Table of Contents

IRS Form 8396 – Mortgage Interest Credit – Owning a home is a milestone, but mortgage interest can strain budgets—especially for first-time buyers. What if you could turn part of that interest into a direct tax credit, reducing your federal bill dollar-for-dollar up to $2,000 annually? IRS Form 8396, the “Mortgage Interest Credit,” makes it possible for eligible homeowners holding a qualified Mortgage Credit Certificate (MCC). If you’re a new buyer searching for “Form 8396 instructions 2025,” a refinancing homeowner wondering about “MCC credit carryforward rules,” or a moderate-income family exploring “mortgage interest tax credit eligibility 2025,” this SEO-optimized guide is your roadmap.

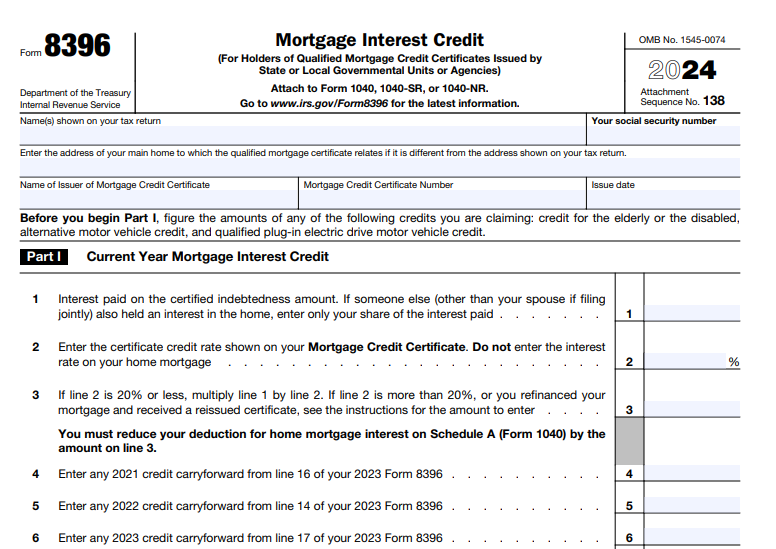

Sourced from the IRS’s official 2025 draft Form 8396 (released August 28, 2025) and instructions, plus Pub. 936 updates, we’ll cover who qualifies, recent tweaks like permanent mortgage deduction caps under the One Big Beautiful Bill Act (OBBBA), and how to file by April 15, 2026. This nonrefundable credit—capped at 20-50% of your certified mortgage interest—could save you thousands over the loan’s life, but it requires reducing your Schedule A deduction. Let’s make homeownership more affordable.

What Is IRS Form 8396?

Form 8396 lets holders of a qualified MCC claim a nonrefundable credit for a percentage (typically 20-50%) of mortgage interest paid on their principal residence. Issued by state or local housing finance agencies (HFAs) under IRS-approved programs, the MCC converts part of your interest into a credit, easing the tax burden for low- to moderate-income buyers. Unlike the mortgage interest deduction (which reduces taxable income), this credit directly offsets your tax liability.

For 2025, the form calculates your current-year credit (Part I) and carryforward (Part II), with a $2,000 annual cap. Attach it to Form 1040 or 1040-SR, and report the credit on Schedule 3, Line 5d. If you itemize, subtract the Line 3 amount from your Schedule A interest deduction—even for carried-forward portions. Refinancing? A reissued MCC keeps the benefit alive, but separate calculations apply if rates differ.

This credit, established under IRC Section 25, supports affordable housing without refunds—unused amounts carry forward indefinitely. With home prices rising, it’s a vital tool for 2025 buyers.

Who Is Eligible for the Mortgage Interest Credit on Form 8396 in 2025?

Eligibility hinges on holding a valid MCC and meeting program rules—no MCC means no credit. Programs vary by state, but federal guidelines apply.

Key Requirements

| Criterion | 2025 Details | Notes |

|---|---|---|

| MCC Issuance | From state/local HFA under qualified program | First-time buyers or targeted area purchasers; income ≤ area median (e.g., $70K-$100K family of 4, varies by location). |

| Residence Use | Principal home; no rentals/vacations | Must live there; exceptions for military/veterans. |

| Mortgage Type | Acquisition debt only; no related-party loans | Certified indebtedness ≤ $750K (post-2017 loans); interest from Form 1098. |

| Income Limits | Per HFA; moderate-income focus | E.g., Louisiana: ≤$70K family of 2; check state HFA. |

| Purchase Price Caps | Varies by area | E.g., $312K in some LA zones; no cap if targeted area. |

Exclusions: MCCs from non-qualified programs; homes not used as main residence; refinances without reissuance. Veterans/military may waive first-time buyer rules.

Recent Changes to IRS Form 8396 for Tax Year 2025

The IRS released the 2025 draft Form 8396 on August 28, 2025, with no structural overhauls but alignments to OBBBA and inflation tweaks. Key updates:

- Permanent Deduction Caps: OBBBA locks the $750K mortgage interest deduction limit (post-Dec. 15, 2017 loans) beyond 2025—no sunset.

- PMI as Deductible Interest: Starting 2026, PMI counts as qualified interest (OBBBA); impacts 2025 refinances.

- $2,000 Cap Holds: No inflation adjustment; 20%+ rates capped at $2,000; allocate for co-owners.

- Refinance Reporting: Attach statement for split-year calculations if MCC rates change.

- Program Availability: Some states (e.g., TX) paused standalone MCCs; bundled with DPA where funds allow.

No major rate changes; e-file preferred.

IRS Form 8396 Download and Printable

Download and Print: IRS Form 8396

Step-by-Step Guide: How to Complete IRS Form 8396 for 2025

Gather your MCC, Form 1098, and prior-year Form 8396. Use the 2025 draft; attach to your return. Based on IRS instructions:

Preparation

- Confirm MCC details: Issuer, rate (Line 2), certified amount.

- Calculate certified interest (Line 1): From 1098, prorated if co-owned.

Part I: Current Year Mortgage Interest Credit (Lines 1-9)

- Line 1: Certified indebtedness interest paid (share if co-owned).

- Line 2: MCC credit rate (e.g., 20%).

- Line 3: Multiply Line 1 × Line 2; cap at $2,000 if >20%.

- Line 4: Carryforward from 2024 Form 8396, Line 17.

- Line 5: Add Lines 3 + 4.

- Line 6: Total available (Line 5).

- Line 7: Tax liability limit (from Credit Limit Worksheet: smaller of tax or credits).

- Line 8: Current credit = smaller of Line 6 or 7.

- Line 9: Enter on Schedule 3, Line 5d.

Example: $10,000 interest (Line 1) × 20% (Line 2) = $2,000 (Line 3, capped). +$500 carryforward (Line 4) = $2,500 (Line 6). If tax = $1,800 (Line 7), credit = $1,800 (Line 8).

Part II: Credit Carryforward to 2026 (Lines 10-17)

- Line 10: Line 6 amount.

- Line 11: Larger of Line 8 or other limits.

- Line 12-17: Subtract used credit; remainder carries to 2026.

Filing Tips

- Reduce Schedule A: Subtract Line 3 from interest deduction.

- Due: April 15, 2026; extend via Form 4868.

- E-File/Mail: IRS Free File or to your service center.

Common Mistakes to Avoid When Filing Form 8396

Maximize your credit without IRS notices—here’s a quick table:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Forgetting Schedule A Reduction | Over-deducting interest | Subtract Line 3 amount; applies even to carryforwards. |

| Wrong Certified Interest | Using full 1098 amount | Prorate for certified debt/share; exclude points. |

| Ignoring Refinance Split | Single calc for changed rates | Attach statement with prorated Lines 1-3. |

| Missing Carryforward | No prior form | Use Line 17 from last year; track annually. |

| Capping Errors | Exceeding $2,000 | Limit Line 3; allocate for co-owners. |

Retain MCC/1098 for 3+ years.

Why Claim the Mortgage Interest Credit? Real-World Impact for 2025

A family with a 20% MCC rate and $12,000 annual interest claims $2,000 credit—slashing taxes by that amount, per IRS examples. Over 30 years, that’s $60,000+ in savings, boosting affordability amid 2025’s steady rates. With OBBBA’s permanent caps, it’s a stable benefit for moderate-income buyers.

Final Thoughts: Maximize Your 2025 Savings with IRS Form 8396

IRS Form 8396 transforms mortgage interest into real relief for MCC holders, but eligibility and reductions demand care—especially post-refinance. Check your state’s HFA for programs and file accurately to carry forward unused credits.

Download the 2025 draft from IRS.gov and consult a tax pro for personalized math. For more, explore Pub. 936. Questions on “MCC refinance 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.