Table of Contents

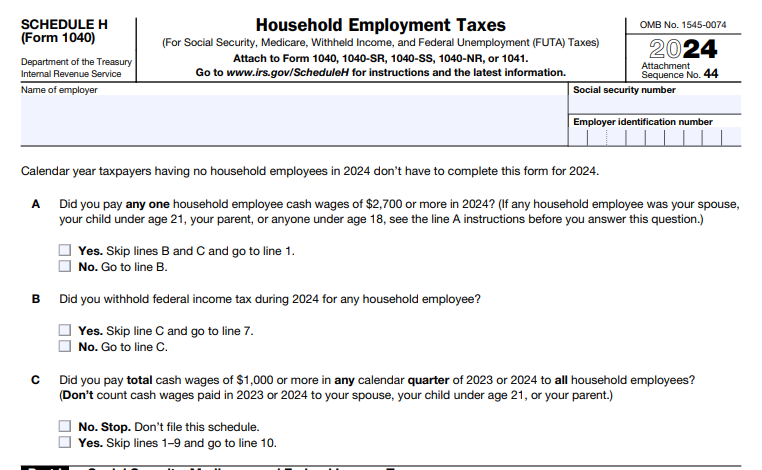

IRS Form 1040 (Schedule H) – Household Employment Taxes – Hiring a nanny, housekeeper, or caregiver? You’re not just providing a service—you’re an employer under IRS rules. IRS Form 1040 Schedule H, “Household Employment Taxes,” is the key form for reporting and paying federal taxes on wages paid to household employees. Often called “nanny taxes,” these include Social Security, Medicare, federal unemployment (FUTA), and withheld income taxes. For tax year 2025, thresholds rise slightly, and with the Social Security wage base at $176,100, accurate filing avoids penalties up to 25% of unpaid taxes.

This SEO-optimized guide covers Schedule H filing requirements for 2025, who qualifies, step-by-step instructions, state considerations, and updates. Whether you’re a busy parent or homeowner, stay compliant with IRS Publication 926. Download the 2025 form at IRS.gov/ScheduleH.

What Is IRS Schedule H (Form 1040)?

Schedule H calculates and reports household employment taxes if you pay cash wages to domestic workers like nannies, au pairs, housekeepers, gardeners, or senior caregivers. It’s attached to your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1041. The form covers:

- FICA Taxes: Social Security (6.2% each for employer/employee) and Medicare (1.45% each).

- FUTA Tax: Federal unemployment (6% on first $7,000, often reduced to 0.6% with state credit).

- Withheld Federal Income Tax: Optional, but reportable if done.

No separate quarterly filings like business employers—pay annually with your return. For 2025, the form removes outdated COVID-19 sick leave credit lines. Total taxes from line 27 go to Schedule 2 (Form 1040), line 9.

Who Must File Schedule H in 2025?

You’re a household employer if you control what, when, and how work is done in/around your home. File if any apply for 2025 wages:

- Paid $2,800+ cash wages to one household employee (up from $2,700 in 2024).

- Paid $1,000+ total cash wages to all household employees in any calendar quarter of 2024 or 2025 (triggers FUTA).

- Withheld federal income tax from a household employee’s wages.

Household Employee vs. Independent Contractor Table (2025)

| Role/Example | Likely Household Employee? | Why? |

|---|---|---|

| Full-time nanny | Yes | You control schedule, duties. |

| Occasional babysitter | No (if < $2,800 total) | Below threshold; self-scheduled. |

| Live-in au pair | Yes | Room/board counts as wages. |

| Gardener (you direct) | Yes | Control over methods. |

| Freelance cleaner (sets own hours) | No | Independent business. |

Exceptions: Wages to your spouse, child under 21, or parent aren’t subject to FICA/FUTA. Non-cash payments (e.g., groceries) generally don’t count as wages.

Even if no Form 1040 is required, file Schedule H standalone by April 15, 2026.

2025 Thresholds and Tax Rates for Household Employment

Key updates: Social Security wage base rises to $176,100 (from $168,600); FICA threshold to $2,800; FUTA unchanged at 0.6% effective rate (6% gross, 5.4% credit).

2025 Household Tax Rates Table

| Tax Type | Employer Rate | Employee Rate (Withheld) | Wage Base/Limit | Threshold to Apply |

|---|---|---|---|---|

| Social Security (FICA) | 6.2% | 6.2% | $176,100 | $2,800 per employee |

| Medicare (FICA) | 1.45% | 1.45% | Unlimited | $2,800 per employee |

| Additional Medicare | 0.9% (if wages >$200K single) | N/A (employer only) | Unlimited | $2,800 per employee |

| FUTA | 6% (0.6% net) | 0% | $7,000 | $1,000/quarter total |

*Total FICA: 15.3% (7.65% each). FUTA credit reduces if state taxes unpaid or in credit reduction states (e.g., CA: 1.2% effective). State UI varies (e.g., CA: up to 6.2% on first $7,000).

Cash wages include checks, direct deposits; exclude employer-paid insurance premiums.

When Is Schedule H Due in 2026?

Attach to your 2025 Form 1040: April 15, 2026 (or October 15 with Form 4868 extension). No separate payment—taxes are due with your return. If no return required, mail Schedule H alone.

For W-2s: Issue to employees by January 31, 2026; file with SSA by February 2, 2026.

IRS Form 1040 (Schedule H) Download and Printable

Download and Print: IRS Form 1040 (Schedule H)

Key 2025 Household Tax Deadlines Table

| Action | Deadline |

|---|---|

| New hire reporting (if state-required) | 20 days from hire |

| W-2 to employee | Jan. 31, 2026 |

| W-2/W-3 to SSA | Feb. 2, 2026 |

| Schedule H with 1040 | April 15, 2026 |

| State UI payment (if applicable) | Varies by state |

How to Complete Schedule H (Form 1040): Step-by-Step (2025 Form)

Use the 2025 draft form; report in U.S. dollars. Gather pay records, Form W-4 (for withholding), and state UI info. Sequence: Part I (FICA), Part II (FUTA), Part III (Totals).

Part I: Social Security, Medicare, and Federal Income Taxes

- Lines 1–2: Employee details (name, SSN, address—if multiple, attach list).

- Line 3: Total cash wages (exclude non-cash; cap Social Security at $176,100/employee).

- Line 4: Social Security wages (line 3 or $176,100 max).

- Line 5: Medicare wages (line 3; unlimited).

- Line 6: Additional Medicare withholding (0.9% on line 5 excess over $200K single/$250K joint).

- Line 7: Federal income tax withheld (per W-4).

- Line 8: Total FICA + income tax (add lines 2, 4, 6, 7).

Part II: Federal Unemployment (FUTA) Tax

- Line 9: Check if $1,000+ in any 2024/2025 quarter.

- Line 10: FUTA wages ($7,000 max/employee).

- Line 11: State contributions paid timely (for credit).

- Line 12: Credit rate (5.4% max; reduce for credit states).

- Lines 13–26: Calculate gross FUTA (6% × line 10), credit (line 11 × line 12), net FUTA (line 13 – credit).

Part III: Total Household Employment Taxes

- Line 27: Add line 8 + net FUTA (to Schedule 2, line 9).

Pro Tip: Use IRS Worksheet in Pub. 926 for multi-employee totals. E-file via tax software; paper mail to IRS address on Form 1040 instructions.

E-Filing and Payment for Schedule H

E-file with your 1040 via IRS Free File, TurboTax, or H&R Block—mandatory if 10+ W-2s. Pay via direct debit or check (note “2025 Form 1040 Schedule H”). No quarterly deposits for households.

Recent Changes to Schedule H for 2025 Filings

- Threshold Increase: FICA to $2,800 (from $2,700); FUTA quarter check includes 2025.

- Wage Base: Social Security $176,100 (up $7,500).

- FUTA Credit Reductions: CA (1.2% effective), CT/NY/Virgin Islands higher; 49 states + DC at full 5.4% credit.

- No Sick Leave Credit: Removed post-2023.

- State UI: Varies; e.g., CA ETT 0.1%, SDI 1.2% (no wage limit).

Monitor IRS.gov for final 2025 form (draft as of Dec. 2025).

Penalties for Late or Incomplete Schedule H Filing

- Failure to File/Pay: 5% per month (max 25%) on unpaid taxes.

- Late W-2: $60–$660 per form.

- Unreported Wages: 1.5%–25% underpayment.

- Interest: ~7% compounded daily.

Reasonable cause (e.g., first-time error) may waive; amend with Form 1040-X.

Best Practices for Schedule H Compliance in 2025

- Track Quarterly: Use apps like HomePay for wage logs.

- Get EIN: Apply via Form SS-4 if needed (free).

- Issue W-2s: By Jan. 31; include FICA in boxes 3–6.

- State Check: Contact agency (e.g., CA EDD for UI-HA form); some require annual filing.

- Software: TurboTax auto-calculates; consult CPA for multi-state.

- New Hires: Report to state within 20 days if required.

Proactive compliance builds employee benefits eligibility (e.g., Social Security credits).

Conclusion: Master Nanny Taxes with Schedule H in 2025

IRS Schedule H ensures fair funding for Social Security and unemployment while protecting your household. With $2,800 thresholds and $176,100 wage base, 2025 filings (due April 2026) demand precise records—avoid penalties by starting now.

Download Pub. 926 and forms at IRS.gov/Pub926. Questions? Call IRS at 800-829-1040. Compliant hiring: Peace of mind for your home.

Last updated: December 2025. Consult IRS or a tax pro for advice.