Table of Contents

IRS Form 1066 – U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return – Real Estate Mortgage Investment Conduits (REMICs) are specialized investment vehicles that pool mortgage loans to issue securities backed by those assets, offering tax advantages to investors while ensuring compliance with IRS rules. Central to this compliance is IRS Form 1066, the U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return. This form reports income, deductions, gains, and losses from REMIC operations, while also calculating taxes on specific activities like prohibited transactions.

As we approach the 2025 filing season for tax year 2024, understanding Form 1066 filing requirements is crucial for REMIC managers and residual interest holders to avoid penalties and maintain tax-exempt status. This SEO-optimized guide covers everything from eligibility and deadlines to step-by-step completion instructions and recent updates. For the most current details, visit IRS.gov/Form1066.

What Is IRS Form 1066?

IRS Form 1066 is the annual income tax return for REMICs, a type of pass-through entity under section 860D of the Internal Revenue Code. It ensures REMICs report their taxable activities transparently, passing most income through to regular interest holders (taxed as debt instruments) and residual interest holders (taxed on their share of REMIC income). The form also computes and pays taxes at the REMIC level on:

- Net income from prohibited transactions (e.g., non-qualified asset sales).

- Net income from foreclosure property.

- Contributions received after the startup day.

REMICs must use the accrual method of accounting and adhere to a calendar-year tax period. Unlike partnerships, REMICs are not subject to entity-level tax on regular operations but must file Form 1066 to validate their status and report allocations via Schedule Q. Failure to qualify as a REMIC can result in taxation as a taxable mortgage pool, triggering severe penalties.

For tax year 2024 (filed in 2025), the form aligns with ongoing IRS emphasis on accurate investor reporting amid rising mortgage-backed securities activity.

Who Must File Form 1066?

Form 1066 is mandatory for any entity that elects REMIC status and meets the qualifications under section 860D(a). Here’s who qualifies:

- Electing Entities: Any trust, estate, association, or corporation that timely elects REMIC treatment for its startup year (and all subsequent years unless terminated). The election is made by filing Form 1066 for the first tax year, attaching details on interests and prepayment assumptions.

- Ongoing REMICs: Entities with an effective election that continue to satisfy asset tests (e.g., 95% qualified mortgages) and restrictions on residual interest holders (no disqualified organizations like tax-exempts without arrangements).

- Exceptions: REMICs with a startup day before April 1, 1988, or under binding contract by March 31, 1988, may have modified rules but still file Form 1066.

Residual interest holders (who bear the tax on REMIC income) rely on Schedule Q attachments for their personal returns. If the REMIC has multiple residual holders, it may need to designate a partnership representative for audit purposes. Foreign REMICs with U.S. activities must also comply.

When Is Form 1066 Due in 2025?

The deadline for Form 1066 for calendar-year REMICs (tax year 2024) is March 15, 2025. For final returns (REMIC termination in 2024), it’s the 15th day of the 3rd month after cessation. Short tax years follow the same rule, adjusted for the period end.

Key 2025 Filing Deadlines Table

| Tax Year Type | Original Due Date | Extended Due Date (with Form 7004) |

|---|---|---|

| Calendar Year 2024 | March 15, 2025 | September 15, 2025 |

| Short Year Ending in 2024 | 15th Day of 3rd Month After End | 6 Months from Original |

| Final Return (2024 Cessation) | 15th Day of 3rd Month After Cessation | 6 Months from Original |

Note: If the due date falls on a weekend or holiday, it shifts to the next business day.

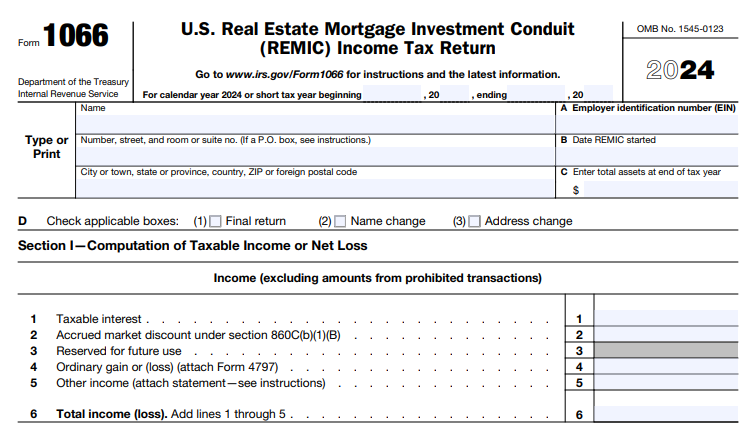

IRS Form 1066 Download and Printable

Download and Print: IRS Form 1066

Extensions and Amendments

- Automatic 6-Month Extension: File Form 7004 by the original due date—no approval needed. This extends filing but not payment of any taxes due (e.g., on prohibited transactions).

- Amended Returns: Use Form 1065-X to correct errors; refile affected Schedule Qs with residual holders. Late amendments may qualify for reasonable cause relief.

Three consecutive years of non-filing can lead to status revocation.

How to Complete IRS Form 1066: Step-by-Step Guide

Form 1066 includes the main return, Schedule J (taxes), Schedule L (balance sheet), Schedule M (capital reconciliation), and Schedule Q (quarterly notices). Use the 2024 form for tax years ending in 2024 or short 2025 periods. Report in U.S. dollars, round to whole numbers, and attach statements as needed (e.g., Form 4562 for depreciation).

Essential Sections and Line Highlights

- Identifying Information (Items A–L):

- Enter EIN, startup day, total assets, and number of residual holders.

- Check boxes for final return, audit regime election (if ≤100 holders), or foreign accounts (trigger FinCEN Form 114).

- Item L: Sum of daily accruals for residuals (120% of federal long-term rate).

- Section I: Income (Lines 1–6):

- Line 1: Taxable interest (net of amortizable premiums).

- Line 2: Accrued market discount.

- Line 5: Other income (e.g., debt cancellation; attach statement).

- Line 6: Total income.

- Deductions (Lines 7–14):

- Line 9: Interest to regular holders (includes OID).

- Line 11: Taxes (from Schedule J).

- Line 12: Depreciation (attach Form 4562).

- Line 14: Total deductions (no NOLs or foreign tax credits here).

- Tax Computation (Lines 15–22):

- Line 15: Taxable income (line 6 minus line 14).

- Line 22: Total tax (primarily from Schedule J).

- Schedule J: Taxes:

- Part I: 35% tax on prohibited transaction net income (gains from non-qualified sales).

- Part II: 35% on foreclosure property net income (after 3-year grace period).

- Part III: 100% on post-startup contributions (with exceptions for clean-up calls).

- Schedule L: Balance Sheet (Per Books):

- Assets: Cash flow investments, qualified reserves, foreclosure property, qualified mortgages, regular interests.

- Liabilities: Accrued interest to holders.

- Schedule M: Reconciliation of Residual Holders’ Capital Accounts:

- Columns track beginning/ending balances, income allocations, and adjustments (e.g., nondeductible expenses).

- Schedule Q: Quarterly Notice to Residual Interest Holders:

- One per holder per quarter; file all with Form 1066.

- Reports share of taxable income/loss, excess inclusions, and asset tests (≥95% qualified).

- Furnish to holders by the last day of the month following quarter-end.

Pro Tip: Sequence: Complete Schedule Q first, then J, main form, L, and M. Use accrual basis; attach prospectuses for new REMICs.

E-Filing Requirements for Form 1066

While Form 1066 itself can be paper-filed, related information returns (e.g., Forms 1099-INT/OID for regular holders) must be e-filed if 10 or more (per Taxpayer First Act). Use IRS-approved software for accuracy. Payments via EFTPS; electronic filing speeds processing to 2–3 weeks.

Recent Changes to Form 1066 for 2025 Filings

The 2024 Form 1066 (used for 2025 filings) includes inflation-adjusted penalty increases:

- Failure-to-File Minimum: Now $510 (up from prior years) if over 60 days late.

- No-Tax-Due Penalty: $245 per residual holder per month (up to 12 months).

No structural changes for 2025; however, REMICs must monitor general updates like enhanced foreign account reporting (FinCEN Form 114). Check IRS.gov for post-October 2024 legislation.

Penalties for Late or Incomplete Form 1066 Filing

Compliance is strict—penalties accrue quickly:

- Failure to File (Section 6651(a)): 5% of unpaid tax per month (max 25%); minimum $510 if over 60 days late.

- No Tax Due (Section 6698): $245 per residual holder per month (max 12 months).

- Failure to Furnish Schedule Q: $130 per schedule (up to $510 if intentional).

- Late Payment: 0.5% per month (max 25%).

- Other: 20–40% for understatements; 100% on excess inclusions to tax-exempts.

Interest applies from due date. Reasonable cause (e.g., natural disasters) waives penalties; state filings may add fees.

Best Practices for Form 1066 Compliance in 2025

- Prepare Early: Gather mortgage schedules, interest accruals, and holder data quarterly.

- Leverage Software: Tools like TurboTax Business or specialized REMIC platforms automate Schedule Q.

- Investor Communication: Distribute Schedule Qs promptly; retain records for 7+ years.

- Professional Help: Engage a CPA for complex asset tests or elections.

- Audit Readiness: Designate a U.S.-based partnership representative if applicable.

Accurate filing supports REMIC’s pass-through benefits, minimizing entity-level taxes.

Conclusion: Master Form 1066 Filing for REMIC Success in 2025

IRS Form 1066 is the cornerstone of REMIC tax compliance, ensuring seamless income allocation while taxing impermissible activities. With the March 15, 2025, deadline looming for tax year 2024, proactive preparation—including extensions via Form 7004—can prevent costly penalties.

Download the latest form and instructions from IRS.gov. For assistance, call the IRS Business Hotline at 800-829-4933. Stay compliant, and let your REMIC focus on mortgage investments, not IRS headaches.

Last updated: December 2025. Consult official IRS sources for tailored advice.