Table of Contents

IRS Form 709 – United States Gift (and Generation-Skipping Transfer) Tax Return – In an era of strategic wealth transfer, understanding IRS Form 709 is essential for anyone making significant gifts to family, friends, or trusts. As the United States Gift (and Generation-Skipping Transfer) Tax Return, Form 709 helps track taxable transfers and ensures compliance with federal gift tax rules. With the 2025 annual gift tax exclusion rising to $19,000 per recipient—up from $18,000 in 2024—more individuals can gift without filing. However, exceeding this limit or involving complex transfers like generation-skipping trusts requires prompt reporting to avoid penalties.

This SEO-optimized guide breaks down everything about IRS Form 709 for 2025: what it is, who must file, key exclusions, step-by-step filing instructions, and common pitfalls. Whether you’re estate planning or simply gifting assets, stay informed to minimize taxes and maximize transfers.

What Is IRS Form 709?

IRS Form 709 is an informational tax return used to report gifts and certain generation-skipping transfers (GSTs) subject to federal gift and GST taxes. It calculates any tax due but doesn’t always result in payment—most filers use it to track lifetime exemptions.

The form covers:

- Gifts: Transfers of money or property without full consideration (e.g., cash, real estate, stocks).

- Generation-Skipping Transfers (GSTs): Gifts to beneficiaries two or more generations below the donor (e.g., grandchildren), taxed to prevent estate tax avoidance.

All gifts are reported on a calendar-year basis, with one Form 709 per year per donor. For 2025 gifts, file by April 15, 2026. Digital assets like cryptocurrency must now be disclosed if included.

Form 709 ties into broader estate planning, as lifetime gifts reduce your estate tax exemption. With the 2025 basic exclusion amount at $13.99 million (unified for gift and estate taxes), strategic gifting can shield wealth from the 40% top rate.

Who Needs to File IRS Form 709 in 2025?

Not every gift triggers a filing. U.S. citizens and residents must file if:

- Total gifts to any one non-spouse recipient exceed the $19,000 annual exclusion.

- You and your spouse elect to split gifts (doubling the exclusion to $38,000 per recipient).

- You make a gift of a future interest (e.g., trust benefits delayed until later).

- Gifts involve terminable interests to a non-citizen spouse or require GST reporting.

Nonresidents not U.S. citizens use Form 709-NA for certain U.S.-situs assets. No filing is needed for gifts under $19,000 or unlimited exclusions like direct tuition/medical payments.

Quick Tip: Track aggregate gifts per recipient annually. For example, multiple $10,000 transfers to one child totaling $25,000 in 2025 require filing for the $6,000 excess.

2025 Gift Tax Exclusions and Exemptions: Key Limits Explained

The IRS provides two layers of protection: annual exclusions and lifetime exemptions. These prevent most Americans from paying gift taxes outright.

Annual Gift Tax Exclusion for 2025

You can gift up to $19,000 per recipient without reporting or tax implications—no limit on recipients. Married couples can “split” gifts for $38,000 per recipient via consent on Form 709.

| Category | 2024 Limit | 2025 Limit | Notes |

|---|---|---|---|

| Per Recipient (Individual) | $18,000 | $19,000 | Applies to cash, property, or assets; unlimited recipients. |

| Married Couples (Gift Splitting) | $36,000 | $38,000 | Requires spousal consent; doubles exclusion. |

| Non-Citizen Spouse | $185,000 | $190,000 | Unlimited for U.S. citizen spouses. |

| Direct Education/Medical Payments | Unlimited | Unlimited | Paid directly to institutions; no reporting needed. |

Exceeding the annual limit? The excess dips into your lifetime exemption—no immediate tax.

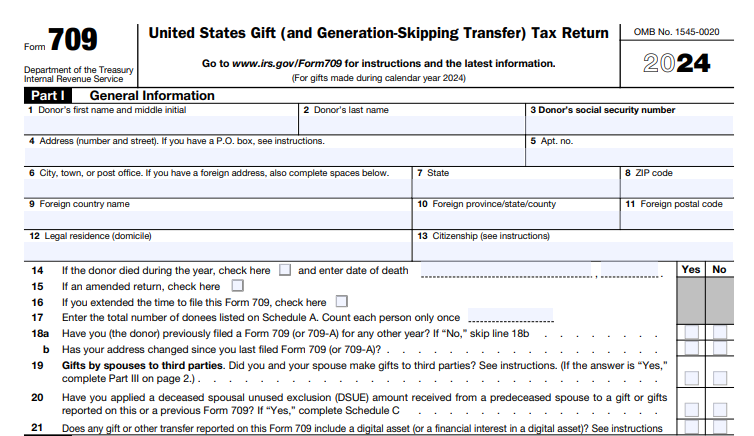

IRS Form 709 Download and Printable

Download and Print: IRS Form 709

Lifetime Gift and Estate Tax Exemption

For 2025, the unified exemption is $13.99 million per person ($27.98 million for couples). Gifts over the annual exclusion reduce this amount, tracked cumulatively on Form 709. Taxes apply only if you exceed it (rates: 18%–40%).

Sunset Alert: Post-2025, exemptions may adjust under current law, but gifts made now use the higher 2018–2025 levels without clawback.

Step-by-Step Guide: How to Complete IRS Form 709 for 2025

Download the 2025 Form 709 and instructions from IRS.gov. Use tax software or a professional for accuracy. Here’s a simplified walkthrough:

Part 1: Donor Information

- Enter your name, SSN, address, and citizenship status.

- Indicate if you’re electing gift splitting (Line 13) or QTIP treatment.

Part 2: Tax Computation

- List taxable gifts from Schedule A (Line 1).

- Subtract deductions (marital/charitable) and apply unified credit (Line 7: $5,541,800 basic credit for 2025).

- Calculate balance due (if any) on Line 15.

Schedules

- Schedule A: Detail each gift (date, description, value, exclusions). Separate direct skips (Part 2).

- Schedule B: Prior-period gifts for cumulative tracking.

- Schedule C: Deceased spousal unused exclusion (DSUE) portability.

- Schedule D: GST computations.

Pro Tip: Value gifts at fair market value on the transfer date. For complex assets like real estate, get appraisals.

When and How to File IRS Form 709: Deadlines and Methods

File by April 15, 2026, for 2025 gifts (or next business day if a holiday). If the donor dies in 2025, the executor files by the estate tax return due date or April 15, 2026 (whichever is earlier).

Extensions

- Automatic 6-month via Form 8892 (file by April 15; pay any tax due).

- Income tax extension (Form 4868) also covers Form 709, but payment isn’t extended.

Filing Options

- Mail: To your state’s IRS Service Center (see instructions).

- E-File: Available for 2025 via Modernized e-File (MeF); authorize a preparer or become an e-file provider.

Amend errors with a new Form 709 marked “Amended” (no dedicated 709-X).

Common Mistakes to Avoid When Filing Form 709

- Forgetting Aggregate Gifts: Sum all transfers to one recipient—don’t treat separately.

- Overlooking Future Interests: Report even under $19,000 if enjoyment is delayed.

- Valuation Errors: Use FMV; underreporting invites audits and 20% penalties.

- Missing Spousal Consent: Gift splitting requires signatures under penalties of perjury.

- Late Filing: 5% monthly penalty on unpaid tax (up to 25%); interest accrues.

Consult a tax advisor for trusts or international gifts.

Final Thoughts: Leverage Form 709 for Smarter Wealth Transfer in 2025

IRS Form 709 isn’t just a compliance hurdle—it’s a tool for tax-efficient gifting. With the $19,000 exclusion and $13.99 million lifetime limit, 2025 offers prime opportunities to reduce your taxable estate without immediate costs. Act before December 31 to maximize exclusions, and file accurately to sidestep penalties.

For personalized advice, review the official 2025 instructions or consult a CPA. Download Form 709 at IRS.gov and start planning your legacy today. Questions? Leave a comment below!

This article is for informational purposes only and not tax advice. Always verify with a professional.

Related Searches: IRS Form 709 instructions 2025, gift tax exclusion 2025, when to file Form 709, GST tax rules.