Table of Contents

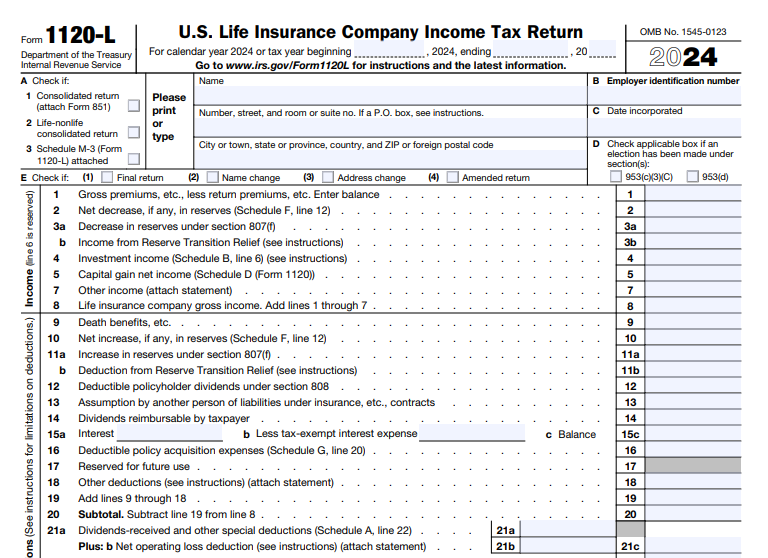

IRS Form 1120-L – U.S. Life Insurance Company Income Tax Return – Navigating tax compliance in the life insurance sector demands precision, especially with IRS Form 1120-L—the dedicated return for reporting income, deductions, credits, and tax liability under specialized rules for life insurers. If you’re a life insurance executive querying “Form 1120-L instructions 2025,” a tax advisor optimizing policyholder surplus deductions, or a CFO tackling NAIC annual statement attachments, this SEO-optimized guide equips you with actionable insights for tax year 2025.

Sourced from the IRS’s official 2024 instructions (applicable for 2025 filings) and recent updates, we’ll cover eligibility, key changes, step-by-step completion, and strategies to minimize audits and penalties. With the filing deadline approaching April 15, 2026, for calendar-year companies, mastering Form 1120-L ensures your company avoids the escalated late-filing penalty—now up to $510 for returns over 60 days late. Let’s streamline your process.

What Is IRS Form 1120-L?

IRS Form 1120-L, the U.S. Life Insurance Company Income Tax Return, is the mandatory federal tax form for domestic life insurance companies and qualifying foreign entities under IRC Section 801. It computes taxable income using unique methodologies like the reserves test (Section 816(a)), segregating life insurance gross income from other operations, and applies a 21% corporate tax rate on non-life activities while deferring taxes on certain policyholder reserves.

Key components include:

- Life/Non-Life Segregation: Reports life insurance company taxable income (LICTI) on Page 1 and policyholder surplus adjustments.

- Schedules: A (taxable income), F (policy acquisition expenses), M-1 (reconciliation), and more.

- Attachments: NAIC annual statement and, for assets ≥ $10M, Schedule M-3 for net income reconciliation.

For 2025, filers must integrate digital asset questions and QOF investment reporting via Form 8997. This form isn’t just compliance—it’s a tool for claiming credits like the general business credit (Form 3800) and optimizing deductions under Section 807.

Who Must File IRS Form 1120-L in 2025?

Every domestic life insurance company—defined as one where life reserves + unearned premiums/unpaid losses on noncancellable policies exceed 50% of total reserves—must file Form 1120-L, regardless of income level. This includes Section 501(m)(1) organizations offering commercial-type insurance.

Eligible Entities

| Entity Type | Filing Obligation | Key Notes |

|---|---|---|

| Domestic Life Insurers | Required | Includes annuity and combined life/health providers; attach NAIC statement. |

| Foreign Life Insurers | Required if U.S.-engaged | File if selling U.S. real property (Section 897); report effectively connected income. |

| Mixed Groups | Required for insurance members | Consolidated groups with non-insurers use Form 1120 parent; insurance subsidiaries complete Schedule M-3 (Form 1120-L). |

| Small Insurers (Assets < $10M) | Required, but Schedule M-3 optional | Voluntary M-3 filing recommended for transparency. |

| Terminated Companies | Final return marked | Attach Form 966 if dissolved. |

Exclusions: Property/casualty insurers file Form 1120-PC; non-insurance corps use Form 1120.

E-filing is mandatory for companies filing 10+ returns annually via the Modernized e-File system. Foreign filers without U.S. business may qualify for streamlined reporting.

Recent Changes to IRS Form 1120-L for Tax Year 2025

The IRS’s 2024 instructions (Rev. Feb 2025) apply to 2025 returns, with no major structural overhauls but targeted enhancements for compliance and inflation adjustments:

- Escalated Late-Filing Penalty: Minimum penalty for returns >60 days late rises to the smaller of tax due or $510 (from $485 in 2024), per IRS Notice adjustments.

- Updated Dividends-Received Deduction Worksheet: Schedule A, Lines 10/21 now incorporate Section 250 GILTI/REIT dividends impacts, aiding international exposure.

- Digital Assets & QOF Reporting: New checkboxes for digital asset transactions; attach Form 8997 for qualified opportunity fund investments held anytime in 2025.

- Schedule M-3 Enhancements: For assets ≥ $10M, expanded mixed-group rules require subgroup consolidations (1120-L vs. 1120-PC); voluntary filers must check Item A, Box 3.

- NAIC Integration: Electronic filers no longer attach full NAIC statements but must reference them; paper filers still include copies.

- Interest Expense Limitations: Form 8990 required for Section 163(j) calculations, with no changes to thresholds.

These align with broader IRS modernization, including post-release tweaks in March 2025 for e-file validations.

IRS Form 1120-L Download and Printable

Download and Print: IRS Form 1120-L

Step-by-Step Guide: How to Complete IRS Form 1120-L for 2025

Gather NAIC statements, policy data, investment records, and subsidiary details. Use tax software for complex calculations like LICTI. Based on 2024 instructions (for 2025 use):

Header & Basic Info

- Name/EIN/Address: Match NAIC filings; apply for EIN via IRS.gov if needed.

- Item A: Check Box 3 if attaching Schedule M-3.

- Item B: Report NAIC annual statement basis.

- Digital Assets Question: Disclose receipts/sales of crypto or NFTs.

Page 1: Tax Computation

- Lines 1-7: Compute life insurance gross income (premiums, investment income, exclusions under Section 101-103).

- Line 8: Add capital gain net income (attach Schedule D (Form 1120)).

- Line 19: Subtotal before deductions.

- Line 20: Taxable investment income (after policyholder deductions, Section 807).

- Line 21: Gain/loss from operations (Schedule C).

- Line 22: LICTI = Line 20 + Line 21 (taxed at 21%).

- Line 23: Non-life taxable income (Schedule T, if applicable).

- Line 26: Total tax; apply credits (e.g., Form 3800 on Line 27).

Example: A company with $5M investment income and $2M policyholder deductions reports $3M on Line 20, taxed at 21% ($630K).

Schedule A: Taxable Income

- Lines 1-15: Detail investment income, reserves increases/decreases (Section 807(c)).

- Lines 16-21: Deductions, including policy acquisition expenses (attach Schedule F).

- Use updated worksheet for dividends-received deduction (50%/65% rates, limited by Section 246(b)).

Schedule F: Policy Acquisition Expenses

- Amortize deferred expenses over 120 months; report excess on Line 21.

Schedule M-1: Reconciliation

- Bridge statutory net income (NAIC basis) to taxable income; mandatory for all.

Schedule M-3 (If Assets ≥ $10M)

- Part I: Financial vs. tax basis.

- Part II/III: Income/expense reconciliations; sub-consolidate for mixed groups.

Schedules K & O

- Schedule K: Shareholder info if >20% ownership.

- Schedule O: Controlled group apportionments.

Filing

- Due Date: 15th day of 4th month after year-end (April 15, 2026, for calendar).

- Extension: File Form 7004 for 6 months (pay estimated tax by original due date).

- Where: E-file via MeF; mail to IRS Ogden, UT, if paper.

- Payments: Use EFTPS; attach Form 7004 if extending.

Common Mistakes to Avoid When Filing Form 1120-L

Life insurers often face audits on reserves and investments—sidestep these:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Omitting NAIC Attachment | Overlooking state-federal sync | Reference in e-file; attach full copy for paper returns. |

| Incorrect LICTI Calculation | Misapplying Section 807 reserves | Use NAIC data; validate with Schedule A worksheet. |

| Skipping Schedule M-3 | Assets < $10M but complex ops | File voluntarily; check Box 3. |

| Late E-Filing | Forgetting 10+ return threshold | Mandate e-file; monitor via IRS account. |

| Ignoring Digital Assets | Undisclosed crypto holdings | Answer Page 1 question; report gains on Schedule D. |

Retain records 7 years; amend via Form 1120X if errors found.

Why File Form 1120-L Accurately? Real-World Benefits for 2025

A mid-sized life insurer with $50M in reserves could defer $10M+ in taxes via proper policyholder deductions, per industry benchmarks. Accurate filing unlocks credits (e.g., R&D via Form 6765) and avoids 5%/month failure-to-file penalties (max 25%). With 2025’s penalty hikes, compliance saves thousands while supporting growth in annuities and investments.

Final Thoughts: Optimize Your 2025 Form 1120-L Filing Now

IRS Form 1120-L is the cornerstone of tax strategy for life insurers, blending NAIC compliance with federal rules to minimize liability. By addressing 2025 updates like enhanced penalties and M-3 requirements, you’ll ensure seamless filing by April 2026.

Download the 2024 form/instructions from IRS.gov (use for 2025) and engage a tax specialist for tailored advice. Explore our guides on Schedule M-3 or Form 1120-PC for related insights. Got questions on “life insurance reserves 2025“? Comment below!

This article is informational only—not tax advice. Consult a CPA or attorney for your company’s needs.