Table of Contents

IRS Form 8859 – Carryforward of the District of Columbia First-Time Homebuyer Credit – For District of Columbia residents who purchased their first home before 2012, unlocking remaining tax savings from the now-expired D.C. First-Time Homebuyer Credit can still provide valuable relief on your 2025 tax return. IRS Form 8859, “Carryforward of the District of Columbia First-Time Homebuyer Credit,” allows eligible taxpayers to apply unused portions of this credit against current-year tax liability, potentially reducing what you owe by up to $5,000. With the 2025 draft form emphasizing simple carryforward claims amid stable tax rules, this nonrefundable credit continues to benefit legacy homebuyers without new eligibility.

This SEO-optimized guide, based on official IRS drafts and resources, explains Form 8859 for tax year 2025 (filed in 2026). Whether you’re a single filer with a $5,000 carryforward or married filing separately with $2,500 left, learn how to claim it on Schedule 3 of Form 1040. Download the draft 2025 Form 8859 from IRS.gov to verify your unused amount today.

What Is IRS Form 8859?

IRS Form 8859 enables taxpayers to claim a carryforward of the D.C. First-Time Homebuyer Credit, a federal incentive enacted in 1997 to boost homeownership in the nation’s capital. Originally up to $5,000 ($2,500 if married filing separately), the credit was available for principal residences purchased in D.C. on or before December 31, 2011. Since the program ended, Form 8859 focuses solely on applying any remaining unused credit from prior years, limited by your 2025 tax liability.

Key features:

- Nonrefundable: Reduces tax owed but doesn’t generate refunds or carrybacks.

- Indefinite Carryforward: Unused amounts roll over to future years until exhausted.

- Attachment Required: File with Form 1040, 1040-SR, or 1040-NR; enter on Schedule 3, line 6h.

For 2025, the draft form (Rev. Aug. 2025) streamlines calculations with a single worksheet, ensuring compliance for the April 15, 2026, deadline.

Who Needs to File IRS Form 8859 in 2025?

File Form 8859 if you:

- Have an unused carryforward from your 2024 Form 8859 (line 4) and want to apply it to your 2025 tax liability.

- Were an original eligible D.C. first-time homebuyer with remaining credit (no new claims allowed post-2011).

- Are filing Form 1040, 1040-SR, or 1040-NR as a D.C. resident or qualifying purchaser.

No filing if your carryforward is zero or your tax liability is fully offset by other credits. Nonresidents or those who claimed the full credit in prior years skip it. Married filing separately filers get half the credit ($2,500 max original).

Eligibility for the D.C. First-Time Homebuyer Credit Carryforward

The original credit required:

- First-Time Buyer: No ownership of a principal residence in D.C. during the prior three years (two for married filers).

- Principal Residence: Purchased and used as your main home in D.C. on or before Dec. 31, 2011.

- Credit Amount: Lesser of $5,000 ($2,500 MFS) or the home’s purchase price.

- Income Limits: Phased out for modified AGI over $70,000 ($110,000 joint); fully eliminated at $90,000 ($130,000 joint).

For 2025 carryforwards, eligibility is straightforward: Simply hold an unused balance from prior Form 8859. No re-testing of original criteria, but the credit is limited to your tax liability after other nonrefundable credits (e.g., foreign tax, child tax). Estates or trusts may qualify if inheriting the carryforward.

IRS Form 8859 Download and Printable

Download and Print: IRS Form 8859

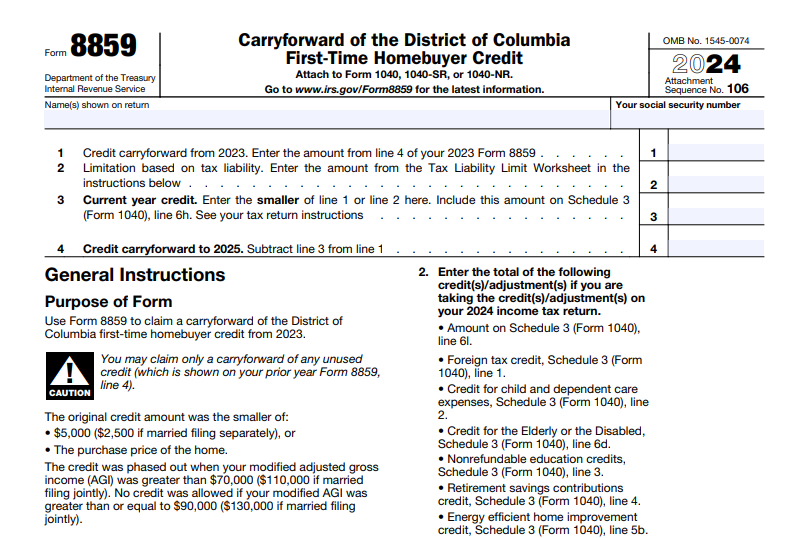

How to Complete IRS Form 8859: Step-by-Step Guide for 2025

The 2025 draft is a one-page form with minimal lines. Gather your 2024 Form 8859 and 2025 tax figures. Use tax software like TurboTax for auto-population.

Step 1: Line 1 – Enter Carryforward Amount

- Transfer the unused credit from line 4 of your 2024 Form 8859. If this is your first carryforward claim, reference your original purchase-year return.

Step 2: Complete the Tax Liability Limit Worksheet for Line 2

This worksheet caps the credit at your available tax after other credits:

- Enter your 2025 tax liability before credits (Form 1040, line 18).

- Subtract eligible prior credits (e.g., child tax from line 19, foreign tax from Schedule 3 line 1, education credits from line 3). List includes mortgage interest (line 6g), adoption (line 6c), and clean vehicle (line 6f).

- Line 2: Result (if zero or negative, enter -0- on lines 2 and 3).

Step 3: Line 3 – Calculate Claimable Credit

- Enter the smaller of line 1 (carryforward) or line 2 (limit). Transfer to Schedule 3 (Form 1040), line 6h.

Step 4: Line 4 – Update Carryforward

- Subtract line 3 from line 1 for the amount to carry to 2026.

Attach to your return; e-file for faster processing. No separate filing deadline—aligns with your 1040.

Example: $3,000 carryforward (line 1), $2,500 tax limit (line 2). Claim $2,500 (line 3); carry $500 to 2026 (line 4).

Key Changes to IRS Form 8859 for 2025

The 2025 draft (posted Aug. 7, 2025) mirrors 2024 with no substantive updates, as the credit remains a legacy program. Minor notes:

- Worksheet Refinements: Added clarity on subtracting 2025-specific credits like clean vehicle (line 6f) and energy home improvements (line 5b).

- Draft Caution: Not for filing; final form expected Dec. 2025, subject to OMB approval.

- No Expiration: Carryforwards continue indefinitely, unaffected by TCJA extensions or OBBBA.

Check IRS.gov for the final version before April 2026.

Common Mistakes to Avoid When Filing Form 8859

- Overclaiming the Limit: Ignoring the worksheet—credit can’t exceed post-credit tax liability.

- Using Original Figures: Don’t recalculate the full $5,000; only apply line 4 from prior year.

- Missing Attachments: Forgetting to include on Schedule 3, line 6h—delays processing.

- AGI Confusion: No phaseout for carryforwards, but verify original eligibility if audited.

- Paper Filing Errors: E-file to avoid transcription mistakes; paper returns increase rejection risk.

Retain purchase records for audits.

Tips for Claiming Your 2025 D.C. Homebuyer Credit Carryforward

- Review Prior Returns: Dig up your original 1040 from 2011 or later to confirm the initial credit.

- Maximize Other Credits: Apply higher-priority credits first to preserve room for Form 8859.

- Software Simplicity: TurboTax or H&R Block auto-fills from prior-year data.

- Joint Filers: Coordinate with spouses—credit halves for MFS but doubles potential savings.

- Professional Help: If inheriting via estate, a CPA ensures proper transfer.

- Track Annually: File even if small; unused amounts grow tax-free.

This credit has saved D.C. buyers over $100 million historically—don’t let yours expire unused.

Final Thoughts: Reclaim Your D.C. Homebuyer Savings with IRS Form 8859 in 2025

IRS Form 8859 keeps the D.C. First-Time Homebuyer Credit alive for pre-2012 purchasers, offering a straightforward way to offset 2025 taxes with legacy carryforwards up to $5,000. As a nonrefundable perk with no end date, it’s a low-effort win for qualifying homeowners—attach, claim, and carry forward the rest.

For the official 2025 draft Form 8859 and instructions, visit IRS.gov/Form8859. Unsure of your balance? A tax advisor can reconstruct it. Dust off those old returns now for a lighter 2026 tax bill.