Table of Contents

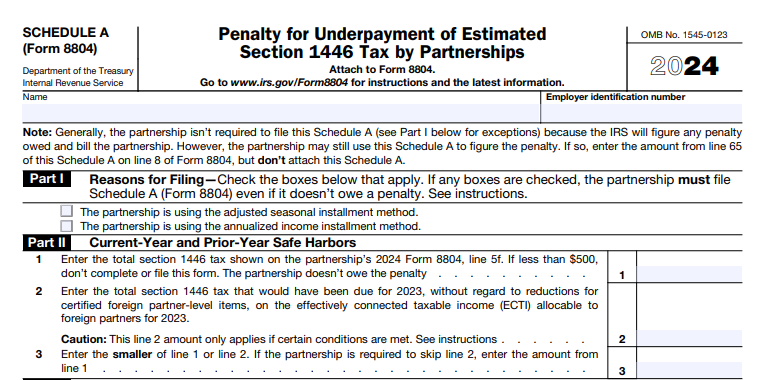

IRS Form 8804 (Schedule A) – Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships – Partnerships with foreign partners navigating U.S. tax compliance face unique withholding obligations under Section 1446. If your partnership allocates effectively connected taxable income (ECTI) to non-U.S. partners, IRS Form 8804 Schedule A calculates any penalty for underpaying estimated withholding taxes. This underpayment penalty, akin to corporate estimated tax penalties under Section 6655, ensures timely payments to avoid IRS interest and additions to tax.

For tax year 2024 (filed in 2025), partnerships must attach Schedule A to Form 8804 if the total Section 1446 tax exceeds $500, even if no penalty is due—especially when using alternative methods like annualized income or adjusted seasonal installments. This SEO-optimized guide covers Form 8804 Schedule A filing requirements, due dates, step-by-step instructions, and strategies to minimize penalties. Download the latest forms at IRS.gov/Form8804.

What Is IRS Form 8804 Schedule A?

Schedule A (Form 8804), titled “Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships,” determines if your partnership owes an underpayment penalty on quarterly estimated withholding taxes. Section 1446 requires partnerships to withhold tax on ECTI allocable to foreign partners at rates up to 37% (non-corporate) or 21% (corporate), paid via Form 8813 installments.

The schedule compares required installments (25% of the lesser of current-year tax or prior-year safe harbor) against actual payments. If shortfalls occur, penalties accrue at the federal short-term rate plus 3% (under Section 6621), compounded daily. No penalty applies if total Section 1446 tax on Form 8804, line 5f, is under $500.

For 2024 filings, the form integrates updates from final regulations, including safe harbor exceptions for short tax years and coordination with Form 8804-C certifications.

Who Must File Schedule A (Form 8804)?

Schedule A is required for partnerships filing Form 8804 that have ECTI allocable to foreign partners. Attach it to Form 8804 if:

- Total Section 1446 tax ≥ $500, regardless of penalty amount.

- Using annualized income installment method (Part IV) or adjusted seasonal method (Part V).

- Prior-year safe harbor is elected but doesn’t fully offset underpayments.

Who Qualifies as a Foreign Partner?

- Nonresident aliens, foreign corporations, or foreign partnerships/trusts with U.S.-sourced ECTI.

- Excludes U.S. residents or partners with valid treaty claims reducing withholding (via Form 8804-C).

Publicly traded partnerships (PTPs) follow modified rules but still file if applicable. Even if no tax is due (e.g., after Form 8804-C adjustments), file if gross ECTI exists. Failure to withhold or report triggers personal liability for the withholding agent.

When Is Schedule A (Form 8804) Due in 2025?

Form 8804 (with attached Schedule A) is due by the 15th day of the 3rd month after the partnership’s tax year ends—for calendar-year 2024, that’s March 17, 2025 (adjusted for weekend). All-foreign-partner partnerships get until the 15th day of the 6th month (June 16, 2025).

Estimated payments via Form 8813 are quarterly: 15th day of the 4th, 6th, 9th, and 12th months (April 15, June 16, September 15, 2025; January 15, 2026).

Key 2025 Deadlines Table for Section 1446

| Event | Calendar-Year 2024 Due Date | Fiscal-Year Example (Ends 6/30/2025) |

|---|---|---|

| Q1 Installment (Form 8813) | April 15, 2025 | October 15, 2025 |

| Q2 Installment (Form 8813) | June 16, 2025 | December 15, 2025 |

| Q3 Installment (Form 8813) | September 15, 2025 | March 16, 2026 |

| Q4 Installment (Form 8813) | January 15, 2026 | June 15, 2026 |

| Form 8804 & Schedule A Filing | March 17, 2025 | September 15, 2025 |

| Extension (Form 7004) | March 17, 2025 (6 months) | September 15, 2025 (6 months) |

*Notes: Weekends/holidays shift to next business day. Form 7004 extends filing but not payments—pay 100% by original due date to avoid penalties.

IRS Form 8804 (Schedule A) Download and Printable

Download and Print: IRS Form 8804 (Schedule A)

How to Complete Schedule A (Form 8804): Step-by-Step Guide

Use the 2024 Schedule A for tax years ending in 2024. Report in U.S. dollars; attach to Form 8804. The IRS may compute the penalty if you don’t file Schedule A, but proactive calculation often reduces it via alternative methods.

Part I: Required Installments

- Line 1: Total Section 1446 tax from Form 8804, line 5f.

- Line 2: Prior-year safe harbor—100% of 2023 tax (or 110% if gross receipts > $1M), ignoring Form 8804-C reductions. Use if ≥50% of current-year tax.

- Line 3: Smaller of lines 1 or 2.

- Lines 4a–4d: 25% of line 3 per quarter (adjust for short years).

- Lines 5–6: Enter actual payments (including overpayments credited from prior year).

- Line 7: Required installment—smaller of line 4 or cumulative payments.

Part II: Underpayment Calculation

- Line 9: Cumulative required minus payments—if positive, underpayment exists.

- Line 10: Shortfall period start (installment due date).

- Line 11: Days late.

- Line 12: Underpayment amount × days × penalty rate (e.g., 8% annualized for Q1 2025).

Parts III–V: Alternative Methods (If Applicable)

- Part III: Standard method.

- Part IV: Annualized income—annualizes ECTI for uneven income (e.g., Q1: 4/12 of year).

- Part V: Adjusted seasonal—for businesses with seasonal patterns (e.g., 22.5% Q1 if prior years show low early income).

Pro Tip: Use Form 8804-W worksheet for installments. Sequence: Complete Form 8804 first, then Schedule A. Software like TurboTax Business automates calculations.

Recent Changes to Schedule A (Form 8804) for 2025 Filings

The 2024 form (filed in 2025) incorporates:

- Penalty Rate Update: Federal short-term rate +3% (8% as of Q1 2025; quarterly adjustments via IRS Notice).

- Safe Harbor Refinement: Prior-year tax must be ≥50% of current; short years (<4 months) exempt from installments.

- Form 8804-C Integration: Enhanced reductions for certified partner deductions/losses.

- E-Filing Push: While paper allowed, electronic via MeF recommended for accuracy.

No major legislative shifts for 2025; monitor IRS.gov for post-draft updates.

Penalties for Late or Incomplete Schedule A Filing

Underpayments trigger:

- Addition to Tax (Section 6655): Penalty rate on shortfall × days late (max 25% equivalent).

- Failure-to-Pay: 0.5% per month on unpaid Form 8804 balance (up to 25%).

- Late Filing: 5% per month on unpaid tax (up to 25%); minimum $485 if >60 days late.

- Interest: Compounded daily at underpayment rate.

Reasonable cause (e.g., first-time abatement) waives penalties—attach statement. Non-compliance risks personal liability for partners.

Best Practices for Schedule A (Form 8804) Compliance in 2025

- Quarterly Monitoring: Use Form 8804-W to project ECTI and adjust payments—catch-up underpayments immediately.

- Leverage Safe Harbors: Pay 100%/110% of prior-year tax to avoid calculations.

- Certify Adjustments: Obtain Form 8804-C from partners early to reduce withholding.

- Software & Pros: Tools like Drake Tax or a CPA handle annualization complexities.

- Recordkeeping: Retain 3+ years of ECTI allocations, payments, and notifications (to partners within 10 days of installments).

- E-Pay: Use EFTPS for installments to ensure timely crediting.

Proactive filing minimizes audits and builds compliance confidence.

Conclusion: Avoid Section 1446 Penalties with Schedule A in 2025

IRS Form 8804 Schedule A is your partnership’s shield against underpayment penalties, ensuring Section 1446 withholding on foreign partners’ ECTI stays compliant. With the March 17, 2025, deadline for calendar-year filers, review installments now—extensions via Form 7004 don’t delay payments.

Access the 2024 form and instructions at IRS.gov/Form8804. For guidance, call the IRS International Hotline at 267-941-1000. Master Schedule A, and focus on growth, not IRS notices.

Last updated: December 2025. Consult official IRS sources or a tax advisor for personalized advice.