Table of Contents

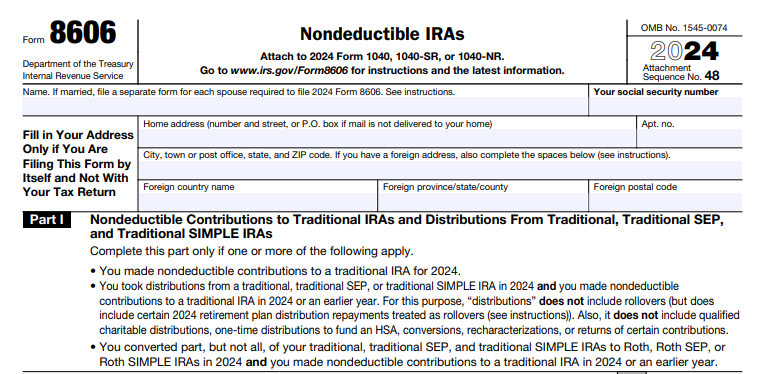

IRS Form 8606 – Nondeductible IRAs – Navigating retirement savings in 2025 means understanding the nuances of IRS Form 8606, the key document for reporting nondeductible IRA contributions. If you’re a high-income earner or have a workplace retirement plan, you might not qualify for full tax deductions on your traditional IRA contributions. That’s where Form 8606 comes in—helping you track after-tax (nondeductible) contributions to avoid double taxation on withdrawals later. Updated instructions for tax year 2024 (filed in 2025) include refinements to basis calculations and repayment adjustments, ensuring accurate reporting amid evolving rules like the SECURE 2.0 Act.

In this SEO-optimized guide, we’ll break down everything about IRS Form 8606 for 2025: its purpose, who needs to file, step-by-step instructions, common pitfalls, and tips to maximize your retirement strategy. Whether you’re exploring nondeductible traditional IRA contributions or Roth conversions, staying compliant prevents penalties up to $100 per error. Download the latest form from IRS.gov and file by April 15, 2025 (or October 15 with extension).

What Is IRS Form 8606?

IRS Form 8606, officially titled Nondeductible IRAs, is an IRS tax form used to report specific IRA transactions that involve after-tax money. It’s essential for maintaining your “basis” in traditional IRAs—the portion of contributions not deducted on your tax return, which grows tax-free but isn’t taxed again on distribution.

The form serves four primary functions:

- Reporting nondeductible contributions to traditional, SEP, or SIMPLE IRAs.

- Calculating the nontaxable portion of distributions from these IRAs if you have basis.

- Documenting conversions from traditional/SEP/SIMPLE IRAs to Roth IRAs.

- Determining the taxable amount of Roth IRA distributions, including early withdrawals.

For 2025 filings (covering 2024 tax year), the form reflects updates like the July 8, 2025, revision to the Line 25c worksheet for Roth distributions, addressing repayments of qualified disaster or birth/adoption distributions. Unlike Form 1040, which handles overall income, Form 8606 focuses on IRA-specific basis tracking to comply with IRC Section 408. Without it, the IRS assumes all distributions are taxable, potentially leading to unexpected tax bills.

IRS Form 8606 Downoad and Printable

Download and Print: IRS Form 8606

Who Must File IRS Form 8606 in 2025?

Not everyone with an IRA needs Form 8606, but it’s mandatory if any of these apply to your 2024 activity (filed in 2025):

- You made nondeductible contributions to a traditional IRA.

- You received distributions from a traditional, SEP, or SIMPLE IRA after ever making nondeductible contributions (basis > $0).

- You converted amounts from a traditional, SEP, or SIMPLE IRA to a Roth IRA.

- You took distributions from a Roth IRA (qualified or not).

- You rolled over nontaxable portions from a qualified plan to a traditional IRA not previously reported.

- Special cases: Inherited IRAs with basis, divorce-related transfers affecting basis, or repayments of certain 2024 distributions (e.g., qualified birth/adoption up to $5,000 per child, domestic abuse up to $10,000, or emergency distributions).

High earners (e.g., modified AGI over $161,000 single or $240,000 joint for Roth eligibility) often file due to phaseouts on deductions. Spouses file separately if required. Even if you don’t file Form 1040, submit Form 8606 standalone with your signature.

| Scenario | Must File Form 8606? | Why? |

|---|---|---|

| Nondeductible traditional IRA contribution | Yes | Tracks basis to avoid future taxation. |

| Roth conversion from traditional IRA | Yes | Reports taxable portion of conversion. |

| Early Roth distribution (under 59½) | Yes | Calculates earnings subject to 10% penalty. |

| Distribution from traditional IRA with no prior basis | No | Fully taxable; no Form 8606 needed. |

| Rollover from 401(k) to Roth IRA | Yes (if partial nontaxable) | Basis carries over for distributions. |

Step-by-Step Guide: How to Fill Out IRS Form 8606 for 2025

Filling out Form 8606 requires prior-year records (e.g., last Form 8606’s Line 14 for basis). Use the 2024 PDF from IRS.gov; no e-filing standalone, but attach to e-filed 1040. Here’s a line-by-line walkthrough based on 2024 instructions (applicable for 2025 filings).

Part I: Nondeductible Contributions to Traditional IRAs and Distributions

- Line 1: Enter 2024 nondeductible contributions (exclude returns or recharacterizations). Use Pub. 590-A worksheet if partial deduction.

- Line 2: Prior basis from previous Form 8606 (Line 14) or IRS table for pre-2024.

- Line 3: Add Lines 1+2 (total basis before distributions).

- Line 6: Year-end traditional IRA value (Dec. 31, 2024) + outstanding rollovers; subtract certain 2024 repayments.

- Line 7: Total 2024 distributions (include repayable types like birth/adoption; exclude rollovers/conversions).

- Line 8: Net amount converted to Roth (from Part II).

- Lines 9-13: Prorate basis: (Line 3 / Line 6) x (Line 7 + Line 8) = nontaxable portion used.

- Line 14: Subtract Line 13 from Line 3 (remaining basis for future).

- Line 15a: Nontaxable distributions (Line 7 – Line 13).

- Line 15b: Prorate for qualified disaster distributions (from Form 8915-F).

- Line 15c: Taxable amount (Line 7 – Line 15a – Line 15b); use worksheet for 3-year repayments (e.g., add back repaid birth distributions).

If no distributions/conversions, skip to Line 14.

Part II: Conversions from Traditional, SEP, or SIMPLE IRAs to Roth IRAs

- Line 16: Total converted (from Line 8 if applicable).

- Line 17: Basis allocable to conversion (Line 3 x (Line 16 / Line 6)).

- Line 18: Nontaxable portion (Line 17); subtract from Form 1040 Line 4b taxable amount.

Part III: Distributions from Roth IRAs

- Line 19: Total 2024 Roth distributions (exclude rollovers; include repayments treated as distributions).

- Line 20: Qualified first-time homebuyer amount (up to $10,000 lifetime).

- Line 21: Line 19 – Line 20.

- Line 22: Basis in regular Roth contributions (use worksheet: prior Line 22 + 2024 contributions – prior distributions).

- Line 23: Basis in conversions/rollovers (from prior Line 24 table, refigured without Line 20).

- Line 24: Line 22 + Line 23 + excess from prior years + 2024 rollovers.

- Line 25a: Nontaxable (Line 21 – Line 24, or $0).

- Line 25b: Prorate for disasters (Form 8915-F).

- Line 25c: Taxable (Line 21 – Line 25a – Line 25b); use 2024 Line 25c Worksheet for repayments (e.g., birth/adoption repaid in 2025—amend return).

Attach to Form 1040 Line 4a/b. Retain copies for life or until full distribution.

Why Use Nondeductible IRAs? Benefits and 2025 Limits

Nondeductible contributions let you superfund your IRA beyond deduction limits ($7,000 under 50; $8,000 50+ for 2024, likely similar for 2025). Earnings grow tax-deferred, and basis withdrawals are tax-free—ideal for backdoor Roth strategies. However, phaseouts apply: Full traditional deduction if AGI < $77,000 single/$123,000 joint (2024); none above $87,000/$143,000.

In 2025, with inflation adjustments pending, expect slight increases. Pair with Roth conversions for tax-free growth, but watch 10% early penalty on earnings.

Common Mistakes to Avoid on Form 8606

- Forgetting basis carryover: Leads to full taxation on distributions ($50 penalty possible).

- Misprorating distributions: Use exact year-end values; ignore rollovers.

- Overstating nondeductibles: $100 penalty; verify with Pub. 590-A.

- No amendment for repayments: If repaying 2024 birth distribution in 2025, file Form 1040X.

- Ignoring disasters/repayments: Use worksheets for accurate Line 15c/25c.

Frequently Asked Questions (FAQs) About IRS Form 8606

When is the deadline to file Form 8606 for 2024 taxes?

April 15, 2025, or October 15 with extension. Attach to Form 1040.

Do Roth IRA contributions require Form 8606?

Only for distributions or if recharacterizing to traditional.

What if I convert a traditional IRA to Roth in 2025?

File for 2025 tax year; taxable portion goes on 2025 Form 1040.

Can I e-file Form 8606?

Yes, as part of e-filed 1040; not standalone.

Final Thoughts: Master Nondeductible IRAs with Form 8606 in 2025

IRS Form 8606 is your safeguard against double taxation on nondeductible IRA contributions, empowering tax-efficient retirement planning. As 2025 approaches, review your basis and consult Pub. 590-A/B for details. For personalized advice, speak with a CPA—rules like Secure 2.0 add layers for Roth SEP/SIMPLE options.

This guide is informational; not tax advice. Verify with IRS.gov.

Related Searches: IRS Form 8606 instructions 2025, nondeductible IRA contributions limits, Roth conversion basis tracking, Form 8606 common errors.