Table of Contents

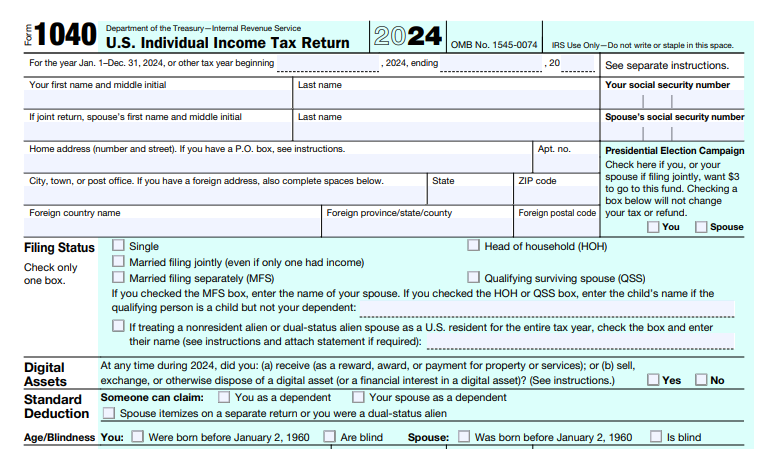

IRS Form 1040 – U.S. Individual Income Tax Return – As tax season approaches, millions of Americans are preparing to file their 2025 IRS Form 1040—the cornerstone of federal income tax reporting. With inflation adjustments boosting the standard deduction to $15,750 for singles and $31,500 for married couples filing jointly, plus new deductions from the One Big Beautiful Bill Act (OBBB) like up to $6,000 for seniors and relief for tips and overtime, 2025 offers opportunities to lower your tax bill. Whether you’re a first-time filer or optimizing deductions, this SEO-optimized guide covers everything from filing requirements to step-by-step instructions, helping you maximize refunds and avoid penalties.

Filing deadline: April 15, 2026 (or October 15 with extension). Download the latest draft forms and instructions from IRS.gov—e-filing is faster and more accurate via Free File or Direct File for eligible taxpayers. Let’s dive in.

What Is IRS Form 1040?

IRS Form 1040, the U.S. Individual Income Tax Return, is the primary form for reporting annual income, calculating taxes owed or refunds due, and claiming credits/deductions for U.S. citizens and residents. It covers wages, investments, self-employment, and more, with progressive tax rates from 10% to 37%.

Key updates for 2025:

- New Schedule 1-A: For additional deductions like qualified tips (up to $25,000), overtime pay, car loan interest on passenger vehicles, and a $6,000 enhanced senior deduction (phasing out above $75,000 MAGI single/$150,000 joint).

- Digital Assets: Expanded reporting for crypto and gig economy income (e.g., 1099-K threshold at $600).

- Child Tax Credit: Increased to $2,200 per qualifying child.

Form 1040-SR is an optional large-print version for those 65+. Use tax software for automatic calculations—over 90% of filers e-file for refunds in under 21 days.

Who Must File IRS Form 1040 in 2025?

Not everyone files; thresholds depend on age, filing status, and income type. U.S. citizens and resident aliens must file if gross income exceeds these 2025 minimums (adjusted for inflation):

| Filing Status | Under 65 | 65+ |

|---|---|---|

| Single | $15,000 | $17,250 |

| Married Filing Jointly | $30,000 | $31,500 (one spouse 65+); $33,000 (both) |

| Head of Household | $22,500 | $24,750 |

| Married Filing Separately | $5 (any age) | $5 (any age) |

| Qualifying Surviving Spouse | $30,000 | $31,500 |

- Self-Employed: File if net earnings ≥$400 (Schedule C/SE).

- Dependents: Lower thresholds (e.g., earned income + $450, max $15,000; see Chart B in instructions).

- Other Triggers: Owe special taxes (e.g., AMT, self-employment), received advance premium tax credits, or want refunds/credits like EITC (even below thresholds).

- Nonresidents: Use Form 1040-NR.

File abroad? U.S. citizens/residents report worldwide income; automatic 2-month extension if outside U.S./Puerto Rico.

2025 Tax Brackets and Rates: What You Need to Know

The U.S. uses seven progressive brackets (10%–37%), made permanent by OBBB. Only income in each bracket is taxed at that rate—e.g., a single filer with $50,000 taxable income pays 10% on the first $11,925, 12% on the next portion, etc.

| Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0–$11,925 | $0–$23,850 | $0–$17,000 |

| 12% | $11,926–$48,475 | $23,851–$96,950 | $17,001–$64,850 |

| 22% | $48,476–$103,350 | $96,951–$206,700 | $64,851–$103,350 |

| 24% | $103,351–$197,300 | $206,701–$394,600 | $103,351–$197,300 |

| 32% | $197,301–$250,525 | $394,601–$501,050 | $197,301–$250,500 |

| 35% | $250,526–$626,350 | $501,051–$751,600 | $250,501–$626,350 |

| 37% | Over $626,350 | Over $751,600 | Over $626,350 |

Rates unchanged; brackets inflation-adjusted ~2.8%. Use the Tax Table for income <$100,000; Qualified Dividends/Capital Gain Worksheet for preferential rates.

IRS Form 1040 Download and Printable

Download and Print: IRS Form 1040

Key Deductions and Credits for 2025

Reduce taxable income with deductions; offset taxes with credits (dollar-for-dollar).

Standard vs. Itemized Deductions

Take the larger amount. 2025 Standard Deduction:

| Filing Status | Base Amount | +65/Blind (per person) |

|---|---|---|

| Single/MFS | $15,750 | +$2,000 |

| MFJ/QSS | $31,500 | +$1,600 (per spouse) |

| HoH | $23,625 | +$2,000 |

Itemized (Schedule A): Medical (>7.5% AGI), state/local taxes (SALT cap $40,000 temporarily), mortgage interest, charity, casualty losses.

New OBBB Deductions (Schedule 1-A, above-the-line): Available to all, including standard deduction takers.

- Tips: Up to $25,000 qualified tips.

- Overtime: Excess over regular rate.

- Car Loan Interest: Qualified passenger vehicle loans.

- Seniors: $6,000 additional (phases out >$75K/$150K MAGI; through 2028).

Other above-the-line (Schedule 1): Student loan interest ($2,500), HSA contributions, self-employed health insurance.

Top Credits

- Child Tax Credit: $2,200/child (up to $1,700 refundable); phases out >$200K single/$400K joint.

- EITC: Up to $8,046 (3+ kids); income limits $18,910 single/$25,511 joint (no kids).

- Education Credits: AOTC up to $2,500; LLC $2,600 max.

Step-by-Step Guide: How to Complete IRS Form 1040 for 2025

Download from IRS.gov (drafts available; final by late 2025). Gather W-2s, 1099s, receipts.

- Filing Status & Personal Info (Lines 1–7): Choose status; enter SSN/ITIN. Check digital asset box (Yes if sold/traded crypto).

- Dependents (Schedule 8812 if CTC): List names/SSNs; new 2025 questions for eligibility.

- Income (Lines 8–11): Total from W-2 (8), interest/dividends (3–3b), IRA/pensions (4a–4b), SS (6b), capital gains (7; Schedule D). Add Schedule 1 extras (e.g., business, unemployment).

- AGI Adjustments (Line 10; Schedule 1): Subtract educator expenses, HSA, etc.

- Standard/Itemized (Line 12; Schedule A): Enter larger; add new Schedule 1-A.

- Taxable Income (Line 15): AGI minus deductions.

- Tax (Line 16): Use brackets/table; add Schedule 2 taxes (AMT, self-employment).

- Credits (Lines 19–23; Schedules 3/8812/8863): Subtract nonrefundable (19), then refundable (e.g., EITC 27).

- Payments/Refund/Owe (Lines 25–38): Withholding, estimated payments; calculate over/underpayment. Sign and date.

Attach schedules; e-file for free if AGI ≤$79K.

When and How to File: Deadlines and Tips

- Deadline: April 15, 2026; extend to October 15 via Form 4868 (pay owed by April to avoid penalties).

- Abroad/Military: +2 months automatic; +4 more via 4868.

- Methods: E-file (90% refunds <21 days); mail to IRS center (see instructions). Direct deposit for refunds.

Amend with Form 1040-X within 3 years.

Common Mistakes to Avoid on Form 1040

- Wrong Filing Status: Costs thousands; double-check HoH eligibility.

- Math Errors: Use software; IRS catches 80% via matching.

- Missing Schedules: Attach 1/2/3 for extras; forget QBI (8995) and lose 20% deduction.

- Digital Assets Oversight: Answer “Yes” if applicable; report gains on Schedule D.

- Late Filing: 5%/month penalty (max 25%); interest on unpaid tax.

Consult a CPA for complex situations like foreign income (Form 2555).

Wrapping Up: File Smart, Save More in 2025

IRS Form 1040 is your gateway to compliance and savings—leverage the higher standard deduction, new OBBB breaks, and credits for a bigger refund. Start early: Gather docs, use IRS tools, and e-file by April 15, 2026. Track changes at IRS.gov/Form1040.

This is informational; not tax advice. Consult a professional for your situation.

Related Searches: IRS Form 1040 instructions 2025, tax brackets 2025, standard deduction 2025, who must file 1040, new tax deductions 2025.