Table of Contents

IRS Form 4970 – Tax on Accumulation Distribution of Trusts – If you’re a beneficiary of a trust, you may encounter complex tax rules designed to prevent income deferral strategies. One key form in this area is IRS Form 4970, officially titled “Tax on Accumulation Distribution of Trusts.” This form helps calculate the additional tax owed when a trust distributes accumulated income from prior years—known as an accumulation distribution—under the IRS’s throwback rules. Understanding Form 4970 is essential for compliance, especially for domestic complex trusts, and can help avoid penalties or unexpected tax bills.

In this comprehensive guide, we’ll break down what Form 4970 entails, who needs to file it, how to complete it step by step, and tips to steer clear of common pitfalls. Whether you’re dealing with a family trust or an estate, this article provides actionable insights based on the latest IRS guidelines as of 2025.

What Is an Accumulation Distribution?

Before diving into Form 4970, it’s crucial to understand accumulation distributions. These occur when a trust pays out more than its current-year distributable net income (DNI). DNI represents the trust’s taxable income available for distribution in the current year, after deductions.

- Simple trusts must distribute all income annually, so accumulation distributions are rare.

- Complex trusts can accumulate income and distribute it later, potentially triggering throwback rules.

Under Internal Revenue Code (IRC) Section 665(b), an accumulation distribution is the excess of amounts properly paid or credited to beneficiaries (beyond current DNI) over the trust’s DNI minus any required current distributions. This “throwback” treats the distribution as if it were made in the year the income was earned, taxing it at the beneficiary’s historical rates plus interest for deferral.

The goal? To discourage trusts from hoarding income at lower trust tax rates (which compress quickly) and distributing it later to beneficiaries in potentially lower brackets.

Who Must File IRS Form 4970?

Form 4970 is required for U.S. beneficiaries of certain domestic trusts that make accumulation distributions. Specifically:

- Domestic complex trusts: Those that accumulated income before distribution.

- Beneficiaries subject to throwback rules: Applies to distributions from trusts created before March 1, 1984, or those that were ever foreign trusts (even if now domestic).

Foreign trusts follow different rules: Beneficiaries report on Form 3520 (Annual Return to Report Transactions With Foreign Trusts), attaching Form 4970 as a worksheet if needed, but do not file it standalone. Nonresident aliens or foreign estates may have limited U.S. tax exposure if income isn’t U.S.-sourced.

If your trust issued a Schedule K-1 (Form 1041) showing an accumulation distribution (from Schedule J, line 37), you’re likely required to file. Always consult a tax professional, as aggregation rules under IRC Section 643(f) may apply to multiple trusts treated as one.

Purpose of IRS Form 4970

The primary purpose of Form 4970 is to compute the partial tax on accumulation distributions under IRC Section 667. It:

- Allocates the distribution to prior years’ undistributed net income (UNI).

- Recomputes the beneficiary’s tax as if the income was received earlier.

- Adds an interest charge for deferral (compounded daily at underpayment rates post-1995).

This ensures the IRS collects deferred taxes, plus a penalty-like interest, preventing abuse. For 2025 filings (covering 2024 tax year), no major structural changes were noted, but filers should check for inflation-adjusted rates.

When and Where to File Form 4970

- Deadline: File with your individual tax return, Form 1040, by April 15, 2025, for calendar-year filers (or the 15th day of the 4th month after year-end for fiscal years). Extensions via Form 7004 add 5.5 months.

- Where to File: Attach to your Form 1040 and mail to the IRS address for your state (see Form 1040 instructions). E-filing is recommended to reduce errors.

- Payment: Include any tax due on Schedule 2 (Form 1040), line 17l.

Late filing incurs failure-to-file penalties (5% per month, up to 25%) plus interest.

IRS Form 4970 Download and Printable

Download and Print: IRS Form 4970

Step-by-Step Instructions for Completing Form 4970

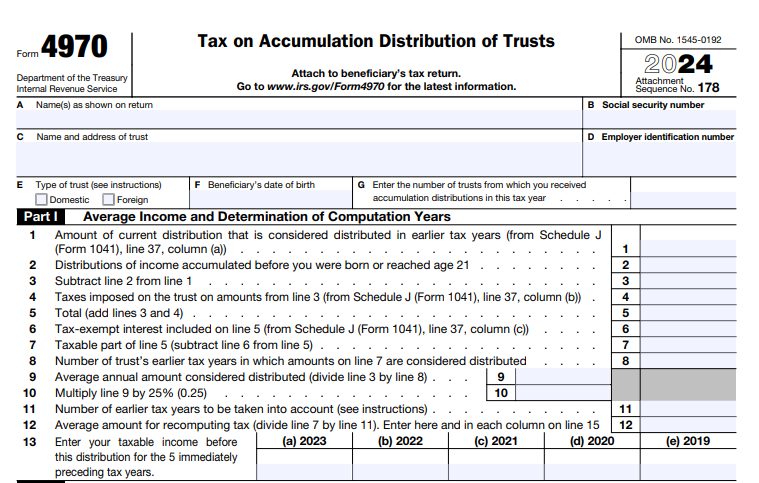

Form 4970 is a one-page form with schedules for detailed computations. Download the latest PDF from IRS.gov. Here’s a high-level guide (always refer to official instructions, as the 404 error on i4970 suggests using Pub. 519 or Form 1041 guidance).

Part I: Accumulation Distribution

- Line 1: Enter the accumulation distribution from Schedule J (Form 1041), line 37, column (b). For foreign trusts or nonresidents, adjust for U.S.-sourced income.

- Line 2: Subtract taxes imposed on the trust (from Schedule J, line 37, column (b)).

- Line 3: Total (Line 1 minus Line 2)—this is the net accumulation distribution.

- Lines 4–7: Apply the multiple trust rule if applicable (add distributions from other trusts).

Part II: Taxable Income for Prior Years

- Line 8: Number of prior years with UNI (up to 5 years back).

- Line 11: Subtract years where distributions exceeded UNI.

- Lines 13–15: Enter and average your taxable income from those years (recompute if needed for AMT).

Part III: Partial Tax

16–27. Use tax tables or rates to recompute tax for each prior year, adding the average accumulation amount. Subtract the original tax to find the partial tax attributable (Line 28).

- Line 28: Partial tax (Line 27 minus original tax). Include estate/GSST credits if applicable.

Additional Schedules

- Foreign Trust Beneficiaries: Adjust for non-U.S. income.

- Recompute AMT: If prior years involved alternative minimum tax.

Tools like tax software (e.g., TurboTax) can automate calculations, but manual filers should double-check math.

Common Mistakes to Avoid When Filing Form 4970

Even seasoned filers slip up on Form 4970 due to its complexity. Here are pitfalls and fixes:

| Mistake | Why It Happens | How to Avoid |

|---|---|---|

| Incorrect UNI Allocation | Misallocating distributions to wrong prior years, ignoring proportional rules. | Use IRS worksheets; track UNI annually from trust records. |

| Math Errors in Recomputations | Simple addition/subtraction slips in Parts II/III, or wrong tax rates. | Double-check with calculator; e-file for auto-flagging. |

| Forgetting Interest Charge | Omitting deferral interest (daily compounded post-1995). | Calculate per IRC §6621; include on Form 1040. |

| Wrong Trust Type | Filing for simple trusts or ignoring foreign rules (use Form 3520 instead). | Review trust instrument; consult Pub. 519. |

| Missing Attachments | Not including Schedule K-1 or recomputed prior returns. | Attach all; amend priors if needed via Form 1040-X. |

These errors can delay processing or trigger audits—IRS math checks caught 2.5 million in 2017 alone.

Recent Updates to Form 4970 and Throwback Rules (2025)

As of October 2025, Form 4970 remains unchanged structurally, but note:

- Line 28 Instructions: Updated in 2021 for estate/GSST credits; no 2024/2025 revisions.

- Throwback Scope: Limited to foreign trusts and pre-1984 domestic ones since 1997 reforms. No expansions in TCJA extensions.

- 65-Day Rule: Trusts can distribute by March 6, 2025, for 2024 DNI to shift tax to beneficiaries.

Check IRS.gov for 2025 PDFs.

FAQs About IRS Form 4970

Does Form 4970 Apply to Foreign Trusts?

No—use Form 3520. Attach Form 4970 as a computation tool.

What If No Accumulation Distribution Occurs?

No need to file; monitor Schedule K-1.

Can I Deduct Trust Taxes Paid?

Yes, subtract from the distribution on Line 2.

How Does This Affect AMT?

Recompute prior-year AMT; include adjustments.

Final Thoughts: Stay Compliant with Form 4970

Navigating IRS Form 4970 ensures fair taxation on trust accumulation distributions while avoiding throwback penalties. With throwback rules targeting deferral abuse, timely filing is key—especially for 2025 deadlines. Gather your Schedule K-1 early, use e-filing, and consider professional help for complex trusts.

For the latest forms and pubs, visit IRS.gov. Proper planning can minimize your tax on accumulation distribution of trusts—don’t let deferral bite back.

This article is for informational purposes only and not tax advice. Consult a qualified CPA or attorney for personalized guidance.