Table of Contents

IRS Form 2441 – Child and Dependent Care Expenses – If you paid for childcare, preschool, summer day camp, or care for a disabled spouse/dependent in 2024 so you (and your spouse) could work or look for work, you may qualify for the Child and Dependent Care Credit worth up to $2,100 (or $4,200 for two or more qualifying persons). The credit is claimed using IRS Form 2441, and for tax year 2024 (filed in 2025), the rules remain generous thanks to the permanent enhancements from the American Rescue Plan.

This SEO-optimized guide explains everything you need to know about Form 2441 in 2025 — eligibility, credit amounts, new limits, how to fill it out line-by-line, common mistakes, and tips to maximize your refund.

What Is Form 2441 and How Much Is the 2024–2025 Credit Worth?

Form 2441 calculates the non-refundable Child and Dependent Care Credit (Internal Revenue Code §21). For tax year 2024:

| Number of Qualifying Persons | Maximum Eligible Expenses | Maximum Credit (50% phase-out complete) |

|---|---|---|

| 1 child or dependent | $3,000 | $1,050 |

| 2 or more | $6,000 | $2,100 |

- The credit percentage ranges from 20% to 35% of eligible expenses, depending on your adjusted gross income (AGI).

- Highest 35% rate applies if AGI ≤ $15,000.

- Phase-out begins at AGI > $15,000 and bottoms out at 20% once AGI exceeds $43,000 (these thresholds are not inflation-adjusted).

Good news: Unlike 2021’s temporary $8,000/$16,000 limits, the $3,000/$6,000 caps are now permanent under current law.

Who Qualifies for the Child and Dependent Care Credit in 2025?

You (and your spouse if married) must meet all five tests:

- Qualifying Person Test

- Child under age 13 when care was provided (or any age if physically/mentally incapable of self-care).

- Must be your dependent (or could be if not for certain rules).

- Disabled spouse or dependent also qualifies.

- Earned Income Test

- You (and spouse if MFJ) must have earned income (W-2 wages, self-employment, etc.).

- Special rule: Full-time students or disabled spouses are treated as having $250/$500 monthly earned income.

- Work-Related Expense Test

- Care was provided so you could work or actively look for work.

- Joint Return Test (if married)**

- Must file Married Filing Jointly (very limited exceptions).

- Provider Identification Test

- You must provide the care provider’s name, address, and SSN or EIN (no credit without this).

2024–2025 Dollar Limits and Phase-Out Table

| AGI (2024) | Credit Percentage | Max Credit – 1 Person | Max Credit – 2+ Persons |

|---|---|---|---|

$0 – $15,000 | 35% | $1,050 | $2,100 $15,001 – $17,000 | 34% | $1,020 | $2,040 … (decreases 1% every $2k) | | | $43,001 and higher | 20% | $600 | $1,200

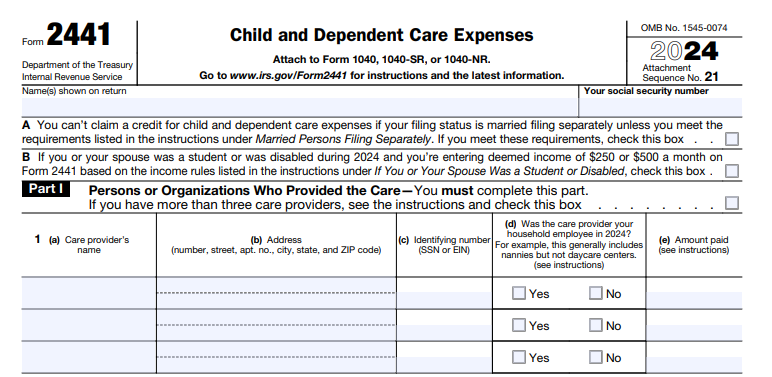

IRS Form 2441 Download and Printable

Download and print: IRS Form 2441

How to Fill Out Form 2441 – Step-by-Step (2024 Form)

Part I – Care Provider Information

- Lines 1a–1c: List each provider’s name, address, SSN/EIN, and amount paid.

- Summer camps, daycare centers, and after-school programs need their EIN.

- If provider refuses SSN/EIN → no credit.

Part II – Credit Calculation

2a–2c: Enter total 2024 care expenses (capped at $3,000/$6,000).

3: Enter your earned income.

4: Enter spouse’s earned income (or deemed $250/$500 if student/disabled).

5: Take the smallest of lines 2c, 3, or 4 → this is your credit base.

6–10: Look up your AGI-based percentage from the table on page 6 of instructions.

11: Multiply line 5 × percentage → this is your credit.

Part III – Dependent Care Benefits (if employer plan)

Only complete if you received employer-provided dependent care assistance (FSA box 10 on W-2).

The credit flows to Form 1040 Schedule 3, line 2.

Common Mistakes That Cost Taxpayers Thousands

- Forgetting provider SSN/EIN (most audited item).

- Claiming household employees (nannies) without an EIN.

- Including overnight camp or tuition expenses (not eligible).

- Claiming care for a 13-year-old (unless disabled).

- Married couples filing separately (almost never allowed).

2025 Updates and New Rules

- Inflation-adjusted penalty for missing provider ID increased to $280 per return (up from $270).

- IRS now cross-checks Form 2441 against Form W-10 and daycare 1099 reports.

- Dependent Care FSA contribution limit remains $5,000 ($2,500 if MFS) for 2025.

- No major legislative changes expected before 2026 (current rules locked through 2025 under TCJA sunset delay).

Quick Credit Maximization Checklist for 2025 Filing

- Use a Dependent Care FSA at work → pay expenses pre-tax (saves FICA + income tax).

- Pay your nanny or au pair legally → get an EIN and issue W-2 (makes expenses fully eligible).

- Keep receipts + signed Form W-10 from providers.

- If self-employed, remember your own earned income limit still caps the credit.

Conclusion: Claim Up to $2,100 in 2025

The Child and Dependent Care Credit remains one of the most valuable working-family tax breaks. With the 2024 expenses capped at $3,000/$6,000 and the credit percentage locked through at least 2025, millions of families will claim $600 to $2,100 on their 2024 returns filed in 2025.

Download the official 2024 Form 2441 and instructions at IRS.gov/Form2441

Free filing options with guided Form 2441 support: IRS Free File, TurboTax, TaxAct, and most major platforms.

Don’t leave money on the table — if you paid for care so you could work in 2024, file Form 2441 and get your credit!

Last updated: December 2025 | Sources: IRS Publication 503 (2024), IRS Form 2441 Instructions (2024), IR-2024-298