Table of Contents

IRS Form 1120-REIT – U.S. Income Tax Return for Real Estate Investment Trusts – In the booming real estate sector, Real Estate Investment Trusts (REITs) offer investors diversified exposure to properties like apartments, offices, and data centers—often with attractive yields. But to maintain tax advantages, REITs must file IRS Form 1120-REIT, the “U.S. Income Tax Return for Real Estate Investment Trusts.” If you’re a REIT manager searching for “Form 1120-REIT instructions 2025,” a compliance officer reviewing “REIT distribution requirements 2025,” or an investor auditing “REIT tax filing deadlines,” this SEO-optimized guide provides the essentials. We’ll break down eligibility, step-by-step filing, and 2025 updates like escalated late-filing penalties (up to $510 minimum), helping you ensure 90%+ taxable income distributions and avoid excise taxes under Section 4981.

Sourced from the IRS’s 2024 instructions (applicable to 2025 returns) and draft Form 1120-REIT (Rev. Dec. 2024), this resource aligns with Subchapter M rules. With the March 17, 2026, deadline for calendar-year REITs, accurate filing preserves pass-through status and shields against corporate-level taxes. Let’s invest in compliance.

What Is IRS Form 1120-REIT?

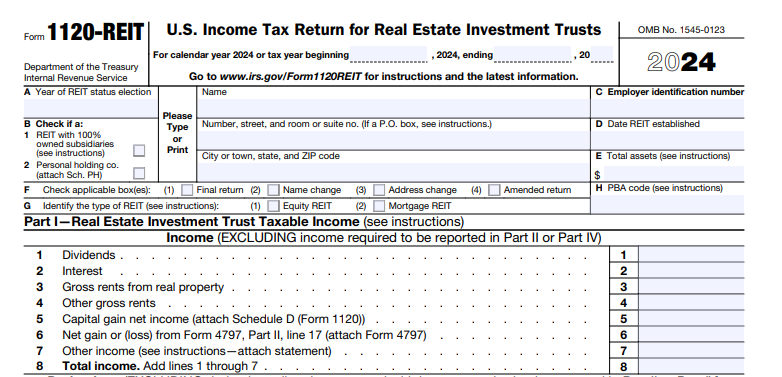

Form 1120-REIT is the annual federal tax return for domestic REITs electing treatment under IRC Section 856, enabling them to report real estate income, deductions, credits, and tax liability while claiming a dividends-paid deduction to pass through earnings to shareholders. This form calculates REIT taxable income (RTI), verifies compliance with income/asset tests, and computes taxes on undistributed income or built-in gains.

Key components:

- Pass-Through Mechanism: Distribute 90%+ of RTI to avoid 21% corporate tax; shareholders report dividends on personal returns.

- Schedules: J (tax computation), K (other info), L (balance sheet), M-1 (reconciliation), and attachments like Schedule D for capital gains.

- Excise Tax Tie-In: Links to Form 8612 for the 4% excise on undistributed income if short of 95% of RTI + 97% of capital gains.

For 2025, filers use the 2024 form, incorporating vehicle lease inclusion amounts from Pub. 463. This return isn’t optional—even dormant REITs file to maintain status, potentially saving millions in entity-level taxes through proper distributions.

Who Must File IRS Form 1120-REIT in 2025?

Any domestic corporation, trust, or association electing REIT status must file Form 1120-REIT annually, regardless of income. Election is made via timely filing; once made, it’s irrevocable without IRS consent.

Eligible Entities

| Entity Type | Filing Obligation | Key Notes |

|---|---|---|

| Equity/Mortgage REITs | Required | Must meet 75%/95% income tests, 75% asset test, and 100+ shareholders. |

| Hybrid REITs (mixed assets) | Required | Report via Schedules; attach diversification statements. |

| Controlled Subsidiaries | Parent files consolidated | Use Form 851; subsidiaries report on Schedule K. |

| Foreign REITs with U.S. Assets | Required if U.S. income | File for effectively connected income; attach Form 1118. |

| Terminating REITs | Final return marked | Check Item E; attach Form 966. |

Exclusions: Non-REIT real estate corps file Form 1120; private REITs still qualify if tests met. E-filing mandatory for 10+ returns annually.

Recent Changes to IRS Form 1120-REIT for Tax Year 2025

The IRS’s 2024 instructions (Rev. Dec. 2024) apply to 2025 filings, with the draft 2025 form available but not required until finalized. No major redesigns, but enhancements focus on penalties and compliance:

- Penalty Increase: For returns due in 2025, the minimum late-filing penalty (>60 days) rises to the smaller of tax due or $510 (from $485), up to 25% of unpaid tax.

- E-Filing Expansion: Mandatory for REITs filing 10+ returns in 2024; supports Modernized e-File (MeF) for faster processing.

- Vehicle Lease Rules: Deduction reductions for terms ≥30 days; inclusion amounts published in early 2025 Internal Revenue Bulletin.

- Distribution No Changes: 90% RTI requirement holds; 4% excise on shortfalls unchanged.

- Post-Release Tweaks: No specific 1120-REIT updates in IRS changes log as of December 2025, but monitor for Section 199A pass-through deductions (20% on qualified REIT dividends, extended post-2025 via OBBBA).

Fiscal REITs use 2024 form for years ending in 2025.

IRS Form 1120-REIT Download and Printable

Download and Print: IRS Form 1120-REIT

Step-by-Step Guide: How to Complete IRS Form 1120-REIT for 2025

Use the 2024 form for 2025; e-file via MeF. Gather financials, shareholder distributions, and asset valuations. Based on 2024 instructions:

Header & Basic Info

- Item A: Year of REIT election.

- Item B: Establishment date.

- Item C: EIN; check for short year.

- Item D: Total assets (year-end).

- Item E: Amended/final return.

Part I: Real Estate Investment Trust Income

- Lines 1-3: Gross rents, other rents, interest from mortgages.

- Lines 4-8: Deductions (interest, taxes, depreciation via Form 4562).

- Line 9: RTI before NOL/dividends-paid.

- Line 10: NOL deduction.

- Line 11: RTI (usually $0 after 90%+ distribution).

Example: $10M rents (Line 1) – $3M expenses (Line 8) = $7M RTI; $6.3M distributed = $0 taxable (Line 11).

Part II: Tax on Termination/Deficiency Dividends

- Lines 1-3: For failure to qualify; tax at 21%.

Schedule J: Tax Computation

- Lines 1-5: RTI tax (Line 11 × 21%).

- Lines 6-12: Credits (Form 3800), alternative minimum, base erosion (Form 8991).

- Lines 13-22: Payments, penalties (Form 2220), refund/due.

Schedule K: Other Information

- Report QOF (Form 8996), controlled groups, 5% owners.

Schedules L & M-1

- L: Balance sheet (book value; quarterly asset tests).

- M-1: Book-to-tax reconciliation.

Filing

- Due: 15th day of 3rd month after year-end (March 17, 2026, calendar); extend via Form 7004 (6 months, pay estimates).

- Where: E-file or mail to Ogden, UT.

- Attachments: Schedule D, Form 2438 (undistributed gains), diversification statement.

Common Mistakes to Avoid When Filing Form 1120-REIT

REIT audits focus on tests and distributions—avoid these:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Under-Distributing RTI | Miscalculating 90% threshold | Use worksheets; declare January dividends for spillover. |

| Asset Test Errors | Quarterly lapses in 75% real estate | Value assets at FMV; attach quarterly schedules. |

| Late E-Filing | Ignoring 10+ return rule | Mandate MeF; monitor via IRS account. |

| Excise Oversight | Shortfall without Form 8612 | Distribute 95%+; elect deficiency dividends. |

| Income Test Failures | Non-qualifying rents >5% | Segregate TRS income; audit gross rents. |

Retain records 7 years; amend via Form 1120X.

Why File Form 1120-REIT Accurately? Real-World Benefits for 2025

A $500M REIT distributing $45M RTI avoids ~$9.45M corporate tax (21% rate), passing savings to shareholders. With 2025’s penalty hikes, timely filing prevents $510+ fines, while proper tests sustain 90%+ yields amid market volatility.

Final Thoughts: Ensure REIT Compliance with Form 1120-REIT in 2025

IRS Form 1120-REIT is vital for tax-efficient real estate investing, but 2025’s e-filing mandates and penalties underscore precision in distributions and tests. Master RTI calculations and quarterly compliance to thrive.

Download the 2024 form/instructions from IRS.gov and consult a REIT tax specialist. For more, explore Pub. 542. Questions on “REIT excise tax 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your REIT’s situation.