Table of Contents

IRS Form 943 – Employer’s Annual Federal Tax Return for Agricultural Employees – Agricultural employers face unique tax reporting obligations, from seasonal hiring to specialized wage thresholds. IRS Form 943, “Employer’s Annual Federal Tax Return for Agricultural Employees,” simplifies compliance by consolidating your annual reporting of Social Security, Medicare, and federal income tax withholding for farmworkers. With the 2025 social security wage base rising to $176,100 and new provisions under the One Big Beautiful Bill Act (OBBBA) for overtime withholding, accurate filing ensures you avoid penalties while claiming credits like the qualified small business payroll tax credit.

This SEO-optimized guide, drawn from official IRS resources, covers everything for the 2025 tax year (wages paid in 2025, due February 2, 2026). Whether you’re a family farm or large agribusiness, mastering Form 943 supports cash flow and IRS compliance. Download the draft 2025 Form 943 and instructions from IRS.gov to prepare.

What Is IRS Form 943?

IRS Form 943 is the annual return for agricultural employers to report federal employment taxes on wages paid to farmworkers. It covers:

- Social Security Tax: 6.2% each from employer and employee (12.4% total) on wages up to $176,100 per employee.

- Medicare Tax: 1.45% each (2.9% total) on all wages, with no limit.

- Additional Medicare Tax: 0.9% withholding on wages over $200,000 (employee-only; no employer match).

- Federal Income Tax Withholding: From employees’ paychecks.

Unlike quarterly Form 941 for non-agricultural employers, Form 943 allows annual filing with semiweekly or monthly deposits. Use Form 943-A for optional monthly tax records, and Form 943-X to amend errors. Household farm employees can report here or on Schedule H (Form 1040). For 2025, electronic filing is encouraged via Modernized e-File (MeF), now including Form 943-X.

Who Needs to File IRS Form 943 in 2025?

File Form 943 if you employed farmworkers in 2025 and paid:

- $150 Test: $150 or more in cash wages to any one farmworker for farmwork.

- $2,500 Test: $2,500 or more in total cash and noncash wages to all farmworkers.

These apply separately per worker or group; special rules exempt certain hand-harvest laborers under $150. Once filed, report annually—even with zero taxes—until a final return. Exemptions include non-agricultural wages (use Form 941) or Puerto Rico employers (unless U.S. withholding applies).

Certified Professional Employer Organizations (CPEOs), section 3504 agents, and aggregate filers must file electronically with Schedule R (Form 943). H-2A visa workers: Withhold income tax optionally; no Social Security/Medicare if visa-related.

IRS Form 943 Download and Printable

Download and Print: IRS Form 943

Key Changes to IRS Form 943 for 2025

The 2025 form incorporates inflation adjustments and OBBBA updates:

- Wage Base Increase: Social Security limit rises to $176,100 (from $168,600 in 2024).

- Overtime Withholding: Under OBBBA (P.L. 119-21), qualified overtime (exceeding FLSA regular rate) up to $12,500 ($25,000 joint) is deductible for 2025–2029; update Form W-4 and use Pub. 15-T for withholding. Report on W-2/1099; subject to employment taxes.

- Payroll Tax Credit Expansion: Qualified small business credit limit $500,000 (post-2022); apply quarterly via Form 8974 to reduce employer shares.

- Filing Enhancements: New “Aggregate Return Filers Only” section; e-file Form 943-X; direct deposit refunds mandatory per Executive Order 14247; return transcripts available online for 2023+.

- Due Date Shift: February 2, 2026 (or February 10 with timely deposits); W-2/W-3 and 1099s due same date to SSA.

No changes to Medicare rates (1.45% each). COVID-19 credits expired; claim via Form 943-X if applicable.

Where to File IRS Form 943 in 2025

Electronic filing is preferred (IRS.gov/EmploymentEfile). For paper, use these addresses based on location:

| If You’re In… | Without Payment | With Payment |

|---|---|---|

| CT, DE, DC, GA, IL, IN, KY, ME, MD, MA, MI, NH, NJ, NY, NC, OH, PA, RI, SC, TN, VT, VA, WV, WI | Dept. of the Treasury Internal Revenue Service Kansas City, MO 64999-0008 |

Internal Revenue Service P.O. Box 806533 Cincinnati, OH 45280-6533 |

| AL, AK, AZ, AR, CA, CO, FL, HI, ID, IA, KS, LA, MN, MS, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WY | Dept. of the Treasury Internal Revenue Service Ogden, UT 84201-0008 |

Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

| No legal residence/principal place of business in any state (incl. PR) | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

| Exempt orgs, gov’t entities, Indian tribes | Dept. of the Treasury Internal Revenue Service Ogden, UT 84201-0008 |

Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

How to Complete IRS Form 943: Step-by-Step Guide for 2025

Gather payroll records, Forms W-2/W-3, and deposit proofs. Use tax software for e-filing; round to whole dollars.

Header and Basic Info

- Enter EIN (apply at IRS.gov if needed), name, address, and calendar year (2025).

- Check boxes for final return, amended (use Form 943-X instead), or third-party designee.

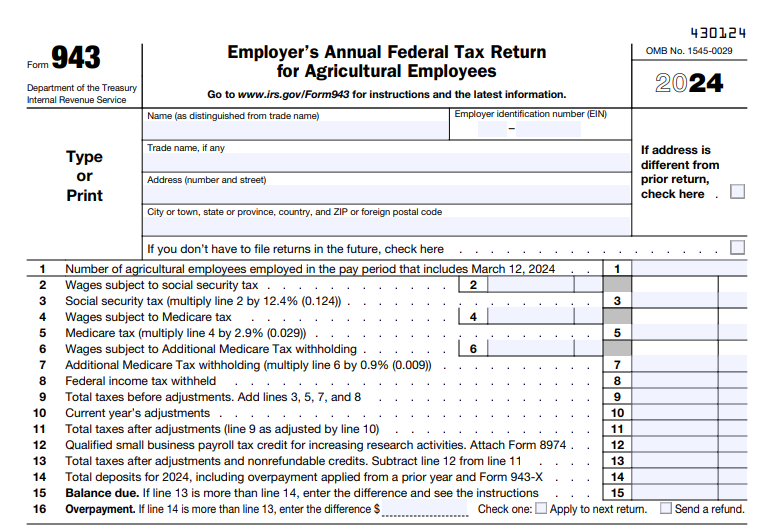

Part 1: Total Employment Taxes (Lines 1–13)

- Line 1: Agricultural employees in March 12, 2025, pay period (exclude household, nonpay, retirees).

- Line 2: Social Security wages (up to $176,100; include cash, fringes).

- Line 3: Social Security tax (line 2 × 12.4%).

- Line 4: Medicare wages (all; no limit).

- Line 5: Medicare tax (line 4 × 2.9%).

- Line 6: Additional Medicare wages (> $200,000).

- Line 7: Additional Medicare tax (line 6 × 0.9%).

- Line 8: Federal income tax withheld.

- Line 9: Total before adjustments (sum lines 3+5+7+8).

- Line 10: Adjustments (e.g., uncollected sick pay; negative for credits).

- Line 11: Total after adjustments (line 9 + 10).

- Line 12: Qualified small business credit (from Form 8974).

- Line 13: Net taxes (line 11 – 12; ≥0).

Part 2: Deposits and Payments (Lines 14–16)

- Line 14: Total deposits (EFTPS records).

- Line 15: Balance due (line 13 – 14; pay via EFT).

- Line 16: Overpayment (line 14 – 13; refund or credit).

Part 3: Monthly Summary (Line 17, if applicable)

For monthly depositors (if line 13 ≥ $2,500): Enter liabilities per month; must equal line 13.

Part 4: Third-Party Designee

Authorize a paid preparer if needed.

Sign and date; attach W-2 summary if paper filing. Reconcile with W-2 boxes (e.g., SS wages = box 3).

Deposits and Payments for 2025

Deposit via EFTPS if line 13 ≥ $2,500: Monthly (by 15th next month) or semiweekly (within 3 banking days). No deposit if < $2,500—pay with return. Balance due: EFT, EFW (e-file), or check with Form 943-V. Overpayments: Direct deposit now available.

Common Mistakes to Avoid When Filing Form 943

- Wage Threshold Errors: Misapplying $150/$2,500 tests—audit trigger.

- Deposit Timing: Late EFTPS = penalties (2–15% of underpayment).

- Reconciliation Failures: W-2 totals mismatch Form 943—file Form W-3 corrections.

- Missing Credits: Forgetting Form 8974 for R&D payroll credit.

- Paper Filing Oversights: Wrong address delays processing.

Penalties: Up to 5% per month for late filing (25% max), plus interest; trust fund recovery (100%) for willful nonpayment.

Tips for Agricultural Employers Filing Form 943 in 2025

- Go Electronic: E-file for faster refunds; access transcripts online.

- Track Overtime: Use new W-4 for OBBBA deductions; report separately on W-2.

- Leverage Credits: Elect $500,000 R&D credit to offset up to 100% of employer taxes quarterly.

- Outsource Wisely: You’re liable for third-party errors—verify compliance.

- Software Integration: QuickBooks or payroll apps sync with EFTPS.

- Plan for H-2A: Optional withholding; exempt from FICA if applicable.

Consult Pub. 15 for ag-specific rules.

Final Thoughts: Streamline Your 2025 Ag Tax Compliance with Form 943

IRS Form 943 empowers agricultural employers to handle employment taxes efficiently, with 2025 updates like the higher wage base and overtime relief enhancing flexibility. Timely filing by February 2, 2026, minimizes penalties and maximizes credits—vital for farm profitability.

For the official 2025 Form 943 and instructions, visit IRS.gov/Form943. Complex setups like CPEOs? A tax pro can optimize. Start reviewing payroll now for a hassle-free 2026.