmers and real estate investors often use it for equipment or improvements. Skip it if using standard mileage rates for vehicles or if all assets were placed in service pre-2025 (except listed property).

Types of Depreciation and Amortization Covered by Form 4562

Form 4562 supports various methods to match deductions with asset use:

- Modified Accelerated Cost Recovery System (MACRS): Default for most tangible property. Uses General Depreciation System (GDS) with 200% declining balance (switching to straight-line) for 3-20 year classes, or straight-line for real estate (27.5 years residential, 39 years nonresidential).

- Alternative Depreciation System (ADS): Required for listed property at ≤50% business use; straight-line over longer periods (e.g., 5 years for autos).

- Section 179 Expensing: Deduct full cost of qualifying assets like machinery or software immediately, up to limits.

- Bonus Depreciation: 100% allowance for new/used qualified property (e.g., equipment with ≤20-year recovery period) placed in service after Jan. 19, 2025.

- Amortization: Straight-line over fixed periods for intangibles (e.g., 15 years for Section 197 assets like goodwill; 180 months for startup costs).

- Other Methods: Unit-of-production for output-based assets or income forecast for films.

Qualifying property excludes land, inventory, and personal-use items. Business use must exceed 50% for accelerated methods; otherwise, use ADS.

Key Changes to IRS Form 4562 for 2025

The OBBBA, signed in July 2025, brings major updates:

- Bonus Depreciation: Restored to 100% permanently for qualified assets post-Jan. 19, 2025 (transitional 40% for Jan. 1-19, 2025 placements).

- Section 179 Limits: Increased to $1,250,000 max deduction; phase-out threshold at $3,130,000 (inflation-adjusted).

- SUV Cap: Raised to $31,300 for Section 179 on sport utility vehicles.

- Research Expenses: Continue 5-year amortization under Section 174; no immediate expensing.

- Auto Limits: First-year depreciation cap at $20,500 (with bonus) or $12,400 (without) for passenger autos placed in 2025.

These changes expand immediate deductions, but elect out of bonus if it exceeds your needs. Check IRS Publication 946 for full details.

IRS Form 4562 Download and Printable

Download and Print: IRS Form 4562

How to Complete IRS Form 4562: Step-by-Step Guide

Gather records: Purchase dates, costs, business-use percentages, prior depreciation (from Form 4562 worksheets). Use tax software for calculations, but verify manually.

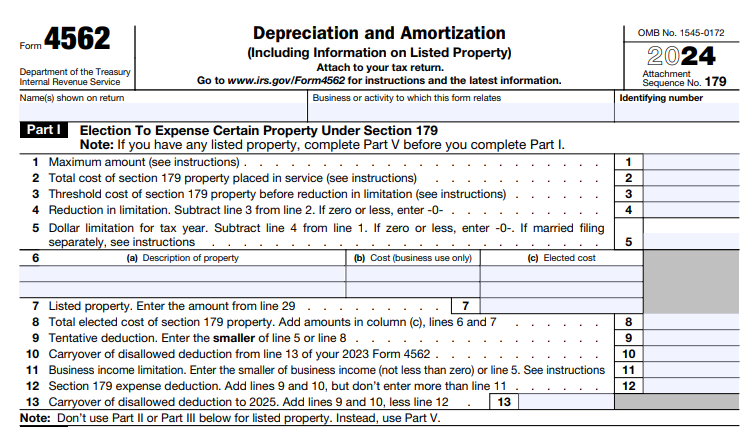

Part I: Election to Expense Under Section 179

- Line 1: Enter max deduction ($1,250,000 for 2025).

- Line 2: Total cost of Section 179 property.

- Line 3: Threshold ($3,130,000); reduce Line 1 if exceeded.

- Lines 4-7: List property (description, cost, elected cost); exclude listed property.

- Line 10: Carryover from prior years.

- Line 11: Limit to business income.

- Line 12: Total deduction; carry over excess.

Example: Buy $800,000 in equipment—expense fully if income allows, reducing basis to zero.

Part II: Special Depreciation Allowance and Other Depreciation

- Line 14: 100% of basis for qualified 2025 property (after Section 179).

- Line 15: Non-MACRS methods (e.g., units-of-production); attach statement.

- Line 16: Other depreciation (e.g., pre-1987 ACRS).

Part III: MACRS Depreciation

- Line 17: Prior-year property (use tables for remaining basis).

- Lines 19a-19i: New GDS property—enter class, date, basis, period, convention (half-year default), method (200% DB), deduction.

- Lines 20a-20d: ADS property.

Use IRS tables (e.g., Table A-1 for 5-year half-year: 20% Year 1).

Part IV: Summary

Totals from Parts I-III; deduct on your return.

Part V: Listed Property

- Lines 25-28: Section 179/special allowance and depreciation for >50% or ≤50% use vehicles/computers.

- Sections B/C: Vehicle logs and employer policies.

Luxury limits apply; recapture if use drops.

Part VI: Amortization

- Line 42: New 2025 costs (e.g., startup over 180 months).

- Line 43: Prior-year (attach details).

- Line 44: Total to your return.

Attach elections and worksheets.

Common Mistakes to Avoid on Form 4562

- Incorrect Business Use %: Overstating leads to audits; keep mileage logs.

- Missing Conventions: Apply mid-quarter if >40% assets in Q4.

- Forgetting Recapture: Report income if use falls below 50%.

- Basis Errors: Subtract Section 179/bonus before MACRS.

- Election Oversights: File statements timely for out-of-bonus or amortization.

Review Publication 946 to sidestep penalties.

Tips for Maximizing Deductions on IRS Form 4562 in 2025

- Time Purchases: Place assets in service by Dec. 31, 2025, for full-year bonus.

- Elect Strategically: Skip bonus for AMT-sensitive filers; use Section 179 for income limits.

- Track Listed Property: Use apps for logs; qualify for higher auto limits with EVs.

- Bundle Assets: Group into general asset accounts for simplicity.

- Consult Pros: CPAs handle complex amortization like R&E costs.

Software like TurboTax integrates Form 4562 seamlessly.

Final Thoughts: Unlock Tax Savings with IRS Form 4562

Mastering Form 4562 in 2025 means leveraging OBBBA’s 100% bonus and expanded Section 179 to accelerate deductions on business property. Accurate filing ensures compliance while optimizing your return—potentially saving thousands.

For the official 2025 Form 4562 and Pub. 946, visit IRS.gov/Form4562. Complex scenarios? Partner with a tax advisor. Start your depreciation planning now for a stronger 2026.