Table of Contents

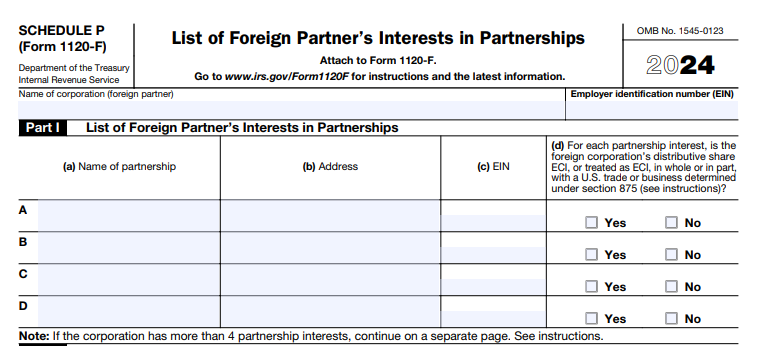

IRS Form 1120-F (Schedule P) – List of Foreign Partner’s Interests in Partnerships – Foreign corporations doing business in the U.S. through partnerships must disclose their ownership stakes annually to the IRS. Schedule P (Form 1120-F) — “List of Foreign Partner Interests in Partnerships” — is the required attachment that reports every U.S. or foreign partnership in which the foreign corporation is a direct or indirect partner.

For tax year 2024 (filed in 2025), every foreign corporation filing Form 1120-F must attach a complete Schedule P, even if it has no effectively connected income (ECI) or no current-year activity in the partnership. The IRS uses Schedule P to track Section 1446 withholding, transfer pricing, BEAT, GILTI, Subpart F, and treaty claims. Non-compliance triggers automatic $25,000+ penalties.

This SEO-optimized guide covers 2025 Schedule P filing requirements, deadlines, line-by-line instructions, common mistakes, and penalty avoidance strategies. Sources: 2024 Form 1120-F Instructions, Treas. Reg. §1.6038B-2, and IRS LB&I campaigns (updated through December 2025).

What Is Schedule P (Form 1120-F)?

Schedule P is a mandatory transparency schedule added in 2017 and significantly expanded in 2020. It requires foreign corporations to list:

- Direct and indirect interests in U.S. and foreign partnerships

- Partner-level capital and profits percentages

- Section 1446 withholding amounts paid or credited

- Transfers of partnership interests during the year (triggers Form 8865 if ≥10%)

Failure to file a complete and accurate Schedule P results in a $25,000 penalty per partnership not listed (Section 6038C), with no reasonable-cause exception in most cases.

IRS Form 1120-F (Schedule P) Download and Printable

Download and Print: IRS Form 1120-F (Schedule P)

Who Must File Schedule P in 2025?

You must attach Schedule P to Form 1120-F if the foreign corporation:

| Situation | Schedule P Required? |

|---|---|

| Files Form 1120-F (protective or income return) | YES — always |

| Owns any direct or indirect partnership interest | YES |

| Tiered partnerships (CFC → foreign partnership → U.S. partnership) | YES — list every level |

| Interest dropped to 0% during the year | YES — still report |

| No ECI and files protective 1120-F only | YES — still mandatory |

| Interest <10% and no Form 8865 required | YES — Schedule P still required |

Only exception: A foreign corporation that never held any partnership interest (direct, indirect, or constructive) during the entire tax year may skip Schedule P.

2025 Filing Deadlines for Schedule P (Form 1120-F)

| Tax Year End | Original Due Date (1120-F) | Automatic 6-Month Extension (Form 7004) |

|---|---|---|

| Dec 31, 2024 | March 17, 2025 | September 15, 2025 |

| Fiscal year example: June 30, 2025 | September 15, 2025 | March 16, 2026 |

Warning: Extensions extend filing but not the $25,000 penalty clock if Schedule P must be complete when filed.

How to Complete Schedule P (Form 1120-F) – Line-by-Line (2024 Form, used in 2025)

Top of Schedule P

- Name and EIN of the foreign corporation (same as Form 1120-F)

- Check box if this is an amended Schedule P

Part I – List of All Partnerships (Columns a–i)

Report every partnership (U.S. or foreign) in which the corporation held any interest during the year:

| Column | What to Enter |

|---|---|

| (a) | Partnership name |

| (b) U.S. EIN (or “Applied For” or foreign tax ID if no EIN) | |

| (c) Check if U.S. partnership | |

| (d) Check if foreign partnership | |

| (e) Check if transfer of interest occurred (≥10% → also triggers Form 8865) | |

| (f) Beginning % of profits interest | |

| (g) Beginning % of capital interest | |

| (h) Ending % of profits interest | |

| (i) Ending % of capital interest |

Part II – Section 1446 Withholding on ECTI (U.S. Partnerships Only)

For each U.S. partnership listed in Part I:

| Column | What to Enter |

|---|---|

| (a) Partnership name & EIN (same as Part I) | |

| (b) Amount of ECTI allocable to the foreign corporation | |

| (c) Section 1446 tax paid by partnership on your behalf | |

| (d) Section 1446 tax credited to you on Form 8805 |

Part III – Transfers of Partnership Interests

Only complete if you checked column (e) in Part I (≥10% transfer → also file Form 8865).

Common Mistakes That Trigger $25,000+ Penalties

- Omitting tiered partnerships (e.g., CFC owns foreign holding company that owns U.S. LLC)

- Leaving Schedule P blank on protective returns

- Using “Various” or “Multiple” instead of listing each partnership

- Failing to update beginning/ending percentages after mid-year transfers

- Not attaching Schedule P when no Form 8805 received (still required)

2025 Updates and Recent IRS Enforcement

- Penalty Inflation Adjustment: $25,000 → $28,000 per omitted partnership beginning 2025 (IR-2024-312).

- LB&I Campaign: Active IRS campaign targeting missing Schedule P on protective 1120-F returns (2023–2026).

- E-Filing: Schedule P is now part of mandatory electronic 1120-F filing (MeF) for all corporations with assets ≥$10M or 250+ returns.

- Coordination with Form 5472: If the partnership is a 25%-foreign-owned disregarded entity, also file Form 5472.

Penalty Table – Schedule P Non-Compliance

| Violation | Penalty per Partnership | Reasonable Cause Relief? |

|---|---|---|

| Failure to file complete Schedule P | $28,000 | Rarely granted |

| Continued failure after IRS notice | +$28,000 every 30 days | No |

| Willful failure | Up to 100% of tax due | No |

Best Practices to Avoid Penalties in 2025

- Maintain a master partnership tracker updated quarterly with % changes

- Attach Schedule P even on protective 1120-F returns

- Use tax software that auto-populates Schedule P from K-1s and internal records

- File Form 8865 and Schedule P for ≥10% transfers (they are not duplicates)

- Keep proof of mailing (certified mail or e-file acknowledgment)

Conclusion: Don’t Risk $28,000+ Penalties – File Schedule P in 2025

Schedule P (Form 1120-F) is no longer optional — the IRS treats it as a core transparency requirement for every foreign corporation filing Form 1120-F. Missing even one partnership triggers an automatic $28,000 penalty with almost no relief.

Download the 2024 Schedule P and instructions at IRS.gov/Form1120F

E-Filing is mandatory for most filers in 2025 — use approved providers like Thomson Reuters ONESOURCE, Vertex, or TaxAct Business.

File accurately by March 17, 2025 (or extended deadline), and keep your foreign corporation compliant.

Last updated: December 2025 | Sources: IRS Form 1120-F Instructions (2024), Treas. Reg. §1.6038-3, IR-2024-312, IRS LB&I Campaign 2023-08