Table of Contents

IRS Form 1120-H – U.S. Income Tax Return for Homeowners Associations – Homeowners associations (HOAs) manage essential community services like maintenance, landscaping, and amenities, but they also face unique tax obligations on non-exempt income. IRS Form 1120-H, “U.S. Income Tax Return for Homeowners Associations,” allows qualifying HOAs to elect special tax treatment under Section 528, excluding exempt function income—such as membership dues and fees—from gross income. For the 2025 tax year, with electronic filing now available and an increased late-filing penalty, timely compliance is crucial to avoid costs and leverage benefits like the 30% flat tax rate on taxable income.

This SEO-optimized guide, based on the latest IRS resources, provides a step-by-step walkthrough for filing by March 15, 2026 (or the 15th day of the third month after fiscal year-end). Whether your HOA is electing for the first time or amending a prior return, understanding Form 1120-H ensures accurate reporting and potential refunds. Download the 2025 draft form and instructions from IRS.gov/Form1120H to stay compliant.

What Is IRS Form 1120-H?

IRS Form 1120-H is the specialized income tax return for homeowners associations, enabling them to claim tax benefits under IRC Section 528. It treats the association as a taxable entity but allows exclusion of “exempt function income” (e.g., assessments for common area upkeep) from taxation, while taxing non-exempt income—like interest, advertising, or facility rentals—at a flat 30% rate (32% for timeshare associations). This simplifies reporting compared to the standard corporate Form 1120, which uses graduated rates but requires more detailed deductions.

Key advantages:

- Exempt Income Exclusion: Up to 100% of dues and similar revenues if used for exempt purposes.

- Flat Tax Simplicity: No need for complex depreciation or NOL carryforwards.

- Election Mechanism: Filing the form constitutes the Section 528 election, revocable only with IRS consent.

For 2025, the form supports e-filing via Modernized e-File (MeF) starting January 2025, streamlining submissions for HOAs filing 10+ returns annually. Use it for calendar year 2025 or fiscal years beginning in 2025 and ending in 2026.

Who Needs to File IRS Form 1120-H in 2025?

Homeowners associations must file Form 1120-H if they:

- Qualify under Section 528(c)(1): Condominium management associations, residential real estate associations, or timeshare associations with at least 100 lots/plots/units and common areas.

- Elect the benefits by filing the form (no separate application needed).

- Have any taxable non-exempt income or wish to exclude exempt income.

Even with no taxable income, file to maintain the election. Non-qualifying or non-electing HOAs use Form 1120. Tax-exempt HOAs under Section 501(c)(4) or (7) may file Form 990 or 1120, but Form 1120-H offers distinct advantages for taxable entities.

Mandatory e-filing applies if your HOA files 10+ returns (e.g., 1099s, W-2s) in the calendar year, per T.D. 9972 regulations effective for 2024 and beyond. Attach to consolidated returns if part of a group.

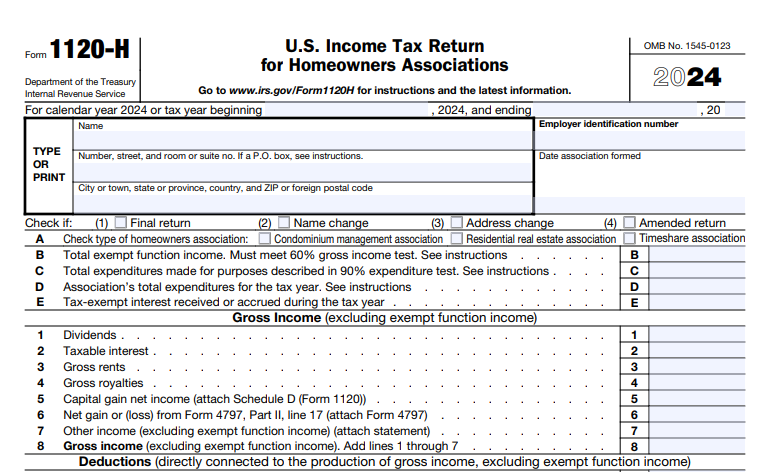

Key Components of IRS Form 1120-H

Form 1120-H is concise, with lines for income segregation and basic computations. No schedules are required, but attach statements for details.

| Section | Purpose | Key Lines for 2025 |

|---|---|---|

| Header | Basic info | EIN, name, address, tax year (e.g., calendar 2025). |

| Income | Exempt vs. non-exempt | Line 1: Total exempt function income (dues, fees). Line 2: Total income. Line 3: Non-exempt income (line 2 – 1). |

| Deductions | Allocable to non-exempt | Line 4: Deductions (e.g., management fees, utilities; limited to non-exempt income). |

| Tax Computation | Flat rate application | Line 5: Taxable income (line 3 – 4). Line 6: Tax at 30% (32% for timeshares). |

| Payments/Refunds | Balance due/refund | Line 10: Overpayment options (credit to 2026 or refund). |

Related forms: Form 1120-HX for amendments (paper only, as e-filing not yet supported for amendments). For interest expense limitations, use Form 8990.

IRS Form 1120-H Download and Printable

Download and Print: IRS Form 1120-H

How to Complete IRS Form 1120-H: Step-by-Step Guide for 2025

Gather records: Financial statements, bank interest, rental income logs, and deduction receipts. Use software like Drake Tax for integration.

Step 1: Header and Election

- Enter EIN (apply via Form SS-4 if needed), name, address.

- Tax year: Calendar or fiscal.

- Check “Initial return” or “Final return” as applicable; the election is automatic upon filing.

Step 2: Report Income (Lines 1–3)

- Line 1: Exempt function gross income (membership dues, initiation fees, fines for common area services).

- Line 2: Total gross income (include all sources).

- Line 3: Non-exempt (line 2 – 1; e.g., dividends, unrelated business income).

Step 3: Deductions (Line 4)

- Enter ordinary expenses allocable to non-exempt income (pro-rate if mixed-use).

- Exclude lobbying or political expenses; capitalize under Section 263A if applicable.

Step 4: Tax and Payments (Lines 5–11)

- Line 5: Taxable income (line 3 – 4).

- Line 6: Tax (30% × line 5; 32% for timeshares).

- Line 7: Estimated tax payments/overpayments from prior year.

- Line 8: Balance due (line 6 – 7) or overpayment (line 7 – 6).

- Line 10: Elect credit to 2026 estimated tax or refund.

- Line 11: Signed declaration.

E-file if eligible; otherwise, mail to IRS Ogden, UT. Pay via EFTPS.

Example: $100,000 dues (exempt), $5,000 interest (non-exempt), $2,000 expenses. Taxable: $3,000; tax: $900 (30%).

Key Changes to IRS Form 1120-H for 2025

The 2025 form builds on 2024 with these updates:

- Electronic Filing Debut: Available starting January 2025 via MeF for original returns (amendments remain paper).

- Late-Filing Penalty Hike: For returns filed in 2025, >60 days late incurs a minimum $510 (or tax due, whichever smaller).

- Threshold for E-Filing: Mandatory if 10+ total returns filed in the calendar year (e.g., including 1099s).

- Short-Year Guidance: Use 2024 form for 2025 short years, adjusting for post-2024 laws.

No rate changes; 30% flat tax persists.

Common Mistakes to Avoid When Filing Form 1120-H

- Misclassifying Income: Treating rental fees as exempt—audit risk; exempt only if for member services.

- Over-Deducting: Expenses must tie to non-exempt income; pro-rate accurately.

- Missing E-Filing Mandate: Count all returns; non-compliance adds penalties.

- Election Oversights: First-time filers must fully complete to elect; partial forms rejected.

- Amended Return Errors: Use 1120-HX for changes; e-file originals only.

Per IRS guidance, attach explanations for lines >$0.

Tips for HOAs Filing IRS Form 1120-H in 2025

- Compare to Form 1120: If taxable income >$50,000, graduated rates on 1120 may save money despite complexity.

- E-File Early: Faster processing; required for multi-return filers.

- Track Exempt vs. Non-Exempt: Use accounting software to segregate dues from ads/interest.

- Leverage Refunds: Apply overpayments to 2026 estimates for cash flow.

- Consult Experts: CPAs ensure qualification under Section 528.

- State Compliance: Many states mirror federal; check for add-backs.

Final Thoughts: Simplify HOA Tax Compliance with IRS Form 1120-H in 2025

IRS Form 1120-H streamlines tax reporting for homeowners associations, offering exempt income exclusions and a straightforward flat rate—ideal for community-focused entities. With 2025’s e-filing rollout and penalty updates, proactive preparation by March 15, 2026, safeguards your HOA’s finances.

For the official 2025 Form 1120-H and instructions, visit IRS.gov/Form1120H. Considering a switch to Form 1120? A tax advisor can evaluate your specifics. Review your 2025 budgets now for seamless filing.