Table of Contents

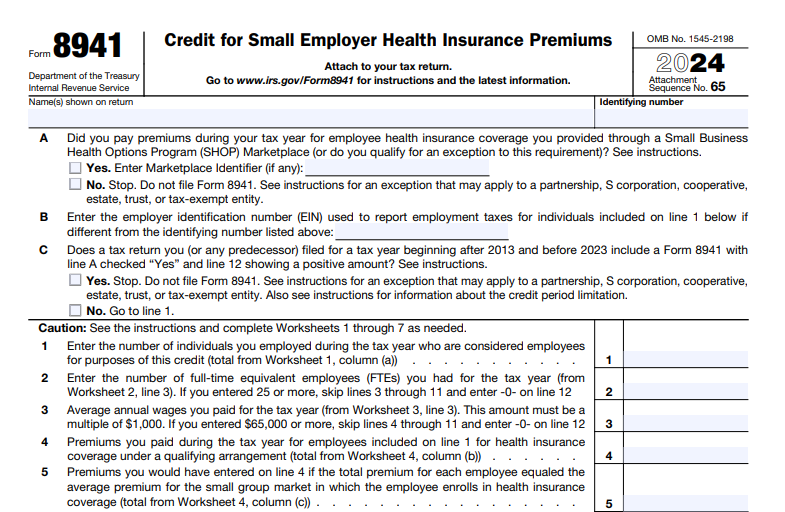

IRS Form 8941 – Credit for Small Employer Health Insurance Premiums – Small businesses play a vital role in the U.S. economy, but providing affordable health insurance remains a challenge. The IRS Form 8941, “Credit for Small Employer Health Insurance Premiums,” offers a powerful incentive: up to 50% of the premiums you pay for employee coverage as a refundable tax credit. For the 2025 tax year, with inflation-adjusted wage limits rising to $67,000 and ongoing SHOP Marketplace flexibility, more employers may qualify to offset rising healthcare costs. This credit—available for two consecutive years starting after 2013—can significantly boost your bottom line, especially for startups and firms with fewer than 25 full-time equivalent (FTE) employees.

This SEO-optimized guide, based on the latest IRS draft instructions and resources, breaks down Form 8941 eligibility, calculations, and filing steps for returns due in 2026. Whether you’re a sole proprietor or nonprofit, claiming this credit via Form 3800 (general business credit) can reduce your tax liability or generate a refund. Download the 2025 draft Form 8941 and instructions from IRS.gov to prepare.

What Is IRS Form 8941?

IRS Form 8941 enables eligible small employers to calculate a tax credit for health insurance premiums paid on behalf of employees. Enacted under the Affordable Care Act (ACA), this credit rewards businesses for offering coverage through a qualifying arrangement, typically requiring you to pay at least 50% of premiums for each enrolled employee. It’s a general business credit, meaning it’s non-refundable for most filers but carries forward up to 20 years or back one year; tax-exempt organizations claim it as a refundable credit on Form 990-T.

The form attaches to your income tax return (e.g., Schedule C for sole proprietors, Form 1120 for corporations) and feeds into Form 3800. For 2025, it includes worksheets to compute FTEs, average wages, and phaseouts, ensuring precise credit amounts. Unlike direct deductions, this credit directly lowers your tax bill dollar-for-dollar.

Who Qualifies for the Small Employer Health Insurance Premiums Credit in 2025?

Eligibility focuses on size, wages, and coverage details. You must meet all criteria:

- Employee Count: Fewer than 25 FTE employees during the tax year. (FTEs are calculated by dividing total hours worked by 2,080; each part-time employee counts as at least one if they work 1+ hour.) The credit phases out between 10–24 FTEs and is zero at 25 or more.

- Average Wages: Less than $67,000 per FTE (inflation-adjusted for 2025). Wages include amounts subject to Social Security and Medicare taxes (no wage base limit). The phaseout begins at $33,000 and eliminates the credit at $67,000 or more.

- Premium Payments: Pay at least 50% of premiums for employee-only coverage (or family if elected) under a qualifying arrangement. Premiums must equal or exceed the average small employer premium in your state (from HHS data).

- Coverage Source: Provided through a Small Business Health Options Program (SHOP) Marketplace plan, with exceptions for counties lacking SHOP access (per Notice 2018-27 and updates).

- Business Type: For-profit or tax-exempt (501(c) organizations). Controlled groups or affiliates are treated as one employer.

Seasonal workers are included only if employed >120 days; former employees may qualify if premiums continue. Pass-through entities (partnerships, S corps) allocate credits via Schedule K-1.

| Eligibility Factor | 2025 Limit | Phaseout Range |

|---|---|---|

| FTE Employees | <25 | 10–24 FTEs |

| Average Wages | <$67,000 | $33,000–$67,000 |

Exclusions: Employers with 25+ FTEs or average wages ≥$67,000 get zero credit. Self-employed individuals aren’t eligible for their own coverage.

IRS Form 8941 Download and Printable

Download and Print: IRS Form 8941

Credit Amount: Up to 50% of Premiums in 2025

The maximum credit is:

- 50% of eligible premiums for non-tax-exempt employers.

- 35% for tax-exempt eligible small employers (limited to certain payroll taxes paid, like withheld income/Medicare taxes).

The credit applies for two consecutive tax years once claimed (starting the year after your first qualifying year post-2013). It’s based on premiums paid, not just incurred, and reduced by state subsidies or tax credits received. For example, a business with 10 FTEs earning $40,000 average, paying $100,000 in premiums, could claim up to $50,000 (50%)—subject to phaseouts if applicable.

Tax-exempt filers cap the credit at payroll taxes paid in 2025 (e.g., employer Medicare tax + withheld employee taxes).

Key Changes to IRS Form 8941 for 2025

The 2025 draft form and instructions reflect inflation adjustments and clarifications:

- Wage Threshold Update: Average wages phaseout starts at $33,000 and ends at $67,000 (up from $62,000 max in 2023).

- SHOP Exceptions Expanded: More counties qualify for non-SHOP plans if direct enrollment is unavailable.

- FTE Calculation Refinements: Explicit rounding down for wages to the nearest $1,000; minimum 1 FTE per employee.

- Tax-Exempt Limits: Credit limited to 2025 payroll taxes (Medicare rates unchanged at 1.45% employer/employee).

- Filing Integration: Enhanced pass-through allocation for cooperatives and estates/trusts.

No changes to the two-year limit or 50%/35% rates. Always verify final instructions, as drafts may evolve.

How to Complete IRS Form 8941: Step-by-Step Guide for 2025

Use the seven worksheets in the instructions for calculations. Gather payroll records, premium statements, and state average premium data.

- Line A: Check “Yes” if premiums were via SHOP (enter identifier) or qualify for an exception; otherwise “No.”

- Line C: Indicate if this starts your two-year credit period (based on prior filings).

- Line 1 (Worksheet 1): List employees, hours, and wages; total employee count.

- Line 2 (Worksheet 2): Compute FTEs (total hours ÷ 2,080, rounded down).

- Line 3 (Worksheet 3): Average wages (total wages ÷ FTEs, rounded down to nearest $1,000).

- Line 4 (Worksheet 4): Eligible premiums paid (adjusted for state averages if needed).

- Line 5: 50% (or 35% for tax-exempt) of line 4.

- Line 6: Applicable percentage for year 1 (50%) or year 2 (35%) of line 5.

- Line 7: Smaller of lines 5 or 6.

- Line 8 (Worksheet 5): Phase out for FTEs >10 (reduces by 50% of excess over 10, up to zero at 25).

- Line 9 (Worksheet 6): Further phase out for wages >$33,000 (similar formula).

- Line 10: Subtract state subsidies.

- Line 11: Net after state limits.

- Lines 13–15: Add/allocate pass-through credits.

- Line 16: Total credit (carry to Form 3800, Part III, line 1y).

- Tax-Exempt Filers: Lines 19–21 limit to payroll taxes; line 20 to Form 990-T.

Attach to your return; e-file if possible for faster processing.

Example: 8 FTEs, $45,000 average wages, $80,000 premiums paid. No phaseout: Credit = 50% × $80,000 = $40,000.

Common Mistakes to Avoid When Filing Form 8941

- Incorrect FTE Count: Forgetting to include seasonal workers or rounding errors—double-check Worksheet 2.

- Overlooking Phaseouts: Assuming full credit with 15 FTEs or $50,000 wages; use worksheets.

- SHOP Non-Compliance: Claiming without Marketplace plan unless excepted—attach proof.

- Double-Dipping: Not reducing deductions by credit amount on Schedule C.

- Missing Attachments: Forgetting Form 3800 or premium documentation.

Penalties apply for underpayment; audits target high-credit claims.

Tips for Maximizing Your 2025 Small Employer Health Insurance Credit

- Shop Early: Enroll in SHOP plans by open enrollment (Nov 1–Jan 15) for full-year credit.

- Track Wages Precisely: Use payroll software to calculate averages; inflation boosts the $67,000 limit.

- Combine with Deductions: Claim partial premium deduction after credit reduction.

- Tax-Exempt Strategy: Nonprofits—prioritize if payroll taxes exceed potential credit.

- Software Help: TurboTax or H&R Block automates worksheets.

- Consult a Pro: For controlled groups or pass-throughs, a CPA ensures aggregation rules.

This credit averages $3,000–$5,000 per eligible business—don’t miss out.

Final Thoughts: Claim Your 2025 Health Insurance Credit with IRS Form 8941

IRS Form 8941 empowers small employers to make health coverage more affordable, with 2025’s adjusted limits expanding access amid rising premiums. By verifying eligibility and following the worksheets, you can unlock up to 50% in credits, easing the burden on your operations.

For the official 2025 draft Form 8941 and instructions, visit IRS.gov/Form8941. Complex setups like affiliates? A tax advisor can tailor your claim. Review your payroll and premiums now for a stronger 2026 return.