Table of Contents

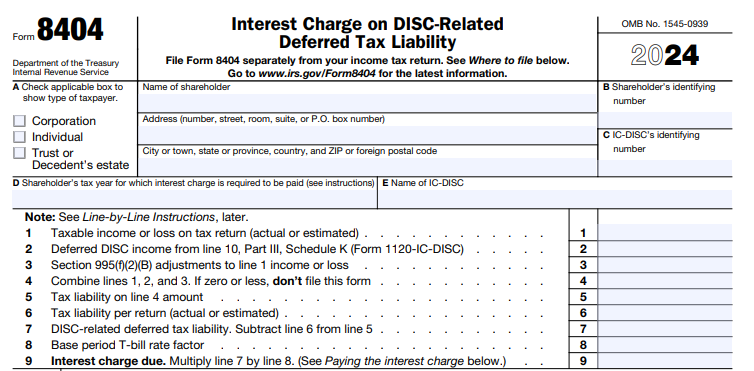

IRS Form 8404 – Interest Charge on DISC-Related Deferred Tax Liability – Exporting U.S. goods can unlock powerful tax incentives, but with benefits come compliance hurdles. For shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs), IRS Form 8404 calculates the mandatory annual interest charge on deferred tax liability from untaxed export commissions. This charge—often 5% or more of the deferred amount—ensures the tax deferral isn’t interest-free, but it’s a small price for the 50% commission deduction under Section 993.

As we head into the 2025 filing season for tax year 2024, accurate Form 8404 preparation is critical to avoid late-payment interest at 7% (compounded daily). This SEO-optimized guide covers eligibility, deadlines, line-by-line instructions, and updates based on the latest IRS data. Download the 2024 Form 8404 at IRS.gov/Form8404.

What Is IRS Form 8404?

Form 8404, “Interest Charge on DISC-Related Deferred Tax Liability,” is used by IC-DISC shareholders to compute and report an interest payment on deferred taxes from qualified export income. Under IRC Section 995(f), IC-DISCs defer tax on 50% of commissions, creating a “deferred tax liability.” The form multiplies this liability by the base period T-bill rate factor (5.053% for 2024) to determine the charge.

Unlike a tax return, Form 8404 is filed separately and requires payment by the income tax due date. C corporations deduct the charge as a business expense; individuals and others cannot. For 2024, the form uses a precise daily-compounded factor for leap years (366 days), simplifying calculations.

Who Must File Form 8404 in 2025?

Every IC-DISC shareholder must file if the IC-DISC reports deferred DISC income to them on Schedule K (Form 1120-IC-DISC), line 10, Part III—even if the amount is zero or negative (though no form is needed if the net on line 4 ≤ $0). This includes:

- Individuals, corporations, trusts, and estates with direct or indirect IC-DISC ownership.

- Nonresident aliens with U.S.-sourced deferred income.

- Pass-through entities (e.g., S corps, partnerships) that allocate deferred income to owners.

No filing if there’s no deferred income or the IC-DISC revokes election. Amended Form 8404 is required for audit changes or estimate corrections.

Who Files Form 8404? Quick Eligibility Table (Tax Year 2024)

| Shareholder Type | Deferred Income Reported? | File Form 8404? |

|---|---|---|

| C Corporation | Yes | Yes |

| Individual | Yes | Yes |

| Trust/Estate | Yes | Yes |

| No Deferred Income | N/A | No |

When Is Form 8404 Due in 2025?

File Form 8404 by the due date of your federal income tax return (excluding extensions) for the tax year ending with or including the IC-DISC’s year-end. Pay the interest charge by your income tax payment due date. No automatic extension for filing or payment—use Form 7004 only if it extends your main return (rare for individuals).

For calendar-year filers (IC-DISC year ends Dec. 31, 2024): April 15, 2025. Fiscal-year example: July 31, 2025, end means November 15, 2025.

Key 2025 Form 8404 Deadlines Table

| Tax Year End | Filer Type | Filing & Payment Due Date |

|---|---|---|

| Dec. 31, 2024 | Individual/C Corp | April 15, 2025 |

| July 31, 2025 | C Corp | November 15, 2025 |

| Dec. 31, 2024 | Partnership (allocating to owners) | Varies by owner |

Notes: Weekends/holidays shift to next business day. Mail separately to IRS, Kansas City, MO 64999.

IRS Form 8404 Download and Printable

Download and Print: IRS Form 8404

How to Complete IRS Form 8404: Step-by-Step (2024 Form for 2025 Filings)

The 2024 form is a simple two-pager. Gather your tax return, IC-DISC Schedule K, and T-bill factor (0.050531976 for 366-day 2024). Report in U.S. dollars; round to whole numbers.

Heading

- Item A: Check filer type (individual, corporation, etc.).

- Item B: Your SSN/EIN.

- Item C: IC-DISC EIN.

- Item D: Tax year (e.g., 2024).

Lines 1–9: Interest Charge Calculation

- Line 1: Taxable income/loss from your return (Form 1040 line 15 or 1120 line 30; actual or estimated).

- Line 2: Deferred DISC income from Schedule K, line 10.

- Line 3: Net Section 996 carryback/carryover adjustments (usually $0; see instructions for NOLs).

- Line 4: Sum lines 1–3 (if ≤ $0, stop—no form needed).

- Line 5: Tax liability on line 4 amount (recompute return including deferred income; use tax tables/rates).

- Line 6: Actual tax liability from your return.

- Line 7: Deferred tax liability (line 5 – line 6).

- Line 8: Base period T-bill rate factor (0.050531976 for 2024; printed on form).

- Line 9: Interest due (line 7 × line 8).

Pro Tip: For short/52-53 week years, adjust the factor using IRS tables in Rev. Rul. 2024-27. Software like TurboTax Business automates recomputation.

Recent Changes to Form 8404 for 2025 Filings

The 2024 form (filed in 2025) is unchanged structurally, but key updates include:

- T-Bill Factor: 5.053% for 2024 (from average 1-year Treasury rates ending Sept. 30, 2024; per Rev. Rul. 2024-27).

- Interest Rates: Underpayment rate remains 7% (Q2 2025 onward; compounded daily on late payments).

- No Major Revisions: As of August 2025, no changes per IRS review; monitor for post-draft legislation.

Penalties for Late or Incomplete Form 8404 Filing

Missing the deadline triggers:

- Late Payment Interest: 7% compounded daily on unpaid line 9 amount (Section 6601; starts from income tax due date).

- Failure-to-Pay Penalty: 0.5% per month (max 25%) on unpaid interest.

- Failure-to-File Penalty: If treated as a return, 5% per month (max 25%), but IRS typically assesses only interest/penalties—no minimum for >60 days late.

Reasonable cause (e.g., illness) may waive; request abatement with documentation. Late amendments avoid further accrual if filed promptly.

Best Practices for Form 8404 Compliance in 2025

- Prepare Early: Recompute tax with deferred income during return drafting; tie to IC-DISC K-1.

- Separate Submission: Mail Form 8404 and payment (check to “United States Treasury,” note “Form 8404-Interest Due” and EIN) to Kansas City—don’t attach to 1040/1120.

- Track Factors: Bookmark IRS Rev. Ruls. for annual T-bill updates.

- Use Tools: Export software (e.g., Thomson Reuters) or CPAs for multi-shareholder IC-DISCs.

- Retain Records: Keep 3+ years of computations, K-1s, and proofs of payment.

For C corps, deduct line 9 on Form 1120, line 17—boosting after-tax savings.

Conclusion: Streamline IC-DISC Compliance with Form 8404 in 2025

IRS Form 8404 is the linchpin of IC-DISC tax deferral, balancing export incentives with a modest interest charge (e.g., ~$530 on $10,500 deferred tax). With April 15, 2025, deadlines for most filers, review your IC-DISC K-1 now to avoid 7% compounding interest.

Access the form and Rev. Rul. 2024-27 at IRS.gov/Form8404. For complex setups, consult a tax pro at 800-829-1040. File on time—export smarter, not harder.

Last updated: December 2025. Always verify with IRS sources for personalized advice.