Table of Contents

IRS Form 6251 – Alternative Minimum Tax – Individuals – As tax season approaches, high-income earners and those with complex deductions must navigate the Alternative Minimum Tax (AMT) to avoid surprises on their 2025 returns. IRS Form 6251, “Alternative Minimum Tax—Individuals,” is the essential tool for calculating whether this parallel tax system applies to you, ensuring you pay the higher of your regular tax or AMT liability. With the One Big Beautiful Bill Act (OBBBA) of 2025 making key Tax Cuts and Jobs Act (TCJA) provisions permanent, including higher AMT exemptions and phaseouts, fewer taxpayers face the AMT—but those who do could owe thousands more.

This SEO-optimized guide, based on the latest IRS updates, breaks down Form 6251 for the 2025 tax year (filed in 2026). From exemption amounts to step-by-step filing, we’ll help you determine if AMT triggers apply and how to minimize exposure. Download the draft 2025 Form 6251 and instructions from IRS.gov to stay ahead of the April 15, 2026, deadline.

What Is IRS Form 6251?

IRS Form 6251 computes your tentative minimum tax under the AMT, a safeguard enacted in 1969 to prevent high-income individuals from using excessive deductions, exclusions, or preferences to reduce their regular tax to zero. The AMT recalculates taxable income by adding back certain “tax preference items” (e.g., state taxes, ISO exercises) and disallowing others (e.g., miscellaneous itemized deductions), then applies rates of 26% or 28%. If the AMT exceeds your regular tax, you pay the difference.

For 2025, Form 6251 remains structurally similar to 2024, with inflation-adjusted thresholds. It integrates with Form 1040 (line 17) and coordinates with credits like the AMT Foreign Tax Credit (Form 1116). Attach it only if AMT is due; otherwise, keep as a worksheet.

Who Needs to File IRS Form 6251 in 2025?

You must complete and potentially attach Form 6251 if:

- Your adjusted gross income (AGI) exceeds the AMT exemption (e.g., $88,100 single, $137,000 married filing jointly).

- You claim preferences like incentive stock option (ISO) exercises, private activity bond interest, or accelerated depreciation.

- You take itemized deductions for state/local taxes (SALT), property taxes, or miscellaneous expenses disallowed under AMT.

- You have passive losses, tax-exempt interest, or foreign income adjustments.

Even if no AMT is owed, complete it to check—tax software like TurboTax automates this. About 200,000–300,000 filers (mostly AGI >$200,000) will owe AMT in 2025, down from pre-TCJA levels due to OBBBA’s permanence. Estates, trusts, and nonresident aliens (Form 1040-NR) follow similar rules.

2025 AMT Exemption Amounts and Phaseouts

OBBBA’s extension of TCJA reforms keeps AMT relief intact, with inflation adjustments via Revenue Procedure 2024-40. Here’s a quick reference:

| Filing Status | AMT Exemption | Phaseout Threshold | Phaseout Rate |

|---|---|---|---|

| Single/Head of Household | $88,100 | $626,350 | 25% |

| Married Filing Jointly/Qualifying Surviving Spouse | $137,000 | $1,252,700 | 25% |

| Married Filing Separately | $68,500 | $626,350 | 25% |

Exemptions phase out at 25 cents per dollar over the threshold (e.g., $10,000 over = $2,500 exemption reduction). At twice the threshold, the exemption zeros out. Rates: 26% on AMTI up to $239,100 ($119,550 MFS), then 28%.

Key Changes to IRS Form 6251 and AMT for 2025

The OBBBA, signed July 4, 2025, permanently adopts TCJA’s higher exemptions and phaseouts, preventing a 2026 “cliff” where exemptions would drop (e.g., to $50,000 single). Inflation tweaks:

- Exemptions up ~3% from 2024 ($85,700 single to $88,100).

- Phaseouts up to $626,350 single/$1,252,700 joint (from $609,350/$1,218,700).

- 28% bracket threshold: $239,100 (up from $232,600).

No new preference items, but monitor for ISO-heavy tech workers or SALT-capped filers. AMT credit (Form 8801) carries forward indefinitely for prior-year payers.

IRS Form 6251 Download and Printable

Download and Print: IRS Form 6251

How to Complete IRS Form 6251: Step-by-Step Guide for 2025

Gather Form 1040 data, Schedule A/D, Form 2555 (foreign income), and prior AMT records. Use the Exemption Worksheet and AMT Schedule D if capital gains apply.

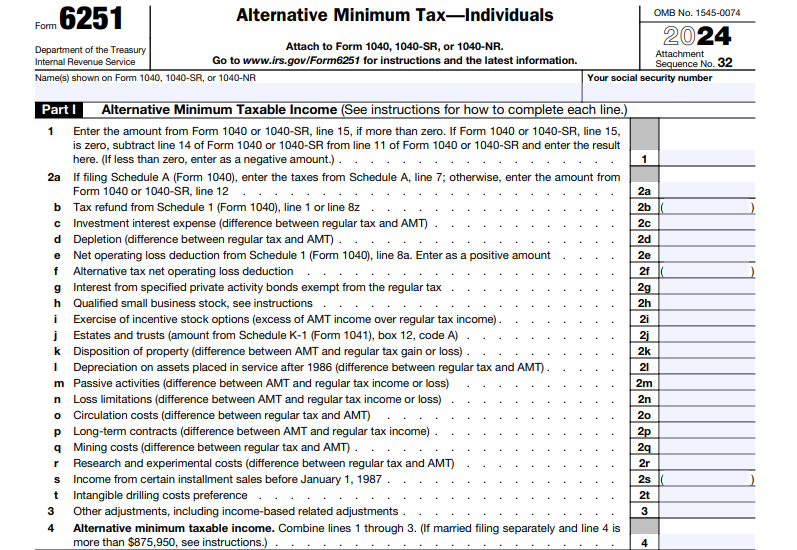

Part I: Alternative Minimum Taxable Income (AMTI)

- Line 1: Enter AGI from Form 1040, line 11 (subtract write-ins if line 15=0).

- Lines 2a–2l: Add back preferences/adjustments:

- 2a: Taxes from Schedule A (e.g., SALT, misc. deductions).

- 2c: Investment interest (refigure Form 4952 for AMT).

- 2e: Depletion excess.

- 2i: ISO spread (bargain element).

- 2j: Private activity bond interest.

- 2l: Other (e.g., passive losses, ATNOL limited to 90% AMTI).

- Line 3: Other adjustments (e.g., depreciation differences, charitable contributions on AMT basis).

- Line 4: AMTI total (line 1 + 2 + 3). For MFS, add 25% of excess over $626,350 (min. $68,500 if ≥$1,252,700).

Example: AGI $150,000 + $20,000 SALT + $10,000 ISO = $180,000 AMTI.

Part II: Alternative Minimum Tax

- Line 5: Exemption from worksheet (e.g., $88,100 single; phaseout if AMTI >$626,350).

- Line 6: AMTI minus exemption.

- Line 7: AMT (26% on first $239,100, 28% after; use Foreign Earned Income Worksheet if applicable).

- Line 8: Subtract AMT foreign tax credit (Form 1116).

- Line 9: Other credits (e.g., child tax, but limited).

- Line 10: Tentative minimum tax (line 7 – 8 – 9).

- Line 11: AMT = line 10 minus regular tax (Form 1040, line 16). If positive, add to line 17.

Part III: Tax Computation with Maximum Capital Gains Rates

Refigure if Schedule D items differ (e.g., AMT basis for capital gains). Use AMT worksheets for qualified dividends/28% gains.

Common Mistakes to Avoid on Form 6251

- Forgetting Add-Backs: Overlooking ISO exercises or SALT—triggers audits.

- Wrong Exemption: Use 2025 figures; phaseout errors inflate liability.

- Ignoring Carryforwards: Miss AMT credit (Form 8801) from prior years.

- No AMT Schedule D: Skip for capital gains, leading to underpayment.

- MFS Penalty: Extra 25% AMTI adjustment if over thresholds.

Per IRS Pub. 17, document all adjustments.

Tips for Minimizing AMT Liability in 2025

- Time ISO Exercises: Spread over years to stay under phaseouts.

- Harvest Losses: Offset gains to lower AMTI.

- Bunch Deductions: Defer SALT if near exemption edge.

- Claim Credits Wisely: Prior-year AMT generates future credits.

- Use Software: TurboTax flags AMT triggers.

- Consult a Pro: For foreign income or complex investments.

With OBBBA’s permanence, plan now to leverage stable rules.

Final Thoughts: Conquer AMT with IRS Form 6251 in 2025

IRS Form 6251 ensures fair taxation but can catch filers off-guard—yet OBBBA’s extensions provide lasting relief for 2025 and beyond. Accurate completion minimizes surprises, potentially saving thousands via credits and planning.

For the official 2025 Form 6251 and instructions, visit IRS.gov/Form6251. High earners or deduction-heavy? A tax advisor can optimize your strategy. Start your AMT projection today for a smoother 2026 filing.