Table of Contents

IRS Form 8835 – Renewable Electricity Production Credit – In an era where clean energy incentives are pivotal for sustainability and profitability, IRS Form 8835—the “Renewable Electricity Production Credit”—stands out as a key tool for developers, operators, and investors in wind, solar, geothermal, and other renewables. If you’re a renewable energy project owner querying “Form 8835 instructions 2025,” a tax advisor navigating IRA bonus credits, or a nonprofit seeking elective payment options, this SEO-optimized guide provides a comprehensive overview. We’ll cover eligibility, step-by-step filing, and 2025-specific updates, ensuring you maximize your credit—up to 2.75 cents per kWh base (adjusted for inflation and bonuses)—while complying with prevailing wage requirements.

Drawn from the IRS’s 2024 instructions (applicable to 2025 returns), Federal Register notices, and Inflation Reduction Act (IRA) guidance, this resource helps you file by April 15, 2026 (or October 15 with extension) and avoid penalties. With construction deadlines looming before January 1, 2025, for many facilities, now’s the time to act. Let’s power up your green tax strategy.

What Is IRS Form 8835?

Form 8835 enables taxpayers to claim the Section 45 renewable electricity production tax credit (PTC) for electricity generated from qualified renewable resources at U.S.-based facilities and sold to unrelated parties. This per-kWh credit applies over a 10-year period starting from the facility’s placement in service, rewarding production from sources like wind, biomass, and hydropower.

Under the IRA of 2022, the PTC was revamped for facilities placed in service after 2021, introducing base rates of 0.3–0.6 cents/kWh (inflation-adjusted), a 5x multiplier for labor-compliant projects, and 10% bonuses for domestic content or energy communities. For 2025 sales, no phaseout applies as reference prices remain below thresholds (e.g., wind at 3.1 cents vs. adjusted 15.98 cents). The form integrates with Form 3800 (General Business Credit) for claiming, and supports elective payments for tax-exempts or credit transfers to monetize benefits.

This credit isn’t just for large-scale farms—small projects under 1 MW qualify with enhanced rates, making it accessible for community solar or micro-hydro initiatives.

Who Is Eligible for the Renewable Electricity Production Credit on Form 8835 in 2025?

Eligibility centers on owning or operating a qualified facility using qualified energy resources, with construction beginning before January 1, 2025, for most categories. The facility must produce electricity in the U.S. or territories, and credits require sales to unrelated persons (or use in the taxpayer’s trade/business).

Eligible Taxpayers

| Taxpayer Type | Eligible Scenarios | Key Requirements |

|---|---|---|

| Individuals & Businesses (e.g., developers, utilities) | Direct credit claim for owned/operated facilities | Must meet prevailing wage/apprenticeship (PWA) for 5x rate; pre-register for transfers. |

| Pass-Through Entities (partnerships, S corps) | Pass credits via Schedule K-1 | Report on line 14; no direct filing if only passed-through. |

| Tax-Exempt/Governmental Entities (nonprofits, tribes) | Elective payment (direct refund) | Post-2022 facilities; 90% phaseout for 2024 construction unless exceptions. |

| Cooperatives & Estates/Trusts | Allocation to patrons/beneficiaries | Elect on line 16; notify within timelines. |

Exclusions: Facilities claiming under Section 45K (carbon capture) or 48 (investment credit); grants under ARRA Section 1603 reduce basis by 50%. No credit for electricity not sold or used commercially.

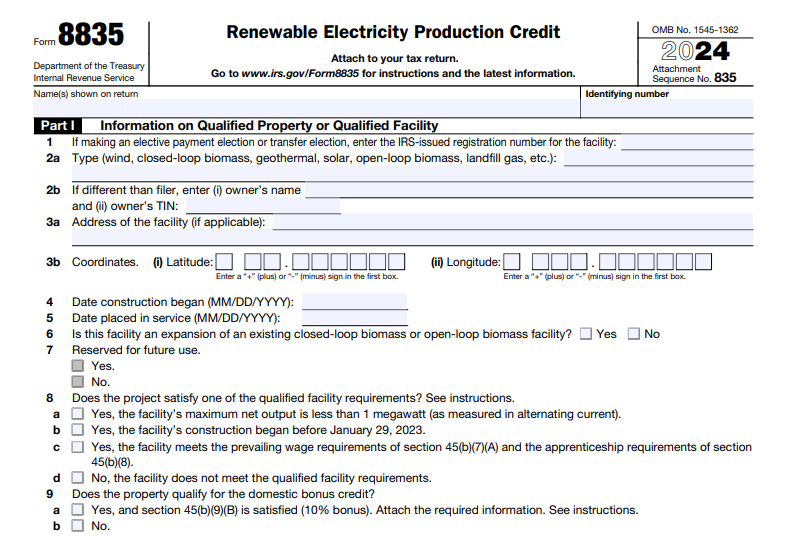

IRS Form 8835 Download and Printable

Download and Printable: IRS Form 8835

Recent Changes to IRS Form 8835 for Tax Year 2025

The IRS’s 2024 instructions apply to 2025 filings, with the inflation adjustment factor at 1.9971 (per Federal Register Vol. 90, No. 102, May 27, 2025), boosting base rates to ~0.6 cents/kWh for pre-2022 facilities and ~0.3 cents for post-2021. Key IRA-driven updates:

- Construction Deadline: Most facilities must begin construction before January 1, 2025; <1 MW projects eligible if started after Dec. 31, 2021.

- No Phaseout: Reference prices (e.g., wind: 3.1 cents/kWh) below threshold (15.98 cents), so full credit available.

- Bonus Credits: 10% add-ons for domestic content (U.S. steel/iron/manufactured products; certify per Notice 2023-38) and energy communities (fossil fuel-impacted areas; per Notices 2023-29/2024-48), applicable post-2022.

- PWA Multiplier: 5x base for projects >1 MW meeting wage/apprenticeship rules (15% apprentice hours, ratios); exceptions for small/rural projects.

- Elective Payment Phaseout Relief: For 2024-constructed facilities, 90% reduction unless domestic content or <1 MW (Notice 2024-09).

- Reporting Relief: For >200 facilities (2023-2024), aggregate on one form with PDF attachment; separate forms required otherwise.

- Transition to Section 45Y: Post-2024 facilities shift to Clean Electricity PTC (0.3 cents/kWh base, zero-emission requirement), but Form 8835 covers legacy claims.

Pre-filing registration mandatory for payments/transfers via IRS Energy Credits Online.

Step-by-Step Guide: How to Complete IRS Form 8835 for 2025

File a separate Form 8835 per facility; attach to your return (e.g., Form 1120) and Form 3800. Use 2024 form for 2025; fiscal filers calculate 2024/2025 separately, noting “FY.”

Part I: Facility Information

- Line 1: IRS registration number (if payment/transfer).

- Lines 2-3: Facility description, address, coordinates.

- Line 4: Construction start date (prove via physical work or 5% safe harbor).

- Line 8: Check for 5x multiplier (8a: <1 MW; 8b: pre-Jan. 29, 2023 start; 8c: PWA met—attach wage details, apprentice logs).

- Line 9: Domestic content bonus—attach certification (project type, U.S. sourcing statement).

- Line 10: Energy community bonus—attach location proof.

Part II: Credit Calculation

- Line 1: kWh produced × rate (e.g., 0.6 cents for wind post-2021; use 2025 IAF-adjusted).

- Line 3: Phaseout adjustment (0 for 2025).

- Lines 5-7: Tax-exempt bond reduction (if financed >15% with bonds).

- Line 8: Base credit.

- Line 9: ×5 if Line 8 checked.

- Line 10: +10% domestic (if Line 9 checked).

- Line 11: +10% energy community (if Line 10 checked).

- Line 12: Total tentative credit.

- Line 13: Elective payment reduction (×10% if applicable).

- Line 14: Add passed-through credits (from K-1s).

- Line 15: Transfers (report on Form 3800).

- Line 16: Cooperative allocation.

Example: 1M kWh from post-2021 wind (0.6¢/kWh base) with PWA and domestic bonus: Line 1 = $6,000; Line 9 = $30,000; Line 10 = $3,000; Total ~$33,000 credit.

Transfer to Form 3800, Part III, line 1f (non-corporate) or 4e (corporate).

Filing Tips

- Due: With tax return; extend via Form 7004.

- E-File: Preferred; attach statements/PDFs.

- Records: Retain 3+ years (production logs, sales contracts, PWA certifications).

Common Mistakes to Avoid When Filing Form 8835

Maximize your credit while dodging audits—here’s a quick reference:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Missing Pre-Registration | Overlooking IRA for payments/transfers | Register at IRS.gov/EnergyCredits before filing. |

| Wrong Rate/Calculation | Ignoring IAF or fiscal splits | Use 1.9971 factor; separate 2024/2025 for FY filers. |

| No PWA Documentation | Assuming 5x applies without proof | Attach apprentice ratios, wage determinations. |

| Aggregating Without Relief | >200 facilities without PDF | Use single form + attachment for 2023-2024; separate for 2025. |

| Double-Dipping | Claiming with ARRA grant | Reduce basis by 50%; no credit. |

Why Claim the Renewable Electricity Production Credit? Real-World Impact for 2025

A 10 MW wind farm producing 20M kWh annually could claim $120,000+ base (0.6¢/kWh), ballooning to $660,000 with 5x PWA and bonuses—enough to fund expansions or debt service. With 2025 as the last year for legacy PTC eligibility, early filing secures carryforwards (20 years) amid the shift to Section 45Y’s zero-emission focus.

Final Thoughts: Harness the 2025 PTC with Form 8835

IRS Form 8835 fuels the green transition, but IRA’s deadlines and bonuses demand precision—especially with construction cutoff on December 31, 2024. By verifying eligibility, documenting PWA, and integrating with Form 3800, you’ll unlock substantial savings.

Download the 2024 form/instructions from IRS.gov and consult a renewable tax specialist. For more on IRA credits, explore Form 3468 guides. Questions on “renewable energy tax credits 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your project.