Table of Contents

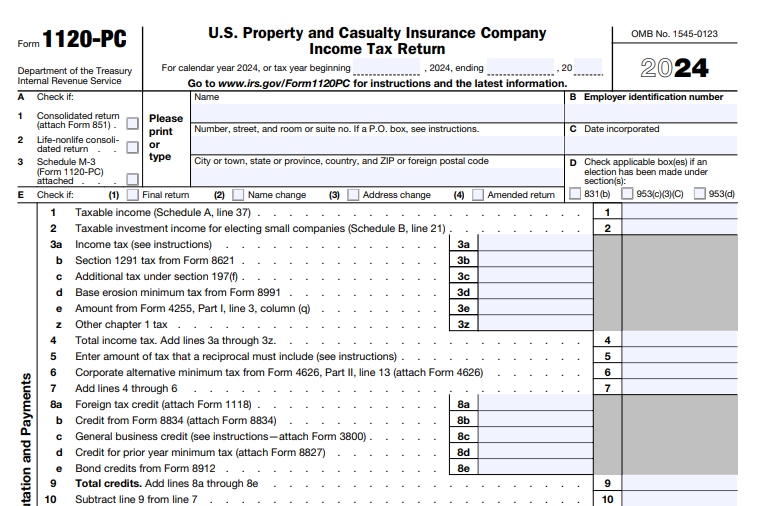

IRS Form 1120-PC – U.S. Property and Casualty Insurance Company Income Tax Return – In the high-stakes world of property and casualty insurance, accurate tax reporting is non-negotiable. IRS Form 1120-PC, the U.S. Property and Casualty Insurance Company Income Tax Return, equips non-life insurers to report income, gains, losses, deductions, credits, and compute tax liability under IRC Section 831(a). For tax year 2024 (filed in 2025), key updates include an increased minimum late-filing penalty (up to $510 for returns over 60 days late), relief from estimated tax penalties tied to the Corporate Alternative Minimum Tax (CAMT) per Notice 2024-66, and new discount factors for unpaid losses under Rev. Proc. 2025-15. With e-filing mandatory for many and NAIC annual statements required, mastering Form 1120-PC instructions for 2025 ensures compliance amid rising regulatory scrutiny.

This SEO-optimized guide details IRS Form 1120-PC for 2025: purpose, eligibility, step-by-step filing, schedules, and error avoidance. Download the 2024 form (Catalog No. 64270Q) from IRS.gov—usable for early 2025 short years—and file by April 15, 2025, for calendar-year filers to sidestep 5% monthly penalties (up to 25%). Ideal for P&C executives, CFOs, and tax pros navigating premiums, losses, and investments.

What Is IRS Form 1120-PC?

Form 1120-PC is the dedicated federal income tax return for property and casualty (P&C) insurance companies—excluding life insurers—to disclose taxable income under special rules like Section 832 for underwriting and investment activities. It captures premiums earned (Schedule E), incurred losses (Schedule F), investment income (Schedule B), and deductions, culminating in a 21% corporate tax rate on taxable income.

Distinct from general Form 1120, it tailors to P&C nuances: discounted loss reserves (Section 846), medical loss ratio (MLR) adjustments for Section 833 organizations (e.g., Blue Cross/Blue Shield), and section 831(b) elections for small insurers (up to $2.8M in premiums for 2024, inflation-adjusted to ~$2.9M in 2025). Attachments include the NAIC annual statement (or pro forma for foreign filers) and Schedule M-3 if assets exceed $10M.

For 2025 filings, expect CAMT integration (Form 4626 if applicable) and enhanced e-file schemas for Modernized e-File (MeF). Non-compliance risks audits, especially for foreign-owned entities under Section 6038A.

IRS Form 1120-PC Download and Printable

Download and Print: IRS Form 1120-PC

Who Must File IRS Form 1120-PC in 2025?

Every domestic nonlife insurance company and qualifying foreign corporations (taxable under Section 831 if U.S.-based) must file Form 1120-PC—regardless of taxable income. This covers P&C lines like auto, home, liability, and commercial multi-peril, including Section 501(m)(1) commercial insurers and Section 833 Blue Plans.

Key thresholds and exceptions:

- Mandatory Filing: If subject to Section 831(a) tax; includes winding-up entities post-disposal of reserves (switch to Form 1120 after).

- Small Insurers: Elect Section 831(b) for tax on investment income only (premiums ≤$2.8M); use Schedule B.

- Exemptions: Section 501(c)(15) fraternal benefit societies file Form 990; life insurers use Form 1120-L.

- Consolidated Groups: Attach to parent return (Form 1120, 1120-L, or 1120-PC); life-nonlife groups separate life/nonlife income.

- Foreign-Owned: 25%+ foreign ownership triggers Form 5472 for reportable transactions.

Foreign disregarded entities owned by foreign insurers (electing Section 953(d)) file pro forma 1120-PC with Form 5472. Obtain EIN via Form SS-4 if needed.

| Entity Type | Filing Required? | Key Notes for 2025 |

|---|---|---|

| Domestic P&C Insurer | Yes | Includes Section 833 if MLR ≥85%; attach NAIC statement. |

| Foreign Qualifying Nonlife | Yes | Pro forma NAIC; Form 5472 if 25%+ foreign-owned. |

| Section 831(b) Elector | Yes (Schedule B) | Premium limit ~$2.9M; tax on investments only. |

| Consolidated Nonlife Group | Yes (Attachment) | Separate from life income; Form 851 required. |

| Exempt Fraternal (501(c)(15)) | No | File Form 990 instead. |

Step-by-Step Guide: How to Fill Out IRS Form 1120-PC for 2025

Prepare with NAIC statements, 1099s, and financials. E-file via MeF for speed; paper to Ogden, UT. Deadline: 15th day of 4th month post-tax year (April 15, 2025, for calendar); extend via Form 7004 (7 months if June 30 end). Use 2024 form for 2025 short years.

Step 1: Header and Identification

- Name/Address/EIN (Item B): Legal name, principal address, EIN (apply via SS-4 if needed).

- Item A: Check consolidated (box 1), life-nonlife (1+2), or Schedule M-3 (box 3 if assets ≥$10M).

- Item D: Elect Section 831(b), 953(c)(3)(C), or 953(d).

- Item E: Mark initial/final/amended; note changes.

Step 2: Income and Deductions (Schedules A/B, C, E, F)

- Schedule B (Investments): Gross income (Lines 1-7: dividends, interest); limit expenses to 25% of net (Part II).

- Schedule C (Dividends): By ownership % (e.g., 50% deduction <20% owned); apply Section 250/246(b) limits via worksheet.

- Schedule E (Premiums): Gross written (Line 1); adjust unearned (Lines 2-6) for reserves/MLR/discounting (Section 846).

- Schedule F (Losses): Paid (Line 1), unpaid discounted (Line 9, by accident year/interest rate).

- Schedule A (Non-Electors): Sum income (Lines 1-13), deductions (15-31: comp, interest, depletion), special (34b), NOL (36b) to taxable (37).

Step 3: Tax Computation and Payments (Page 1)

- Line 1: Taxable income (Schedule A Line 37 or B Line 21).

- Line 3a: ×21%; add other taxes (3b-3z: e.g., Form 8991 BEAT).

- Lines 8-9: Credits (foreign tax, Form 3800 GBC).

- Line 15: Total tax; subtract payments (17) for owed/refund (19/20).

- Line 18: Penalty (Form 2220); CAMT relief if applicable.

Step 4: Other Schedules and Attachments

- Schedule H (Section 833): Deduction if MLR ≥85% (Line 6).

- Schedule I: Answer on groups, foreign ownership, NOL, BEAT.

- Schedule L/M-1: Balance sheet/reconciliation (M-3 if $10M+ assets).

- Attach NAIC, Forms 851/1122 (consolidated), in order.

| Section | Key Lines | Tips |

|---|---|---|

| Header | Items A-E | Verify EIN; elect 831(b) timely. |

| Income (Sch. B/C/E/F) | Premiums/Losses | Discount per Rev. Proc. 2025-15; MLR ≥85% for full deduction. |

| Tax (Page 1) | Lines 1-20 | 21% rate; CAMT waiver per Notice 2024-66. |

| Schedules | H/I/L/M | M-3 mandatory ≥$10M assets; NAIC attach. |

Common Mistakes to Avoid When Filing Form 1120-PC

P&C filers face unique pitfalls—errors in loss discounting or MLR can trigger audits/penalties (5% monthly late filing, $510 min for 2025 >60 days). Top issues:

- Omitting NAIC Statement: Late penalty; retain for e-file.

- Incorrect Discounting: Use 2024 factors (Rev. Proc. 2025-15); mismatch triggers Section 846 adjustments.

- MLR Errors (Section 833): Deduction only if ≥85%; enter 0 if <85% on Schedule A Line 34a.

- Foreign Reporting Gaps: Miss Form 5472 for 25%+ ownership; $25K+ penalties.

- Schedule M-3 Oversight: Mandatory ≥$10M assets; voluntary otherwise—reconcile book-to-tax.

- Underpayment Penalty: Include on Line 18 even if zero (CAMT relief via Notice 2024-66).

Frequently Asked Questions (FAQs) About IRS Form 1120-PC

When is the deadline for Form 1120-PC in 2025?

April 15, 2025, for calendar year; extend with Form 7004 (no payment extension).

Does a small P&C insurer file Schedule B?

Yes, if electing Section 831(b); limits tax to investments (premiums ≤$2.8M).

What if assets exceed $10M?

File Schedule M-3 (not M-1); check Item A box 3.

Is e-filing required for Form 1120-PC?

Encouraged via MeF; mandatory for certain attachments (e.g., 10+ returns filed).

How does MLR affect deductions?

≥85% MLR allows full unearned premium deduction (Section 833); otherwise limited.

Final Thoughts: Streamline Your 2025 Form 1120-PC Filing

IRS Form 1120-PC is vital for P&C compliance, blending underwriting precision with tax strategy to minimize liability. With 2025’s penalty hikes and CAMT tweaks, proactive filing—bolstered by NAIC reconciliation and timely elections—avoids costly surprises. Consult Pub. 542 or a tax advisor for complexities like BEAT (Form 8991) or foreign ops.

Informational only; not tax advice. Verify via IRS.gov.

Related Searches: IRS Form 1120-PC instructions 2025, property casualty insurance tax return, Schedule E premiums earned, section 831(b) election, Form 1120-PC common errors, NAIC annual statement attachment.